Spain Paper Packaging Market Size, Share, Trends and Forecast by Product Type, Grade, Packaging Level, End-Use Industry, and Region, 2026-2034

Spain Paper Packaging Market Summary:

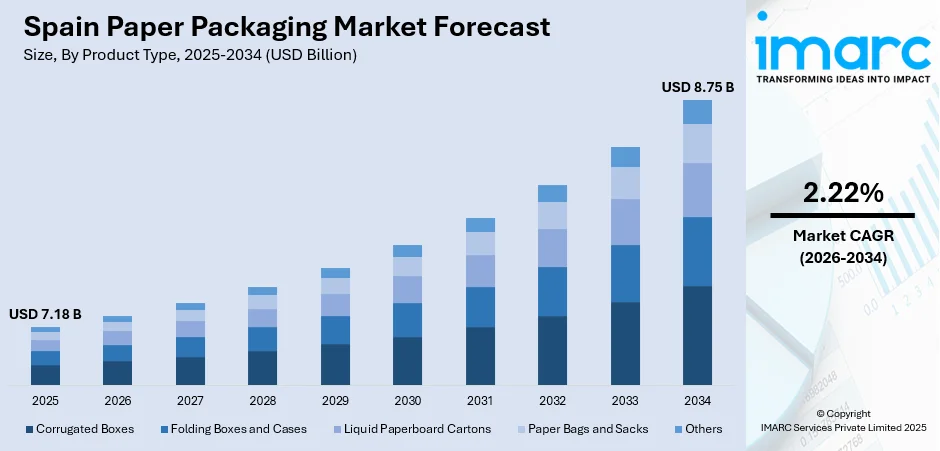

The Spain paper packaging market size was valued at USD 7.18 Billion in 2025 and is projected to reach USD 8.75 Billion by 2034, growing at a compound annual growth rate of 2.22% from 2026-2034.

The Spain paper packaging market is experiencing steady growth as businesses and consumers shift toward sustainable, recyclable, and cost-efficient packaging solutions. Increasing environmental regulations, rising demand for eco-friendly materials, and strong adoption across food, beverage, and e-commerce sectors are driving market expansion. Innovation in lightweight, high-strength paper formats further supports broader industry uptake.

Key Takeaways and Insights:

- By Product Type: Corrugated boxes dominate the market with a share of 40% in 2025, driven by durability, versatility, and strong demand across logistics and retail sectors.

- By Grade: Solid bleached leads the market with a share of 35% in 2025, supported by its premium quality, printability, and suitability for high-end packaging applications.

- By Packaging Level: Primary packaging prevails the market with a share of 50% in 2025, reflecting rising consumer goods consumption and growing emphasis on protective, sustainable packaging.

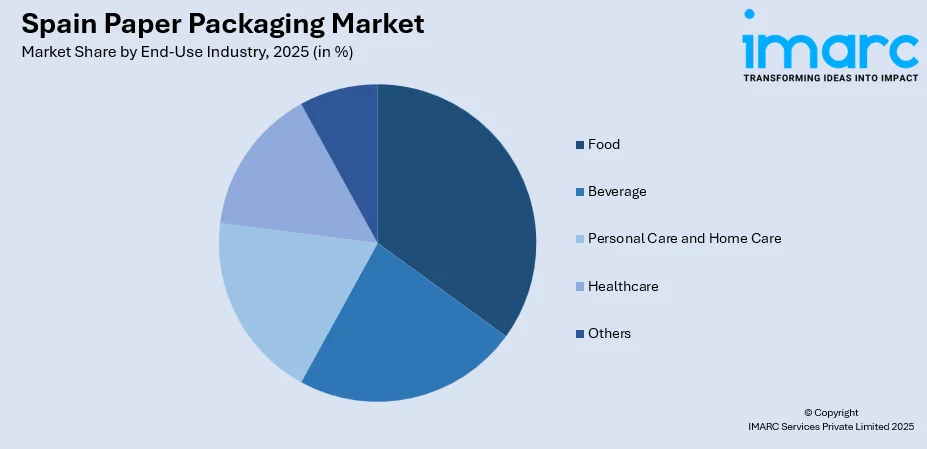

- By End-Use Industry: Food represents the market with a share of 45% in 2025, fueled by demand for safe, recyclable, and compliant packaging across processed and fresh food categories.

- Key Players: The competitive landscape features established packaging manufacturers focusing on innovation, recyclable material development, and automation. Companies are strengthening supply chains, expanding production capacity, and investing in sustainable solutions to meet rising demand from food, retail, and e-commerce industries.

To get more information on this market, Request Sample

The Spain paper packaging market is gaining strong momentum as businesses and consumers shift toward sustainable, recyclable, and cost-efficient packaging solutions. Growing environmental awareness and stricter regulations on single-use plastics are accelerating the adoption of paper-based formats across various sectors. In February 2025, Mondi and Proquimia launched paper-based stand-up pouches for dishwashing tabs in Spain and Portugal, significantly reducing CO2 emissions compared to plastic. The pouches, made from 85% paper, align with sustainability goals and enhance recyclability in both countries. This transition is further supported by strong innovation in corrugated designs, lightweight materials, and improved recyclability standards. Market growth is reinforced by rising corporate sustainability commitments and the rapid expansion of e-commerce, which increases demand for durable, protective packaging. Advancements in printing and structural engineering enhance product performance, while consumer preference for responsible brands continues to strengthen market uptake. These factors collectively position Spain’s paper packaging market for steady and long-term expansion.

Spain Paper Packaging Market Trends:

Growing Shift Toward Sustainable Packaging Solutions

Spanish consumers and businesses are increasingly prioritizing eco-friendly materials, driving greater adoption of recyclable, biodegradable, and compostable paper packaging. In December 2024, Graphic Packaging International and Elaborados Naturales launched the PaperSeal™ Shape paperboard tray in Spain, replacing traditional plastic trays. The design enhances sustainability, requiring less plastic and meeting recycling standards, while ensuring food safety and quality for refrigerated potato products. Brands are replacing plastic formats with paper-based alternatives to align with stricter sustainability commitments and improve environmental credibility.

Advancements in Packaging Design and Printing Technologies

Advancements in packaging design and printing technologies are driving the adoption of lightweight paper grades and high-strength corrugated formats, helping brands improve durability and reduce material use. Customizable digital printing supports sharper visuals, faster turnaround, and targeted branding, making paper packaging more appealing for retail, cosmetics, and premium food applications.

Expansion of E-Commerce Fueling Demand for Protective Paper Formats

Rising e commerce activity is increasing demand for sturdy paper based protective formats. In 2024, the Spain e-commerce market was valued at USD 431.3 Billion. Corrugated boxes, padded mailers, and paper fillers are gaining traction as businesses prioritize safe transit, low material weight, and eco-friendly operations. Logistics players prefer these solutions to improve shipment efficiency while supporting sustainability goals and reducing overall waste.

Market Outlook 2026-2034:

The market outlook for the forecast period reflects steady expansion, supported by rising demand for sustainable and cost-efficient packaging solutions across consumer goods, food and beverages, and e commerce segments. Paper based formats continue to replace plastic alternatives as brands strengthen their environmental commitments. For instance, major retailers have shifted to recyclable paper mailers to cut plastic usage. The market generated a revenue of USD 7.18 Billion in 2025 and is projected to reach a revenue of USD 8.75 Billion by 2034, growing at a compound annual growth rate of 2.22% from 2026-2034.

Spain Paper Packaging Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Corrugated Boxes |

40% |

|

Grade |

Solid Bleached |

35% |

|

Packaging Level |

Primary Packaging |

50% |

|

End-Use Industry |

Food |

45% |

Product Type Insights:

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

The corrugated boxes dominate with a market share of 40% of the total Spain paper packaging market in 2025.

The corrugated boxes contribute significantly to the market growth, driven by its strength, cost efficiency, and widespread use across logistics and retail supply chains. According to industry reports, Spain emerged as Europe’s third-largest corrugated cardboard producer, generating €6.97 Billion and employing over 25,000 people. With a 90 percent recycling rate, the segment reflects strong national commitment to sustainability and circular material usage.

Corrugated boxes also benefit from high demand in the food industry, which remains the largest end user due to its need for hygienic, sturdy, and customizable packaging. The sector’s efficiency and adaptability continue to drive innovation, particularly for e-commerce shipping formats. Many Spanish online retailers now rely on right-sized corrugated packaging to minimize damage, reduce material waste, and optimize transport costs. This growing focus on customizability reinforces the segment’s central role in Spain’s economy and packaging landscape.

Grade Insights:

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

The Solid bleached leads with a share of 35% of the total Spain paper packaging market in 2025.

Solid bleached board holds a strong position in Spain’s paper packaging landscape, supported by its premium surface quality, print clarity, and suitability for high-end consumer applications. Its use is expanding across cosmetics, pharmaceuticals, confectionery, and specialty foods, where brands prioritize visual appeal and protective performance. The material’s ability to deliver sharp graphics and a refined finish strengthens its role in premium retail packaging.

Sustainability-focused innovations further enhance its market prominence. In November 2025, Spanish company Lecta received the flustix Less Plastics Product certification for its EraCup Natural board, a material that is at least 99.25 percent plastic-free. Made from responsibly sourced pulp and meeting compostability and recyclability standards, this solid bleached board reflects rising demand for eco-friendly packaging solutions. Its strong environmental credentials and suitability for food service applications reinforce its growing relevance in Spain’s evolving packaging industry.

Packaging Level Insights:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

The primary packaging dominates with a market share of 50% of the total Spain paper packaging market in 2025.

The primary packaging segment holds a strong position in Spain’s paper packaging industry due to its essential role in protecting products at the first point of contact. Rising consumption of packaged foods, beverages, pharmaceuticals, and personal care products continues to fuel demand for durable, lightweight, and sustainable primary packaging materials. Brands increasingly prefer paper-based formats such as folding cartons, paper cups, and sachets to meet consumer expectations around safety, hygiene, and environmental responsibility.

Real-world adoption further reflects this momentum. In 2025, several Spanish FMCG manufacturers shifted from plastic to paper-based primary packaging to comply with evolving EU circular economy targets. One notable example is the growing use of recyclable paper cups and food-grade cartons in quick-service restaurants, which significantly reduced single-use plastic dependency. Such transitions highlight how regulatory pressure, brand sustainability commitments, and consumer preferences collectively strengthen the dominance of primary paper packaging across Spain’s fast-moving product categories.

End-Use Industry Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Food

- Beverage

- Personal Care and Home Care

- Healthcare

- Others

The food leads with a share of 45% of the total Spain paper packaging market in 2025.

The food segment leads the Spain paper packaging market as brands increasingly shift toward recyclable, lightweight, and compliant packaging solutions that match evolving consumer expectations. Strong demand from fresh produce, bakery items, dairy, beverages, and ready-to-eat meals continues to widen the segment’s influence. This momentum is reinforced by the expanding foodservice sector, which reached USD 154.4 Billion in 2024, boosting the need for safe, adaptable, and sustainable paper-based formats.

Growth in convenience foods, rising retail activity, and tightening regulations on single-use plastics further accelerate adoption across the country. Manufacturers are introducing innovative solutions such as grease-resistant papers, high-strength cartons, and custom-printed corrugated containers tailored for food applications. These advancements improve product safety, strengthen shelf appeal, and support Spain’s transition toward more responsible packaging systems.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Northern Spain shows steady demand for paper packaging, supported by strong food processing, dairy, and fisheries industries. Growing retail expansion and sustainability-focused consumers in regions like the Basque Country and Galicia continue to drive preference for recyclable, high-quality paper-based solutions.

Eastern Spain, including Catalonia and Valencia, remains a key hub for manufacturing, logistics, and export-oriented industries, fueling consistent use of paper packaging. Rising e commerce activity and premium food production further strengthen demand for durable, innovative, and visually appealing packaging formats.

Southern Spain benefits from thriving agriculture, horticulture, and beverage industries, creating substantial demand for protective and cost-effective paper packaging. Expanding tourism and foodservice activities also contribute to higher consumption of flexible, recyclable packaging for takeaway, retail, and hospitality applications.

Central Spain, led by Madrid’s large commercial and retail base, shows strong adoption of sustainable paper packaging. Growing FMCG activity, rising convenience food demand, and increasing corporate sustainability commitments support greater use of corrugated boxes, cartons, and specialty paper formats across the region.

Market Dynamics:

Growth Drivers:

Why is the Spain Paper Packaging Market Growing?

Increasing Regulatory Push for Eco Friendly Materials

Stricter waste reduction policies, plastic substitution mandates, and extended producer responsibility requirements are accelerating the adoption of recyclable and biodegradable paper packaging across industries. In July 2025, Spain announced new regulations requiring all packaging to be 100% recyclable, reusable, or compostable by 2025, aligning with EU circular economy goals. The Royal Decree mandates eco-design, clear labeling, and encourages reusable packaging. This initiative aims to enhance sustainability and support businesses in adapting to these requirements. Manufacturers are prioritizing paper-based solutions to comply with evolving environmental standards while reducing long-term operational risks. This regulatory momentum is also encouraging investments in sustainable materials, greener production processes, and eco-certified packaging formats, reinforcing industry wide transition toward environmentally responsible solutions and boosting overall market acceptance.

Growth of the Food and Beverage Industry

Spain’s expanding food processing sector and rising consumption of packaged meals, bakery products, beverages, and ready-to-eat foods are driving strong demand for paper packaging. For instance, in October 2025, Stolt Sea Farm announced the construction of a new food processing and R&D center in Rianxo, Galicia. The facility will employ over 100 workers, focusing on packaging sole and turbot products, while enhancing logistics and food safety capabilities. The industry's need for safe, compliant, and visually appealing formats supports widespread use of corrugated boxes, cartons, and flexible paper solutions. Retail growth and increasing home delivery volumes further enhance usage of protective, hygienic, and lightweight packaging, positioning paper as a preferred material for efficient handling, branding, and sustainability.

Growing Investment in Recycling Infrastructure

Ongoing improvements in Spain’s recycling ecosystem, including advanced sorting facilities, fiber recovery systems, and municipal waste management programs, are strengthening the availability of high-quality recycled paper. In October 2024, Mondi joined 12 European companies to form Paper Sacks Go Circular Spain, aiming to enhance the recycling of paper bags in the construction industry. The alliance seeks to improve circularity and sustainability in construction waste management in Spain. This enhanced infrastructure supports cost efficient production and reduces dependency on virgin raw materials. With businesses and municipalities prioritizing circular economy practices, recycled paper adoption is increasing across packaging applications, enabling manufacturers to meet sustainability targets while maintaining consistent quality and supply reliability.

Market Restraints:

What Challenges the Spain Paper Packaging Market is Facing?

Volatility in Raw Material Prices

Frequent fluctuations in pulp, recycled fiber, and energy costs create financial uncertainty for manufacturers. These variations make it difficult to maintain stable pricing, compress profit margins, and plan long term production strategies, especially for companies heavily dependent on imported raw materials.

Rising Competition from Alternative Sustainable Materials

Bioplastics, compostable films, and reusable packaging formats are increasingly preferred by brands seeking distinctive sustainability credentials. As these alternatives gain market visibility, traditional paper packaging faces pressure to innovate, risking slower demand growth in segments where performance or durability requirements are higher.

Limited Recycling Quality and Contamination Issues

Despite strong recycling efforts, contamination in collected paper and inconsistent sorting practices reduce the quality of recovered fiber. This limits its usability in premium packaging applications, increases processing costs, and forces manufacturers to depend more on virgin materials, challenging sustainability and cost efficiency.

Competitive Landscape:

The Spain paper packaging market features a competitive landscape shaped by a mix of established domestic manufacturers and global packaging companies expanding their presence. Competition centers on product quality, sustainability performance, customization capabilities, and supply chain reliability. Players are increasingly investing in lightweight grades, high strength corrugated solutions, and advanced printing technologies to differentiate offerings. Growing demand for recyclable and compostable formats is also driving strategic collaborations with retailers and foodservice operators. Companies are focusing on circular economy initiatives, improving fiber recovery, and expanding recycled paper capacity to strengthen their market position. Innovation, cost efficiency, and regulatory compliance remain key competitive priorities.

Recent Developments:

- In May 2025, Nefab Group acquired Embalajes Echeberria in Spain, enhancing its packaging solutions and market position. The integration will improve support for local customers in various sectors, emphasizing sustainability and innovation, while expanding Nefab's global workforce and annual turnover.

- In November 2024, All4Labels launched STARPACK™, an eco-friendly paper alternative to plastic packaging, utilizing renewable materials. Awarded the Liderpack Award, it significantly reduces plastic use by 80%. The innovation, developed by the team in Spain, strengthens the company's sustainable packaging initiatives.

- In May 2025, Amazon announced its plans to launch custom-fit cardboard and paper packaging across Europe, including Spain, to reduce waste and emissions. The company will install hundreds of automated machines in fulfillment centers, supporting its goal of 100% recyclable packaging achieved in 2023.

Spain Paper Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others |

| Grades Covered | Solid Bleached, Coated Recycled, Uncoated Recycled, Others |

| Packaging Levels Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| End-Use Industries Covered | Food, Beverage, Personal Care and Home Care, Healthcare, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain paper packaging market size was valued at USD 7.18 Billion in 2025.

The Spain paper packaging market is expected to grow at a compound annual growth rate of 2.22% from 2026-2034 to reach USD 8.75 Billion by 2034.

Corrugated boxes held the largest share, driven by strong usage across retail, e commerce, and logistics. Their durability, cost efficiency, and sustainability appeal support widespread adoption, making them the preferred choice for protective and transport packaging.

Key factors driving the Spain paper packaging market include rising demand for sustainable materials, growth in food, beverage, and e commerce sectors, and advancements in lightweight, high strength paper grades. Increasing regulatory emphasis on recyclability and reduced plastic usage also accelerates market expansion.

Major challenges include volatile raw material prices, quality issues in recycled fiber, and growing competition from alternative sustainable materials such as bioplastics and reusable systems. Manufacturers also face pressure to balance cost efficiency with rising sustainability and performance expectations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)