Spain Heating and Plumbing Market Size, Share, Trends and Forecast by Product Type, Service, Distribution Channel, End User, and Region, 2026-2034

Spain Heating and Plumbing Market Overview:

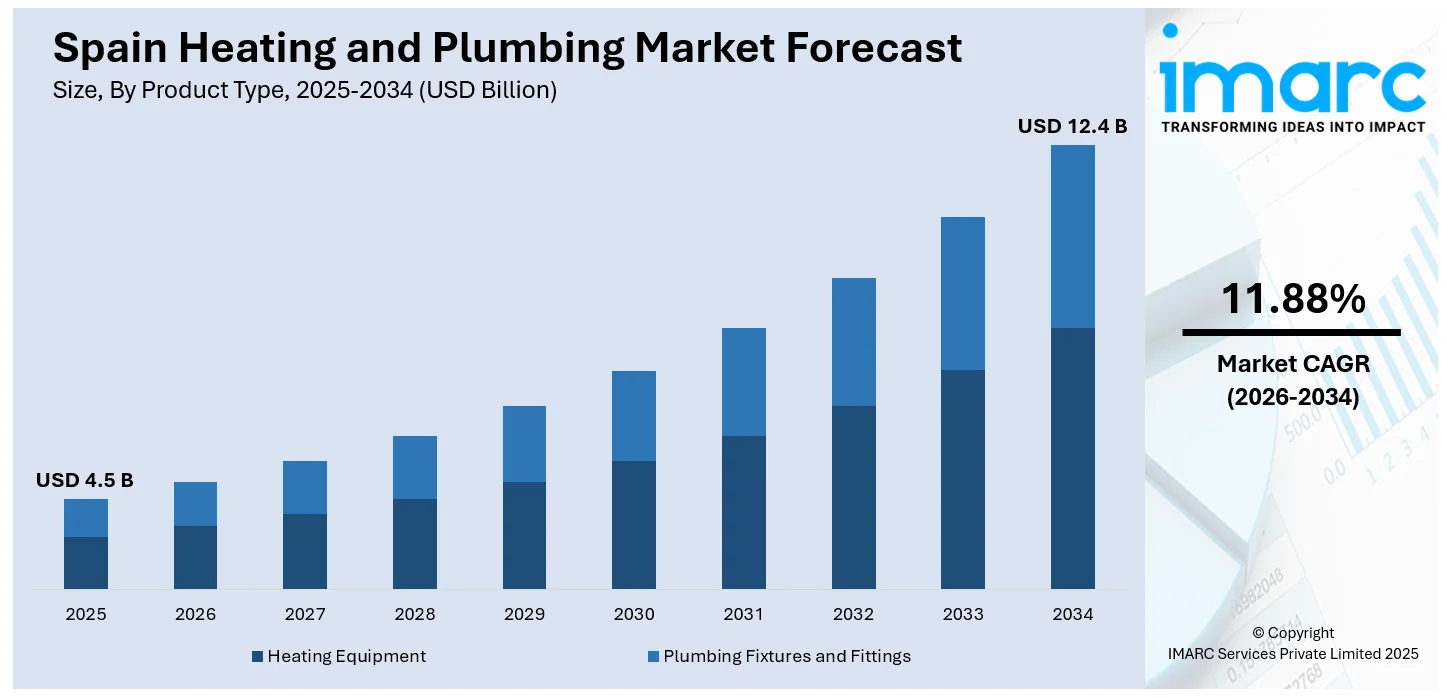

The Spain heating and plumbing market size reached USD 4.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 12.4 Billion by 2034, exhibiting a growth rate (CAGR) of 11.88% during 2026-2034. The market is growing due to rising demand for energy-efficient systems, government incentives, smart home integration, renewable heating solutions, urbanization, infrastructure modernization, and increasing consumer preference for sustainable and cost-effective water and heating technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.5 Billion |

| Market Forecast in 2034 | USD 12.4 Billion |

| Market Growth Rate 2026-2034 | 11.88% |

Spain Heating and Plumbing Market Trends:

Rising Demand for Energy-Efficient and Smart Heating Systems

The Spain heating and plumbing market is witnessing a strong shift towards energy-efficient and smart heating solutions. As energy prices increase and the European Union (EU) tightens carbon emission rules, business and consumer markets are turning to high-efficiency condensing boilers, heat pumps, and hybrid systems. Moreover, smart thermostats and Internet of Things (IoT)-based heating controls are gaining traction, enabling consumers to maximize energy efficiency and lower bills via remote monitoring and automation. Besides this, the government of Spain is promoting such shifting by granting subsidies and taxation reduction for upgrades involving energy-saving heaters, continuing adoption. Additionally, commercial and residential buildings are integrating district heating networks and solar thermal systems to minimize dependency on fossil fuels. For example, in November 2024, Engie acquired District Heating Eco Energías, a company specializing in biomass-based district heating networks in Spain. This move strengthens Engie's leadership in sustainable heating solutions, promoting eco-friendly energy infrastructure. As a result, the heating industry is evolving towards intelligent, eco-friendly solutions that align with sustainability goals while providing enhanced comfort and cost savings for consumers, thus enhancing the Spain heating and plumbing market outlook.

To get more information on this market Request Sample

Expansion of Sustainable Plumbing Solutions and Water-Efficient Technologies

The Spanish plumbing industry is undergoing a sustainability revolution because of the rising adoption of efficient water technologies along with environmentally friendly materials. This trend is significantly driving the Spain heating and plumbing market growth. The combination of tightened water conservation regulations and growing public ecological consciousness leads to increased interest in low-flow faucet technology, dual-flush toilets, and greywater recycling technologies. For instance, in November 2024, Salher ensured that all its water reuse systems complied with Spain's Royal Decree 1085/2024, aligning with EU regulations to enhance water quality and safety. This commitment underscores the industry's dedication to sustainable water management. Additionally, smart plumbing technology continues its integration into construction by developers and builders because these systems use sensors both for leak detection and building water system performance enhancement in residential and commercial properties. Furthermore, the market has adopted PEX (cross-linked polyethylene) pipes and corrosion-resistant fittings as these materials demonstrate durable performance while minimizing environmental impact. Also, the installation of rainwater harvesting technologies in newly built housing ventures works to combat future water shortage problems. As a result, Spain demonstrates its sustainability dedication through these trends which also provide long-term cost benefits to homeowners and businesses, thereby boosting the Spain heating and plumbing market share.

Spain Heating and Plumbing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product type, service, distribution channel and end user.

Product Type Insights:

- Heating Equipment

- Boilers

- Furnaces

- Heat Pumps

- Radiant Heating Systems

- Plumbing Fixtures and Fittings

- Pipes and Valves

- Faucets and Showers

- Bathtubs and Sinks

- Toilets

The report has provided a detailed breakup and analysis of the market based on the product type. This includes heating equipment (boilers, furnaces, heat pumps, radiant heating systems) and plumbing fixtures and fittings (pipes and valves, faucets and showers, bathtubs and sinks, toilets).

Service Insights:

- Installation

- Maintenance and Repair

- Consulting

- Upgrade or Replacement

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes installation, maintenance and repair, consulting, and upgrade or replacement.

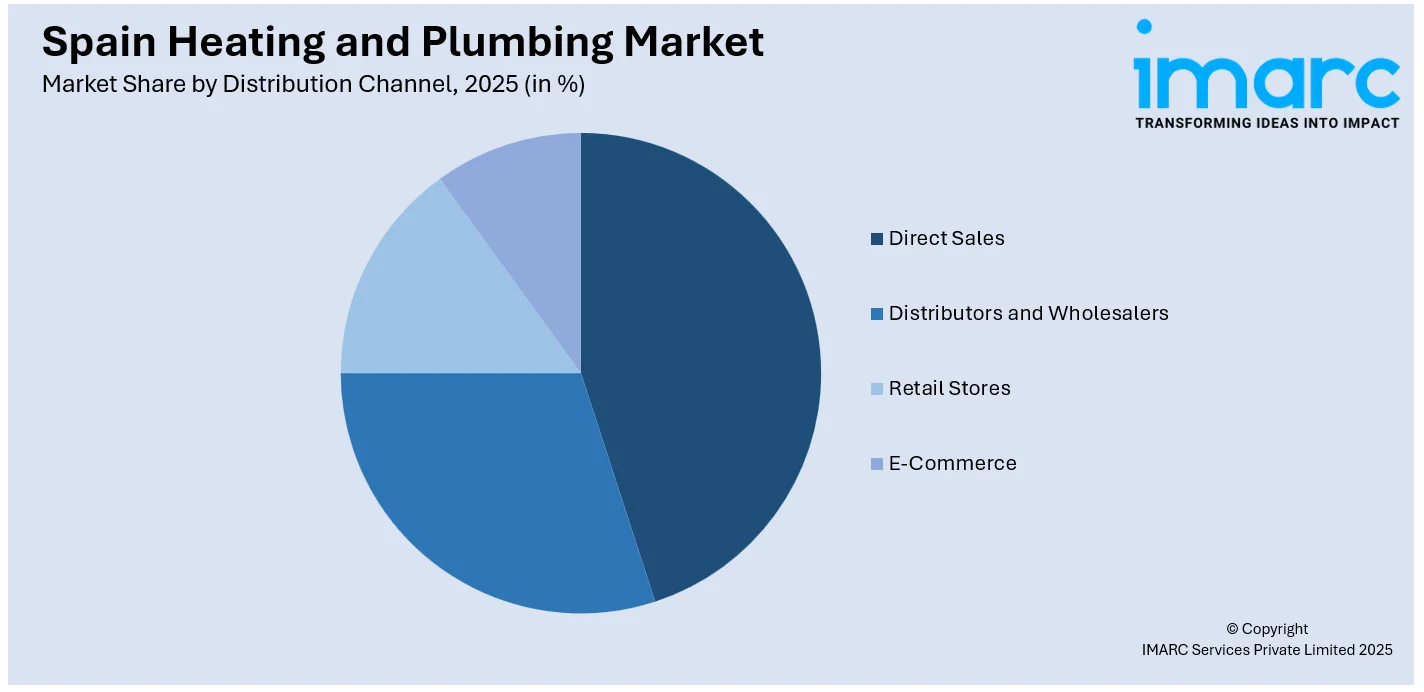

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct Sales

- Distributors and Wholesalers

- Retail Stores

- E-Commerce

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales, distributors and wholesalers, retail stores and e-commerce.

End User Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Eastern, Southern, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Heating and Plumbing Market News:

- In September 2024, Neinor Homes entered into a joint venture with Bain Capital, acquiring a 10% stake in Habitat and agreeing to manage Habitat's ongoing developments and land bank. This strategic move consolidates Neinor's leadership in Spain's residential sector, potentially increasing demand for heating and plumbing installations in new housing projects.

- In May 2024, Haier HVAC Solutions Iberia made its inaugural appearance at the Construmat show in Barcelona, presenting innovations such as the R290 heating range and renewable technologies, including photovoltaic systems and inverters. This debut underscores Haier's commitment to energy-efficient solutions, enhancing the Spanish HVAC market's sustainability.

Spain Heating and Plumbing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Services Covered | Installation, Maintenance and Repair, Consulting, Upgrade or Replacement |

| Distribution Channels Covered | Direct Sales, Distributors and Wholesalers, Retail Stores, E-Commerce |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain heating and plumbing market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain heating and plumbing market on the basis of product type?

- What is the breakup of the Spain heating and plumbing market on the basis of service?

- What is the breakup of the Spain heating and plumbing market on the basis of distribution channel?

- What is the breakup of the Spain heating and plumbing market on the basis of end user?

- What is the breakup of the Spain heating and plumbing market on the basis of region?

- What are the various stages in the value chain of the Spain heating and plumbing market?

- What are the key driving factors and challenges in the Spain heating and plumbing?

- What is the structure of the Spain heating and plumbing market and who are the key players?

- What is the degree of competition in the Spain heating and plumbing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain heating and plumbing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain heating and plumbing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain heating and plumbing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)