Spain Palm Oil Market Size, Share, Trends and Forecast by Application and Region, 2026-2034

Spain Palm Oil Market Overview:

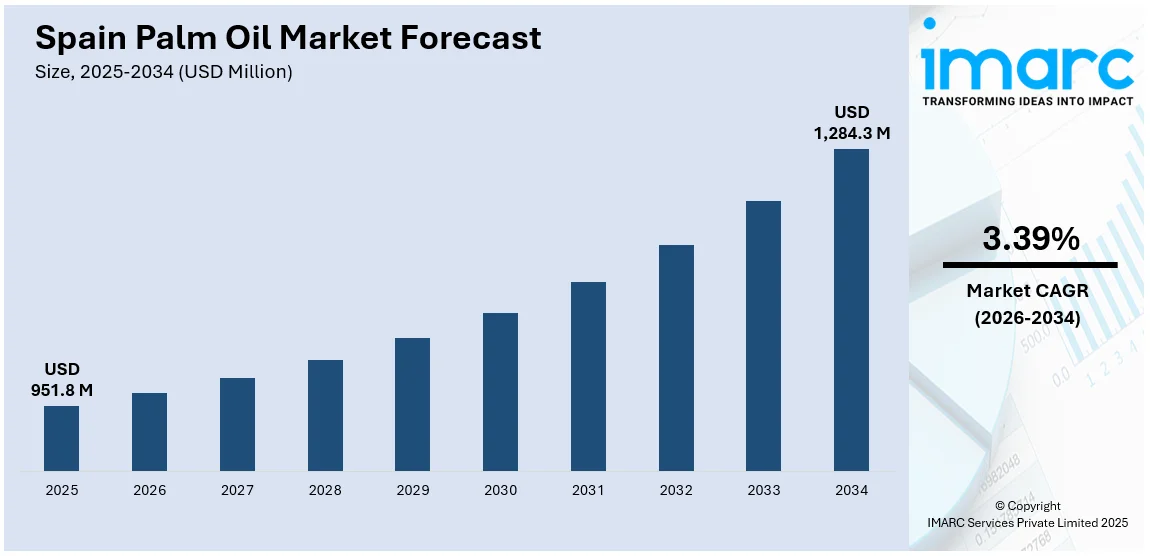

The Spain palm oil market size reached USD 951.8 Million in 2025. Looking forward, the market is expected to reach USD 1,284.3 Million by 2034, exhibiting a growth rate (CAGR) of 3.39% during 2026-2034. The market is driven by strong demand from the food, cosmetics, and biofuel sectors, supported by steady imports from major producers like Indonesia and Malaysia. Sustainability certifications and EU regulations are shaping sourcing preferences. The growing interest in responsible consumption continues to influence overall trends in the Spain palm oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 951.8 Million |

| Market Forecast in 2034 | USD 1,284.3 Million |

| Market Growth Rate 2026-2034 | 3.39% |

Spain Palm Oil Market Trends:

Expanding Industrial Processing and Refining Capacity

Spain has developed a robust infrastructure for refining and processing imported palm oil, allowing it to meet both domestic needs and re-export to other EU countries. Spanish ports such as Algeciras and Cartagena handle significant palm oil volumes efficiently, thanks to established storage and refining facilities. This industrial capacity supports versatile applications across chemicals, animal feed, and oleochemicals, enhancing local value addition. As Spain continues to invest in refining technology and bulk handling logistics, it becomes a more attractive hub for palm oil imports and processing. These advancements contribute to lower operational costs and higher productivity, making the country a strategic node in the regional palm oil supply chain and supporting long-term growth in the Spanish palm oil market.

To get more information on this market Request Sample

Rise of Private Label and Low-Cost Consumer Goods

The growth of private label brands in Spain’s retail sector has increased the use of affordable ingredients like palm oil in packaged foods, personal care, and cleaning products, which is further driving the Spain palm oil market growth. Supermarket chains prioritize cost-effective formulations to maintain competitive pricing, especially in value-oriented product categories. Palm oil’s low cost and functional versatility make it a preferred choice for manufacturers producing under private labels. As consumer spending remains price-sensitive amid inflationary pressures, brands continue to rely on palm oil to offer budget-friendly alternatives without compromising product performance. This demand from retail giants and contract manufacturers sustains consistent import volumes and reinforces palm oil’s role as a strategic ingredient in Spain’s fast-moving consumer goods (FMCG) segment.

Strategic Trade Relations and Diversified Sourcing

Spain maintains strong trade ties with leading palm oil exporters, ensuring a steady and diverse supply base. While Indonesia and Malaysia remain key sources, Spain has also explored alternative suppliers like Colombia and West African countries to mitigate risks and ensure uninterrupted imports. These diversified trade routes strengthen resilience against supply chain disruptions, geopolitical tensions, or weather-related issues in Southeast Asia. Spain’s proactive trade policies and participation in EU-level commodity agreements further support stable import flows. Additionally, palm oil is often purchased under long-term contracts, allowing for better price control and planning. This strategic approach to procurement enhances Spain’s role as both a major importer and regional distributor, ensuring the market remains well-supplied and competitively positioned.

Spain Palm Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on application.

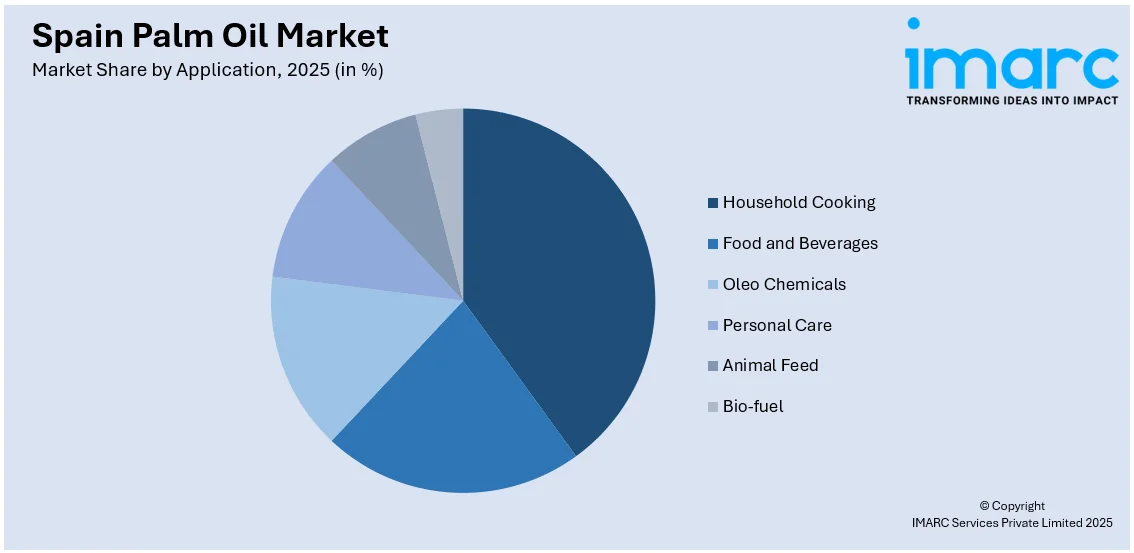

Application Insights:

Access the comprehensive market breakdown Request Sample

- Household Cooking

- Food and Beverages

- Oleo Chemicals

- Personal Care

- Animal Feed

- Bio-fuel

The report has provided a detailed breakup and analysis of the market based on the application. This includes household cooking, food and beverages, oleo chemicals, personal care, animal feed, and bio-fuel.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Palm Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Household Cooking, Food and Beverages, Oleo Chemicals, Personal Care, Animal Feed, Bio-fuel |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain palm oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain palm oil market on the basis of application?

- What is the breakup of the Spain palm oil market on the basis of region?

- What are the various stages in the value chain of the Spain palm oil market?

- What are the key driving factors and challenges in the Spain palm oil market?

- What is the structure of the Spain palm oil market and who are the key players?

- What is the degree of competition in the Spain palm oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain palm oil market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain palm oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain palm oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)