Spain Personal Care Products Market Size, Share, Trends and Forecast by Type, Distribution Channel, Consumer Type, and Region, 2026-2034

Spain Personal Care Products Market Overview:

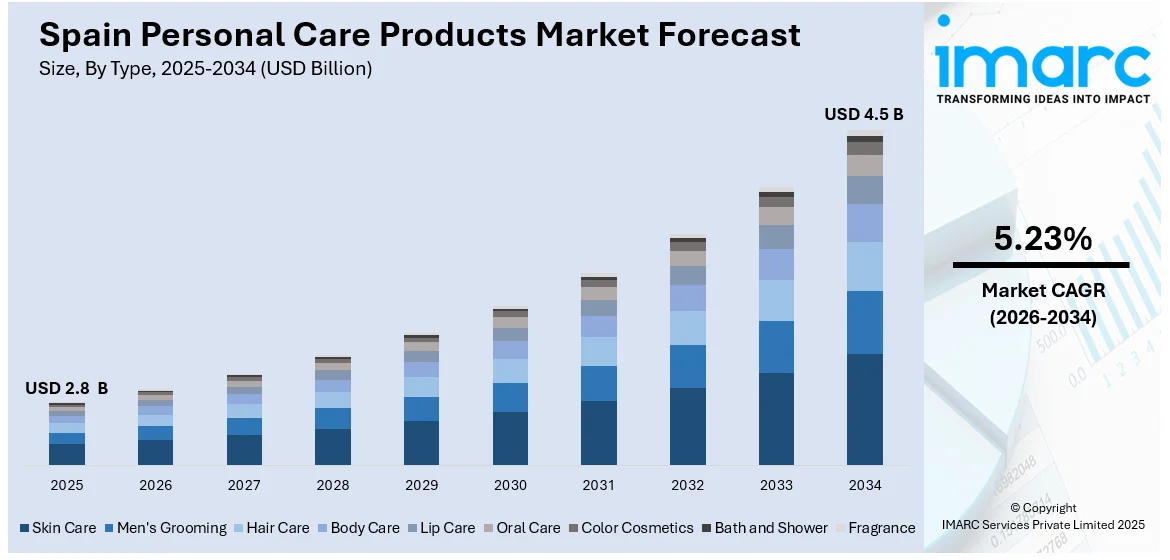

The Spain personal care products market size reached USD 2.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.5 Billion by 2034, exhibiting a growth rate (CAGR) of 5.23% during 2026-2034. The increasing consumer demand for natural and organic ingredients, a strong influence of beauty and skincare trends, growth in men's grooming and anti-aging products, emergence of sustainable packaging and digitalization, and e-commerce advancements enhancing product accessibility and consumer engagement are aiding in market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.8 Billion |

| Market Forecast in 2034 | USD 4.5 Billion |

| Market Growth Rate 2026-2034 | 5.23% |

Spain Personal Care Products Market Trends:

Surge in Demand for Sustainable and Natural Products

The Spain personal care market is witnessing a strong shift toward sustainable and natural products due to rising consumer awareness of environmental impact and skin health. Consumers are opting for organic, cruelty-free, and eco-friendly alternatives, pushing brands to reformulate their offerings with plant-based ingredients and biodegradable packaging. The natural cosmetics market in Spain is poised for steady growth, with projected revenue reaching USD 201.73 million in 2025. The market is expected to expand at a CAGR of 4.28% from 2025 to 2030, driven by increasing consumer preference for clean beauty products. Companies like Natura Bissé and Freshly Cosmetics are leveraging this trend by launching formulas devoid of toxins. Furthermore, Spain is enforcing stricter laws on plastic waste, which is pressuring companies to utilize packaging that is recyclable, refillable, and biodegradable. This tendency will be further accelerated by the Spanish government's goal of reducing plastic waste by 30% by 2026. Accordingly, there is a promising prognosis for market development as big retailers like Sephora Spain and El Corte Inglés are diversifying their natural and sustainable product lines to satisfy changing customer demands.

To get more information on this market Request Sample

Integration of Beauty Products into Lifestyle and Fashion

Beauty products in Spain have transcended traditional boundaries, integrating seamlessly into lifestyle and fashion sectors. This fusion has expanded the reach of personal care products, making them an essential part of daily life and self-expression. In 2023, the perfume and cosmetics industry in Spain achieved a turnover of €10.4 billion, marking a 12.1% hike in comparison to the previous year, with this growth trend continuing into 2024. In line with this, reports suggest that cosmetic products have become indispensable for 72% of Europeans, reflecting their integration into daily routines and cultural practices. This trend is further evidenced by beauty brands venturing into merchandise like caps and t-shirts, adopting fashion strategies to enhance brand presence and customer loyalty. The rise of social media and beauty influencers has been instrumental in driving this cultural shift, encouraging self-care and personal expression through beauty products. In conclusion, the Spain personal care products market's growth is propelled by a post-pandemic resurgence in cosmetic consumption and the blending of beauty products with lifestyle and fashion, reflecting evolving consumer behaviors and cultural dynamics.

Spain Personal Care Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, distribution channel, and consumer type.

Type Insights:

- Skin Care

- Men's Grooming

- Hair Care

- Body Care

- Lip Care

- Oral Care

- Color Cosmetics

- Bath and Shower

- Fragrance

The report has provided a detailed breakup and analysis of the market based on the type. This includes skin care, men's grooming, hair care, body care, lip care, oral care, color cosmetics, bath and shower, and fragrance.

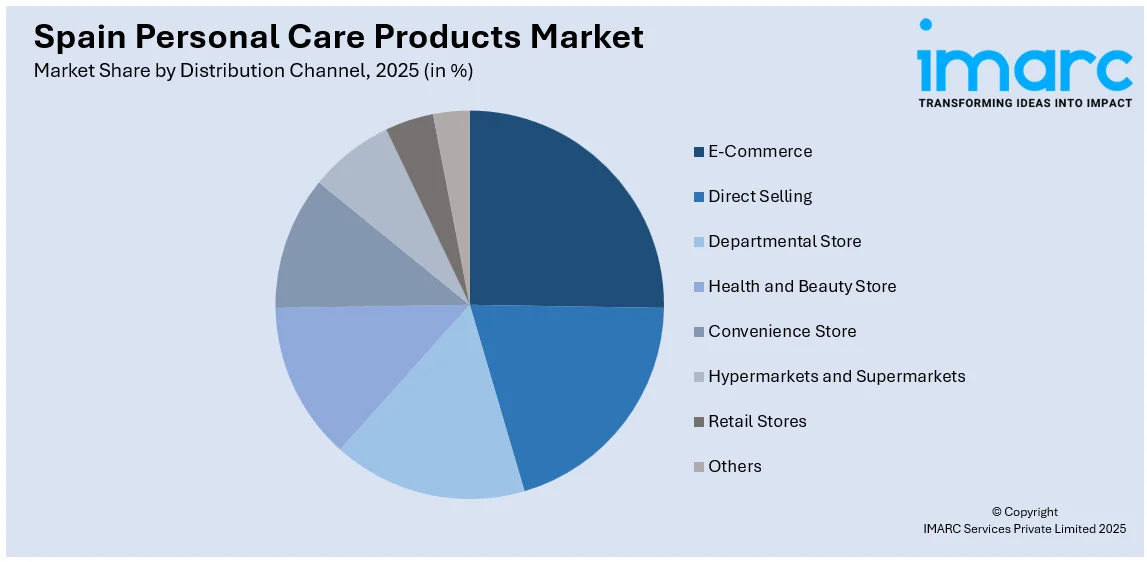

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- E-Commerce

- Direct Selling

- Departmental Store

- Health and Beauty Store

- Convenience Store

- Hypermarkets and Supermarkets

- Retail Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes e-commerce, direct selling, departmental store, health and beauty store, convenience store, hypermarkets and supermarkets, retail stores, and others.

Consumer Type Insights:

- Male

- Female

The report has provided a detailed breakup and analysis of the market based on the consumer type. This includes male and female.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Personal Care Products Market News:

- November 2024: Colombian actress, presenter, and model Sofia Vergara partnered with Spanish laboratory Cantabria Labs to develop and launch Toty, a new brand. The collaboration aims to create and produce a complete line of sun-protection beauty products.

- September 2024: Cosmewax, a prominent contract manufacturer of cosmetics, announced its expansion with a new skincare facility in Puzol, Spain. Backed by an investment of nearly 11 million euros, this development will boost the company’s production capacity by 50%. Covering 5,100 square meters, the facility will incorporate cutting-edge technology while maintaining the highest standards of quality and sustainability.

Spain Personal Care Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Skin Care, Men's Grooming, Hair Care, Body Care, Lip Care, Oral Care, Color Cosmetics, Bath and Shower, Fragrance |

| Distribution Channels Covered | E-Commerce, Direct Selling, Departmental Store, Health and Beauty Store, Convenience Store, Hypermarkets and Supermarkets, Retail Stores, Others |

| Consumer Types Covered | Male, Female |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain personal care products market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain personal care products market on the basis of type?

- What is the breakup of the Spain personal care products market on the basis of distribution channel?

- What is the breakup of the Spain personal care products market on the basis of consumer type?

- What are the various stages in the value chain of the Spain personal care products market?

- What are the key driving factors and challenges in the Spain personal care products market?

- What is the structure of the Spain personal care products market and who are the key players?

- What is the degree of competition in the Spain personal care products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain personal care products market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain personal care products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain personal care products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)