Spain Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2026-2034

Spain Insurtech Market Overview:

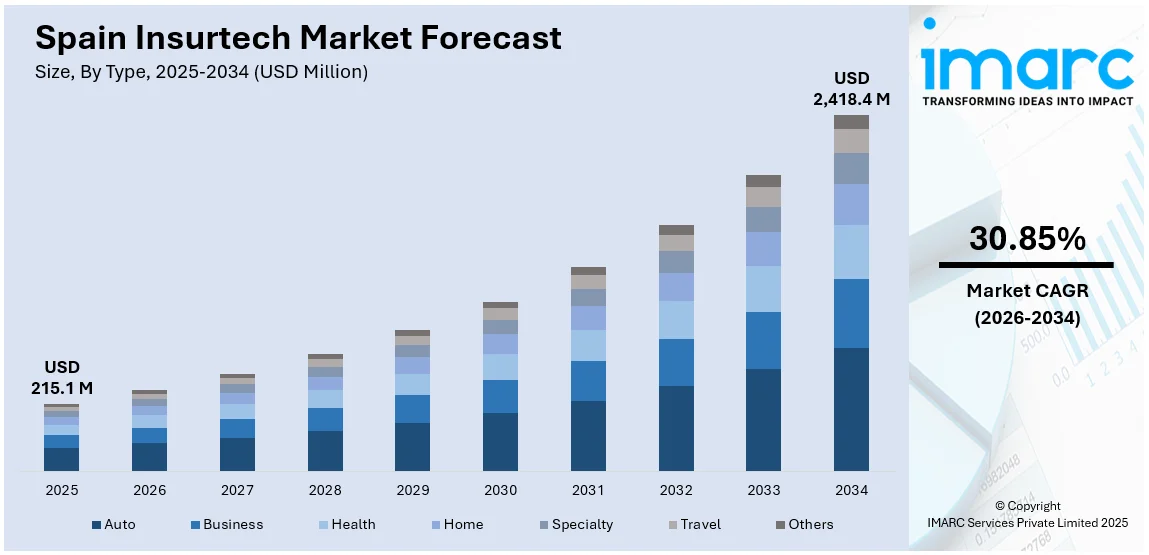

The Spain Insurtech market size reached USD 215.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,418.4 Million by 2034, exhibiting a growth rate (CAGR) of 30.85% during 2026-2034. The market in Spain is growing because of increasing adoption of embedded insurance models and rising demand for cyber risk protection among small businesses. These trends reflect shifting user expectations, greater digital integration, and a need for real-time, personalized insurance solutions across platforms and business environments, thus influencing the Spain Insurtech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 215.1 Million |

| Market Forecast in 2034 | USD 2,418.4 Million |

| Market Growth Rate 2026-2034 | 30.85% |

Spain Insurtech Market Trends:

Expansion of Embedded Insurance

Embedded insurance denotes the smooth incorporation of insurance offerings within the purchasing journey of products and services, frequently enabled by application programming interfaces (APIs). This integration allows individuals to obtain insurance coverage easily at the point of sale, thus removing the complications that typically come with purchasing insurance separately. Insurtech companies are creating new distribution channels and reaching previously overlooked user segments by integrating insurance into diverse digital ecosystems, including e-commerce platforms, mobility services, and travel reservations. This method improves client experience by delivering customized, contextually appropriate insurance options, utilizing real-time data analysis to personalize protection. Moreover, embedded insurance models minimize operational inefficiencies and distribution expenses, enabling insurers and technology providers to enhance the scalability of their services more efficiently. The rising acceptance of this model corresponds with wider digital transformation trends and the growing individuals demand for seamless, integrated service experiences. In 2025, Barcelona-based Insurtech startup Weecover raised €4.2 million in a funding round led by Swanlaab Venture Factory and Nauta to support its global expansion. The company specializes in embedded insurance solutions via APIs, serving markets in Spain, Portugal, France, Andorra, and Mexico. The funds will be used to grow the team, enhance AI capabilities, and scale its platform internationally.

To get more information on this market Request Sample

Rising Demand for Cybersecurity Solutions

With the rise of complex cyberattacks and data breaches affecting small and medium-sized enterprises (SMEs), there is a rise in the need for tailored insurance solutions that surpass standard coverage. Insurtech firms are creating sophisticated cyber risk reduction solutions that combine insurance with forward-looking risk management tools. These solutions utilize tools like cyber risk evaluation, immediate threat observation, and digital insights to help clients detect weaknesses and avert possible cyber incidents. This proactive risk management approach not only reduces the probability and impact of cyber incidents but also encourages enhanced cybersecurity measures among policyholders, aligning with the wider industry emphasis on risk prevention. In addition, by integrating cyber awareness training and continuous risk evaluations into their services, Insurtech companies boost product value and attract a tech-savvy user base worried about new cyber risks. For example, in 2024, Insurtech BOXX Insurance partnered with AXA to launch an advanced cyber risk mitigation solution aimed at helping small businesses predict, prevent, and respond to cyber threats. The platform offered features like cyber risk scoring, dark web monitoring, digital risk assessments, and cyber awareness training. This solution initially targeted business clients in Spain to enhance their digital security proactively. The increasing demand for integrated cyber risk management tools tailored to small businesses is emerging as a significant factor influencing the Spain Insurtech market growth.

Spain Insurtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, service, and technology.

Type Insights:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes auto, business, health, home, specialty, travel, and others.

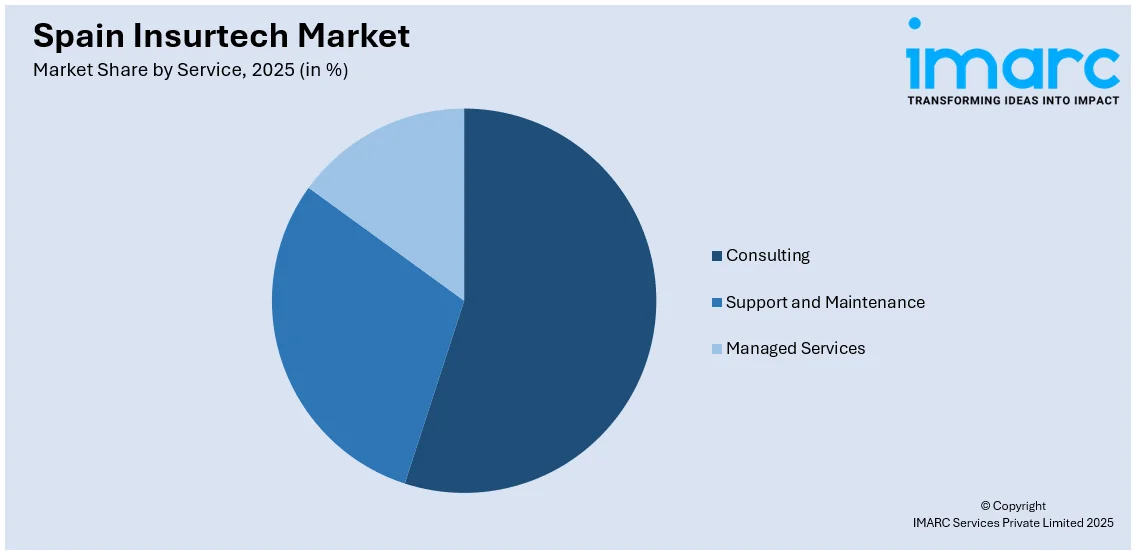

Service Insights:

Access the comprehensive market breakdown Request Sample

- Consulting

- Support and Maintenance

- Managed Services

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes consulting, support and maintenance, and managed services.

Technology Insights:

- Block Chain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes block chain, cloud computing, IoT, machine learning, robo advisory, and others.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Insurtech Market News:

- In January 2025, Telefónica’s investment arm Íope Ventures joined a €4.2 million funding round for Spain-based Insurtech startup Weecover, supporting its international growth. Weecover’s platform enables embedded insurance offers within retail and financial transactions across multiple countries. Telefónica plans to expand its Insurtech portfolio to 15 startups, leveraging embedded insurance to innovate its service offerings.

- In September 2024, Madrid-based InsurTech startup Tuio raised $16.7 million in equity and debt funding led by MassMutual Ventures to accelerate growth and enhance client services. Tuio offered digital home, life, and pet insurance and has grown to over 45,000 customers in Spain.

Spain Insurtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Block Chain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain Insurtech market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain Insurtech market on the basis of type?

- What is the breakup of the Spain Insurtech market on the basis of service?

- What is the breakup of the Spain Insurtech market on the basis of technology?

- What is the breakup of the Spain Insurtech market on the basis of region?

- What are the various stages in the value chain of the Spain Insurtech market?

- What are the key driving factors and challenges in the Spain Insurtech market?

- What is the structure of the Spain Insurtech market and who are the key players?

- What is the degree of competition in the Spain Insurtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain Insurtech market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain Insurtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain Insurtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)