Spain Pro AV Market Size, Share, Trends and Forecast by Solution, Distribution Channel, Application, and Region, 2026-2034

Spain Pro AV Market Overview:

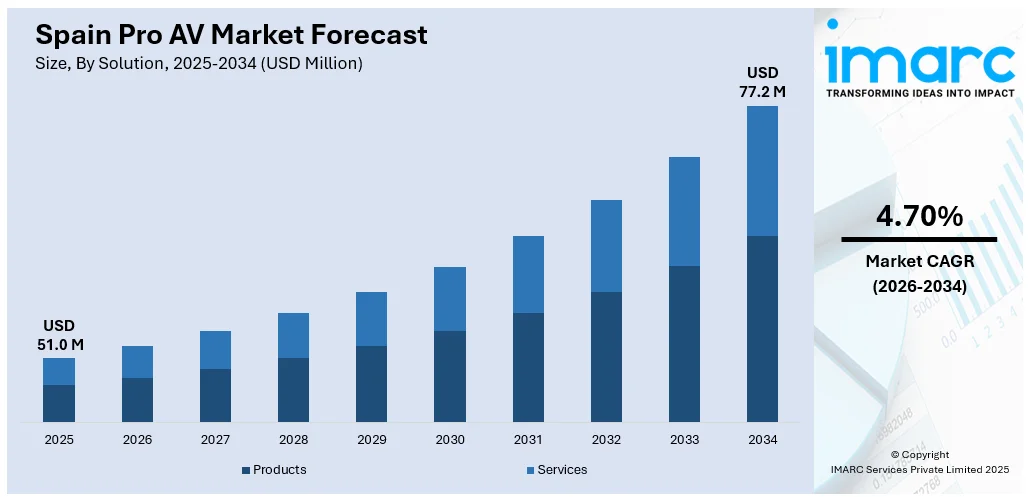

The Spain Pro AV market size reached USD 51.0 Million in 2025. The market is projected to reach USD 77.2 Million by 2034, exhibiting a growth rate (CAGR) of 4.70% during 2026-2034. The market is expanding as businesses increasingly invest in advanced display systems, video conferencing, and AV-over-IP technologies. Growing integration in retail, education, and corporate sectors continues to support Spain Pro AV market share across fixed installations and live event applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 51.0 Million |

| Market Forecast in 2034 | USD 77.2 Million |

| Market Growth Rate 2026-2034 | 4.70% |

Spain Pro AV Market Trends:

Rising Integration Across Industries

The Spain Pro AV market growth is being pushed by broader adoption across commercial sectors. Retail, hospitality, healthcare, and education industries are adopting professional audiovisual solutions to enrich the experience of users and communication. Digital signage, interactive kiosks, and audio systems are becoming ubiquitous in public and semi-public areas. Large display screens, centralized AV management systems, and smart conferencing devices are now de rigueur in contemporary office environments and hotels as well. Demand for immersive spaces is also on the rise in museums, theme parks, and corporate experience centers. It is not only expanding product penetration but also driving upgrades to newer, networked AV systems. At the middle and lower end of the market, smaller companies are also embracing simpler Pro AV installations because of better affordability and plug-and-play architecture. Current innovations indicate mid-sized companies leveraging IP-based distribution platforms to handle content across LANs, simplifying wiring and increasing flexibility. The transformations are underpinning demand for scalable and simple-to-integrate solutions catering to varied business sizes and industry segments.

To get more information on this market Request Sample

Demand Shift Toward AV-over-IP

Spain’s Pro AV landscape is moving steadily toward AV-over-IP solutions, shifting away from traditional matrix switchers and legacy cabling. This transition is driven by the need for flexible, scalable, and cost-effective deployment, particularly in multi-site and large venue projects. Universities, corporate campuses, and government facilities are turning to network-based AV distribution to simplify installations and allow centralized control. This shift is also enabling remote diagnostics and firmware updates, reducing downtime and maintenance costs. Higher bandwidth availability and improved network infrastructure are supporting more stable and higher-quality AV transmission over IP. Installers are increasingly recommending AV-over-IP to clients due to its compatibility with existing IT networks and long-term cost benefits. Developments over the past year highlight this shift, with a noticeable rise in deployment of 10GbE backbone networks and IP-based video walls in both public and private sector projects. AV solution providers in Spain are responding by expanding product lines that are IP-compatible and supporting open standards for broader interoperability.

Spain Pro AV Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on solution, distribution channel, and application.

Solution Insights:

- Products

- Display

- AV Acquisition and Delivery Products

- Projectors

- Sound Reinforcement Products

- Conferencing Products

- Others

- Services

- Installation Services

- Maintenance Services

- IT Networking Services

- System Designing Services

- Others

The report has provided a detailed breakup and analysis of the market based on the solution. This includes products (display, AV acquisition and delivery products, projectors, sound reinforcement products, conferencing products, and others) and services (installation services, maintenance services, IT networking services, system designing services, and others).

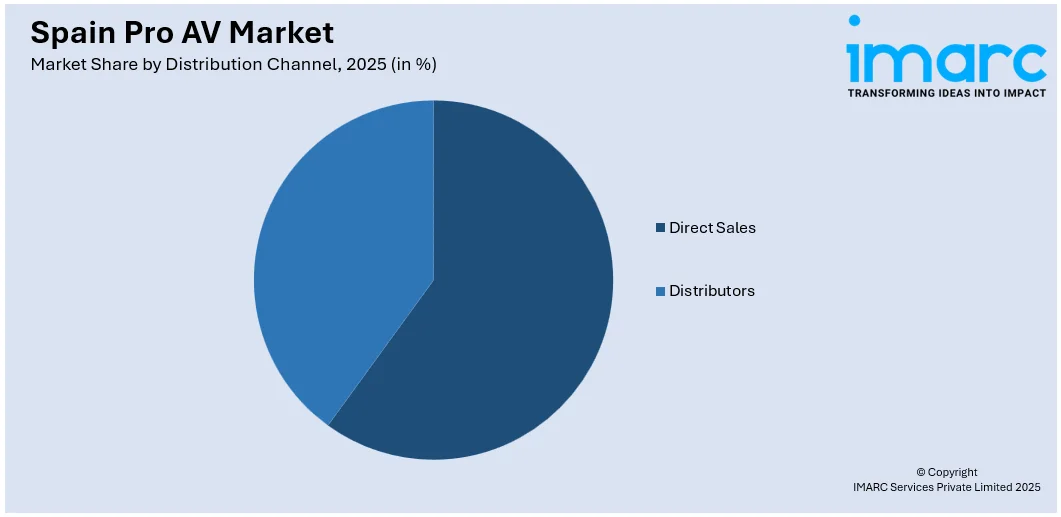

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct Sales

- Distributors

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales and distributors.

Application Insights:

- Home Use

- Commercial

- Education

- Government

- Hospitality

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes home use, commercial, education, government, hospitality, and others.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Pro AV Market News:

- July 2025: PlexusAV partnered with AVIT Vision to distribute its AV-over-IP solutions in Spain and Portugal. This deal introduced IPMX-based technologies to the region, boosting Pro AV interoperability and expanding access to advanced AV tools, strengthening market presence and regional product availability.

Spain Pro AV Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Distribution Channels Covered | Direct Sales, Distributors |

| Applications Covered | Home Use, Commercial, Education, Government, Hospitality, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain pro AV market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain Pro AV market on the basis of solution?

- What is the breakup of the Spain Pro AV market on the basis of distribution channel?

- What is the breakup of the Spain Pro AV market on the basis of application?

- What is the breakup of the Spain Pro AV market on the basis of region?

- What are the various stages in the value chain of the Spain Pro AV market?

- What are the key driving factors and challenges in the Spain Pro AV market?

- What is the structure of the Spain Pro AV market and who are the key players?

- What is the degree of competition in the Spain Pro AV market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain Pro AV market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain Pro AV market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain Pro AV industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)