Spain Confectionery Market Size, Share, Trends and Forecast by Product Type, Age Group, Price Point, Distribution Channel, and Region, 2026-2034

Spain Confectionery Market Overview:

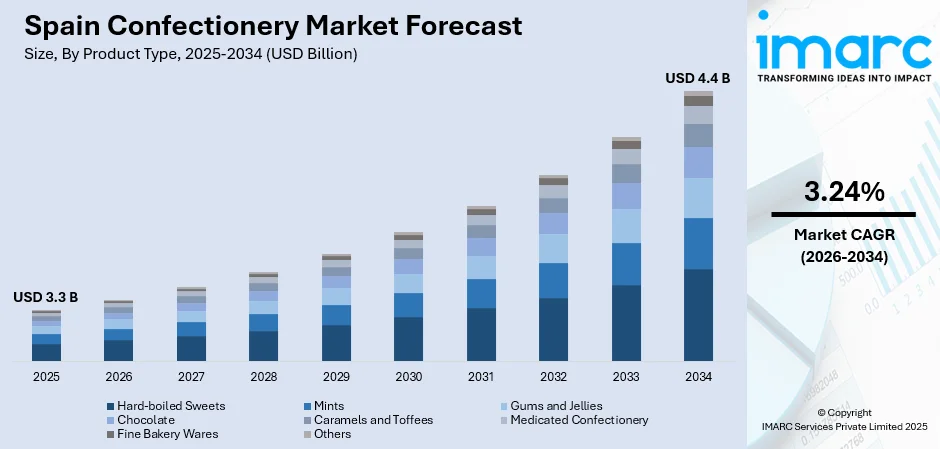

The Spain confectionery market size reached USD 3.3 Billion in 2025. The market is projected to reach USD 4.4 Billion by 2034, exhibiting a growth rate (CAGR) of 3.24% during 2026-2034. The industry is fueled by changing consumer trends, rising demand for indulgent sweets, and growth in premium and artisanal offerings. Urbanization, growing disposable incomes, and gift culture also drive sales across chocolate, sugar, and gum categories. Furthermore, increasing retail penetration and innovation in products also contribute significantly to the growth of the consumer base. All these factors combined drive the Spain confectionery market share, promoting steady growth and competition.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.3 Billion |

| Market Forecast in 2034 | USD 4.4 Billion |

| Market Growth Rate 2026-2034 | 3.24% |

Spain Confectionery Market Trends:

Growing Demand for Luxury and Handcrafted Confectionery

Spain's confectionery market is witnessing growing demand for premium and handcrafted confectionery driven by changing consumer sentiments towards quality, authenticity, and new flavor experiences. Consumers are gravitating more towards handcrafted chocolates, organic sweets, and gourmet sweets that emphasize traditional recipes, natural ingredients, and ornate packaging. These products are likely to appeal to consumers seeking indulgence and exclusivity, particularly during holidays and special occasions. The growth of artisanal products also demonstrates an overall preference among consumers for local production and sustainability. Moreover, innovation in product texture, flavor, and sourcing of ingredients has enhanced consumer appeal across all demographics. The Spain confectionery market growth is also driven substantially by the premiumization trend, wherein consumers are eager to pay a premium for products which are able to resonate with their lifestyle and palate.

To get more information on this market Request Sample

Confectionery consumption driven by health-consciousness

Healthy and wellness trends are revolutionizing Spain's confectionary market with consumers increasingly seeking low-sugar, sugar-free, and functional candies. There is a significant trend towards products addressing specific dietary needs, including gluten-free, vegan, and low-calorie products. This is fueled by increasing health consciousness for obesity, diabetes, and other health-related issues. In May 2024, Chocolates Trapa received the “Flavor of the Year 2024” award for its zero added sugar chocolate range, which includes 85% cocoa and white chocolate variants—highlighting industry momentum toward clean-label, reduced-sugar innovations. Consequently, companies are investing in reformulating conventional products with natural sweeteners, plant-based ingredients, and added probiotics or vitamins. Also, transparent labeling and openness in nutritional content are becoming imperative buying considerations. This emphasis on health-centric products is transforming market dynamics and increasing the base of consumers to health-conscious demographics. The Spain confectionery market trends indicate a robust shift toward reconciling indulgence with nutrition, presenting long-term innovation and consumer engagement opportunities.

Online and Modern Retail Channel Expansion

The confectionery products distribution landscape in Spain is changing quickly as a result of the growing impact of e-commerce and modern retailing formats. Consumers are increasingly using online channels for the convenience of ordering products but also for the greater choice, unique offerings, and tailored shopping experience. Supermarkets, hypermarkets, and specialty retailers are also augmenting their confectionery range with high-end and healthy options to address evolving shopper preferences. Furthermore, digital marketing, social media campaigns, and influencer-led promotions are having an important impact on promoting product visibility and purchasing behavior. Omnichannel approaches are being integrated to support brands in keeping consumers engaged across physical and digital points of contact. The trend is crucial to supporting further market growth due to its alignment with changing shopping habits and enabling easier access to varied product ranges.

Spain Confectionery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, age group, price point, and distribution channel.

Product Type Insights:

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others.

Age Group Insights:

- Children

- Adult

- Geriatric

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes children, adult, and geriatric.

Price Point Insights:

- Economy

- Mid-range

- Luxury

The report has provided a detailed breakup and analysis of the market based on the price point. This includes economy, mid-range, and luxury.

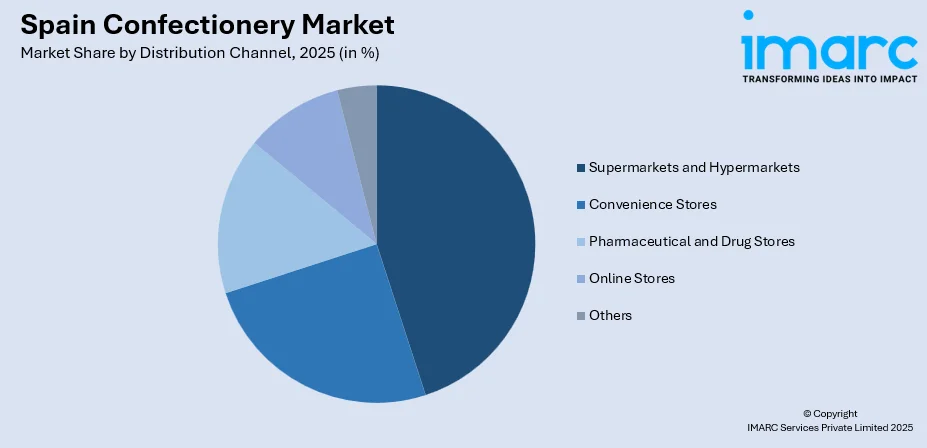

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmaceutical and drug stores, online stores, and others.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Confectionery Market News:

- In April 2024, Spain-based Burmar Sweets launched its Galaxy Special Edition line, featuring bold new flavors including energy, melon, piña colada, cherry, and raspberry. Available in both liquid and gummy candy formats, the range debuted with revamped packaging that emphasizes vibrant visual appeal and enhanced sensory experience, aligning with evolving consumer demand for innovative flavor profiles and eye-catching design.

- In May 2024, Chocolates Trapa, a renowned Spanish confectionery brand, launched its Trapa Collection 100% Cocoa tablet—a premium offering that is gluten-free and contains no hydrogenated fats, trans fats, or palm oil. The collection includes variants with zero added sugar, 85% cocoa, and white chocolate, all of which earned the prestigious “Flavor of the Year 2024” recognition for their taste and clean-label.

- In June 2024, Torrons Vicens and Xocolata Jolonch, traditional Catalan confectioners, unveiled a new range of nougat products that merge dessert and savory flavors. Notable among them was a Chupa Chups-flavored nougat—an almond praline with strawberry and caramel lollipop pieces coated in white and ruby chocolate. The brands also partnered with celebrated Spanish chefs such as Albert Adrià, Quique Dacosta, Ángel León, and Jordi Roca to craft avant-garde nougat fusions, showcasing a blend of culinary art and confectionery tradition.

Spain Confectionery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hard-Boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, Others |

| Age Groups Covered | Children, Adult, Geriatric |

| Price Points Covered | Economy, Mid-Range, Luxury |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain confectionery market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain confectionery market on the basis of product type?

- What is the breakup of the Spain confectionery market on the basis of age group?

- What is the breakup of the Spain confectionery market on the basis of price point?

- What is the breakup of the Spain confectionery market on the basis of distribution channel?

- What is the breakup of the Spain confectionery market on the basis of region?

- What are the various stages in the value chain of the Spain confectionery market?

- What are the key driving factors and challenges in the Spain confectionery market?

- What is the structure of the Spain confectionery market and who are the key players?

- What is the degree of competition in the Spain confectionery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain confectionery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain confectionery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain confectionery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)