Spain Plywood Market Size, Share, Trends and Forecast by Application, Sector, and Region, 2026-2034

Spain Plywood Market Summary:

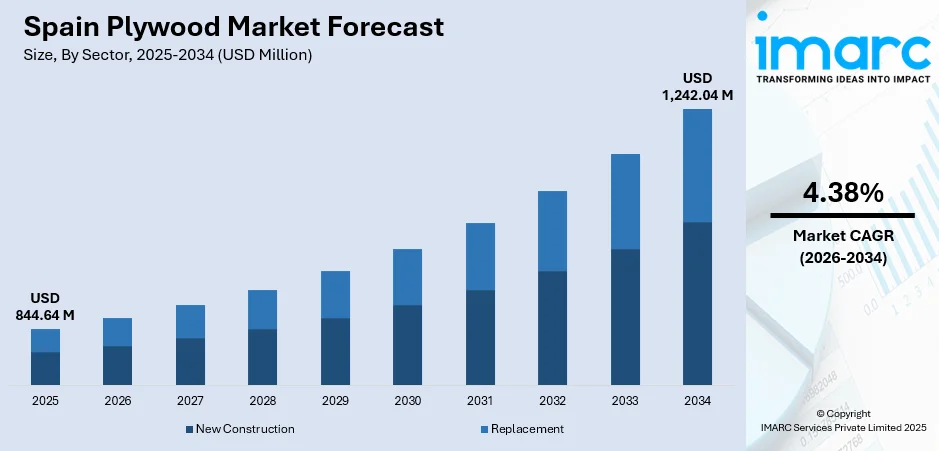

The Spain plywood market size was valued at USD 844.64 Million in 2025 and is projected to reach USD 1,242.04 Million by 2034, growing at a compound annual growth rate of 4.38% from 2026-2034.

The Spain plywood market is experiencing significant growth driven by rising construction activities and the growing demand for sustainable building materials. Increasing investments in residential, commercial, and infrastructure projects are driving the need for plywood, while innovations in eco-friendly and engineered wood products appeal to environmentally conscious people. Additionally, government initiatives promoting renewable resources and the expansion of the furniture and interior design sectors are further boosting the market demand, positioning Spain as a key growth hub.

Key Takeaways and Insights:

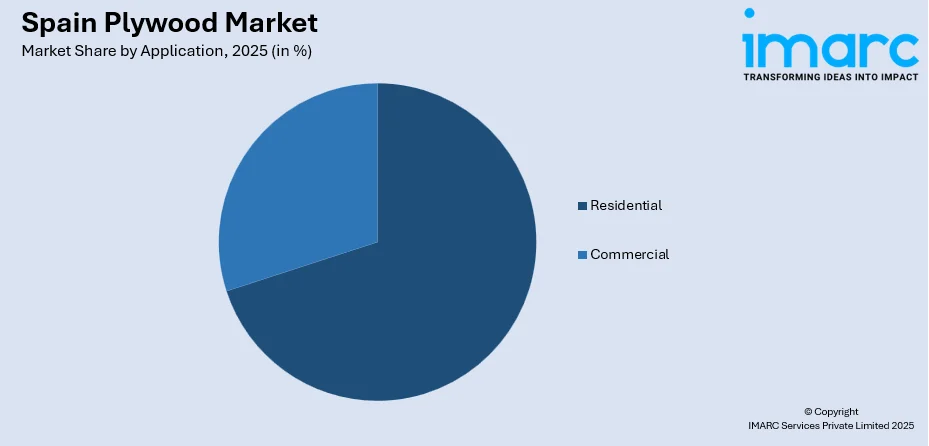

- By Application: Residential segment dominated the market with approximately 70% revenue share in 2025, driven by strong housing demand across metropolitan areas, favorable mortgage conditions, and government initiatives promoting affordable housing construction throughout urban and suburban regions.

- By Sector: New construction segment held the largest market share of 65% in 2025, supported by expanding residential developments, hospitality infrastructure projects, and commercial building activity concentrated in major economic centers, including Madrid, Barcelona, and Valencia.

- Key Players: The Spain plywood market exhibits intense rivalry and the presence of both established manufacturers and smaller regional players. Producers face pressure from alternative panel materials that offer cost advantages in standard applications, requiring plywood companies to emphasize quality, durability, and specialized performance.

To get more information on this market, Request Sample

The Spain plywood market is witnessing growth, primarily driven by robust demand from the construction and furniture sectors. Expanding infrastructural development projects are increasing the need for versatile and durable building materials, positioning plywood as a preferred choice due to its strength, lightweight properties, and adaptability. A notable indicator of the country’s growing industrial activity is CATL’s commencement of a new factory in Aragon in 2025, reflecting rising construction activity and the potential for heightened plywood consumption in large-scale projects. Furthermore, the increasing emphasis on modern interior design and customized furniture solutions is supporting the market growth, as manufacturers innovate to meet diverse aesthetic and functional requirements. Technological advancements in production, including improved laminating and finishing techniques, are enhancing product quality and broadening its applications. Furthermore, plywood’s ease of handling and structural reliability make it an attractive material for builders and designers, supporting sustained market adoption across multiple sectors.

Spain Plywood Market Trends:

Rising Investment in Renewable Energy Infrastructure

A key factor supporting the growth of the market is the increasing investment in renewable energy infrastructure, where plywood serves as a versatile, cost-effective material for construction and support structures. For instance, in 2025, Moeve (formerly Cepsa) announced plans to begin construction of the Andalusian Green Hydrogen Valley, the country’s largest green hydrogen project. Such large-scale developments require temporary platforms, formwork, protective enclosures, and interior paneling, all of which can incorporate plywood. As Spain expands its green energy initiatives, the demand for durable, adaptable, and economically efficient materials like plywood is growing.

Increasing Construction Activities

The expansion of residential, commercial, and infrastructural construction projects in Spain is a key factor catalyzing the demand for plywood. Rising modernization initiatives require versatile, durable, and cost-effective materials, with plywood providing structural stability and ease of installation. In 2025, Spain announced a €1.3 billion EU-funded plan to accelerate industrial construction of social housing, further increasing material requirements. This sustained construction activity reinforces plywood’s critical role as a reliable input, directly influencing production planning, procurement strategies, and overall market growth in the country.

Growing Employment in Furniture Manufacturing

The increasing demand for durable, aesthetically appealing, and customizable furniture is bolstering the Spain plywood market growth. Its structural strength, versatility, and capacity to support innovative designs make it a preferred material for furniture and interior design manufacturers. In 2025, Spanish designers Rafa Peris and David Guilmain showcased the MT Chair, a minimalist plywood chair supporting up to 200 kg without hardware, crafted from two bent plywood sheets using advanced 5-axis CNC technology. Such innovations highlight plywood’s potential in high-design, functional furniture applications.

Market Outlook 2026-2034:

The Spain plywood market demonstrates notable growth potential throughout the forecast period, underpinned by favorable construction sector dynamics and the rising residential demand. The market generated a revenue of USD 844.64 million in 2025 and is projected to reach USD 1,242.04 million by 2034, growing at a compound annual growth rate of 4.38% from 2026-2034. This reflects steady market development as residential construction activity continues, tourism-related infrastructure expands, and furniture manufacturing increasingly adopts premium plywood specifications.

Spain Plywood Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Application | Residential | 70% |

| Sector | New Construction | 65% |

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Residential

- Commercial

Residential dominates with a market share of 70% of the total Spain plywood market in 2025.

Residential leads the market, as rising housing demand drives use in floors, roofs, walls, and cabinetry. Renovations further increase usage, exemplified by the Sustainable Communities Spain project in 2025, a €130 million initiative creating durable, energy-efficient homes for urban households.

Plywood is preferred in residential projects for its cost-effectiveness, adaptability, and ease of installation. In Sustainable Communities Spain developments, plywood supports quick construction, sustainable design, and long-lasting performance, meeting Spanish households’ growing priorities for efficiency, affordability, and environmentally conscious living.

Sector Insights:

- New Construction

- Replacement

New construction leads with a share of 65% of the total Spain plywood market in 2025.

New construction dominates the plywood market, as residential, commercial, and infrastructure developments require durable and adaptable wood panels. For instance, contemporary mixed-use complexes increasingly incorporate plywood in structural systems and interior installations to ensure efficiency, resilience, and long-term project viability.

Additionally, strong demand arises as new construction prioritizes materials offering strength, adaptability, and affordability, positioning plywood as a preferred option. This strong demand for adaptable and efficient materials like plywood in new construction is further fueled by high-level government initiatives, as exemplified by Spanish President Pedro Sánchez's 2025 announcement of the launch of the PERTE for the Industrialisation of Housing, a strategic initiative with a €1.3 billion investment aimed at modernizing construction and increasing housing production.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The market in Northern Spain is growing due to industrial development, infrastructure projects, and urban expansion in regions like Galicia, Asturias, and the Basque Country. Sustainable construction practices and a thriving furniture industry are further supporting plywood demand.

Eastern Spain, including Catalonia and Valencia, sees increasing plywood usage driven by commercial construction and tourism-related infrastructure. The rising preference for eco-friendly and engineered wood products supports the market growth, with furniture manufacturing and interior design contributing significantly.

Southern Spain, particularly Andalusia, are employing plywood in residential construction, tourism infrastructure, and urban development projects. Government initiatives promoting sustainable materials, alongside the expanding furniture and interior design sectors, are enhancing plywood demand across the region.

Central Spain, including Madrid and Castilla-La Mancha, shows rising plywood demand supported by large-scale infrastructure, commercial development, and the growing number of interior design projects. Engineered and eco-friendly wood products are increasingly preferred, contributing to long-term market growth and investment opportunities.

Market Dynamics:

Growth Drivers:

Why is the Spain Plywood Market Growing?

Increasing Tourism and Hospitality Sector Demand

The growth of Spain’s tourism and hospitality sector is influencing the plywood market by driving the need for materials essential for building and renovating hotels, restaurants, and leisure venues. According to Spain's National Statistics Institute (INE), more than 87 million international tourists visited the country in 2024, surpassing the previous record of 83.7 million in 2019. This increase in tourism drives the construction and renovation of hotels, resorts, restaurants, and leisure facilities, which require versatile, durable, and aesthetically appealing materials like plywood. The sector’s focus on quality, design, and efficiency encourages manufacturers to supply innovative plywood solutions, reinforcing its critical role in supporting the country’s growing hospitality infrastructure.

Growing Use in Renovation and Remodeling Activities

Increasing investments in renovation and remodeling projects across residential and commercial spaces are catalyzing the demand for plywood. Its flexibility, durability, and ease of installation make plywood a preferred choice for furniture, partitions, flooring, and paneling. In 2024, the FACILITA project was launched to promote the energy renovation of public buildings in Spain. Such urban and suburban renovation trends are driving the need for plywood, encouraging manufacturers to innovate and provide specialized products tailored to remodeling, ensuring a sustainable and recurring market segment.

Certification of New Wood Resources

The approval of new structural-grade wood resources is impelling the growth of the market by expanding the supply of renewable raw materials suitable for construction applications. For instance, in 2024, the Spanish Association for Standardization (UNE) and the European Committee for Standardization (CEN) authorized poplar clones MC and Luisa Avanzo for structural use, allowing their integration into plywood, laminated beams, and cross-laminated timber without additional testing. This development supported sustainable building practices, strengthened the domestic poplar industry, and provided manufacturers with a reliable, cost-effective, and certified material source, thereby enhancing production capacity and market growth potential.

Market Restraints:

What Challenges the Spain Plywood Market is Facing?

Raw Material Price Volatility and Supply Chain Pressures

Fluctuations in raw material and chemical input costs affect production expenses and profit margins, creating uncertainty across the plywood supply chain. Dependence on external suppliers exposes manufacturers to disruptions, delays, and currency variations, making cost management and stable sourcing critical. These pressures challenge pricing strategies, operational planning, and the overall efficiency of plywood production and distribution.

Stringent Environmental Regulations and Compliance Requirements

Tightening environmental regulations and emissions standards increase operational complexity and costs for plywood manufacturers. Compliance demands traceability of wood sourcing, investments in verification systems, and adjustments to production processes. Meeting sustainability and emissions requirements necessitates continuous monitoring, testing, and process modifications, making regulatory adherence a key factor in operational planning and long-term market participation.

Competition from Alternative Panel Materials

The growth of alternative panel products presents challenges to plywood’s market position. Lower-cost substitutes in certain applications put pressure on plywood producers to highlight unique performance, durability, and sustainability features. Companies must focus on product innovation, technical advantages, and environmental credentials to maintain competitiveness and differentiate from alternative materials in evolving construction and furniture markets.

Competitive Landscape:

The competitive landscape of the plywood market is marked by intense rivalry and the presence of both established manufacturers and smaller regional players. Producers face pressure from alternative panel materials that offer cost advantages in standard applications, requiring plywood companies to emphasize quality, durability, and specialized performance. Market participants must continuously innovate, focusing on sustainability, technical properties, and process efficiency to differentiate themselves. Success depends on balancing competitive pricing, regulatory compliance, and supply chain management while meeting evolving customer demands and maintaining a strong market presence.

Recent Developments:

- In September 2025, TT Plywood expanded into the European market, with shipments of premium birch plywood to Spain's furniture industry and core plywood to Sweden's packaging sector. This highlights TT Plywood's adaptability in meeting diverse European needs, offering customized solutions.

- In April 2025, RIVA Spain introduced the ARTE collection, an engineered hardwood flooring with a herringbone pattern made from premium European White Oak and backed by a durable Baltic Birch plywood core. The collection combines strength, elegance, and longevity, featuring finishes protected by Bona® UV-matte lacquer. ARTE is designed to enhance both residential and commercial spaces with timeless beauty.

Spain Plywood Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Residential, Commercial |

| Sectors Covered | New Construction, Replacement |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain plywood market size was valued at USD 844.64 million in 2025

The Spain plywood market is expected to grow at a compound annual growth rate of 4.38% from 2026-2034 to reach USD 1,242.04 million by 2034.

Residential applications dominated with a 70% revenue share in 2025, driven by strong housing demand, favorable construction conditions, and government initiatives promoting affordable housing development across metropolitan and suburban areas in Spain.

Key factors driving the Spain plywood market include the expanding residential, commercial, and infrastructural construction sector, which is driving the plywood demand, as modernization requires durable, versatile, and cost-efficient materials. The €1.3 billion EU-funded 2025 social-housing plan further elevates material needs, strengthening plywood’s strategic role in procurement and market growth.

Major challenges include raw material price volatility affecting production costs, stringent environmental regulations increasing compliance requirements, competition from alternative panel materials in commodity applications, and supply chain dependencies on imported wood species and chemical inputs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)