Spain Lithium-ion Battery Market Size, Share, Trends and Forecast by Product Type, Power Capacity, Application, and Region, 2026-2034

Spain Lithium-ion Battery Market Overview:

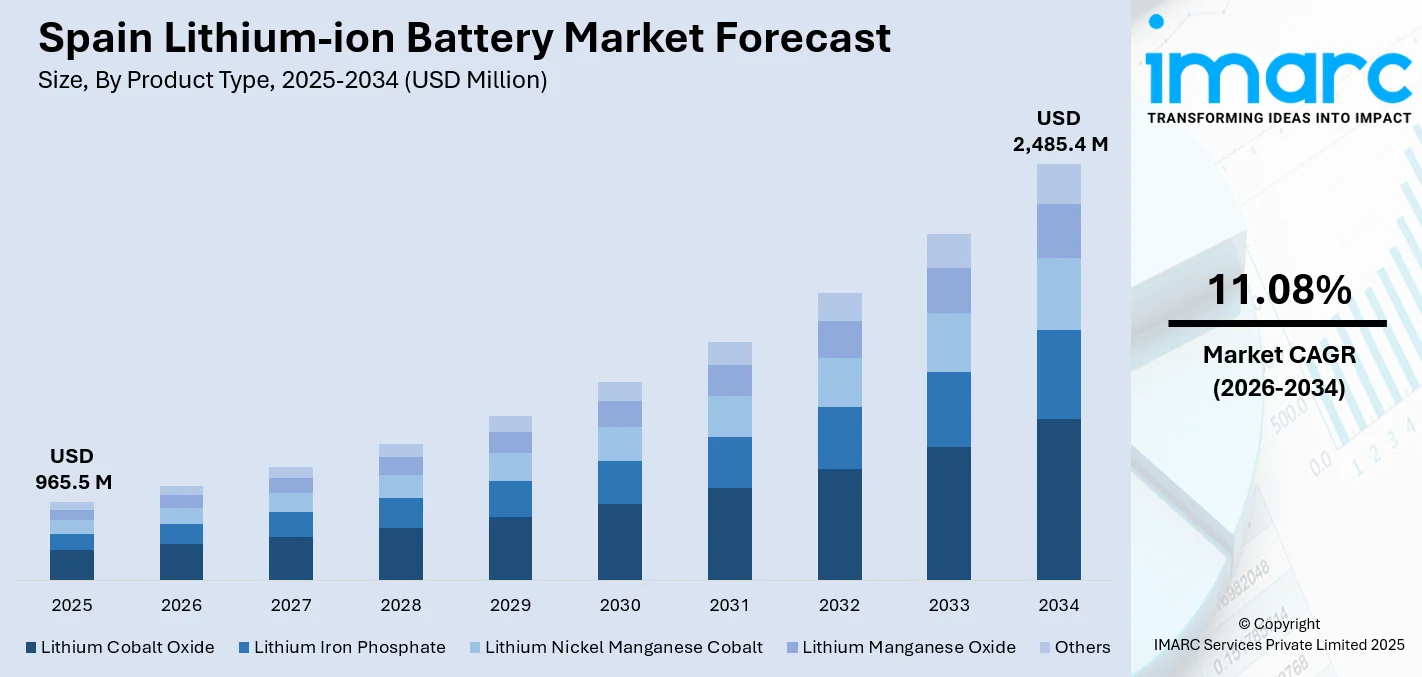

The Spain lithium-ion battery market size reached USD 965.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,485.4 Million by 2034, exhibiting a growth rate (CAGR) of 11.08% during 2026-2034. Growing electric vehicle adoption, renewable energy integration, and EU decarbonization policies are some of the factors contributing to the Spain lithium-ion battery market share. Expanding energy storage needs, government incentives, technological advances, and local manufacturing investments strengthen domestic supply chains and support market expansion across automotive, grid storage, and consumer electronics sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 965.5 Million |

| Market Forecast in 2034 | USD 2,485.4 Million |

| Market Growth Rate 2026-2034 | 11.08% |

Spain Lithium-ion Battery Market Trends:

Growing Focus on Domestic Battery Manufacturing

Spain is experiencing a rising emphasis on large-scale battery production, with increasing attention on technologies that balance performance and sustainability. Manufacturers are prioritizing lithium iron phosphate alongside other advanced chemistries to meet the diverse requirements of electric mobility. Facilities are being designed to operate with minimal environmental impact, aligning with long-term carbon neutrality goals. The shift reflects the broader move toward securing local supply chains for energy storage components, reducing reliance on imports, and fostering regional innovation. As electric vehicle adoption accelerates, this manufacturing focus positions Spain as a competitive player in Europe’s clean energy transition, supporting both industrial growth and environmental commitments. These factors are intensifying the Spain lithium-ion battery market growth. For example, in December 2024, Stellantis and CATL announced plans to invest up to EUR 4.1 Billion in a joint venture to build a large-scale lithium iron phosphate battery plant in Zaragoza, Spain. The carbon-neutral facility would be developed in phases. Stellantis would use both lithium-ion NMC and LFP chemistries for its vehicles, aiming for carbon net zero by 2038 with minimal residual emissions.

To get more information on this market Request Sample

Rising Demand and Investment

Spain’s lithium-ion battery market is showing strong momentum as the country ramps up its renewable energy adoption and electric mobility transition. With government policies encouraging decarbonization, demand for high-capacity, efficient storage solutions is rising from both the automotive and energy storage sectors. Major automotive manufacturers are increasing EV production in Spain, prompting investment in local battery manufacturing and supply chain development. Additionally, the growth of solar and wind power in the country has boosted interest in grid-scale lithium-ion storage systems to stabilize supply and ensure energy reliability. Partnerships between Spanish companies and international battery producers are becoming more frequent, aimed at securing advanced technologies and competitive pricing. At the same time, research initiatives are focusing on improving energy density, reducing production costs, and enhancing recycling capabilities to meet sustainability goals. This combination of policy support, industrial investment, and technology development positions Spain as a growing player in Europe’s battery market, with opportunities for both domestic production and export.

Spain Lithium-ion Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, power capacity, and application.

Product Type Insights:

- Lithium Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt

- Lithium Manganese Oxide

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes lithium cobalt oxide, lithium iron phosphate, lithium nickel manganese cobalt, lithium manganese oxide, and others.

Power Capacity Insights:

- 0 to 3000mAh

- 3000mAh to 10000mAh

- 10000mAh to 60000mAh

- More than 60000mAh

The report has provided a detailed breakup and analysis of the market based on the power capacity. This includes 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, and more than 60000mAh.

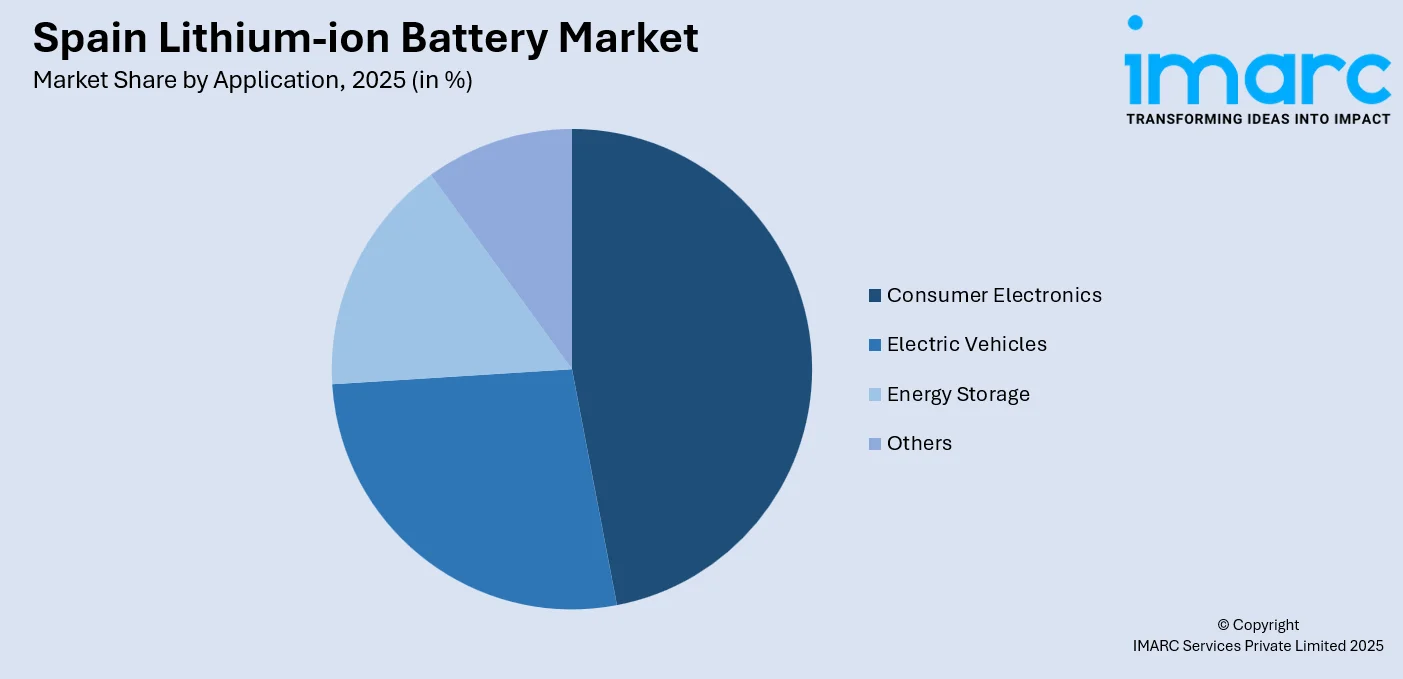

Application Insights:

Access the comprehensive market breakdown Request Sample

- Consumer Electronics

- Electric Vehicles

- Energy Storage

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes consumer electronics, electric vehicles, energy storage, and others.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Lithium-ion Battery Market News:

- In January 2025, ICL and Shenzhen Dynanonic announced plans to invest about EUR 285 Million to build a lithium iron phosphate (LFP) cathode active material plant in Sallent, Spain, for lithium-ion battery production. The project would expand ICL’s battery materials business into Europe and support the region’s energy transition. It combines ICL’s phosphate expertise with Dynanonic’s battery materials leadership to strengthen the sustainable supply chain.

Spain Lithium-ion Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt, Lithium Manganese Oxide, Others |

| Power Capacities Covered | 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, More than 60000mAh |

| Applications Covered | Consumer Electronics, Electric Vehicles, Energy Storage, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain lithium-ion battery market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain lithium-ion battery market on the basis of product type?

- What is the breakup of the Spain lithium-ion battery market on the basis of power capacity?

- What is the breakup of the Spain lithium-ion battery market on the basis of application?

- What is the breakup of the Spain lithium-ion battery market on the basis of region?

- What are the various stages in the value chain of the Spain lithium-ion battery market?

- What are the key driving factors and challenges in the Spain lithium-ion battery market?

- What is the structure of the Spain lithium-ion battery market and who are the key players?

- What is the degree of competition in the Spain lithium-ion battery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain lithium-ion battery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain lithium-ion battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain lithium-ion battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)