Spain EdTech Market Size, Share, Trends and Forecast by Sector, Type, Deployment Mode, End User, and Region, 2026-2034

Spain EdTech Market Summary:

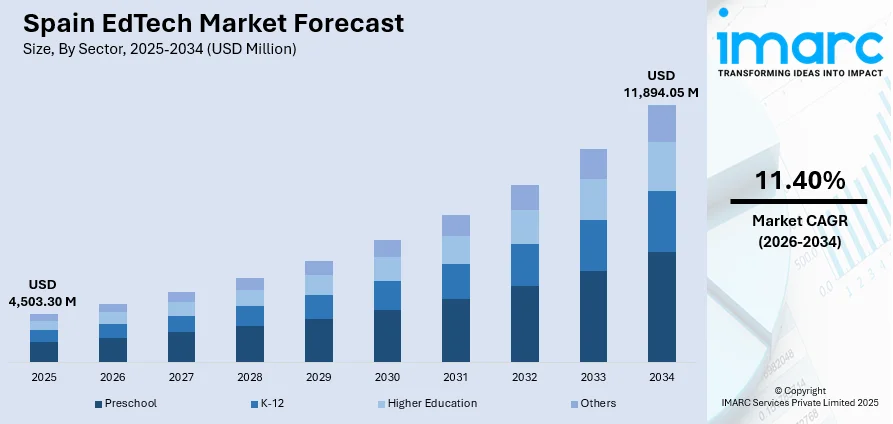

The Spain EdTech market size was valued at USD 4,503.30 Million in 2025 and is projected to reach USD 11,894.05 Million by 2034, growing at a compound annual growth rate of 11.40% from 2026-2034.

The Spain EdTech market is experiencing robust expansion driven by extensive government digitalization initiatives and substantial investments in educational infrastructure. The country's commitment to modernizing its education system through technology integration, coupled with rising demand for personalized learning solutions across educational sectors, is accelerating market development. Additionally, the growing adoption of cloud-based platforms and artificial intelligence tools in classrooms is transforming traditional pedagogical approaches, while increasing internet penetration and digital literacy rates are creating favorable conditions for EdTech adoption, strengthening the Spain EdTech market share.

Key Takeaways and Insights:

- By Sector: K-12 segment dominated the market with approximately 52.04% revenue share in 2025, driven by comprehensive government programs aimed at integrating digital technologies in primary and secondary education curricula across the country.

- By Type: Software segment leads the market with a share of 60.1% in 2025, owing to widespread adoption of learning management systems, virtual classroom platforms, and adaptive learning applications across educational institutions.

- By Deployment Mode: Cloud-based dominate with an 85.07% share in 2025, reflecting the preference for scalable, cost-effective platforms that enable remote accessibility and seamless content updates for educational stakeholders.

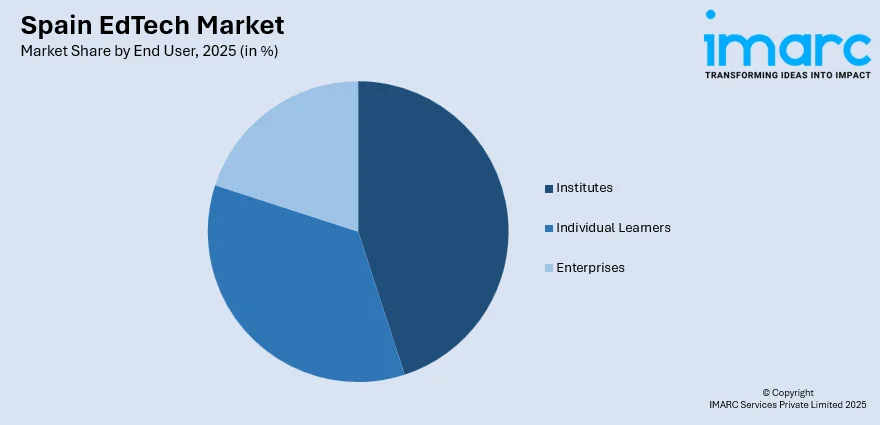

- By End User: Institutes segment accounts for the largest share at 45.12% in 2025, supported by substantial government funding for school digitalization programs and comprehensive teacher training initiatives.

- Key Players: The Spain EdTech market exhibits a moderately fragmented competitive landscape, characterized by the presence of established international technology providers alongside innovative domestic startups specializing in language learning, adaptive mathematics, and corporate training solutions.

To get more information on this market Request Sample

Spain's EdTech ecosystem has emerged as one of the most dynamic in Southern Europe, benefiting from extensive public sector investment and supportive policy frameworks. In 2023, 66.2% of the Spanish population had at least basic digital skills, well above the EU average of 55.6%. The government has implemented comprehensive digitalization programs targeting educational infrastructure modernization, device distribution to reduce digital access gaps, and installation of interactive digital systems in classrooms across the country. National digital skills plans encompass multiple action lines targeting education system digitalization and teacher training. Furthermore, Spain has achieved strong basic digital skills coverage among its population, surpassing regional averages, which reflects the country's commitment to building a digitally competent society. The presence of globally recognized EdTech companies has further strengthened Spain's position as a regional innovation hub for educational technology solutions.

Spain EdTech Market Trends:

Integration of Artificial Intelligence in Personalized Learning

Educational institutions across Spain are increasingly incorporating artificial intelligence technologies to deliver customized learning experiences tailored to individual student needs. For instance, as of 2025, 73% of teachers in Spain report having used AI at least once in their classrooms, from lesson preparation to content supplementation. AI-powered adaptive learning platforms analyze student performance patterns and automatically adjust content difficulty levels, enabling more effective knowledge acquisition. The deployment of intelligent tutoring systems and chatbot-based learning assistants is enhancing student engagement while reducing teacher workload through automated assessment and feedback mechanisms.

Expansion of Gamification and Interactive Learning Methodologies

Spanish educational institutions are adopting gamification strategies to enhance student motivation and participation in learning activities. For instance, in January 2025 the Kahoot! platform was formally adopted by more than 30 public universities in Spain, including Universidad Carlos III de Madrid, Universidad de Sevilla, and Universitat Autònoma de Barcelona, benefiting over 36,000 students and faculty members. Game-based learning approaches incorporating elements such as points, badges, leaderboards, and interactive challenges are being integrated across curricula to foster active engagement. Virtual and augmented reality technologies are enabling immersive educational experiences, including virtual field trips and laboratory simulations, transforming how students interact with complex concepts.

Rising Emphasis on STEAM Education and Digital Skills Development

There is growing focus on integrating science, technology, engineering, arts, and mathematics education through digital platforms and specialized curricula. In 2025, Madrid’s Código Escuela 4.0 program provided schools with robotics kits and teacher training, integrating robotics and computational thinking into classrooms to advance STEAM education. Schools are establishing dedicated programming and robotics laboratories to develop computational thinking skills from early educational stages. The emphasis on cultivating digital competencies, including coding, data literacy, and technology fluency, reflects the broader objective of preparing students for evolving workforce requirements.

Market Outlook 2026-2034:

The Spain EdTech market is positioned for sustained expansion throughout the forecast period, supported by continued government digitalization initiatives and growing institutional adoption of technology-enhanced learning solutions. The convergence of artificial intelligence, cloud computing, and immersive technologies is expected to drive innovation in educational content delivery and administrative efficiency. Rising demand for personalized learning experiences and workforce upskilling solutions will further contribute to market momentum. The market generated a revenue of USD 4,503.30 Million in 2025 and is projected to reach a revenue of USD 11,894.05 Million by 2034, growing at a compound annual growth rate of 11.40% from 2026-2034.

Spain EdTech Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Sector | K-12 | 52.04% |

| Type | Software | 60.1% |

| Deployment Mode | Cloud-based | 85.07% |

| End User | Institutes | 45.12% |

Sector Insights:

- Preschool

- K-12

- Higher Education

- Others

The K-12 dominates with a market share of 52.04% of the total Spain EdTech market in 2025.

The K-12 sector's leadership position reflects Spain's comprehensive policy focus on digitizing primary and secondary education through national initiatives that integrate computational thinking and programming into curricula from early stages. National‑level efforts, including teacher‑training via School of Computational Thinking and AI for Teachers, support the integration of robotics and programming (e.g., block‑based coding, electronics kits) into primary and secondary curricula. Students across Spain are benefiting from specialized equipment in programming and robotics, while the Ministry of Education has organized extensive digital skills training courses with widespread teacher participation, ensuring effective technology integration in classroom settings.

The growing adoption of digital learning platforms, interactive whiteboards, and tablet-based instruction in K-12 settings is transforming classroom experiences and enabling blended learning approaches. Schools are increasingly deploying learning management systems and educational applications that support differentiated instruction, allowing teachers to address diverse student learning needs while maintaining engagement through multimedia content and collaborative tools.

Type Insights:

- Hardware

- Software

- Content

The software leads with a share of 60.1% of the total Spain EdTech market in 2025.

The software segment's dominance is driven by widespread institutional adoption of learning management systems, virtual classroom platforms, and assessment tools that enable efficient educational delivery and administrative management. For example, the public‑private program Amazon’s Amazon Future Engineer (AFE) recently committed to train half a million young people in Spain in digital skills by 2027, delivering programming courses and digital‑skills training to schools across primary and secondary levels. Spanish educational institutions are increasingly implementing adaptive learning software that personalizes content delivery based on individual student performance, while collaboration platforms facilitate remote and hybrid learning modalities across educational levels.

The proliferation of AI-powered educational applications, including intelligent tutoring systems and automated grading solutions, is further accelerating software adoption across educational segments. Language learning applications, mathematics platforms, and STEAM-focused software solutions developed by domestic EdTech companies are gaining traction both domestically and in international Spanish-speaking markets, expanding the reach and influence of Spanish educational technology.

Deployment Mode Insights:

- Cloud-based

- On-premises

The cloud-based dominates with a market share of 85.07% of the total Spain EdTech market in 2025.

The strong preference for cloud-based deployment reflects the scalability, cost-effectiveness, and accessibility advantages these solutions offer to educational institutions with varying resource constraints. Cloud platforms enable seamless content updates, facilitate real-time collaboration between students and teachers, and support device-agnostic access that accommodates diverse hardware environments across Spanish schools and educational centers.

The government's emphasis on digital infrastructure development, including high-speed internet connectivity in educational institutions, has created favorable conditions for cloud adoption. Additionally, cloud-based solutions support the flexible learning models that have gained prominence, enabling institutions to maintain educational continuity while offering students the convenience of accessing learning materials from any location with internet connectivity.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Individual Learners

- Institutes

- Enterprises

The institutes lead with a share of 45.12% of the total Spain EdTech market in 2025.

Educational institutions across Spain are driving EdTech adoption through systematic integration of digital tools into teaching and administrative processes. Under the Connected Schools Programme (part of the Digital Spain 2026 agenda), more than 300,000 portable devices have been provided to students, and interactive digital systems (IDS) have been installed in over 240,000 classrooms nationwide, measures aimed at reducing the digital‑access gap and modernizing classroom infrastructure.

Universities and vocational training centers are implementing comprehensive learning ecosystems that combine content management, student analytics, and assessment capabilities. The emphasis on teacher digital competency development, with extensive educator participation in digital skills accreditation programs, has accelerated effective technology integration in instructional practices across institutional settings throughout the country.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Northern Spain's EdTech landscape benefits from strong industrial and technological foundations in regions such as the Basque Country and Navarra, which support robust STEM education initiatives. The region hosts established technology clusters and innovation ecosystems that facilitate collaboration between educational institutions and industry partners, driving adoption of cutting-edge learning technologies and vocational training platforms.

Eastern Spain, anchored by Catalonia and the Valencia Community, represents a significant EdTech hub with Barcelona serving as a major startup ecosystem. The region benefits from high digital literacy rates, strong university systems, and concentration of technology companies developing innovative educational solutions. Multilingual education requirements drive demand for language learning platforms and localized content.

Southern Spain's EdTech market is characterized by growing investment in digital infrastructure to bridge urban-rural educational divides in Andalusia and surrounding autonomous communities. Government-led digitalization programs are expanding access to online learning resources in historically underserved areas, while tourism-related industries drive demand for hospitality and service sector training platforms.

Central Spain, centered on Madrid, represents the primary concentration of EdTech companies, venture capital investment, and corporate training markets. The capital region hosts headquarters of major domestic EdTech firms and serves as the gateway for international platforms entering the Spanish market. Concentration of higher education institutions and corporate headquarters drives demand for professional development and upskilling solutions.

Market Dynamics:

Growth Drivers:

Why is the Spain EdTech Market Growing?

Comprehensive Government Digitalization Programs and Funding Initiatives

The Spanish government has implemented extensive digitalization programs that are fundamentally transforming the educational landscape and creating substantial opportunities for EdTech adoption. For instance, in 2024 the Ministry of Education launched the “Código Escuela 4.0” initiative, providing schools with robotics kits, programming resources, and teacher-training workshops to foster computational thinking and digital skills from early educational stages. National digital agendas and accompanying skills development plans represent coordinated policy frameworks backed by significant financial commitments. These initiatives encompass connected schools programs providing digital infrastructure including device distribution, interactive classroom systems, and teacher training. The comprehensive approach addresses multiple dimensions of educational technology integration, from hardware provision to digital competency development, creating a systematic foundation for sustained market expansion across all educational segments.

Rising Demand for Personalized and Adaptive Learning Solutions

Educational institutions and individual learners are increasingly seeking technology solutions that enable customized learning experiences tailored to diverse needs and learning styles. The shift away from one-size-fits-all instructional approaches has accelerated adoption of adaptive learning platforms that adjust content difficulty and pacing based on individual student performance. In 2024, EDUCA EDTECH Group marked its 20th anniversary with a rebrand and first Brand Manifesto, emphasizing “Knowledge needs no place” while expanding its online‑education presence across Spain and Latin America. This demand is further amplified by growing awareness of learning differences and the need for differentiated instruction, driving investment in AI-powered educational tools that can identify knowledge gaps and provide targeted interventions while reducing teacher administrative burdens and enabling more effective instructional time allocation.

Expanding Internet Connectivity and Digital Infrastructure

Spain's robust digital infrastructure development is enabling broader EdTech adoption across geographic and socioeconomic segments. Internet access in Spanish households has expanded significantly, while ongoing investments are addressing connectivity gaps in rural and underserved areas. In 2024–25, the government’s UNICO 5G Active Networks Program awarded €161.3 million to expand 5G to small localities, extending high‑speed connectivity to approximately 326,000 people and covering thousands of kilometers of rural road networks. The proliferation of digital devices, including tablets and laptops provided through government programs, has created the technological foundation necessary for widespread e-learning implementation. This infrastructure expansion is complemented by rising digital literacy rates, with Spain achieving strong basic digital skills coverage among its population, creating favorable conditions for technology-enhanced learning adoption across all demographics.

Market Restraints:

What Challenges the Spain EdTech Market is Facing?

Persistent Digital Divide Between Urban and Rural Regions

Despite significant progress in digital infrastructure development, disparities in technology access and connectivity between urban centers and rural areas continue to impede uniform EdTech adoption across Spain. Remote and economically disadvantaged regions face challenges related to broadband availability, device accessibility, and technical support resources, creating barriers to equitable educational technology implementation and limiting market penetration in underserved communities.

Teacher Training and Technology Adaptation Challenges

Effective EdTech implementation requires educators to develop proficiency in utilizing digital tools and integrating technology into pedagogical practices. While substantial training programs have been implemented, varying levels of digital competency among teachers and resistance to changing established instructional methods can slow adoption. The need for ongoing professional development and technical support represents a continuous investment requirement for educational institutions seeking comprehensive digital transformation.

Data Privacy and Security Concerns in Educational Settings

The collection and processing of student data through EdTech platforms raises significant privacy and security considerations that require careful management. Educational institutions must navigate complex regulatory requirements while ensuring protection of sensitive information related to minors. Concerns about data handling practices, platform security vulnerabilities, and appropriate use of student analytics can create hesitation in technology adoption decisions among schools and parents.

Competitive Landscape:

The Spain EdTech market exhibits a moderately fragmented competitive structure characterized by the presence of established international technology corporations, specialized domestic EdTech companies, and innovative startups addressing specific educational segments. Major global players leverage extensive resources and platform ecosystems to serve institutional customers, while Spanish companies have achieved notable success in language learning, mathematics education, and corporate training domains. The market has witnessed growing venture capital interest, with EdTech ranking among the largest sectors by company count in Spain's technology ecosystem. Competition centers on innovation in adaptive learning capabilities, content quality, user engagement features, and integration with institutional learning management systems and administrative platforms.

Recent Developments:

- In September 2025: El País highlighted EDUCA EDTECH Group for launching PHIA, its AI-powered mentoring assistant that offers personalised, adaptive learning support across its platforms. The company also released its first international whitepaper examining how online education influences employability in Spain and Latin America, signalling broader strategic ambitions.

- In August 2025, Italy’s EdTech startup Faba raised €4.5 million to expand into Spain, one of its fastest-growing markets. The Treviso-based company offers screen-free audio storytelling for children, aiming to accelerate its Spanish presence. The funding round, led by CDP Venture Capital, brings total investment to €8.2 million since 2022.

- In August 2025, Barcelona-based EdTech startup Masterplace raised USD 2 million in a seed round to launch its AI-powered educational platform. The app allows tutors to create, deliver, and monetize courses with AI support, while students access adaptive learning. Web3 integration protects intellectual property and promotes broader educational impact.

Spain EdTech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| Types Covered | Hardware, Software, Content |

| Deployment Modes Covered | Cloud-based, On-premises |

| End Users Covered | Individual Learners, Institutes, Enterprises |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain EdTech market size was valued at USD 4,503.30 Million in 2025.

The Spain EdTech market is expected to grow at a compound annual growth rate of 11.40% from 2026-2034 to reach USD 11,894.05 Million by 2034.

The K-12 sector dominated the market with a share of 52.04%, driven by comprehensive government digitalization programs targeting primary and secondary education institutions across Spain through national initiatives focused on technology integration and teacher training.

Key factors driving the Spain EdTech market include extensive government digitalization initiatives, rising demand for personalized learning solutions, expanding internet connectivity, growing adoption of cloud-based platforms, and increasing integration of artificial intelligence in educational applications.

Major challenges include the persistent digital divide between urban and rural regions, teacher training requirements for effective technology integration, data privacy and security concerns in educational settings, and varying levels of institutional readiness for digital transformation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)