Spain Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End-Use Industry, and Region, 2026-2034

Spain Drones Market Overview:

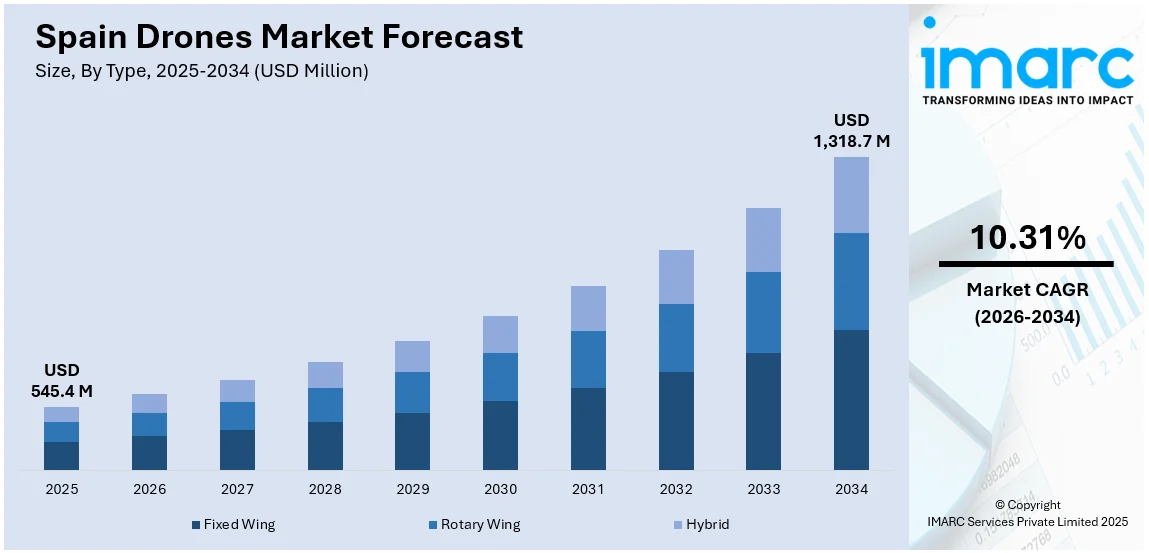

The Spain drones market size reached USD 545.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,318.7 Million by 2034, exhibiting a growth rate (CAGR) of 10.31% during 2026-2034. The market is fueled by government encouragement and well-defined regulatory guidelines that allow for secure and efficient operation of drones. Major industries like agriculture, which employs drones for monitoring crops and precision spraying, and construction, which sees applications in aerial surveying and site inspections, are major contributors to market expansion. Environmental monitoring and logistics also contribute significantly to the growth of applications. Integration of varying industrial adoption, regulatory clarity, and technological progress further increases the Spain drones market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 545.4 Million |

| Market Forecast in 2034 | USD 1,318.7 Million |

| Market Growth Rate 2026-2034 | 10.31% |

Spain Drones Market Trends:

Government Initiatives and Regulatory Framework

Spain's growth in the drone market is profoundly driven by favorable government policies and a developing regulatory framework designed to incorporate unmanned aerial systems securely and efficiently. The Spanish Aviation Safety and Security Agency (AESA) has established stringent rules governing drone registration, pilot training, and flying operations, allowing commercial and hobbyist users to find it simpler to adhere to legality. Spain is also a lead contributor to the European Union's quest to develop a single EU-wide drone regulatory framework, facilitating Spanish operators' potential gains from cross-border drone uses across the EU. In addition, the government also promotes innovation by providing finance and pilot programs in areas like agriculture, logistics, and public safety. Special zones for drone trials have also been created in areas like Castilla-La Mancha and Catalonia, allowing firms to test new technologies under real-world conditions. All these rules and policies create a strong platform that fosters investment, innovation, and extensive use of drone technology in Spain.

To get more information on this market Request Sample

Agricultural Applications and Environmental Monitoring

Agriculture continues to be a top driver of drone uptake in Spain, primarily due to the country's varied agricultural terrain and requirements for precision agriculture solutions. Spain is a top producer in Europe of olives, grapes, and citrus fruits, crops that significantly exploit drone-based technologies like aerial photography, crop health monitoring, and precision pesticide spraying. Agricultural farmers in areas such as Andalusia and Valencia use drones to enhance crop yield at lower input levels and environmental costs. Apart from farming, Spain's diversified ecosystems and protected natural reserves depend on drones for conservation efforts and environmental monitoring. Drones are employed to monitor wildlife, monitor forest cover, and monitor illegal activities like poaching or logging. This emphasis on both agricultural yields and environmental conservation underscores how drone uses are best positioned to take advantage of Spain's geographical and economic features, which will also help in bolstering the Spain drones market growth.

Expanding Commercial and Industrial Applications

Spain's increasing drone market is also spurred by expanded adoption in various commercial and industrial areas. Drones are widely utilized by construction firms for surveying sites, tracking progress, and safety inspections, particularly in fast-growing urban areas such as Madrid and Barcelona. The solar farms and wind turbines benefit from drone inspection in the renewable energy field, enabling faster identification of maintenance requirements and reduced downtime. Logistics firms in Spain are also testing deliveries with drones to address last-mile delivery issues, especially in rural or difficult-to-reach regions. The media and tourism industries also use drones to capture aerial shots, improve marketing campaigns, and market the rich cultural resources and natural scenery of Spain. With a dynamic start-up culture and partnerships between industry players and universities, Spain keeps on developing and innovating drone uses, propelling consistent market expansion and technological innovation.

Spain Drones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, component, payload, point of sale, and end-use industry.

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed wing, rotary wing, and hybrid.

Component Insights:

- Hardware

- Software

- Accessories

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and accessories.

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

A detailed breakup and analysis of the market based on the payload have also been provided in the report. This includes <25 Kilograms, 25-170 Kilograms, and >170 Kilograms.

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the point of sale. This includes original equipment manufacturers (OEM) and aftermarket.

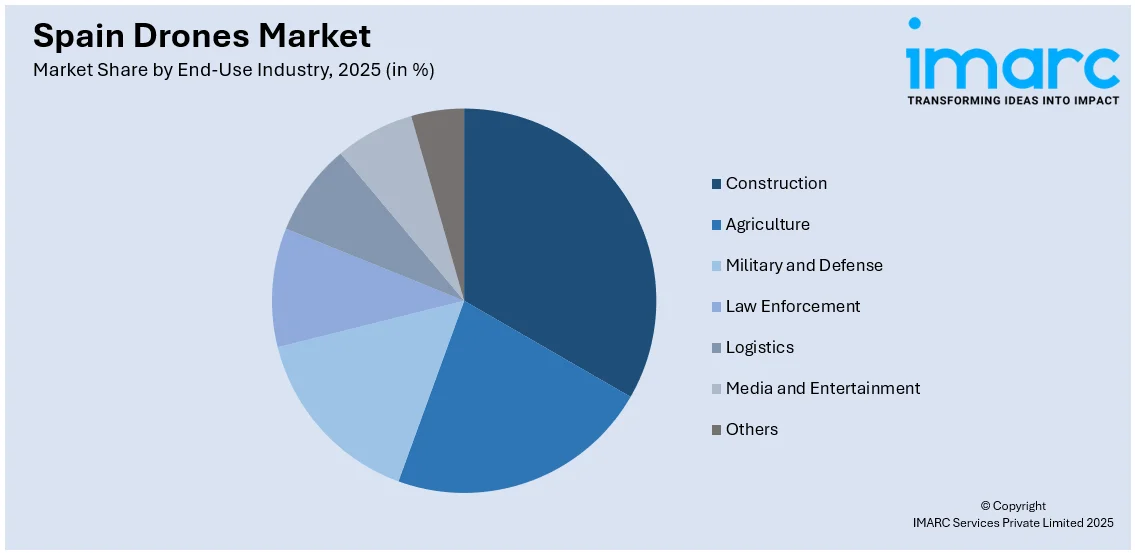

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes construction, agriculture, military and defense, law enforcement, logistics, media and entertainment, and others.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which includes Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Drones Market News:

- In February 2025, Spain's Ministry of Defense (MINISDEF) awarded a contract to Skydio, the leading US drone manufacturer and a world leader in autonomous flying, to supply autonomous small uncrewed aerial systems (sUAS) technology to the Spanish Armed Forces. Under a deal worth up to €18 Million ($18.7 Million USD), Skydio will provide Skydio X10D drones in association with Paukner Group, a Spanish dealer of defense and security equipment.

Spain Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Points of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End-Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain drones market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain drones market on the basis of type?

- What is the breakup of the Spain drones market on the basis of component?

- What is the breakup of the Spain drones market on the basis of payload?

- What is the breakup of the Spain drones market on the basis of point of sale?

- What is the breakup of the Spain drones market on the basis of end-use industry?

- What is the breakup of the Spain drones market on the basis of region?

- What are the various stages in the value chain of the Spain drones market?

- What are the key driving factors and challenges in the Spain drones market?

- What is the structure of the Spain drones market and who are the key players?

- What is the degree of competition in the Spain drones market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain drones market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain drones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)