Spain Community Cloud Market Size, Share, Trends and Forecast by Component, Application, Industry Vertical, and Region, 2026-2034

Spain Community Cloud Market Summary:

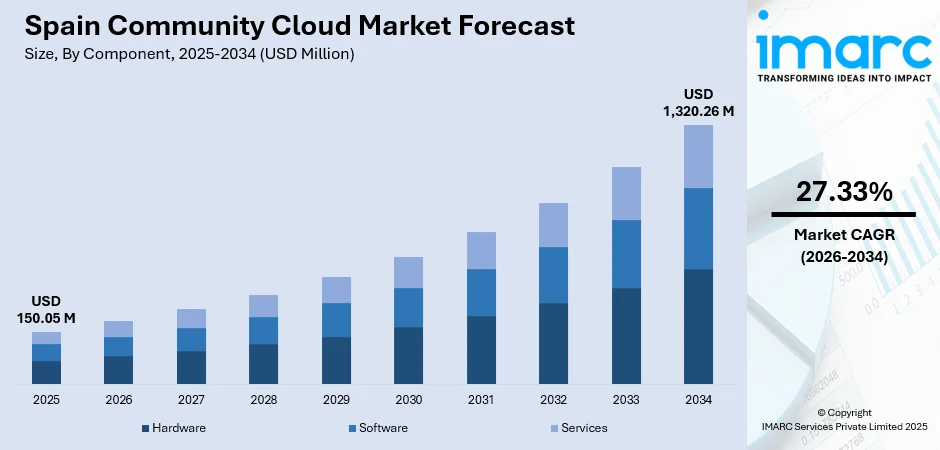

The Spain community cloud market size was valued at USD 150.05 Million in 2025 and is projected to reach USD 1,320.26 Million by 2034, growing at a compound annual growth rate of 27.33% from 2026-2034.

The Spain community cloud market is experiencing robust expansion, as organizations across regulated industries are prioritizing secure, collaborative infrastructure solutions that meet stringent data sovereignty requirements. The growing demand for shared computing resources among industry consortia, research institutions, and government agencies is accelerating the adoption. Enhanced regulatory frameworks are positioning community cloud as the preferred deployment model for sensitive workloads.

Key Takeaways and Insights:

- By Component: Software dominates the market with a share of 55% in 2025, driven by increasing enterprise demand for collaboration tools, business intelligence dashboards, and enterprise application software that enable seamless data sharing and workflow management across community cloud environments.

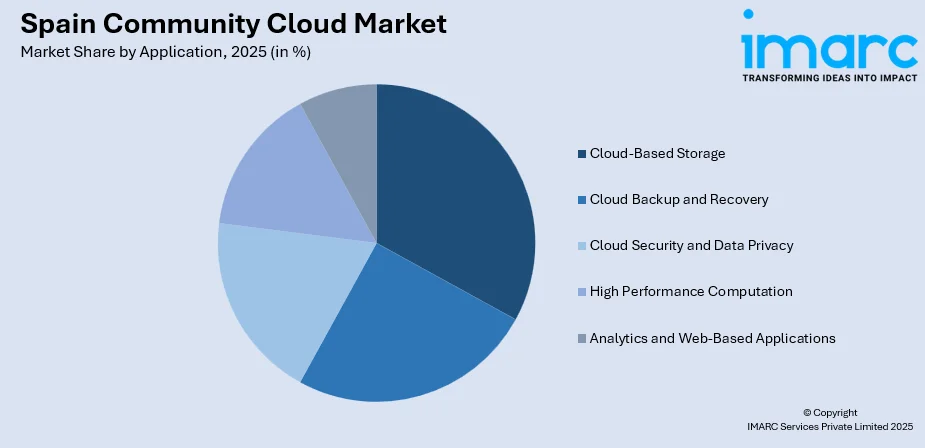

- By Application: Cloud-based storage leads the market with a share of 25% in 2025, owing to escalating data volumes, regulatory compliance requirements for secure data retention, and growing organizational needs for centralized, accessible storage solutions within protected community environments.

- By Industry Vertical: BFSI represents the largest segment with a market share of 26% in 2025, due to stringent regulatory compliance mandates, growing cybersecurity concerns, and the financial sector's requirement for secure, auditable infrastructure that community cloud architectures uniquely provide.

- Key Players: The Spain community cloud market exhibits moderate competitive intensity, with global cloud providers competing alongside European sovereign cloud specialists and regional technology integrators to deliver compliant, localized community cloud solutions tailored to Spanish regulatory requirements.

To get more information on this market, Request Sample

The Spain community cloud market is advancing, as government agencies, financial institutions, healthcare organizations, and educational establishments are embracing collaborative cloud infrastructure to address shared computing requirements while maintaining data sovereignty. Major technology providers are establishing dedicated cloud regions in Spain. In September 2024, DXC Technology launched a new Center of Excellence in Zaragoza in partnership with AWS, creating hundreds of jobs and supporting public and private sector organizations with artificial intelligence (AI) and cloud adoption services. These developments underscore the strategic importance of Spain as a digital hub and the growing preference for community cloud deployments among organizations seeking compliant, cost-effective, and collaborative infrastructure solutions.

Spain Community Cloud Market Trends:

Rising Demand for Sovereign Cloud Infrastructure

European digital sovereignty initiatives are driving substantial investments in community cloud deployments that ensure data residency and operational autonomy within national borders. Organizations across regulated sectors in Spain are prioritizing cloud infrastructure operated under European control to comply with evolving data protection frameworks. In February 2025, nine technology organizations in Europe, led by OpenNebula Systems from Spain, led the launch of Virt8ra, Europe's first sovereign edge cloud backed by EUR 3 Billion in IPCEI-CIS funding, enabling computing and storage resources across six EU member states while strengthening community cloud independence from hyperscaler dependencies.

Accelerating Hybrid and Multi-Cloud Adoption

Spanish enterprises are increasingly adopting hybrid cloud architectures that combine community cloud environments with public and private deployments to optimize workload placement and cost efficiency. This trend reflects the growing organizational maturity in cloud strategy and the need to balance security requirements with operational flexibility. In June 2024, Unicaja advanced its hybrid cloud strategy by adopting the IBM Cloud for Financial Services through IBM's Multizone Cloud Region in Madrid, demonstrating how financial institutions leverage community cloud models to harness cloud capabilities while ensuring regulatory adherence and the market growth.

Integration of AI and Advanced Analytics

Community cloud providers are embedding AI capabilities to enhance data analytics, automate operations, and deliver intelligent insights across shared infrastructure environments. This integration enables organizations within community clouds to access advanced technologies without substantial individual investments. In June 2024, Oracle revealed plans to launch a new cloud region in Madrid as part of a USD 1 Billion investment, strengthening AI and cloud service delivery and supporting Spanish enterprises in running AI workloads and managing sensitive data locally within community cloud architectures.

Market Outlook 2026-2034:

The Spain community cloud market revenue is projected to witness substantial expansion through the forecast period, driven by sustained digital transformation across government, financial services, healthcare, and educational sectors. Continued hyperscaler investments in Spanish data center infrastructure, combined with growing regulatory requirements for data localization and security, will accelerate community cloud adoption. The market generated a revenue of USD 150.05 Million in 2025 and is projected to reach a revenue of USD 1,320.26 Million by 2034, growing at a compound annual growth rate of 27.33% from 2026-2034. Emerging applications in edge computing, AI, and high-performance computing will further expand community cloud use cases across Spanish industries.

Spain Community Cloud Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Software | 55% |

| Application | Cloud-Based Storage | 25% |

| Industry Vertical | BFSI | 26% |

Component Insights:

- Hardware

- Server

- Networking

- Storage

- Others

- Software

- Enterprise Application Software

- Collaboration Tools Software

- Dashboards Business Intelligence Software

- Services

- Training Services

- Maintenance and Support

- Regulation and Compliance

- Consulting

Software (enterprise application software, collaboration tools software, and dashboards business intelligence software) dominates with a market share of 55% of the total Spain community cloud market in 2025.

The software segment's dominance reflects the critical importance of enterprise applications, collaboration platforms, and business intelligence tools in enabling effective community cloud operations. Organizations within community clouds require robust software solutions to manage shared workflows, analyze collective data assets, and maintain productivity across distributed teams.

The growing adoption of software as a service (SaaS)-based enterprise resource planning, customer relationship management (CRM), and collaboration suites within community environments is driving segment growth. As per industry reports, the SaaS industry in Spain attracted over USD 8.24B in funding over the decade from 2016 to 2025. Software investments enable community cloud members to leverage advanced functionalities without individual infrastructure overhead, accelerating digital transformation while optimizing technology expenditures across the shared environment.

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Cloud-Based Storage

- Cloud Backup and Recovery

- Cloud Security and Data Privacy

- High Performance Computation

- Analytics and Web-Based Applications

Cloud-based storage leads with a share of 25% of the total Spain community cloud market in 2025.

Cloud-based storage applications hold prominence due to exponentially growing data volumes across industries and the critical need for secure, compliant data repositories within shared environments. Community cloud storage enables organizations to centralize data assets while maintaining governance controls and regulatory compliance.

The segment benefits from increasing requirements for data retention, archival, and accessibility across healthcare records, financial transactions, and government documentation. European data protection frameworks, including General Data Protection Regulation (GDPR) requirements for data residency and access controls, further strengthen demand for community cloud storage solutions that offer localized, auditable infrastructure. Organizations across Spain increasingly recognize cloud storage within community environments as essential for managing data sprawl while ensuring security and compliance.

Industry Vertical Insights:

- BFSI

- Gaming

- Government

- Healthcare

- Education

- Others

BFSI exhibits a clear dominance with a 26% share of the total Spain community cloud market in 2025.

The BFSI sector leads community cloud adoption due to stringent regulatory compliance requirements, sophisticated cybersecurity demands, and the need for secure, auditable infrastructure. Financial institutions benefit from community cloud models that enable shared infrastructure costs while maintaining isolation and compliance with frameworks, such as DORA and European Banking Authority guidelines.

Spanish banks with Latin American operations particularly benefit from Madrid's community cloud infrastructure, which provides direct connections to regional financial hubs while ensuring regulatory alignment across jurisdictions. In January 2025, the Spanish banking group, BBVA, shifted its analytics infrastructure to cloud services as part of a technology transformation initiative throughout Europe and Latin America. The migration to cloud infrastructure decreased the time needed for analytical tasks by 94%. The migration included relocating tens of thousands of processes and shifting thousands of users without any service disruptions.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Northern Spain shows rising adoption of community cloud platforms among manufacturing clusters, research institutions, and regional administrations. Demand is driven by data-sharing needs, compliance requirements, and inter-organizational collaboration. Strong industrial networks push community cloud usage for joint projects, regional development programs, and shared digital resources.

Eastern Spain benefits from a strong presence of technology firms, logistics hubs, and retail enterprises. Community cloud adoption supports data security, collaboration, and standardized operations across partner organizations. Smart city initiatives and digital service providers increase interest in shared infrastructure among local authorities and industry groups.

Southern Spain’s adoption focuses on education, tourism associations, and public sector collaboration. Community clouds support document sharing, compliance, and cost-efficient information technology (IT) among connected institutions. Limited budgets encourage shared platforms, while the growing digital awareness improves acceptance across small municipalities and regional organizations.

Central Spain holds prominence in the market due to administrative concentration and business density. Government agencies, regulatory bodies, and large enterprises drive the demand for secure collaborative platforms. Community cloud solutions support policy coordination, data management, and operational integration across departments and industry alliances.

Market Dynamics:

Growth Drivers:

Why is the Spain Community Cloud Market Growing?

Escalating Digital Transformation and Government Initiatives

Spanish government initiatives are driving substantial investments in cloud infrastructure as part of comprehensive digital transformation strategies. These investments encompass AI strategies, digital skills initiatives, and updated telecommunications frameworks that collectively modernize the regulatory environment. As per the State of the Digital Decade 2024 report, Spain's yearly growth rate of the adoption of AI by businesses was 9.3%, which was four times that of the EU (2.6%). Community cloud models particularly benefit from these initiatives as they enable shared infrastructure costs across public sector organizations while meeting stringent security and compliance requirements. Government agencies increasingly leverage community clouds for e-governance platforms, citizen services, and inter-agency data sharing, establishing public sector leadership in community cloud adoption.

Massive Hyperscaler Data Center Investments

Global cloud providers are committing unprecedented investments in Spanish data center infrastructure, creating the foundation for expanded community cloud services. As per IMARC Group, the Spain data center market size reached USD 3.4 Billion in 2024. Hyperscalers bring advanced technologies, high-speed connectivity, and strong cybersecurity measures, which increase trust in shared cloud environments. Their presence also encourages smaller businesses, regional authorities, and research institutions to adopt community cloud solutions, as they can access enterprise-grade infrastructure and compliance standards. Additionally, the development of local hyperscale data centers reduces latency, ensures data sovereignty, and fosters regional collaboration, making community cloud adoption more practical and attractive across Spain.

Stringent Regulatory Compliance and Data Sovereignty Requirements

European regulatory frameworks are compelling organizations to adopt community cloud models that ensure data residency, operational autonomy, and compliance with evolving data protection standards. Sector-specific regulations, such as the Digital Operational Resilience Act (DORA) for financial services, create substantial demand for cloud infrastructure that maintains data within European jurisdictions under European operational control. Spain's National Security Framework establishes additional requirements for public sector cloud deployments. Community cloud architectures uniquely address these compliance challenges by enabling shared infrastructure among organizations with common regulatory obligations while maintaining necessary isolation and audit capabilities. With increasing number of cyberattacks and the heightened focus on cybersecurity, the regulatory environment positions community cloud as essential infrastructure for organizations handling sensitive information. Data from the National Institute of Cybersecurity (INCIBE) indicated that in 2024, 97,348 cybersecurity incidents were reported in Spain, showing a rise of 16.6% compared to 2023.

Market Restraints:

What Challenges the Spain Community Cloud Market is Facing?

Data Security and Privacy Concerns

Despite robust security measures, organizations remain cautious about sharing infrastructure within community cloud environments due to concerns about data isolation, access controls, and potential breach exposure. The shared nature of community clouds raises questions about lateral movement risks and the security implications of co-tenancy with other organizations. These concerns particularly affect highly sensitive workloads where organizations must balance collaboration benefits against security requirements.

Complexity of Regulatory Compliance

Navigating the complex landscape of European, national, and sector-specific regulations presents challenges for community cloud adoption. Organizations must ensure compliance with multiple overlapping frameworks, including national security requirements. The evolving regulatory environment requires continuous monitoring and adaptation, creating compliance overhead that can slow community cloud adoption, particularly among smaller organizations with limited regulatory expertise.

Skills Gap and Technical Expertise Shortage

The shortage of qualified cloud computing and cybersecurity professionals constrains community cloud adoption across Spanish industries. Organizations require specialized expertise to deploy, manage, and secure community cloud environments effectively. The cybersecurity skills gap is particularly acute, with high demand for cloud security, incident response, and compliance specialists. This talent scarcity can delay implementation timelines and increase operational costs for organizations pursuing community cloud strategies.

Competitive Landscape:

The Spain community cloud market exhibits dynamic competition among global hyperscalers, European sovereign cloud providers, and regional technology integrators. Market participants differentiate through compliance certifications, industry-specific expertise, and localized service offerings tailored to Spanish regulatory requirements. Strategic partnerships between cloud providers and telecommunications operators are establishing integrated community cloud ecosystems. Competition intensifies around sovereign cloud capabilities as organizations prioritize European-controlled infrastructure. Providers are expanding service portfolios to include AI, analytics, and edge computing within community cloud frameworks, creating comprehensive platforms for digital transformation.

Recent Developments:

- In October 2025, NextCloud, a community-driven open source platform, was set to take part in Madrid Tech Show 2025. The firm’s representatives would be present along with the company’s partner Danysoft in the Cloud and AI Infrastructure section. It would elaborate about how Nextcloud Hub could be utilized as the top secure option for collaboration requirements.

Spain Community Cloud Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered | Cloud-Based Storage, Cloud Backup and Recovery, Cloud Security and Data Privacy, High Performance Computation, Analytics and Web-Based Applications |

| Industry Verticals Covered | BFSI, Gaming, Government, Healthcare, Education, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain community cloud market size was valued at USD 150.05 Million in 2025.

The Spain community cloud market is expected to grow at a compound annual growth rate of 27.33% from 2026-2034 to reach USD 1,320.26 Million by 2034.

Software, holding the largest revenue share of 55%, remains pivotal for the community cloud adoption in Spain, enabling enterprise applications, collaboration tools, and business intelligence capabilities essential for effective shared infrastructure operations across regulated industries.

Key factors driving the Spain community cloud market include government digital transformation initiatives, massive hyperscaler data center investments, stringent regulatory compliance requirements, growing demand for data sovereignty, and increasing adoption across BFSI, government, and healthcare sectors.

Major challenges include data security and privacy concerns within shared environments, complexity of navigating multiple regulatory compliance frameworks, shortage of qualified cloud computing and cybersecurity professionals, and integration complexities with legacy systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)