Spain Pallet Market Size, Share, Trends and Forecast by Type, Application, Structural Design, and Region, 2026-2034

Spain Pallet Market Overview:

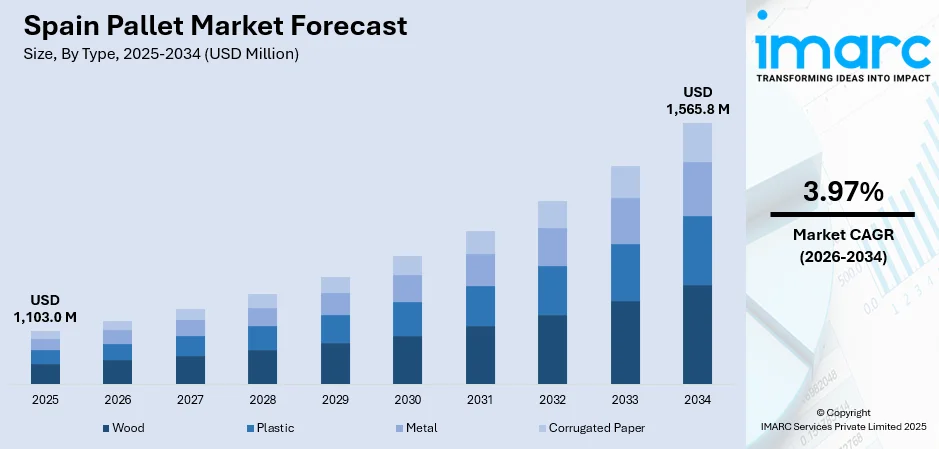

The Spain pallet market size reached USD 1,103.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,565.8 Million by 2034, exhibiting a growth rate (CAGR) of 3.97% during 2026-2034. The market is driven by stringent EU sustainability mandates, compelling adoption of certified, reusable pallets, and a corporate focus on ESG compliance. It is further propelled by sector-specific logistical demands, particularly in pharmaceuticals and exports, necessitating high-performance technical materials such as plastic and composites. This is complemented by a strategic industry-wide shift towards total cost of ownership models and circular economy principles, further augmenting the Spain pallet market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,103.0 Million |

| Market Forecast in 2034 | USD 1,565.8 Million |

| Market Growth Rate 2026-2034 | 3.97% |

Spain Pallet Market Trends:

Accelerated Shift Towards Sustainable and Certified Pallets

A dominant trend in the Spanish pallet market is the pronounced shift towards sustainable, reusable, and certified wood pallets, driven by stringent European and corporate sustainability mandates. The demand for pallets certified under the European EPAL (European Pallet Association) system remains robust due to their standardized, interchangeable, and repairable nature, which is crucial for efficient closed-loop pooling systems. Furthermore, growing environmental consciousness among Spanish manufacturers and exporters is fueling the preference for pallets made from sustainably sourced timber, often bearing PEFC or FSC certification. A 2024 EIB Climate Survey shows that 95% of Spaniards support climate adaptation, with 66% making it a priority and 88% calling for immediate investment in order to avoid higher costs in the future; 89% have witnessed extreme weather events in the previous five years, and 66% have direct consequences such as health issues (27%) or water scarcity (18%). In 2023, the EIB invested a record-breaking €6.77 Billion (approximately USD 7.92 Billion) in Spain's climate projects, ranging from renewable energy to clean transport, and globally, for each €1 (USD 1.1706) invested in resilience, it saves between €5 (USD 5.85) and €7 (USD 8.19) in damage. As consciousness of the environment grows, Spain's pallet sector, vital for logistics, food provision, and exports, is under increasing pressure to adopt circular, low-carbon methods in order to survive floods, heatwaves, and supply chain breaks. This trend is not merely regulatory; it is a strategic business move. Companies are leveraging sustainable packaging as a key component of their ESG (Environmental, Social, and Governance) reporting and green branding, appealing to eco-aware consumers and B2B partners. The circular economy model, where pallets are repaired and reused extensively throughout their lifecycle, is becoming the standard, reducing waste and overall logistics costs while minimizing the environmental footprint of Spain's supply chains.

To get more information on this market Request Sample

Material Diversification and the Rise of Technical and Alternative Pallets

While wood maintains its market dominance, a significant trend is the strategic diversification into high-performance technical and alternative material pallets to meet specific logistical needs. The demand for plastic pallets, particularly made from HDPE or polypropylene, is growing in sectors such as pharmaceuticals, food and beverage, and chemicals, where hygiene, washability, and consistent weight are paramount. Therefore, this is also propelling the Spain pallet market growth. These pallets offer advantages in export scenarios where strict International Standards for Phytosanitary Measures (ISPM 15) for wood treatment complicate processes. Simultaneously, the market is witnessing innovation in materials such as pressed wood composites and even corrugated cardboard for lightweight, one-way export applications. This trend reflects the market's maturation, moving beyond a one-size-fits-all approach. Spanish manufacturers and logistics providers are increasingly selecting pallets based on a detailed cost-benefit analysis of the specific supply chain journey, prioritizing factors such as weight, durability, sanitation, and total cost of ownership over initial purchase price alone.

Spain Pallet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on type, application, and structural design.

Type Insights:

- Wood

- Plastic

- Metal

- Corrugated Paper

The report has provided a detailed breakup and analysis of the market based on the type. This includes wood, plastic, metal, and corrugated paper.

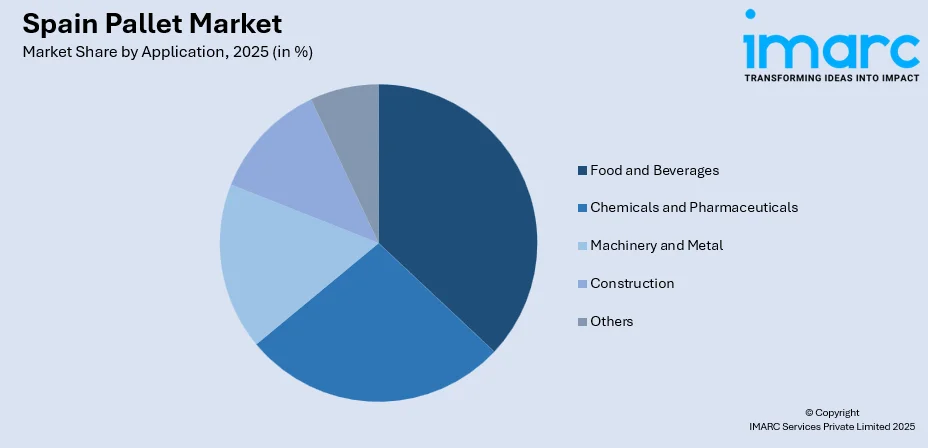

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Chemicals and Pharmaceuticals

- Machinery and Metal

- Construction

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes food and beverages, chemicals and pharmaceuticals, machinery and metal, construction, and others.

Structural Design Insights:

- Block

- Stringer

- Others

The report has provided a detailed breakup and analysis of the market based on the structural design. This includes block, stringer, and others.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Pallet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Wood, Plastic, Metal, Corrugated Paper |

| Applications Covered | Food and Beverages, Chemicals and Pharmaceuticals, Machinery and Metal, Construction, Others |

| Structural Designs Covered | Block, Stringer, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain pallet market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain pallet market on the basis of type?

- What is the breakup of the Spain pallet market on the basis of application?

- What is the breakup of the Spain pallet market on the basis of structural design?

- What is the breakup of the Spain pallet market on the basis of region?

- What are the various stages in the value chain of the Spain pallet market?

- What are the key driving factors and challenges in the Spain pallet market?

- What is the structure of the Spain pallet market and who are the key players?

- What is the degree of competition in the Spain pallet market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain pallet market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain pallet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain pallet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)