Spain Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2026-2034

Spain Commercial Insurance Market Overview:

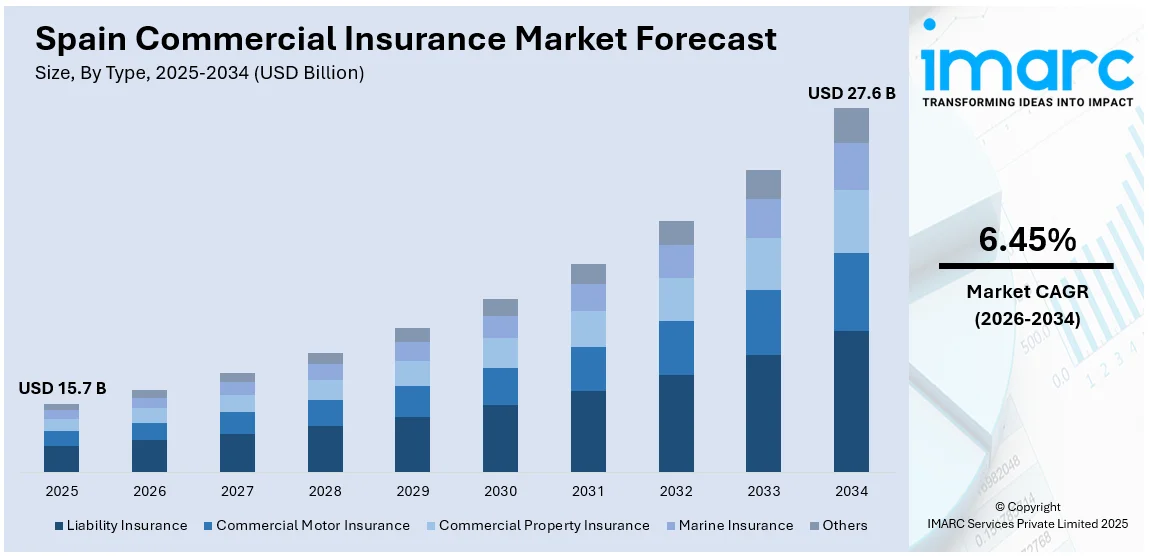

The Spain commercial insurance market size reached USD 15.7 Billion in 2025. The market is projected to reach USD 27.6 Billion by 2034, exhibiting a growth rate (CAGR) of 6.45% during 2026-2034. The market is expanding due to rising demand for customized policies and digital insurance solutions. Businesses are increasingly seeking tailored coverage for property, liabilities, and cyber risks. These trends are supporting the Spain commercial insurance market share, driving growth across various sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 15.7 Billion |

| Market Forecast in 2034 | USD 27.6 Billion |

| Market Growth Rate 2026-2034 | 6.45% |

Spain Commercial Insurance Market Trends:

Digitalization and risk management shift

Insurers in Spain are refocusing on business clients that need clearer cover, quicker service, and steadier pricing. Large corporates want tailored programs, while SMEs look for simple packages they can buy online. The push to improve margins after higher loss costs continues, yet buyers still expect better claims support and prevention tools. In this setting, Spain Commercial Insurance market growth is linked to smarter underwriting and data use. Recent developments appear mid-cycle rather than sudden change. Usage-based fleet cover grows as telematics adoption rises and logistics firms track vehicles in real time. Cyber moves from optional to core, helped by clearer wordings and basic hygiene requirements that lower claim frequency. Underwriters add supply-chain questionnaires to spot concentration risk among key suppliers. More carriers test parametric add-ons for weather, giving faster payouts to farms, hotels, and event operators. Embedded policies surface inside accounting and e-commerce platforms that small firms already use, lifting take-up with minimal friction. Analytics teams score clients on fire, flood, and cyber posture to target risk-control visits. Claims teams pilot remote assessment and photo AI to shorten cycle times, which supports retention and reduces leakage in property and motor lines.

To get more information on this market Request Sample

Regulation, Climate, and Distribution changes

Market direction remains shaped by EU rules, local supervision, and state catastrophe backing. Pricing discipline holds as reinsurers keep terms tight for peak perils. Buyers accept clearer deductibles and higher limits where needed, provided service improves. The key developments sit in the middle of the market’s year: climate risk drives demand in flood-prone areas, with more take-up of cover that complements the Consorcio scheme. Agribusiness seeks drought and hail solutions, and coastal firms review storm surge exposure. Sustainability reporting pushes larger insureds to document risk controls, which supports better terms at renewal. Brokers keep their central role for complex placements, yet bancassurance and carrier portals gain share in standard SME packs. Partnerships with software vendors place liability and cyber offers at checkout, narrowing protection gaps. Capacity for renewable projects expands as Spain builds solar and wind assets, bringing higher limits for construction and operational phases. Trade credit appetite improves where payment behavior stabilizes, though underwriting remains cautious by sector. Carriers invest in fraud detection and straight-through processing to cut expenses, freeing room for selective price competition. These shifts point to steadier growth tied to prevention, clear wordings, and balanced capital.

Spain Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

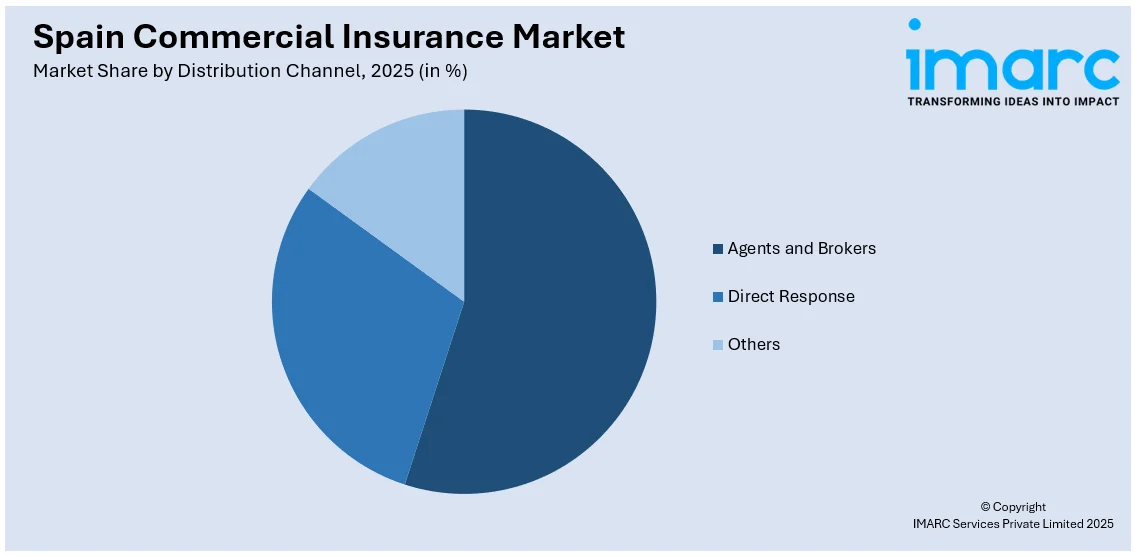

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Agents and Brokers

- Direct Response

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes transportation and logistics, manufacturing, construction, it and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Commercial Insurance Market News:

- July 2025: MasOrange and Zurich Seguros formed a strategic alliance to offer personalized, digital insurance services across Spain. This partnership, targeting 32 million customers, focused on device, health, and home insurance, enhancing the Spain commercial insurance market by leveraging AI and big data for improved customer experience and growth.

- July 2025: DUAL Europe launched its Trade Credit Insurance offering, expanding its commercial insurance portfolio across Europe, including Spain. Led by experienced professionals, the new products, Top-Up and Non-Cancellable Credit Limits, addressed growing demand for reliable credit risk management, strengthening the Spain commercial insurance market growth.

Spain Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain commercial insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain commercial insurance market on the basis of type?

- What is the breakup of the Spain commercial insurance market on the basis of enterprise size?

- What is the breakup of the Spain commercial insurance market on the basis of distribution channel?

- What is the breakup of the Spain commercial insurance market on the basis of industry vertical?

- What is the breakup of the Spain commercial insurance market on the basis of region?

- What are the various stages in the value chain of the Spain commercial insurance market?

- What are the key driving factors and challenges in the Spain commercial insurance market?

- What is the structure of the Spain commercial insurance market and who are the key players?

- What is the degree of competition in the Spain commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain commercial insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain commercial insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)