Spain Human Insulin Market Size, Share, Trends and Forecast by Product Type, Distribution Chanel, Disease Type, and Region, 2026-2034

Spain Human Insulin Market Size and Share:

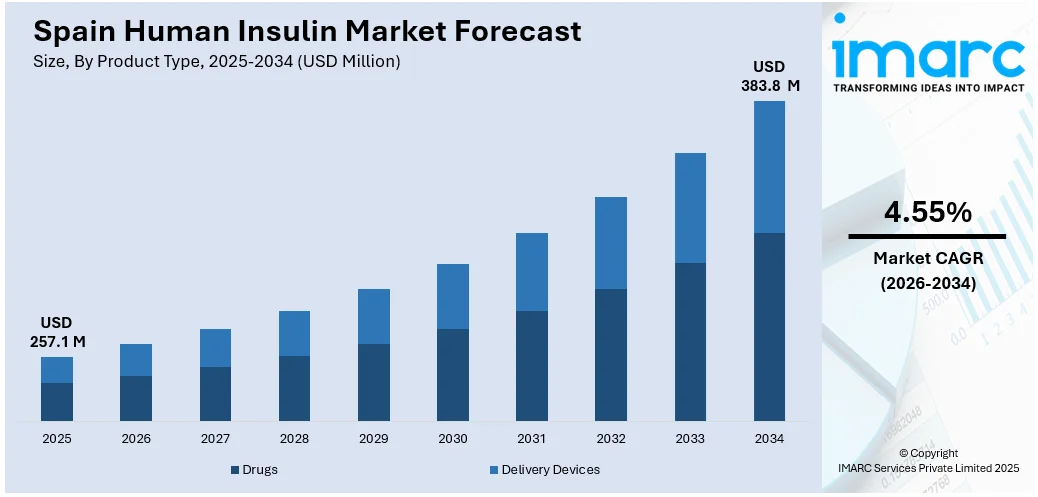

The Spain human insulin market size reached USD 257.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 383.8 Million by 2034, exhibiting a growth rate (CAGR) of 4.55% during 2026-2034. The rising diabetes prevalence, increasing adoption of insulin analogs, government initiatives for diabetes management, expanding healthcare access, technological advancements in insulin delivery, rising obesity rates, and pharmaceutical innovations improving insulin efficacy, stability, and patient adherence are some of the major factors positively impacting the Spain human insulin market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 257.1 Million |

| Market Forecast in 2034 | USD 383.8 Million |

| Market Growth Rate (2026-2034) | 4.55% |

Spain Human Insulin Market Trends:

Increasing Diabetes Prevalence Driving Demand

The rising number of diabetes cases in the country is contributing to the Spain human insulin market growth. According to the International Diabetes Federation, in 2000, approximately 2 million people with diabetes was identified between the ages of 20 and 79 in Spain. By 2021, this number more than doubled to over 5.1 million, with projections estimating it will reach nearly 5.6 million by 2045. A sedentary lifestyle, unhealthy dietary patterns, and an aging population are contributing factors to this increase. Type 2 diabetes dominates, requiring sustained insulin therapy as the disease progresses. As awareness grows, more patients seek timely treatment, increasing the demand for insulin. Government policies emphasize early diagnosis and management to reduce long-term complications, driving investments in insulin procurement and reimbursement schemes. Pharmaceutical companies are expanding their product portfolios to cater to this growing need, ensuring a steady supply of both human and analog insulin. The shift toward patient-centric diabetes care is also influencing the market, as healthcare providers emphasize personalized treatment plans. This evolving landscape underscores the importance of continued innovation and accessibility in Spain’s insulin market to address the increasing burden of diabetes effectively.

To get more information on this market Request Sample

Growing Adoption of CGM Systems

The increasing adoption of Continuous Glucose Monitoring (CGM) systems is positively influencing the Spain human insulin market outlook. These advanced glucose-tracking devices are improving diabetes management by providing real-time data, reducing the reliance on traditional blood glucose monitoring, and enhancing insulin therapy precision. The integration of CGM with smart insulin delivery systems is leading to improved patient adherence and better glycemic control, which is increasing demand for both basal and rapid-acting insulins. Government initiatives supporting digital health adoption and expanding reimbursement policies for CGM devices are further accelerating market expansion. The key players are focusing on technological advancements, including AI-driven analytics and smartphone integration, making CGM more accessible and user-friendly. For instance, in February 2024, DexCom, Inc. announced that its newest Continuous Glucose Monitoring (CGM) device, Dexcom ONE+, would be available in, Belgium, Spain, and Poland. This system features Dexcom's most accurate sensor design to date and incorporates feedback from users and healthcare professionals to enhance usability for people using insulin to treat Type 1 or Type 2 diabetes. The company plans to expand availability to additional countries in the future. The increasing preference for automated insulin delivery systems, combined with Spain’s rising diabetic population, is expected to strengthen CGM’s role in driving human insulin demand over the coming years.

Spain Human Insulin Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, distribution channel, and disease type.

Product Type Insights:

- Drugs

- Human Insulin Analogs and Biosimilars

- Rapid Acting

- Long Acting

- Premixed

- Human Insulin Biologics

- Short Acting

- Intermediate Acting

- Premixed

- Human Insulin Analogs and Biosimilars

- Delivery Devices

- Pens

- Reusable Pens

- Disposable Pens

- Pen Needles

- Standard Pen Needles

- Safety Pen Needles

- Syringes

- Others

- Pens

The report has provided a detailed breakup and analysis of the market based on the product type. This includes drugs [human insulin analogs and biosimilars (rapid acting, long acting, and premixed) and human insulin biologics (short acting, intermediate acting, and premixed)] and delivery devices [pens (reusable pens and disposable pens), pen needles (standard pen needles and safety pen needles), syringes, and others].

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

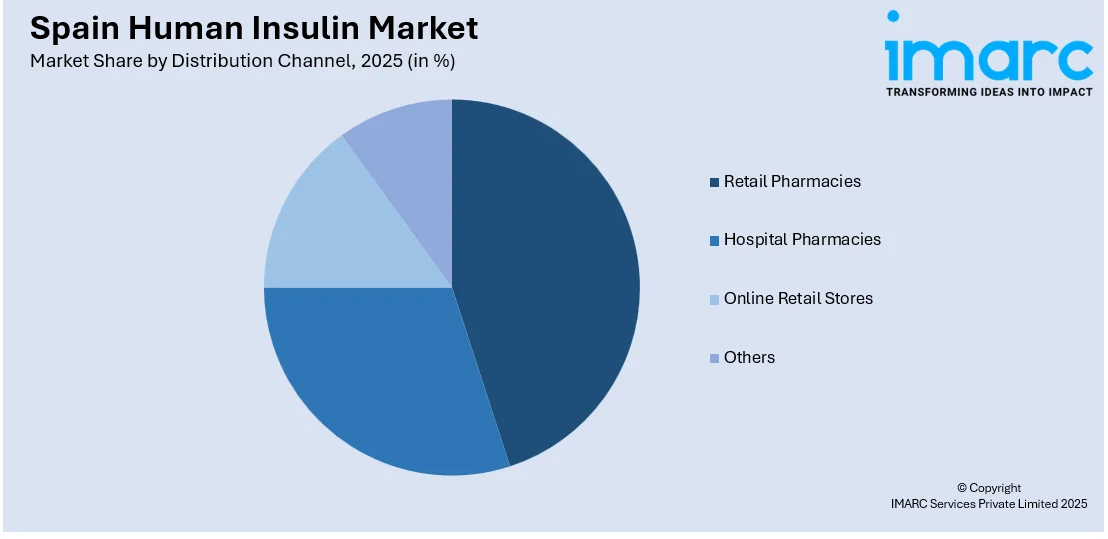

- Retail Pharmacies

- Hospital Pharmacies

- Online Retail Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes retail pharmacies, hospital pharmacies, online retail stores, and others.

Disease Type Insights:

- Type I Diabetes

- Type II Diabetes

The report has provided a detailed breakup and analysis of the market based on the disease type. This includes type I diabetes and type II diabetes.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Human Insulin Market News:

- October 2024: Spain-based company Insulcloud announced its strategic expansion into the U.S. market following FDA clearance of its Insulclock CAP smart device. This Bluetooth-enabled medical device transforms disposable insulin pens into connected diabetes management tools, capturing critical information such as insulin brand, dose measurement, injection date and time, and pen temperature at the time of injection. The company plans to integrate Insulclock CAP into existing healthcare applications through an FDA-cleared software development kit and is considering establishing its first international office in Boston.

- February 2025: The Eversense® 365 Continuous Glucose Monitoring (CGM) system, which complies with the EU Medical Device Regulation (MDR), has been submitted for CE Mark by Senseonics Holdings, Inc. Following approval, the system will be distributed in Germany, Italy, Spain (including Andorra), Poland, Switzerland, and Sweden by its business partner, Ascensia Diabetes Care. This significant event comes after the nationwide debut in October 2024 and the U.S. FDA approval in September 2024.

Spain Human Insulin Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Retail Pharmacies, Hospital Pharmacies, Online Retail Stores, Others |

| Disease Types Covered | Type I Diabetes, Type II Diabetes |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain human insulin market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain human insulin market on the basis of product type?

- What is the breakup of the Spain human insulin market on the basis of distribution channel?

- What is the breakup of the Spain human insulin market on the basis of disease type?

- What is the breakup of the Spain human insulin market on the basis of region?

- What are the various stages in the value chain of the Spain human insulin market?

- What are the key driving factors and challenges in the Spain human insulin market?

- What is the structure of the Spain human insulin market and who are the key players?

- What is the degree of competition in the Spain human insulin market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain human insulin market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain human insulin market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain human insulin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)