Spain Rooftop Solar Market Size, Share, Trends and Forecast by Grid Type, End User, and Region, 2026-2034

Spain Rooftop Solar Market Summary:

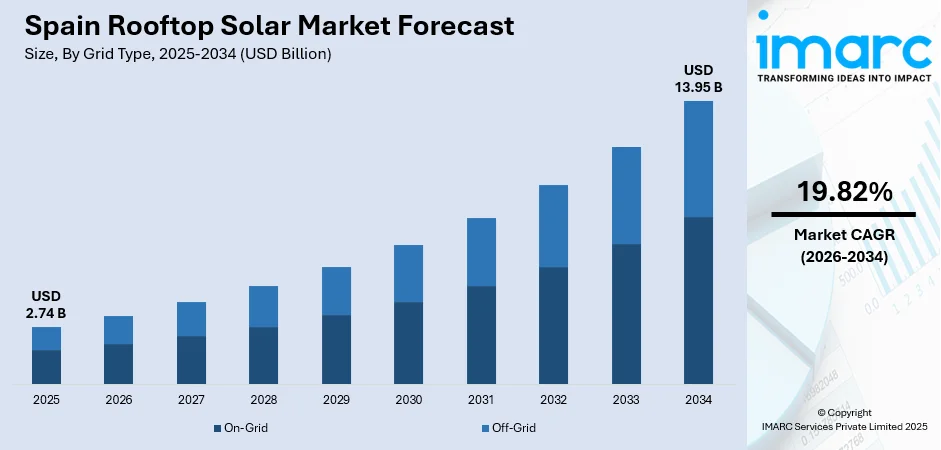

The Spain rooftop solar market was valued at USD 2.74 Billion in 2025 and is projected to reach USD 13.95 Billion by 2034, expanding at a compound annual growth rate of 19.82% from 2026-2034.

In Spain, the market continues to benefit from the country's exceptional solar irradiance, making rooftop installations highly efficient for energy generation. Government elimination of the controversial ‘sun tax’ combined with ambitious National Energy and Climate Plan targets for self-consumption capacity has created favorable investment conditions. The integration of smart monitoring technologies and battery storage systems enhances energy independence for residential and commercial consumers, while streamlined regulatory frameworks encourage broader adoption across urban and rural areas, contributing to Spain rooftop solar market share.

Key Takeaways and Insights:

- By Grid Type: On-grid dominates the market with a share of 92% in 2025, driven by favorable net metering policies allowing surplus energy compensation, established grid infrastructure across urban centers, and reduced installation complexity compared to hybrid systems requiring battery storage.

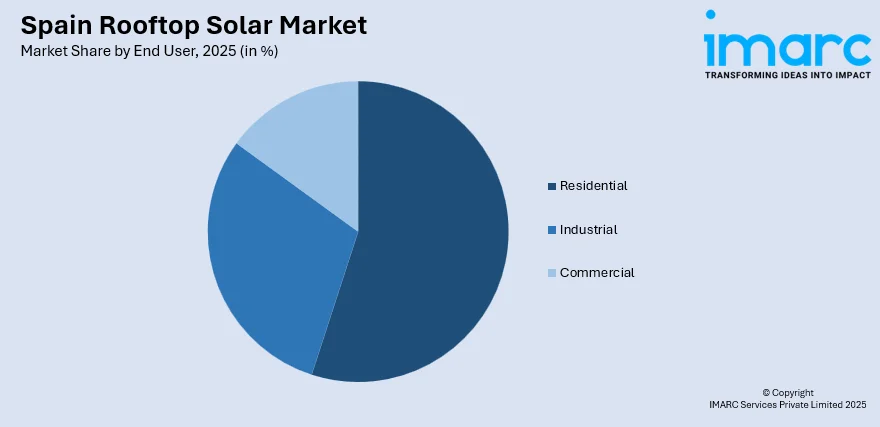

- By End User: Residential leads the market with a share of 55% in 2025, owing to increasing household adoption rates for energy cost reduction, government tax incentives across autonomous communities, and growing consumer awareness about energy independence benefits during periods of electricity price volatility.

- Key Players: The Spain rooftop solar market exhibits moderate competitive intensity, with established energy utilities competing alongside specialized installers and emerging subscription-based service providers across residential and commercial segments.

To get more information on this market Request Sample

In Spain, the rooftop solar market expansion reflects the country's commitment to achieving ambitious renewable energy targets under the updated National Energy and Climate Plan. In May 2025, TotalEnergies opened its biggest cluster of solar power plants in Europe, located close to Sevilla in Spain. It included five solar initiatives with an overall installed capacity of 263 MW. This solar farm would generate 515 GWh annually of renewable energy, which was comparable to the energy use of more than 150,000 homes in Spain, and would prevent 245,000 Tons of CO2 emissions each year. The market benefits from declining panel costs, improved photovoltaic (PV) efficiency, and the growing integration with building automation systems that optimize consumption patterns and maximize savings for both households and businesses.

Spain Rooftop Solar Market Trends:

Rising Integration of Battery Energy Storage Systems

Battery storage adoption has become increasingly prominent within Spain's rooftop solar landscape, fundamentally changing how households and businesses approach energy independence. Homeowners combine solar installations with storage solutions to maximize self-consumption and reduce grid reliance during peak pricing hours. In 2024, over 60% of installations in Spain featured solar battery systems, indicating significant consumer demand for energy autonomy and protection against electricity price fluctuations.

Emergence of Subscription-Based Solar Installation Models

Innovative financing mechanisms are transforming market accessibility by eliminating upfront investment barriers that previously hindered adoption among cost-conscious consumers. Subscription services enable households and businesses to install rooftop solar systems with zero initial capital expenditure, paying monthly fees while benefiting from generated electricity savings. These models have attracted significant venture capital investment, with Spanish solar subscription companies expanding their service networks to cover all regions including island territories.

Proliferation of Building-Integrated PVs

Architectural integration of solar technology represents an emerging trend as building owners seek aesthetically seamless renewable energy solutions for rooftops, facades, and building envelopes. Building-integrated PVs allow solar panels to function as construction materials while generating clean electricity, appealing particularly to commercial property developers and historic building renovations. Around one-quarter of all new rooftop PV installations in Spain in 2024 featured battery storage, highlighting ongoing expansion in distributed energy. This approach addresses space constraints in densely populated urban areas where traditional rooftop panel configurations may face limitations.

Market Outlook 2026-2034:

Government initiatives supporting energy storage integration, simplified permitting procedures, and regional tax incentive programs will sustain market momentum. The market generated a revenue of USD 2.74 Billion in 2025 and is projected to reach a revenue of USD 13.95 Billion by 2034, growing at a compound annual growth rate of 19.82% from 2026-2034. Continued electricity price awareness among consumers and commercial entities, combined with technological improvements in panel efficiency and smart grid connectivity, positions the market for sustained long-term growth.

Spain Rooftop Solar Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Grid Type | On-Grid | 92% |

| End User | Residential | 55% |

Grid Type Insights:

- On-Grid

- Off-Grid

On-grid dominate with a market share of 92% of the total Spain rooftop solar market in 2025.

On-grid systems lead Spain’s rooftop solar market because they allow users to remain connected to the main electricity network while generating their own power. This dual access ensures reliable supply during low sunlight periods and reduces the need for expensive battery storage, making installation more affordable and practical for households and businesses.

Additionally, on-grid users can export excess electricity back to the grid, improving overall cost savings. Grid connectivity supports stable performance and easier system maintenance. Commercial users prefer on-grid systems as they handle higher loads efficiently. The simple technical structure shortens installation time and lowers operational risks. Financial predictability and scalability also make these systems suitable for large rooftops and multi-unit residential buildings.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Industrial

- Commercial

- Residential

Residential leads with a share of 55% of the total Spain rooftop solar market in 2025.

Spanish households increasingly embrace rooftop solar installations as electricity prices and environmental awareness drive adoption across urban and rural communities. The residential sector benefits from diverse government incentives, including regional income tax credits, property tax reductions, and construction tax exemptions that significantly improve installation payback periods for homeowners. According to the 2024 Annual Report on Photovoltaic Self-Consumption, more than 483,000 homes and over 75,000 businesses in Spain were utilizing self-consumption systems, demonstrating widespread market penetration across different consumer segments.

Residential rooftop solar technology has achieved substantial efficiency improvements, with modern panels delivering higher output compared to systems available a decade ago. Homeowners in single-family dwellings can achieve self-sufficiency potential exceeding seventy percent based on research analyzing photovoltaic generation against typical household consumption patterns. Smart monitoring applications enable residents to track energy production, consumption, and grid export data in real-time, optimizing usage patterns and automating appliance scheduling to maximize solar utilization during peak generation hours.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Northern Spain demonstrates growing rooftop solar adoption despite relatively lower solar irradiance compared to southern regions. Industrial facilities in Basque Country and Cantabria increasingly install self-consumption systems to reduce operational energy costs. The region benefits from established manufacturing infrastructure and corporate sustainability commitments driving commercial installations.

Eastern Spain represents a leading market for rooftop solar installations, with the Valencian Community and Catalonia accounting for significant cumulative self-consumption capacity. Streamlined permitting processes and widespread installer networks facilitate rapid deployment across urban and coastal areas.

Southern Spain dominates the rooftop solar market owing to exceptional solar irradiance conditions across Andalusia and favorable regional grant programs. The region experiences the highest solar radiation levels nationally, optimizing energy generation from rooftop installations. Andalusia alone accounts for major portion of cumulative self-consumption capacity, positioning it among national leaders.

Central Spain benefits from strong rooftop solar growth driven by Madrid's substantial consumption base and favorable urban rooftop availability. The Community of Madrid represents one of the largest potential for solar photovoltaic self-consumption. Commercial and industrial installations support regional decarbonization objectives.

Market Dynamics:

Growth Drivers:

Why is the Spain Rooftop Solar Market Growing?

Supportive Government Policies and Regulatory Framework Evolution

Spain's comprehensive policy framework creates favorable conditions for rooftop solar market expansion through multiple regulatory mechanisms designed to encourage self-consumption adoption. In February 2024, the Spanish government initiated a significant incentive program with a budget of USD 1.24 Billion from the Recovery, Transformation, and Resilience Plan aimed at promoting clean energy technology supply chain advancement. Regional autonomous communities maintain additional tax credit programs, with notable schemes in Murcia, Valencia, and Navarra incentivizing residential installations through income tax deductions. Regulatory stability also increases investor confidence, motivating developers and energy companies to expand small-scale solar projects. Clear grid connection rules and standardized installation practices reduce technical complexity for users. In addition, public awareness campaigns and official sustainability commitments influence positive consumer attitudes toward solar energy.

Innovations in Technology

Technological innovations are significantly boosting the market by making systems more efficient, affordable, and user-friendly. In December 2025, Spain's Institute for Energy Diversification and Saving granted close to 10 gigawatt-hours of energy storage capacity through the FEDER funding initiative, distributing over €827 Million to 133 projects that integrated battery, pumped hydro, and thermal storage technologies in the regions of Andalusia, Galicia, and Castilla-La Mancha. Advancements in solar panel efficiency allow more energy generation from limited roof space, making installations attractive for apartments and small buildings. Improvements in inverter technology enhance power output accuracy and system reliability. Smart monitoring solutions enable users to track energy production and consumption in real time, increasing awareness and system optimization. Energy storage innovations also allow households to use solar power during non-sunlight hours, improving self-consumption. Additionally, lightweight and flexible panel designs simplify installation on different roof types. Integration with smart home systems provides greater control over energy use. As technology becomes more reliable and accessible, consumer trust grows, installation costs drop, and rooftop solar continues to expand as a preferred clean energy solution in Spain.

Rising Electricity Prices and Consumer Energy Independence Prioritization

Rising electricity costs are strongly motivating households and businesses in Spain to adopt rooftop solar systems to reduce long-term energy expenses. As conventional power prices increase, solar energy offers a cost-stable and predictable alternative. Consumers view rooftop solar as an investment rather than an expense, as system payback periods shorten with higher power tariffs. Energy independence is also becoming a priority, with users seeking protection from grid instability and future price fluctuations. Producing their own electricity gives consumers greater control over energy usage and budgeting. Businesses benefit from lower operating costs and improved sustainability branding. In addition, solar-equipped homes gain higher property value, making installations financially attractive. This growing focus on cost savings and self-reliance is accelerating rooftop solar adoption and transforming consumer attitudes toward renewable power solutions across Spain.

Market Restraints:

What Challenges is the Spain Rooftop Solar Market Facing?

Grid Infrastructure Limitations and Connection Delays

Spain's electrical distribution network faces capacity constraints limiting efficient integration of expanding rooftop solar installations. Many residents report delays in grid connection approvals, often waiting weeks or months after panel installation before receiving authorization to operate. Medium-voltage grids across multiple regions experience congestion, with similar challenges anticipated for high and ultra-high-voltage networks as installation volumes increase.

Shortage of Skilled Installers and Supply Constraints

Rapid growth in demand has created pressure on the availability of trained technicians and certified installers. Skill shortages lead to higher labor costs and project delays. In some cases, lower-quality installations occur due to inexperienced workers, affecting system performance. Supply chain constraints for inverters, batteries, and panels can also cause delays and price fluctuations. A lack of standardized training programs further limits workforce readiness across Spain’s expanding solar industry.

Administrative Complexity and Regional Permitting Inconsistencies

Bureaucratic obstacles continue to impact rooftop solar deployment timelines despite regulatory simplification efforts undertaken by authorities. Permitting processes vary substantially between autonomous communities and municipalities, creating unpredictable project development timelines for installers and consumers. Administrative digitalization remains incomplete across many regions, requiring extensive paperwork and multiple agency interactions for installation approval.

Competitive Landscape:

The Spain rooftop solar market features diverse participant categories, including multinational energy corporations, domestic utilities, specialized installation companies, and innovative subscription service providers, competing across different customer segments and geographic territories. Established energy utilities leverage existing customer relationships and financial resources to expand rooftop solar service offerings, while specialized installers focus on technical expertise and regional market knowledge. New entrants employing subscription and leasing models have disrupted traditional purchasing dynamics by eliminating upfront investment requirements. Competition intensifies as market participants expand service portfolios to include battery storage integration, maintenance contracts, and smart energy management solutions.

Recent Developments:

- In March 2025, the Vigo plant of the Stellantis Group, in partnership with Prosolia Energy, opened Spain's largest rooftop solar facility for self-utilization, establishing a solar framework that raised the bar for the nation's industrial sector. This facility featured 33,000 solar panels covering an area of 170,000 square meters, boasting an installed capacity of 18.3 megawatts peak (MWp) and producing 22.7 gigawatt hours (GWh) each year.

Spain Rooftop Solar Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grid Types Covered | On-Grid, Off-Grid |

| End Users Covered | Industrial, Commercial, Residential |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain rooftop solar market size was valued at USD 2.74 Billion in 2025.

The Spain rooftop market is expected to grow at a compound annual growth rate of 19.82% from 2026-2034 to reach USD 13.95 Billion by 2034.

On-grid dominates the market with a 92% share, benefiting from established distribution infrastructure, net metering compensation schemes, and lower installation costs compared to off-grid configurations requiring battery storage.

Key factors driving the Spain rooftop solar market include supportive government regulatory frameworks, electricity price volatility motivating energy independence, declining installation costs, and improved panel efficiency enabling higher generation yields.

Major challenges include grid infrastructure limitations causing connection delays, subsidy phase-outs reducing financial incentives, administrative complexity varying between autonomous communities, financing accessibility gaps for multi-family buildings and rental properties, and regional permitting inconsistencies extending project development timelines.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)