Spain Fintech Market Size, Share, Trends and Forecast by Deployment Mode, Technology, Application, End User, and Region, 2026-2034

Spain Fintech Market Overview:

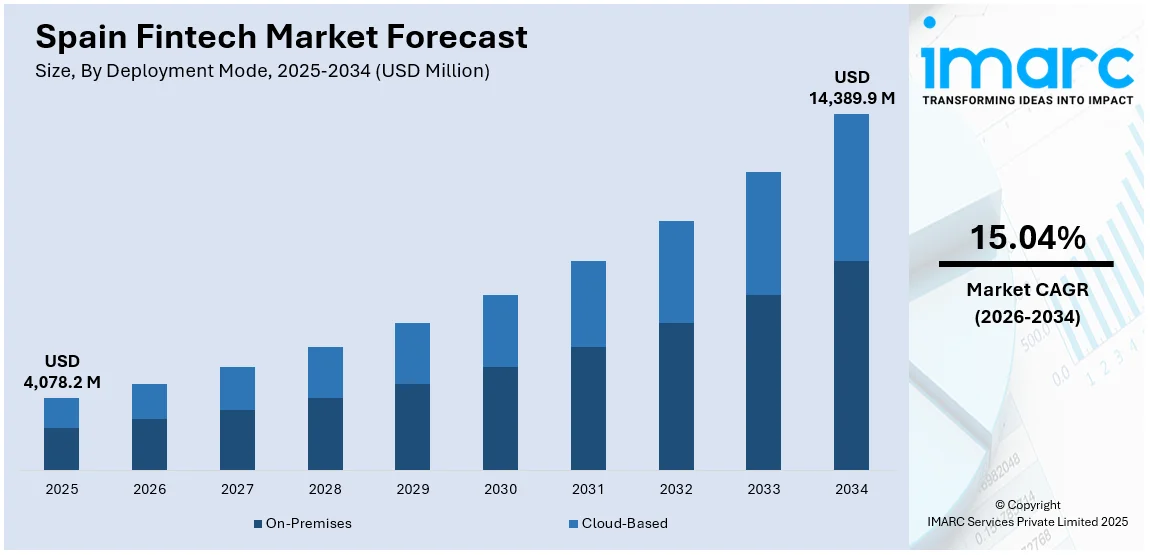

The Spain fintech market size reached USD 4,078.2 Million in 2025. The market is projected to reach USD 14,389.9 Million by 2034, exhibiting a growth rate (CAGR) of 15.04% during 2026-2034. The market is evolving rapidly, driven by increased digital adoption, innovation in financial services, and supportive regulatory initiatives. Major trends are the growth in mobile banking, development in digital payments, and heightened demand for customized financial solutions. Deployment modes like cloud-based platforms are popular, while technologies such as AI and blockchain are dictating the future. The market spreads across different applications and end users, providing varied opportunities across regions. These considerations cumulatively affect the Spain fintech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4,078.2 Million |

| Market Forecast in 2034 | USD 14,389.9 Million |

| Market Growth Rate 2026-2034 | 15.04% |

Spain Fintech Market Trends:

Digital Wallets and Prepaid Cards Drive Financial Shift

Spain’s financial ecosystem experienced a significant milestone in June 2025, with the prepaid card and digital wallet sector hitting a new benchmark. This growth is largely fueled by consumer demand for faster, more flexible payment options. In fact, recent data shows that over 70% of retail transactions in Spain are now completed using digital or contactless payments, highlighting the rapid pace of adoption. Mobile and online payments have become everyday habits, making digital wallets and prepaid cards central to how Spaniard’s shop, travel, and manage expenses. This shift goes beyond convenience it’s about expanding access. Prepaid solutions often serve as a bridge for unbanked or underbanked populations, supported by Spain’s open digital infrastructure that promotes financial inclusion. Consumer trust in digital wallets has grown steadily, bolstered by transparent interfaces and strong security measures. These tools not only increase accessibility but also streamline interactions with financial services. As this transformation unfolds, Spain fintech market growth is no longer speculative it’s clearly visible in everyday life, driven by technology tailored to real-world needs.

To get more information on this market Request Sample

Real-Time Payments Redefining User Expectations

In March 2024, Spain’s financial system reached a notable milestone in instant transactions, signaling how real-time payments are reshaping the market. One standout metric: more than half of all SEPA instant credit transfers in Spain are now processed through domestic real-time payment platforms. This growing volume reflects a clear shift in user expectations speed and convenience have become non-negotiable in everyday finance. Real-time transfers have moved beyond peer-to-peer use; they are now embedded in everything from bill payments to business-to-consumer disbursements. Infrastructure investments and broad banking integration are accelerating this shift, making near-instant fund movement the new standard. What used to be optional is quickly becoming the baseline. These changes aren’t just technical, they're behavioral. Consumers expect immediacy, and fintech is delivering. This pattern signals a broader evolution in how people think about access to money and services. As this continues, it becomes clear that Spain fintech market trends aren’t just about innovation they are about aligning services with daily life in real time.

BNPL Adoption Reshaping Consumer Credit Behavior

In February 2025, Spain’s consumer finance landscape marked a turning point with new data highlighting the momentum behind Buy Now, Pay Later (BNPL) services. One key finding: over one-third of online shoppers in Spain used BNPL at least once in the previous year, indicating growing comfort with installment-based payments. BNPL is no longer a fringe offering, it’s becoming a preferred choice, especially among younger consumers seeking flexibility without long-term credit commitments. This trend is closely tied to shifts in online purchasing behavior, where seamless, embedded payment experiences influence both conversion rates and basket sizes. As regulation catches up to consumer demand, the sector is maturing, improving transparency while still offering the simplicity that draws users in. BNPL’s rising integration across retail and digital platforms positions it as more than just a payment method it’s a redefinition of how consumers approach short-term borrowing. This evolution reflects a broader dynamic within the Spain fintech market, where consumer expectations are actively shaping financial product design and adoption in real time.

Spain Fintech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on deployment mode, technology, application, and end user.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

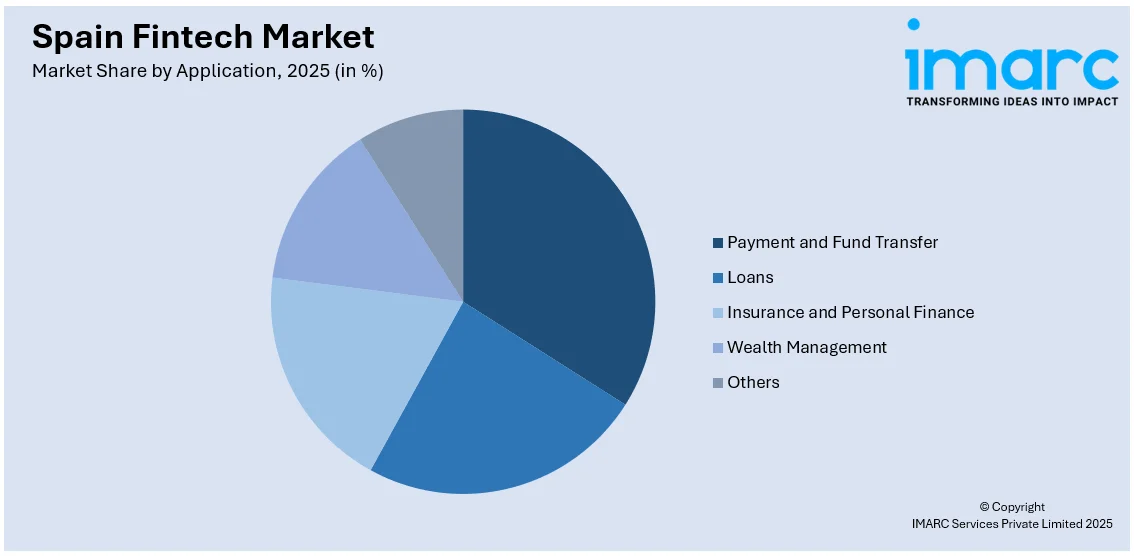

Application Insights:

Access the comprehensive market breakdown Request Sample

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes payment and fund transfer, loans, insurance and personal finance, wealth management, and others.

End User Insights:

- Banking

- Insurance

- Securities

- Others

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes banking, insurance, securities, and others.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Fintech Market News:

- May 2025: Spain-based sustainable finance platform Goparity has secured new funding to support the growth of ethical investing across the region. The firm, which leads the way with environmentally and socially conscious financial products, will invest the funds in deepening its platform and building out its customer base. With Spain being one of its core markets, Goparity is working to bring sustainable investing within reach of individuals and companies. The funding also indicates an increase in interest in ethical finance and aids the company's vision to deliver positive change.

Spain Fintech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End Users Covered | Banking, Insurance, Securities, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain fintech market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain fintech market on the basis of deployment mode?

- What is the breakup of the Spain fintech market on the basis of technology?

- What is the breakup of the Spain fintech market on the basis of application?

- What is the breakup of the Spain fintech market on the basis of end user?

- What is the breakup of the Spain fintech market on the basis of region?

- What are the various stages in the value chain of the Spain fintech market?

- What are the key driving factors and challenges in the Spain fintech market?

- What is the structure of the Spain fintech market and who are the key players?

- What is the degree of competition in the Spain fintech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain fintech market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain fintech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain fintech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)