Spain Electric Two-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Voltage Type, Peak Power, Battery Technology, Motor Placement, and Region, 2026-2034

Spain Electric Two-Wheeler Market Overview:

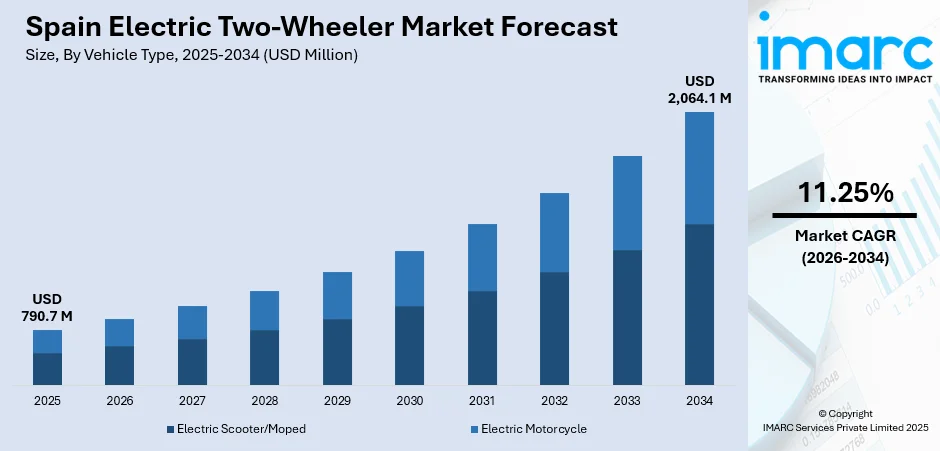

The Spain electric two-wheeler market size reached USD 790.7 Million in 2025. The market is projected to reach USD 2,064.1 Million by 2034, exhibiting a growth rate (CAGR) of 11.25% during 2026-2034. Urban congestion and fuel price concerns are encouraging Spanish commuters to adopt electric two‑wheelers as a practical, eco‑friendly solution. Supportive government policies and regional subsidies are making these vehicles more accessible, while improvements in charging networks reduce range limitations. Delivery and logistics companies are increasingly switching to electric scooters for efficiency and cost benefits. Advancements in battery technology and smart features enhance performance and convenience. Additionally, shared‑mobility services are popularizing electric two‑wheelers among younger users, driving Spain electric two-wheeler market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 790.7 Million |

| Market Forecast in 2034 | USD 2,064.1 Million |

| Market Growth Rate 2026-2034 | 11.25% |

Spain Electric Two-Wheeler Market Trends:

Charging Infrastructure & Battery Innovation

One significant Spain’s electric two‑wheeler market trend is the development of charging networks and battery technologies, which are transforming the electric two‑wheeler experience. Expanding access to public and private charging points helps ease the concern of running out of power, making electric vehicles a more practical option for everyday use. Innovative solutions, such as quick‑charging systems and emerging battery‑swapping models, provide greater convenience for both individual riders and fleet operators who need fast turnaround times. At the same time, advancements in battery technology are improving performance by offering longer ranges, reduced charging times, and lighter designs, enhancing overall vehicle efficiency. This evolution in infrastructure and technology gives riders greater confidence in electric two‑wheelers as a dependable form of transport. Together, these improvements make electric mobility more seamless, supporting broader adoption and integrating these vehicles into the daily routines of commuters and commercial users alike.

To get more information on this market Request Sample

Government Policies & Financial Incentives

Government initiatives play a central role in driving the adoption of electric two‑wheelers in Spain. The MOVES III program, extended until December 31, 2025, now has a €1.735 billion budget, with €1.335 billion already allocated, supporting the purchase of over 142,000 electric vehicles and the installation of 113,000+ charging points as of early 2025. These subsidies, combined with tax reductions, registration discounts, and preferential access to low‑emission zones, make electric two‑wheelers more financially accessible to individuals and businesses. Municipal actions—such as dedicated parking and relaxed operating restrictions—further support their integration into urban transport systems. Together, these national and local measures create a favorable policy environment that reduces ownership barriers and reassures consumers about the long‑term value of electric mobility. For delivery and logistics companies, these incentives make fleet electrification both practical and cost‑effective, accelerating the Spain electric two-wheeler market growth.

Commercial & E‑commerce Demand

The growing need for efficient, low‑cost delivery solutions is significantly boosting electric two‑wheeler adoption in Spain. Businesses in e‑commerce, food delivery, and urban logistics increasingly rely on electric scooters and mopeds to navigate congested city streets quickly and economically. These vehicles offer advantages like lower operational costs, quiet operation, and easy maneuverability, making them an ideal fit for last‑mile delivery. Companies are also motivated by sustainability goals, with electric two‑wheelers helping to reduce their carbon footprint while maintaining operational efficiency. Beyond commercial fleets, shared‑mobility platforms are integrating electric two‑wheelers into rental services, appealing to young, tech‑savvy users who prefer flexible and eco‑friendly transport options. This dual demand—from businesses seeking efficiency and individuals valuing convenience—creates a strong foundation for market growth. As these trends converge, electric two‑wheelers are becoming a vital component of Spain’s evolving urban mobility landscape.

Spain Electric Two-Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on vehicle type, battery type, voltage type, peak power, battery technology, and motor placement.

Vehicle Type Insights:

- Electric Scooter/Moped

- Electric Motorcycle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes electric scooter/moped, and electric motorcycle.

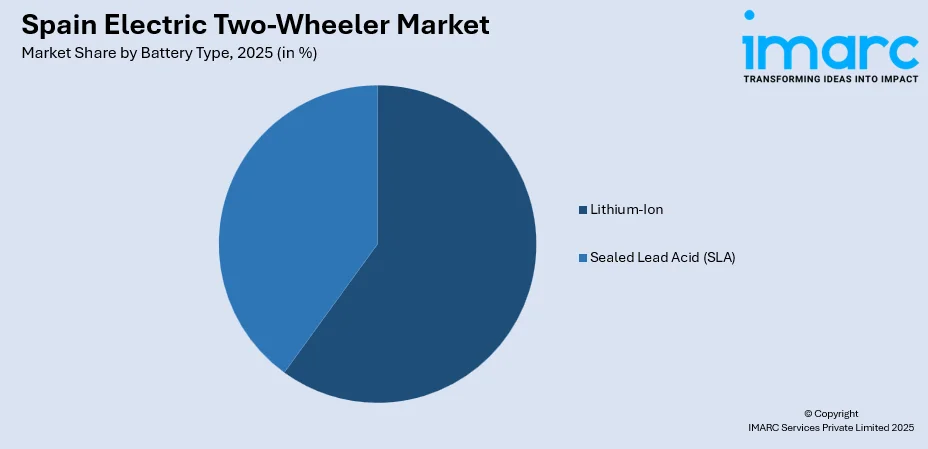

Battery Type Insights:

Access the comprehensive market breakdown Request Sample

- Lithium-Ion

- Sealed Lead Acid (SLA)

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion, and sealed lead acid (SLA).

Voltage Type Insights:

- <48V

- 48-60V

- 61-72V

- 73-96V

- >96V

A detailed breakup and analysis of the market based on the voltage type have also been provided in the report. This includes <48V, 48-60V, 61-72V, 73-96V, and >96V.

Peak Power Insights:

- <3 kW

- 3-6 kW

- 7-10 kW

- >10 kW

A detailed breakup and analysis of the market based on the peak power have also been provided in the report. This includes <3 kW, 3-6 kW, 7-10 kW, and >10 kW.

Battery Technology Insights:

- Removable

- Non-Removable

A detailed breakup and analysis of the market based on the battery technology have also been provided in the report. This includes removable, and non-removable.

Motor Placement Insights:

- Hub Type

- Chassis Mounted

A detailed breakup and analysis of the market based on the motor placement have also been provided in the report. This includes hub type, and chassis mounted.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Electric Two-Wheeler Market News:

- In September 2024, India’s Hero MotoCorp will launch its Vida electric scooters in the UK, France, and Spain by mid‑2025, marking its entry into European markets. This move aims to capitalize on rising EV demand and aligns with ongoing India‑UK free trade talks that could lower tariffs. CEO Niranjan Gupta highlighted strong regional interest in Hero’s e‑scooters, as the company expands beyond Asia, Africa, and Latin America to strengthen its global electric mobility presence.

Spain Electric Two-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Electric Scooter/Moped, Electric Motorcycle |

| Battery Types Covered | Lithium-Ion, Sealed Lead Acid (SLA) |

| Voltage Types Covered | <48V, 48-60V, 61-72V, 73-96V, >96V |

| Peak Powers Covered | <3 kW, 3-6 kW, 7-10 kW, >10 kW |

| Battery Technologies Covered | Removable, Non-Removable |

| Motor Placements Covered | Hub Type, Chassis Mounted |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain electric two-wheeler market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain electric two-wheeler market on the basis of vehicle type?

- What is the breakup of the Spain electric two-wheeler market on the basis of battery type?

- What is the breakup of the Spain electric two-wheeler market on the basis of voltage type?

- What is the breakup of the Spain electric two-wheeler market on the basis of peak power?

- What is the breakup of the Spain electric two-wheeler market on the basis of battery technology?

- What is the breakup of the Spain electric two-wheeler market on the basis of motor placement?

- What is the breakup of the Spain electric two-wheeler market on the basis of region?

- What are the various stages in the value chain of the Spain electric two-wheeler market?

- What are the key driving factors and challenges in the Spain electric two-wheeler market?

- What is the structure of the Spain electric two-wheeler market and who are the key players?

- What is the degree of competition in the Spain electric two-wheeler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain electric two-wheeler market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain electric two-wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain electric two-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)