Spain Medical Loupes Market Size, Share, Trends and Forecast by Type, Magnification, Lens Type, Distribution Channel, Application, End User, and Region, 2026-2034

Spain Medical Loupes Market Summary:

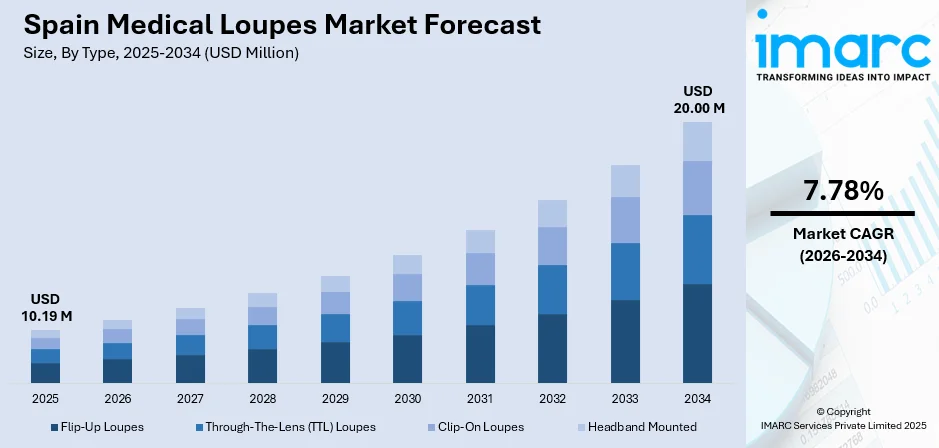

The Spain medical loupes market size was valued at USD 10.19 Million in 2025 and is projected to reach USD 20.00 Million by 2034, growing at a compound annual growth rate of 7.78% from 2026-2034.

Spain's medical loupes market is propelled by the nation's expanding healthcare infrastructure, rising demand for precision-enhancing optical devices in dental and surgical applications, and growing emphasis on ergonomic solutions among healthcare professionals. The increasing adoption of advanced magnification technologies, combined with rising investments in public and private healthcare facilities, supports sustained market expansion across the country.

Key Takeaways and Insights:

- By Type: Through-The-Lens (TTL) Loupes dominated the market with approximately 54% revenue share in 2025, driven by their integrated design offering superior optical alignment, lightweight construction, and enhanced user comfort during extended dental and surgical procedures across Spanish healthcare facilities.

- By Magnification: Up to 3.0x segment leads the market with a share of 48% in 2025, owing to their widespread applicability across general dental examinations, routine surgical procedures, and training institutions where moderate magnification meets most clinical visualization requirements.

- By Lens Type: Galilean dominate the market with a 70% share in 2025, attributed to their cost-effectiveness, compact design, lighter weight compared to prismatic alternatives, and suitability for entry-level practitioners seeking reliable magnification solutions.

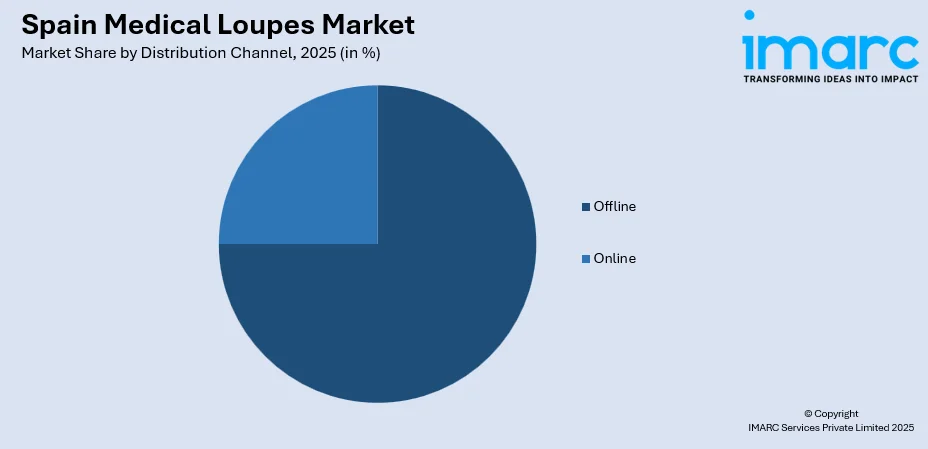

- By Distribution Channel: Offline accounts for the largest share of approximately 75% in 2025, as healthcare professionals prefer hands-on evaluation, customized fitting, and professional consultation available through specialized medical equipment distributors and optical retailers.

- By Application: Dental represent the largest segment with 48% market share in 2025, driven by Spain's extensive dental implant market, rising demand for precision in cosmetic and restorative dentistry, and the proliferation of dental clinics across urban and suburban regions.

- By End User: Dental Clinics dominate with 45% market share in 2025, supported by Spain's robust private dental sector, increasing patient volumes seeking advanced dental treatments, and growing practitioner awareness regarding ergonomic benefits of magnification devices.

- Key Players: The Spain medical loupes market exhibits a moderately competitive landscape with established international optical manufacturers and specialized medical device companies offering diverse product portfolios tailored to dental and surgical professionals seeking precision visualization solutions.

To get more information on this market Request Sample

The Spanish medical loupes market benefits from the country's well-developed National Health System (SNS) infrastructure comprising numerous hospitals and dental facilities requiring advanced visualization equipment. For example, the new University Hospital of Melilla (HUME), inaugurated in 2025 with over 150 million euros invested, features state-of-the-art surgical and diagnostic technology. This development highlights the SNS's commitment to enhancing clinical-care capabilities nationwide. Spain's position as a prominent health tourism destination further stimulates demand for high-quality medical devices. The market witnesses growing adoption among younger healthcare professionals trained with magnification technologies during their medical education. Integration of LED illumination, wireless connectivity, and ergonomic frame designs represents ongoing product innovation trends. Regional disparities in healthcare infrastructure create varying adoption patterns, with metropolitan areas demonstrating higher penetration rates while rural regions present expansion opportunities for market participants.

Spain Medical Loupes Market Trends:

Integration of Advanced LED Illumination Systems

Spanish healthcare professionals increasingly demand medical loupes featuring integrated high-intensity LED lighting systems that provide shadow-free illumination of treatment areas. A 2024–2025 milestone at Hospital Universitario La Luz in Madrid, where surgeons performed a maxillofacial tumor removal using augmented-reality glasses, underscores Spain’s accelerating shift toward advanced, precision-focused visualization technologies in clinical practice. Extended battery life capabilities enable uninterrupted usage during lengthy procedures. Manufacturers are developing adjustable color temperature options to optimize visualization across different clinical applications. This technological enhancement improves diagnostic accuracy and treatment precision while reducing eye strain among practitioners performing detailed work.

Rising Emphasis on Ergonomic Frame Designs

The market witnesses growing preference for lightweight, anatomically optimized loupe frames that promote proper posture during clinical procedures. A 2024 study of 131 surgeons across 17 specialties in Spain found that 80.2% reported experiencing forced or awkward postures during operations, and 96.9% of them believed their physical discomfort stemmed directly from those postures. Healthcare practitioners recognize the long-term occupational health benefits of ergonomically designed magnification devices. Customizable nose pads, adjustable temples, and balanced weight distribution characterize contemporary product offerings. This trend addresses musculoskeletal concerns prevalent among dental and surgical professionals performing repetitive precision tasks throughout extended working hours.

Expansion of Wireless Connectivity Features

Medical loupes incorporating wireless connectivity capabilities are gaining traction within Spanish healthcare settings, enabling real-time data transmission and telemedicine applications. This digitalization trend mirrors a broader shift in Spain’s hospitals. In 2025, HM Hospitales completed the country’s first remote robotic telesurgeries using the Toumai Surgical Robot, highlighting the readiness of Spanish surgical infrastructure for connected, network‑enabled devices. These advanced devices facilitate remote consultations, educational streaming, and clinical documentation through integrated camera systems. Compatibility with mobile applications allows practitioners to customize device settings and monitor battery status remotely. This digitalization trend aligns with Spain's broader healthcare technology modernization initiatives.

Market Outlook 2026-2034:

The Spain medical loupes market demonstrates promising growth prospects driven by sustained healthcare infrastructure investments, expanding dental tourism, and increasing awareness regarding ergonomic workplace practices among healthcare professionals. Government initiatives supporting healthcare modernization and private sector investments in advanced medical facilities create favorable market conditions. The aging population requiring comprehensive dental and surgical interventions further augments demand. The market generated a revenue of USD 10.19 Million in 2025 and is projected to reach a revenue of USD 20.00 Million by 2034, growing at a compound annual growth rate of 7.78% from 2026-2034.

Spain Medical Loupes Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Through-The-Lens (TTL) Loupes | 54% |

| Magnification | Up to 3.0x | 58% |

| Lens Type | Galilean | 70% |

| Distribution Channel | Offline | 75% |

| Application | Dental | 48% |

| End User | Dental Clinics | 45% |

Type Insights:

- Flip-Up Loupes

- Through-The-Lens (TTL) Loupes

- Clip-On Loupes

- Headband Mounted

The Through-The-Lens (TTL) loupes dominates with a market share of 54% of the total Spain medical loupes market in 2025.

Through-The-Lens loupes maintain market leadership in Spain owing to their permanently aligned optical configuration that eliminates the need for repeated adjustments during clinical procedures. Spanish dental practitioners and surgeons prefer TTL designs for their streamlined aesthetics, reduced frame weight, and customized prescription integration capabilities. The permanently mounted lens system provides consistent magnification positioning, enhancing procedural efficiency and visual comfort throughout extended treatment sessions in demanding healthcare environments. In August 2023, a review published in the British Dental Journal found that TTL loupes enhance visual acuity, operative precision, and ergonomic posture, significantly reducing musculoskeletal strain compared with procedures performed without magnification.

The segment benefits from Spain's expanding dental implant market where precision visualization is paramount for successful outcomes. Healthcare facilities investing in ergonomic workplace initiatives increasingly specify TTL loupes for their personnel. Manufacturers continue refining frame materials and lens coatings to address Spanish practitioners' requirements for durability, anti-reflective properties, and comfortable extended wear. Growing awareness regarding occupational health among healthcare professionals drives sustained demand for this optimized loupe configuration.

Magnification Insights:

- Up to 3.0x

- 3.0x-5.0x

- Above 5.0x

The Up to 3.0x leads with a share of 48% of the total Spain medical loupes market in 2025.

Lower magnification loupes maintain dominance within Spain's medical loupes market due to their versatility across diverse clinical applications and broader depth of field characteristics. General dental practitioners performing routine examinations, hygiene procedures, and basic restorative work find this magnification range adequate for most clinical requirements. For example, a 2023 systematic review found that dental students using loupes achieved significantly better visual acuity, improved ergonomic posture, and reduced neck angulation compared with no magnification, outcomes that are particularly relevant for entry‑level or general dental work. Medical schools and training institutions specify entry-level magnification for student practitioners developing foundational visualization skills before progressing to higher-power options.

The segment's cost-effectiveness appeals to newly established dental practices and healthcare facilities operating within budget constraints. Spanish practitioners appreciate the wider field of view enabling efficient patient assessment without frequent repositioning. Lightweight optical configurations associated with lower magnification reduce user fatigue during extended treatment schedules. Market expansion continues as awareness grows regarding the benefits of magnification adoption across general practice settings beyond specialized surgical applications.

Lens Type Insights:

- Galilean

- Prismatic

The Galilean dominates with a market share of 70% of the total Spain medical loupes market in 2025.

Galilean lens systems dominate Spain's medical loupes market owing to their compact construction, lighter weight, and favorable cost-to-performance ratio compared to prismatic alternatives. Spanish dental practitioners seeking entry-level magnification solutions prefer Galilean designs for their simplicity and adequate image quality at lower magnification ranges. The straightforward optical path requires fewer elements, resulting in more affordable products accessible to independent practitioners and smaller healthcare facilities. In December 2025, a study published in the Journal of Dentistry noted that while Galilean loupes are lightweight and cost-effective, users may experience higher postural strain compared with prismatic loupes, highlighting the trade-offs between accessibility and ergonomic performance.

The segment benefits from established manufacturing efficiencies enabling competitive pricing across distribution channels. Spanish medical equipment distributors maintain extensive Galilean loupe inventories meeting routine demand from dental clinics and surgical facilities. While prismatic designs offer superior optical performance at higher magnifications, Galilean systems satisfy most clinical visualization requirements encountered in general practice settings. Ongoing refinements in lens coatings and frame materials enhance the user experience within this accessible product category.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

The offline leads with a share of 75% of the total Spain medical loupes market in 2025.

Traditional offline distribution channels maintain overwhelming dominance within Spain's medical loupes market as healthcare professionals prioritize hands-on product evaluation before purchase decisions. Specialized medical equipment distributors, dental supply companies, and optical retailers provide personalized fitting services essential for optimal loupe customization. Spanish practitioners value in-person consultations enabling assessment of frame comfort, magnification suitability, and working distance specifications tailored to individual clinical requirements.

Professional trade exhibitions including dental conferences hosted in Barcelona and Madrid serve as significant product demonstration venues connecting manufacturers with potential customers. After-sales support including adjustments, repairs, and warranty services reinforces offline channel preference among healthcare institutions. While online platforms gain traction for accessory purchases and repeat orders, initial loupe procurement predominantly occurs through established distributor relationships ensuring appropriate product selection and professional setup assistance.

Application Insights:

- Surgical

- Dental

- Others

The dental dominates with a market share of 48% of the total Spain medical loupes market in 2025.

Dental applications dominate Spain's medical loupes market reflecting the country's substantial dental services sector and high prevalence of dental implant procedures. Spain's dental implant market has witnessed remarkable growth, supporting demand for precision visualization equipment among practitioners performing complex restorative and cosmetic procedures. Dental professionals increasingly recognize magnification as essential for detecting subtle pathological conditions, ensuring accurate margin preparation, and achieving optimal treatment outcomes.

The proliferation of private dental clinics across Spanish metropolitan areas, supported by an ecosystem of more than 24,000 dental clinics and approximately 3,800 dental laboratories, helps sustain robust equipment demand. Dental hygienists adopting loupes for scaling and prophylaxis procedures expand the user base beyond dentists alone. Spain's dental tourism industry, attracting international patients seeking cost-effective treatments, motivates practitioners to invest in professional-grade equipment demonstrating clinical excellence and technological competence to discerning clientele.

End User Insights:

- Hospitals

- Dental Clinics

- Ambulatory Surgery Centers

- Others

The dental clinics leads with a share of 45% of the total Spain medical loupes market in 2025.

Dental clinics represent the primary end-user segment within Spain's medical loupes market, reflecting the country's extensive network of private dental practices concentrated in urban centers. Independent dental practitioners and clinic operators invest in personalized magnification equipment tailored to their specific procedural requirements and working preferences. Spain's dental services sector employs numerous practitioners across general, cosmetic, and specialist disciplines, each representing potential loupe adoption opportunities.

The fragmented nature of Spain's dental clinic landscape creates diverse procurement patterns with individual practitioners making equipment decisions independently. Growing awareness regarding ergonomic benefits drives adoption among experienced professionals seeking to extend their career longevity by reducing occupational strain. Newer clinic establishments incorporate magnification equipment into initial capital investments recognizing competitive advantages in patient communication and treatment quality perception. Equipment financing options facilitate loupe acquisition for practitioners managing cash flow considerations.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Northern Spain's medical loupes market benefits from the region's advanced healthcare infrastructure, particularly the Basque Country's renowned health services consistently ranked among Spain's finest. The presence of established hospitals in Galicia, Cantabria, and Asturias supports steady demand for precision medical equipment. Regional healthcare investments and emphasis on quality care standards drive adoption among dental and surgical professionals.

Eastern Spain, particularly Catalonia and Valencia, represents a significant market for medical loupes driven by Barcelona's concentration of prestigious healthcare institutions and dental facilities. The region hosts numerous international medical conferences and trade exhibitions showcasing advanced visualization technologies. Catalonia's substantial dental practitioner population and thriving medical tourism sector create robust demand for premium magnification devices.

Southern Spain, encompassing Andalusia and Murcia, demonstrates growing medical loupes adoption driven by expanding dental clinic networks across major cities including Malaga, Seville, and Granada. The region's developing healthcare infrastructure and rising dental tourism from Northern European visitors stimulate equipment investments. Growing practitioner awareness regarding magnification benefits supports market expansion throughout Andalusian metropolitan areas.

Central Spain, centered on Madrid, constitutes a primary medical loupes market owing to the capital's concentration of prestigious hospitals, specialized clinics, and dental facilities. The region houses leading healthcare institutions attracting skilled practitioners who demand advanced equipment. Madrid's role as Spain's commercial hub ensures access to diverse distribution channels and manufacturer representation supporting comprehensive product availability.

Market Dynamics:

Growth Drivers:

Why is the Spain Medical Loupes Market Growing?

Expansion of Healthcare Infrastructure and Government Investment

Spain's sustained investment in its National Health System (SNS) infrastructure drives medical loupes market expansion through modernization of public healthcare facilities requiring contemporary medical equipment. In 2025, the University Hospital of Melilla (HUME) was inaugurated, featuring state‑of‑the‑art surgical and diagnostic technology, underscoring SNS initiatives to enhance clinical precision and patient care. The government's commitment to healthcare accessibility ensures continued development of hospital and clinic networks across autonomous communities. Public healthcare expenditure supporting facility upgrades creates procurement opportunities for visualization equipment manufacturers. Regional health services implementing quality improvement initiatives increasingly specify advanced magnification devices for surgical and dental departments. The decentralized healthcare administration allows autonomous communities to independently invest in specialized medical equipment aligned with local clinical priorities.

Rising Demand for Precision Dental Procedures

Spain's thriving dental implant market, with millions of procedures performed annually, generates substantial demand for precision visualization equipment among dental practitioners. According to the SEPA (Spanish Society of Periodontology), more than 17 million dental implants were placed in Spain between 2015 and 2024, reflecting a high and growing volume of restorative dental work that drives demand for magnification devices. The growing preference for cosmetic dentistry including veneers, whitening, and aesthetic restorations requires enhanced visualization capabilities for optimal outcomes. Minimally invasive dental techniques gaining popularity necessitate magnification to perform delicate procedures with precision. Patient expectations regarding treatment quality motivate practitioners to invest in professional equipment demonstrating clinical competence. The expansion of dental tourism bringing international patients seeking cost-effective treatments encourages Spanish dental facilities to maintain technologically advanced equipment portfolios.

Growing Awareness of Ergonomic Benefits Among Healthcare Professionals

Spanish healthcare professionals increasingly recognize the occupational health benefits of ergonomically designed medical loupes that promote proper posture during clinical procedures. Awareness campaigns highlighting musculoskeletal disorder prevention among dental and surgical practitioners drive adoption of magnification devices as essential workplace equipment. The Spain dental devices market size reached USD 195.62 Million in 2024, and IMARC Group expects it to grow to USD 346.05 Million by 2033, exhibiting a CAGR of 6.07% during 2025–2033, reflecting rising demand for such ergonomic and precision-enhancing tools. Professional associations recommending magnification use for career longevity influence procurement decisions among established practitioners. Medical education institutions incorporating loupe training into curricula prepare future professionals for magnification-assisted practice. Healthcare facility managers implementing ergonomic workplace initiatives specify magnification equipment to protect staff wellbeing and reduce absenteeism related to occupational strain injuries.

Market Restraints:

What Challenges the Spain Medical Loupes Market is Facing?

High Initial Investment Costs

Premium medical loupes with advanced features including integrated lighting and customized prescriptions represent significant capital investments that smaller dental practices and individual practitioners may find challenging to justify. The cost differential between entry-level and professional-grade equipment creates adoption barriers among price-sensitive market segments.

Limited Awareness in Rural Healthcare Settings

Healthcare facilities in Spain's rural regions demonstrate lower magnification device adoption rates due to limited exposure to advanced visualization technologies and reduced access to specialized distributor networks. Geographic disparities in healthcare infrastructure development create uneven market penetration across autonomous communities.

Quality Variations Among Available Products

Inconsistent optical quality and construction standards across available products create buyer uncertainty regarding appropriate product selection. Practitioners unfamiliar with technical specifications may encounter difficulties distinguishing between genuine professional equipment and lower-quality alternatives, potentially leading to unsatisfactory purchase experiences.

Competitive Landscape:

The Spain medical loupes market exhibits a moderately fragmented competitive landscape characterized by established international optical equipment manufacturers competing alongside specialized medical device companies. Market participants differentiate through product innovation, customization capabilities, and comprehensive after-sales support services. Distribution partnerships with dental supply companies and medical equipment dealers expand manufacturer reach across Spanish autonomous communities. Competitive strategies emphasize ergonomic design features, integrated illumination systems, and prescription compatibility to address diverse practitioner requirements. Regional distribution networks maintained by leading players ensure product availability throughout metropolitan and suburban healthcare markets. Emerging online distribution channels create additional competitive dynamics as manufacturers explore direct-to-practitioner sales models supplementing traditional distributor relationships.

Recent Developments:

- In February 2025, Spain has performed more than 17 million dental implants over the past decade, reflecting rising demand for high-precision dental procedures. The growth of complex oral surgeries is pushing clinicians to adopt advanced tools that enhance accuracy. As a result, dental professionals are increasingly turning to medical loupes, driving strong demand for magnification devices that improve procedural precision and efficiency.

Spain Medical Loupes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flip-Up Loupes, Through-The-Lens (TTL) Loupes, Clip-On Loupes, Headband Mounted |

| Magnifications Covered | Up to 3.0x, 3.0x-5.0x, Above 5.0x |

| Lens Types Covered | Galilean, Prismatic |

| Distribution Channels Covered | Offline, Online |

| Applications Covered | Surgical, Dental, Others |

| End Users Covered | Hospitals, Dental Clinics, Ambulatory Surgery Centers, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain medical loupes market size was valued at USD 10.19 Million in 2025.

The Spain medical loupes market is expected to grow at a compound annual growth rate of 7.78% from 2026-2034 to reach USD 20.00 Million by 2034.

Through-The-Lens (TTL) loupes dominated the market with a 54% share, driven by their superior optical alignment, integrated prescription capabilities, and enhanced user comfort preferred by Spanish dental and surgical professionals.

Key factors driving the Spain medical loupes market include expanding healthcare infrastructure investments, rising demand for precision dental procedures, growing awareness of ergonomic benefits among healthcare professionals, and increasing adoption of technologically advanced magnification devices.

Major challenges include high initial investment costs for premium equipment, limited awareness in rural healthcare settings, quality variations among available products, and the need for specialized training to optimize magnification device usage effectively.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)