Spain Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2026-2034

Spain Private Equity Market Summary:

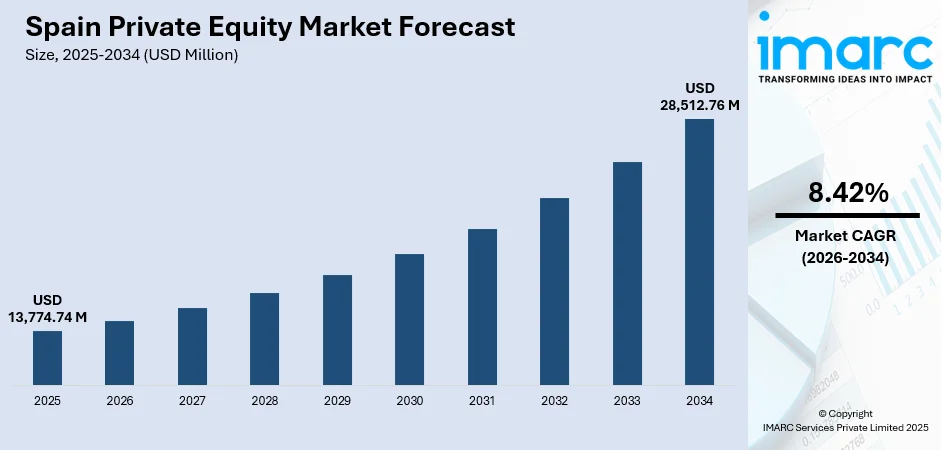

The Spain private equity market size was valued at USD 13,774.74 Million in 2025 and is projected to reach USD 28,512.76 Million by 2034, growing at a compound annual growth rate of 8.42% from 2026-2034.

The market is experiencing robust expansion driven by economic recovery, digital innovation, and corporate restructuring initiatives. Lower valuations, supportive fiscal policies, and sustained interest from international funds have bolstered activity. The diversification of capital deployment into sustainable and regional investments continues to strengthen Spain private equity market share within the broader Southern European landscape.

Key Takeaways and Insights:

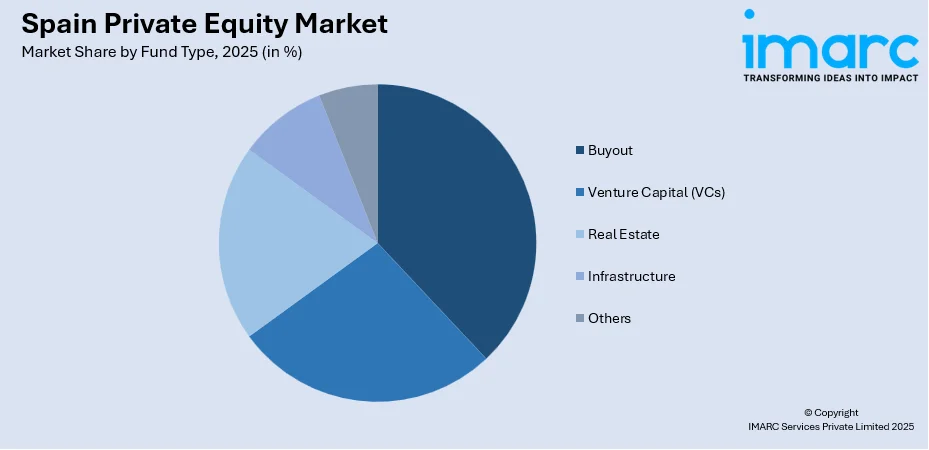

- By Fund Type: Buyout dominates the market with a share of 38% in 2025, driven by middle-market transactions targeting established businesses seeking operational improvements and international expansion.

- Key Players: The Spain private equity market exhibits moderate competitive intensity, with multinational financial institutions competing alongside established domestic fund managers across diverse investment strategies and price segments.

To get more information on this market Request Sample

The market benefits from Spain's strategic geographic position enabling access to European and Latin American markets, enhancing cross-border investment potential. Private equity firms are increasingly targeting family-owned businesses undergoing generational transitions, applying operational expertise to unlock value through digital upgrades, talent acquisition, and market expansion across manufacturing, agribusiness, and retail sectors. Domestic fundraising has reached record levels in recent years, reflecting local institutional and private investors' ongoing confidence in the PE ecosystem's long-term foundation. The favorable legal framework and increasing openness from local.

Spain Private Equity Market Trends:

Surge in Family-Owned Business Buyouts

Private equity involvement in Spain's family-owned businesses is accelerating as enterprises seek generational transitions or restructuring support. These companies represent stable, revenue-generating opportunities requiring modernization or internationalization. PE firms leverage operational expertise to unlock value through digital upgrades, talent acquisition, and market expansion. In February 2024, GED Capital completed its third divestment from GED V Spain fund through the sale of Procubitos Europe, a premium ice manufacturer and distributor, to Magnum Capital, demonstrating the success of buy-and-build strategies in the Spanish market.

Urban Tech and Smart Infrastructure Focus

Private equity firms are increasingly targeting urban tech and smart infrastructure projects, driven by public-private partnerships and EU recovery funds. Investments focus on mobility-as-a-service platforms, smart city frameworks, and digital public utilities. The integration of IoT, big data, and artificial intelligence into urban planning is making these ventures more profitable and scalable. In July 2024, Asterion Industrial Partners announced the first close of its third infrastructure fund at €1.5 Billion, targeting energy, telecommunications, and transport investments across five European countries including Spain.

Rising Emphasis on ESG and Sustainable Investments

Environmental, social, and governance considerations are becoming central to investment strategies as managers prioritize impact and sustainable investments that integrate environmental and social characteristics. Interest in energy and infrastructure funds, particularly those focused on renewable energy, has notably increased. The European Investment Bank Group invested €12.3 Billion in Spain in 2024, with over €7.2 Billion directed toward climate action and environmental sustainability projects, demonstrating the scale of capital flowing into sustainable investments.

Market Outlook 2026-2034:

The Spain private equity market demonstrates strong growth potential as macroeconomic conditions stabilize and interest rates moderate. Lower borrowing costs are expected to revitalize leveraged buyout activity while record levels of dry powder position funds for increased deal-making. Technology, healthcare, and renewable energy sectors will continue attracting significant capital as digital transformation accelerates across industries. The market generated a revenue of USD 13,774.74 Million in 2025 and is projected to reach a revenue of USD 28,512.76 Million by 2034, growing at a compound annual growth rate of 8.42% from 2026-2034.

Spain Private Equity Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Fund Type | Buyout | 38% |

Fund Type Insights:

Access the comprehensive market breakdown Request Sample

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Buyout dominates the market with a share of 38% of the total Spain private equity market in 2025.

The buyout segment maintains its leading position as private equity firms target established mid-market companies requiring operational improvements and strategic repositioning. These transactions typically involve acquiring majority stakes in profitable businesses across manufacturing, consumer products, healthcare, and industrial services sectors. Private equity firms are applying buy-and-build strategies to consolidate fragmented industries and achieve economies of scale. Middle-market transactions have demonstrated notable growth in recent years, reflecting continued confidence in Spain's business landscape and opportunities for professional management to unlock growth potential in portfolio companies through operational enhancements and international expansion.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Northern Spain encompasses the Basque Country, Navarra, Cantabria, Asturias, and Galicia regions. The area attracts private equity investment due to its strong industrial manufacturing base, established family-owned enterprises, and advanced automotive and machinery sectors. The Basque Country in particular features a robust ecosystem of medium-sized industrial companies seeking growth capital and succession planning support, making it attractive for buyout-focused funds targeting operational improvements.

Eastern Spain is anchored by Catalonia and the Valencia region, with Barcelona serving as Southern Europe's leading startup and technology hub. The region hosts a thriving startup ecosystem and benefits from strong technology, healthcare, and life sciences clusters. Private equity activity focuses on venture capital investments, technology-enabled businesses, and healthcare consolidation opportunities. Barcelona's status as a global innovation center attracts both domestic and international fund managers seeking exposure to high-growth companies.

Southern Spain includes Andalusia, Murcia, and the Extremadura regions. The area draws private equity investment primarily in tourism-related assets, renewable energy projects, and agribusiness operations. Spain's abundant solar resources and favorable climate conditions make Southern Spain particularly attractive for infrastructure funds targeting clean energy investments. The hospitality and leisure sectors also present consolidation opportunities for funds focused on consumer-facing businesses.

Central Spain is dominated by Madrid, the country's financial capital and headquarters for major domestic and international private equity firms. The region benefits from concentration of corporate headquarters, professional services infrastructure, legal and financial advisory networks, and access to deal flow across diverse sectors. Central Spain leads market activity due to its role as the primary hub for large-cap transactions, fund formation activities, and cross-border investment coordination.

Market Dynamics:

Growth Drivers:

Why is the Spain Private Equity Market Growing?

Strong Economic Recovery and Supportive Policy Environment

Spain's economic fundamentals provide a solid foundation for private equity activity as GDP growth continues to outpace broader European averages. The European Central Bank's monetary easing cycle has improved financing conditions, encouraging leveraged transactions and reducing borrowing costs for acquisitions. Government programs through the Official Credit Institute and public vehicles such as Fond-ICO Global, Fond-ICO Next Tech, and Fond-ICO Pyme provide substantial support for digitalization, sustainability, and business innovation. Domestic PE fundraising has reached record levels in recent years, evidencing local institutional and private investors' ongoing confidence in the market's long-term potential.

Digital Transformation Driving Technology Investments

The information technology sector continues leading private equity investments as digital transformation reshapes business operations across industries. PE funds recognize the long-term growth potential of technology-driven business models enabling efficiency gains and new revenue streams. The IT sector captures the largest share of total PE investment volume, with numerous transactions targeting software, fintech, and e-commerce platforms annually. Healthcare technology and digital health solutions have emerged as particularly attractive subsectors, with PE firms playing key roles in consolidating clinics, laboratories, and specialized care providers while supporting innovation in medical technology and pharmaceuticals.

Robust International Investor Interest

International private equity funds maintain strong appetite for Spanish assets, recognizing attractive valuations and growth potential relative to other European markets. Spain's strategic location facilitates access to both European and Latin American markets, enhancing cross-border investment opportunities. Foreign capital contributes the majority of investment volume in Spanish companies annually, demonstrating sustained confidence from global investors. This continued international interest, combined with abundant liquidity held by global fund managers, positions the market for continued growth as macroeconomic conditions improve and geopolitical uncertainties potentially stabilize.

Market Restraints:

What Challenges is the Spain Private Equity Market Facing?

Extended Holding Periods and Limited Exit Opportunities

Private equity funds face challenges in realizing investments as exit channels remain constrained. IPO markets exhibit volatility while strategic buyer appetite fluctuates with economic conditions. Holding periods have increased as funds await favorable conditions for divestments, straining fund performance metrics and limiting capital recycling for new investments.

Valuation Gaps Between Buyers and Sellers

Sellers' price expectations, often anchored in the valuations achieved during previous market peaks, have not always aligned with buyers' more conservative outlooks. This mismatch has resulted in protracted negotiations, increased deal renegotiations, and in some cases, failed processes, contributing to overall market slowdown.

Regulatory Complexity and Geopolitical Uncertainty

Heightened regulatory oversight, particularly regarding foreign direct investment in sectors such as technology, healthcare, and infrastructure, adds complexity to transaction timelines. Geopolitical tensions and potential trade policy changes create uncertainty that encourages investors to adopt cautious approaches when evaluating new opportunities.

Competitive Landscape:

The Spain private equity market features a diverse competitive environment comprising established domestic fund managers, international PE firms with local presence, and specialized sector-focused investors. Domestic firms have demonstrated strong fundraising capabilities while international funds maintain significant market share through large-cap transactions. Competition centers on deal sourcing capabilities, sector expertise, and operational value creation skills. The market exhibits increasing specialization as firms develop deep expertise in attractive sectors including technology, healthcare, renewable energy, and infrastructure. Buy-and-build strategies remain prevalent as funds seek to create value through platform acquisitions and strategic add-ons.

Spain Private Equity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain private equity market size was valued at USD 13,774.74 Million in 2025.

The Spain private equity market is expected to grow at a compound annual growth rate of 8.42% from 2026-2034 to reach USD 28,512.76 Million by 2034.

Buyout held the largest market share at 38% in 2025, driven by middle-market transactions targeting established businesses requiring operational improvements and international expansion through buy-and-build strategies.

Key factors driving the Spain private equity market include strong economic recovery and supportive government programs, digital transformation driving technology investments, robust international investor interest with abundant liquidity, and increasing focus on sustainable and impact investments.

Major challenges include extended holding periods due to limited exit opportunities, valuation gaps between buyer and seller expectations, regulatory complexity regarding foreign direct investment, geopolitical uncertainty affecting investor confidence, and tight financing conditions in certain market segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)