Spain Shoes Market Size, Share, Trends and Forecast by Product Type, Material, Distribution Channel, End User, and Region, 2026-2034

Spain Shoes Market Summary:

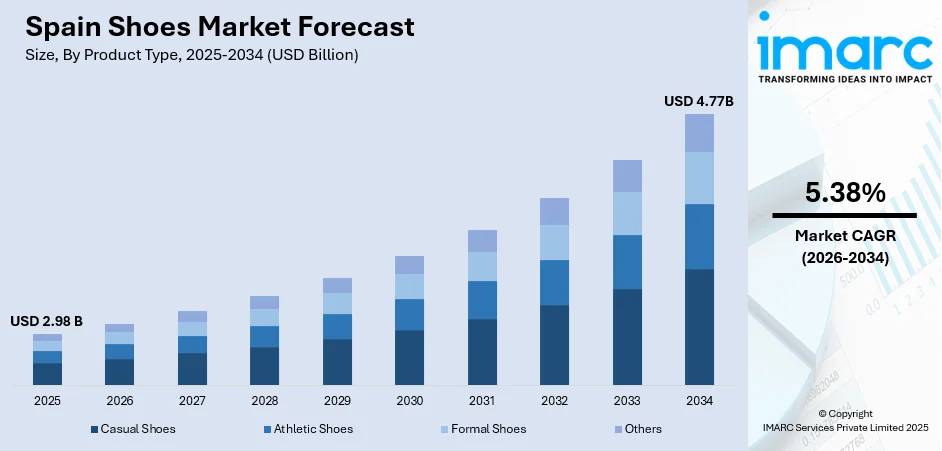

The Spain shoes market size was valued at USD 2.98 Billion in 2025 and is projected to reach USD 4.77 Billion by 2034, growing at a compound annual growth rate of 5.38% from 2026-2034.

The market is driven by evolving consumer preferences toward sustainable and locally crafted footwear, alongside increasing adoption of digital retail platforms and direct-to-consumer business models. Growing emphasis on eco-friendly materials and ethical manufacturing practices continues to shape purchasing decisions. The prominence of traditional Spanish shoemaking regions further strengthens domestic production capabilities. Enhanced omnichannel retail strategies and technological integration in shopping experiences are accelerating market expansion, contributing to the Spain shoes market share.

Key Takeaways and Insights:

- By Product Type: Casual shoes dominate the market with a share of 42% in 2025, driven by rising preference for comfortable everyday footwear, lifestyle changes favoring relaxed dress codes, and growing demand for versatile designs suitable for multiple occasions.

- By Material: Leather leads the market with a share of 45% in 2025, owing to its durability, premium aesthetic appeal, traditional Spanish craftsmanship heritage, and increasing consumer preference for natural materials over synthetic alternatives.

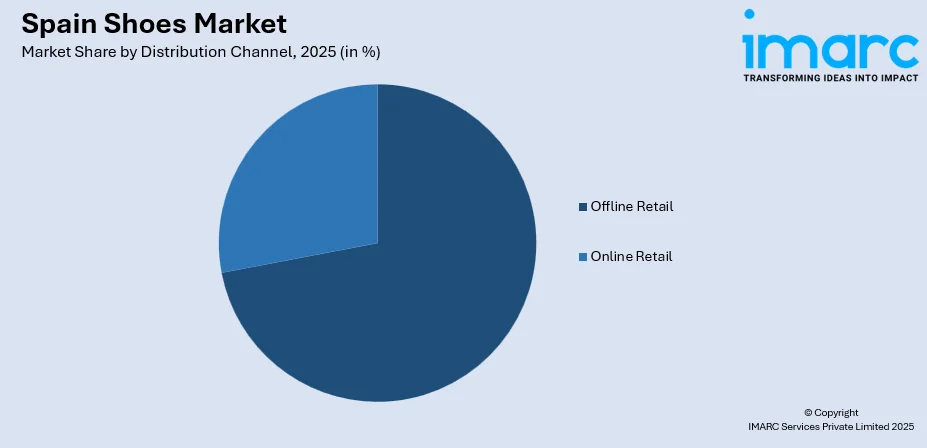

- By Distribution Channel: Offline retail represents the largest segment with a market share of 72% in 2025, driven by consumers' preference for physical trial experiences, personalized customer service, and the established network of specialty footwear stores across Spanish cities.

- By End User: Women command the market with a share of 40% in 2025, attributed to higher purchase frequency, diverse style requirements across occasions, and expanding product variety catering specifically to female consumer preferences.

- Key Players: The market compete through design innovation, brand differentiation, and strong regional distribution networks. Companies emphasize craftsmanship, sustainability, and diversified product portfolios while expanding omnichannel strategies to strengthen consumer engagement and maintain competitive advantage across distinct climatic and lifestyle-driven regional markets.

To get more information on this market Request Sample

The Spain shoes market continues to expand as consumer preferences evolve toward quality-focused and ethically produced footwear. Spanish consumers increasingly prioritize comfort, durability, and style versatility when making purchasing decisions, driving manufacturers to innovate across product categories. The country's rich heritage in artisanal shoemaking, particularly concentrated in regions like Alicante and Elche, provides a strong foundation for domestic production excellence. In October 2025, Elche celebrated 150 years of footwear excellence, marking a historic milestone in the city’s industry and highlighting its global leadership in design, innovation, and sustainable production. Moreover, the rising disposable incomes among urban populations enable greater spending on premium footwear offerings. Additionally, the integration of digital technologies within retail operations enhances customer engagement and brand accessibility. Fashion consciousness among younger demographics and growing awareness about sustainable consumption practices further stimulate demand, positioning the Spanish footwear sector for sustained momentum.

Spain Shoes Market Trends:

Growing Preference for Sustainable and Eco-Friendly Footwear

Environmental consciousness is reshaping consumer behavior within the Spanish footwear sector. Shoppers increasingly seek products manufactured using organic, recycled, or biodegradable materials that minimize ecological impact. This shift encourages manufacturers to adopt sustainable production methods, including reduced water consumption, renewable energy utilization, and waste minimization throughout supply chains. In March 2025, Futurmoda 2025 in Elche showcased over 20 companies presenting eco‑friendly footwear production technologies, including machinery for recycled and biodegradable materials and 3D printing solutions. Additionally, transparency in sourcing practices and ethical labor conditions has become essential for brand credibility. Spanish shoemakers are responding by highlighting their commitment to environmental stewardship through product labeling and marketing communications, creating competitive advantages in an increasingly eco-aware marketplace.

Digital Transformation and Omnichannel Retail Expansion

The Spanish footwear industry is experiencing significant digital evolution as brands embrace technology-driven retail strategies. Enhanced e-commerce platforms featuring virtual try-on capabilities, personalized recommendations, and seamless checkout processes are attracting digitally native consumers. In March 2025, Spain’s online footwear and leather goods sales reached €191.6 million, marking a 14.2 % year‑on‑year increase, highlighting the growing adoption of digital retail channels. Simultaneously, physical stores are integrating digital touchpoints to create cohesive shopping journeys. Click-and-collect services, mobile applications, and social commerce initiatives enable brands to engage customers across multiple channels effectively. This omnichannel approach strengthens customer relationships while expanding market reach beyond traditional geographic limitations, particularly benefiting smaller artisanal producers seeking broader audience access.

Revival of Artisanal Craftsmanship and Heritage Branding

Traditional Spanish shoemaking craftsmanship is experiencing renewed appreciation among consumers seeking authentic, high-quality products. Heritage manufacturing techniques, passed through generations in established footwear-producing regions, differentiate Spanish products in competitive global markets. Consumers increasingly value the story behind products, including artisan expertise, regional production origins, and time-honored construction methods. In March 2025, Spanish luxury shoemaker Pedro García celebrated its 100‑year heritage with a global launch of a commemorative collection, highlighting handcrafted sandals and Swarovski embellishments, reflecting strong consumer interest in artisanal craftsmanship. This trend supports premium positioning strategies while preserving cultural manufacturing traditions. Younger consumers particularly appreciate brands that balance contemporary design aesthetics with traditional craftsmanship values, driving demand for footwear that combines modern style with artisanal authenticity.

Market Outlook 2026-2034:

The Spain shoes market is anticipated to demonstrate robust revenue growth throughout the forecast period, supported by sustained consumer demand across diverse product categories and distribution channels. Continued emphasis on sustainable manufacturing practices, digital retail innovation, and premiumization strategies will drive market expansion. The strengthening of domestic production capabilities, combined with growing export opportunities within European markets, positions Spanish footwear manufacturers favorably. Evolving consumer preferences toward comfort-oriented designs and versatile styling options will generate consistent revenue streams, ensuring positive market trajectory through the decade. The market generated a revenue of USD 2.98 Billion in 2025 and is projected to reach a revenue of USD 4.77 Billion by 2034, growing at a compound annual growth rate of 5.38% from 2026-2034.

Spain Shoes Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Casual Shoes | 42% |

| Material | Leather | 45% |

| Distribution Channel | Offline Retail | 72% |

| End User | Women | 40% |

Product Type Insights:

- Casual Shoes

- Athletic Shoes

- Formal Shoes

- Others

The casual shoes dominate with a market share of 42% of the total Spain shoes market in 2025.

Casual shoes maintain their dominant position within the Spanish footwear market, reflecting fundamental shifts in lifestyle preferences and workplace dress codes across the country. The modern Spanish consumer increasingly prioritizes comfort and versatility, seeking footwear suitable for multiple daily activities without compromising style. In August 2024, Hispanitas launched its Autumn/Winter 2024-2025 “City Lights” collection, featuring loafers, sneakers, ballet flats, and flat shoes that combine craftsmanship, contemporary elegance, and versatility. Moreover, this segment benefits from broad demographic appeal, attracting consumers across age groups who value practical yet fashionable options for everyday wear.

The casual footwear category continues expanding as fashion trends favor relaxed aesthetics and athleisure influences permeate mainstream style choices. Spanish manufacturers respond by developing innovative designs that combine comfort technologies with contemporary visual appeal. The segment's accessibility across price points ensures strong market penetration, from affordable everyday options to premium designer offerings that cater to discerning consumers seeking elevated casual styles.

Material Insights:

- Leather

- Synthetic

- Textile

- Others

The leather leads with a share of 45% of the total Spain shoes market in 2025.

Leather maintains its preeminent position within Spain's footwear material landscape, supported by the country's renowned expertise in leather craftsmanship and processing. Spanish consumers demonstrate strong preference for natural materials that offer superior durability, breathability, and aesthetic refinement compared to synthetic alternatives. The material's association with quality and luxury reinforces its dominance across both premium and mid-market segments.

Traditional leather processing centers throughout Spain continue producing high-quality materials that supply domestic and international manufacturers. Consumer appreciation for genuine leather extends beyond functional benefits to encompass cultural values surrounding craftsmanship and authenticity. Sustainable leather production practices, including vegetable tanning methods and responsible sourcing initiatives, address environmental concerns while preserving the material's market leadership position among quality-conscious Spanish consumers. In February 2025, SGS renewed its membership as a Contributing Partner of the Sustainable Leather Foundation, supporting initiatives for ethical, transparent, and environmentally responsible leather manufacturing.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Retail

- Offline Retail

The offline retail exhibits a clear dominance with a 72% share of the total Spain shoes market in 2025.

Offline retail establishments maintain overwhelming dominance within Spain's footwear distribution landscape, reflecting deeply embedded consumer preferences for tangible shopping experiences. In 2024, shoe store sales in Spain grew by 2.9%, reaching €4.925 Billion, with specialized retailers generating €2.56 Billion, reflecting continued consumer preference for offline shopping. Further, Spanish shoppers value the ability to physically examine products, assess fit and comfort, and receive personalized service from knowledgeable staff. Department stores, specialty footwear retailers, and brand boutiques provide comprehensive product assortments that satisfy diverse consumer requirements.

These channels benefit from strategic locations in high-traffic commercial areas, shopping centers, and traditional city-center shopping districts. Retailers continuously enhance in-store experiences through improved visual merchandising, comfortable fitting areas, and integration of digital tools that complement physical shopping. The personal touch offered by trained sales associates, combined with immediate product availability, sustains consumer preference for brick-and-mortar shopping despite growing digital alternatives.

End User Insights:

- Men

- Women

- Children

The women dominate with a market share of 40% of the total Spain shoes market in 2025.

Female consumers represent the largest end-user segment within Spain's footwear market, driven by higher purchase frequency and diverse style requirements across personal and professional contexts. Spanish women demonstrate strong engagement with fashion trends, seeking varied footwear options ranging from everyday casual styles to occasion-specific formal designs. This segment benefits from extensive product variety specifically developed to address female consumer preferences.

Manufacturers and retailers prioritize female consumers through targeted marketing initiatives, expanded size ranges, and dedicated product lines addressing specific comfort and style requirements. The segment's strength reflects broader cultural emphasis on personal presentation and fashion consciousness among Spanish women. Seasonal fashion cycles and evolving style trends generate consistent replacement demand, while growing participation in athletic and outdoor activities expands category opportunities within this influential consumer segment.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Northern Spain represents an important footwear market shaped by cooler, wetter climate conditions that drive preference for durable, weather-resistant designs. The region’s strong industrial heritage and established commercial centers support well-developed retail networks. Consumers prioritize practicality while valuing quality craftsmanship, resulting in steady demand for both functional and contemporary styles across key urban areas.

Eastern Spain serves as a major market region, anchored by historic footwear manufacturing clusters in Alicante. Mediterranean coastal cities experience pronounced seasonal demand linked to tourism, while urban centers sustain diverse retail ecosystems. In March 2024, the Elche footwear sector became Spain’s first to implement a voluntary shoe‑recycling system, ahead of the 2025 legal deadline, demonstrating strong environmental commitment. Moreover, domestic consumers and international visitors consistently seek Spanish-made products, supporting strong sales across mid-range, comfort, and fashion-oriented footwear categories.

Southern Spain displays distinct market dynamics influenced by its warm climate, which encourages demand for lightweight, breathable footwear suitable for prolonged outdoor use. Tourism-heavy coastal regions generate substantial seasonal sales peaks, complemented by stable year-round demand in larger cities. Growing retail modernization and rising e-commerce adoption continue shaping purchasing behavior across varied consumer groups.

Central Spain, led by Madrid, stands out as a premier footwear market with high purchasing power and fashion-conscious consumers. As a national retail and lifestyle hub, the region supports strong demand for premium and trend-driven products. A wide mix of retail formats, from flagship stores to modern malls, caters to diverse metropolitan customer segments.

Market Dynamics:

Growth Drivers:

Why is the Spain Shoes Market Growing?

Increasing Consumer Preference for Premium and Quality Footwear

Spanish consumers are demonstrating heightened appreciation for premium footwear products that offer superior craftsmanship, durability, and design excellence. This preference shift reflects broader economic improvements and growing disposable incomes, particularly among urban populations who prioritize quality over quantity in purchasing decisions. Consumers increasingly view footwear as investment pieces rather than disposable commodities, willing to pay premium prices for products that deliver extended lifespan and superior comfort. This trend benefits established Spanish manufacturers renowned for quality production while encouraging emerging brands to emphasize craftsmanship credentials. In April 2025, Camper’s collections, designed in Mallorca, emphasize durable, repairable shoes blending traditional craftsmanship with contemporary style, sold across 350+ stores in 30 countries. Further, the premiumization movement extends across all product categories, from athletic footwear incorporating advanced performance technologies to formal shoes featuring traditional construction methods.

Expansion of E-Commerce and Digital Retail Infrastructure

Digital retail channels are experiencing accelerated development within Spain's footwear sector, creating new growth avenues for manufacturers and retailers alike. Improved logistics networks enable faster delivery times across the country, while secure payment systems build consumer confidence in online transactions. Spanish footwear brands are investing significantly in digital capabilities, developing sophisticated e-commerce platforms that replicate premium shopping experiences virtually. Social media integration enables direct consumer engagement and targeted marketing, particularly effective for reaching younger demographics. The direct-to-consumer model empowers brands to control their narrative, maintain pricing integrity, and gather valuable customer insights. Cross-border e-commerce capabilities additionally enable Spanish manufacturers to access international markets efficiently, expanding revenue opportunities beyond domestic boundaries. In August 2025, Valencia-based Zapato Feroz, founded in 2016, continues prioritizing children’s foot health and sustainability, achieving €11 million turnover in 2024, with 95% of sales in Spain online.

Strong Heritage of Spanish Footwear Manufacturing Excellence

Spain's established reputation as a center for quality footwear production provides fundamental support for continued market growth. Manufacturing clusters in Alicante, La Rioja, and other regions maintain deep expertise accumulated over generations of specialized production. This heritage creates competitive advantages through skilled workforce availability, established supplier networks, and recognized quality standards that command consumer respect domestically and internationally. In February 2025, La Rioja’s footwear industry exported over 50% of its production and received €800,000 in government support for innovation and design initiatives. Moreover, Spanish footwear carries positive brand associations related to craftsmanship, design sophistication, and material quality that support premium positioning strategies. Government initiatives supporting traditional industries, combined with industry associations promoting Spanish footwear excellence, reinforce these competitive strengths. The "Made in Spain" designation increasingly resonates with consumers seeking alternatives to mass-produced imports, driving preference toward domestically manufactured products.

Market Restraints:

What Challenges the Spain Shoes Market is Facing?

Intense Competition from Low-Cost International Imports

Spanish footwear manufacturers face significant competitive pressure from imported products originating from countries with lower production costs. These imports, often priced substantially below domestically produced alternatives, attract price-sensitive consumer segments and challenge market share retention. Spanish producers must continuously justify premium pricing through demonstrable quality advantages and brand differentiation. Retail channels face margin pressures when competing imported products occupy significant shelf space, potentially limiting distribution opportunities for domestic manufacturers seeking expanded market presence.

Fluctuating Raw Material Costs and Supply Chain Vulnerabilities

The footwear manufacturing sector experiences ongoing challenges related to raw material price volatility, particularly affecting leather, rubber, and textile inputs essential for production. Supply chain disruptions can create material shortages that impact production schedules and product availability. Spanish manufacturers dependent on imported components face additional exposure to currency fluctuations and international logistics complications. These uncertainties complicate pricing strategies and margin management, requiring manufacturers to develop flexible sourcing arrangements and inventory management approaches.

Changing Consumer Shopping Behaviors and Retail Channel Disruption

Traditional retail formats face adaptation challenges as consumer shopping behaviors continue evolving toward digital and hybrid models. Physical retail establishments must invest significantly in store modernization and experiential enhancements to maintain relevance. Some consumers demonstrate reduced store visit frequency, potentially limiting impulse purchase opportunities that traditionally supported footwear sales. Retailers navigating this transition require substantial capital investments while managing existing store network obligations, creating operational complexity during market transformation periods.

Competitive Landscape:

The Spain shoes market exhibits a dynamic competitive environment characterized by diverse participant categories operating across varied market segments and price points. Established domestic manufacturers leverage heritage credentials and quality reputations to maintain premium positioning, while international brands compete through extensive marketing investments and global design resources. The market structure encompasses large-scale producers with comprehensive product portfolios alongside specialized artisanal manufacturers focusing on niche segments and customization capabilities. Competition intensifies around product innovation, sustainable manufacturing credentials, and omnichannel retail effectiveness. Digital transformation is reshaping competitive dynamics, enabling smaller brands to access consumers directly while challenging traditional distribution arrangements. Market participants increasingly differentiate through sustainability commitments, supply chain transparency, and authentic brand storytelling that resonates with values-driven consumers.

Recent Developments:

- In May 2024, PUMA and Palomo Spain introduced a loafer-sneaker hybrid built on the PUMA Nitefox sole, fitted with a Frosted Ivory leather upper, tassels, and a metal buckle. The shoe taps into the rise of dress-inspired sneakers, arriving as the trend gains momentum across major footwear labels.

Spain Shoes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Casual Shoes, Athletic Shoes, Formal Shoes, Others |

| Materials Covered | Leather, Synthetic, Textile, Others |

| Distribution Channels Covered | Online Retail, Offline Retail |

| End Users Covered | Men, Women, Children |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain shoes market size was valued at USD 2.98 Billion in 2025.

The Spain shoes market is expected to grow at a compound annual growth rate of 5.38% from 2026-2034 to reach USD 4.77 Billion by 2034.

Casual shoes accounted for 42% share, supported by shifting lifestyle trends and increasing consumer preference for comfortable, versatile footwear suitable for daily use across work, leisure, and social settings, driving consistent demand and broader market adoption.

Key factors driving the Spain shoes market include increasing consumer preference for premium quality footwear, expansion of e-commerce and digital retail infrastructure, strong heritage of Spanish footwear manufacturing excellence, and growing demand for sustainable and eco-friendly products.

Major challenges include intense competition from low-cost international imports, fluctuating raw material costs, supply chain vulnerabilities, changing consumer shopping behaviors requiring retail adaptation, and the need for continuous investment in digital transformation and sustainability initiatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)