Spain Shrimp Market Size, Share, Trends and Forecast by Environment, Species, Shrimp Size, Distribution Channel, and Region, 2026-2034

Spain Shrimp Market Overview:

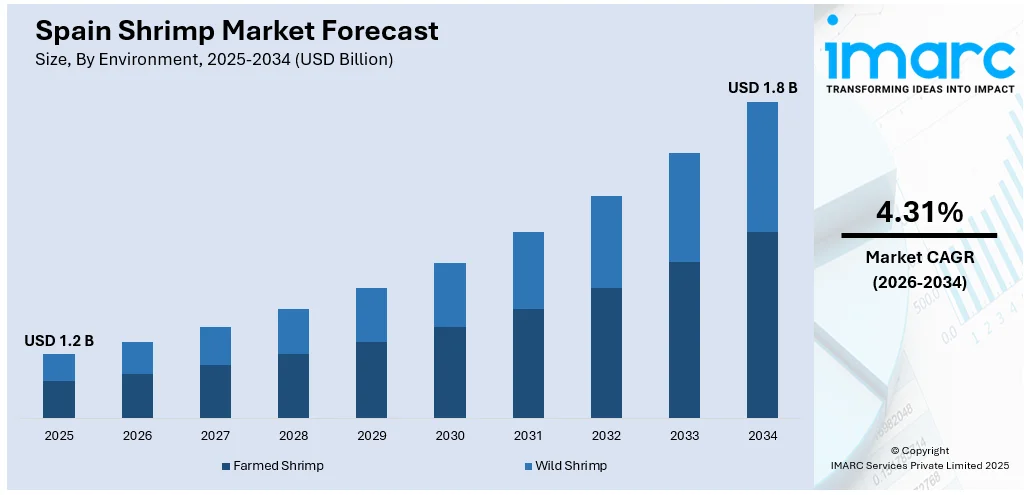

The Spain shrimp market size reached USD 1.2 Billion in 2025. The market is projected to reach USD 1.8 Billion by 2034, exhibiting a growth rate (CAGR) of 4.31% during 2026-2034. The market is expanding as higher household seafood consumption and better cold storage facilities drive supply. Continuous focus on sustainable aquaculture and steady imports further support Spain shrimp market share among local suppliers, restaurants, and growing retail distribution channels across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.2 Billion |

| Market Forecast in 2034 | USD 1.8 Billion |

| Market Growth Rate 2026-2034 | 4.31% |

Spain Shrimp Market Trends:

Aquaculture Expansion in Coastal Regions

Some fishing communities in Spain are gradually shifting toward shrimp farming as it offers better and more stable returns compared to traditional wild catches. This slow but steady move toward aquaculture is helping diversify income sources and strengthen the domestic supply. Farmers in coastal areas are now adopting improved pond management techniques that aim to increase yields while reducing harm to surrounding waterways. To support this shift, small producer groups are setting up cold storage units close to farms, reducing transport time and preserving product quality. Local authorities have begun offering limited financial assistance, helping farmers invest in updated equipment and meet the European Union’s standards for responsible and hygienic aquaculture practices. These efforts are contributing to a modest but meaningful rise in local shrimp production and are also increasing demand for Spain shrimp feed as farms expand operations and optimize feed-to-growth ratios.

To get more information on this market Request Sample

Focus on Sustainability and Certification to Meet Modern Standards

Brands operating in the Spain fish market are placing stronger emphasis on sustainability and traceability to respond to rising consumer concerns about environmental impact and food safety. Clean farming practices are being featured more prominently on packaging, with producers using certification labels to build trust and signal quality. These certifications help companies differentiate themselves in a market where buyers are increasingly selective about sourcing. Responsible farming is not just a domestic concern; exporters are aligning operations with European standards to gain easier access to foreign markets. Investments in new equipment and better on-site handling procedures reflect a broader push toward long-term environmental accountability and compliance with international trade regulations. Sustainability has become a necessary component of staying competitive, both at home and abroad.

Consumer Trends Driving Market Growth and Product Innovation

Spanish consumers are showing strong interest in convenient shrimp products that are easy to store, prepare, and cook. This has led to an increase in demand for ready-to-cook packs and seasoned frozen shrimp, especially among families and working individuals looking for quick meal solutions. Hotels and restaurants continue to feature shrimp dishes on their menus to attract both tourists and locals, prompting larger and more frequent orders from suppliers. Supermarkets and neighborhood stores are expanding their offerings of frozen shrimp in pre-packed formats to match the preferences of busy shoppers. At the distribution level, mid-tier suppliers are increasingly relying on online channels to reach small retail outlets and individual customers more efficiently. Exporters are also adapting to these trends by introducing value-added products like pre-cooked trays and shrimp snacks for the European market. Countries like France and Italy have shown growing interest in these convenient formats, reflecting similar shifts in the Spain prawn market, where ease of preparation and consistent quality have become key purchase drivers.

Spain Shrimp Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on environment, species, shrimp size, and distribution channel.

Environment Insights:

- Farmed Shrimp

- Wild Shrimp

The report has provided a detailed breakup and analysis of the market based on the environment. This includes farmed shrimp and wild shrimp.

Species Insights:

- Penaeus Vannamei

- Penaeus Monodon

- Macrobrachium Rosenbergii

- Others

The report has provided a detailed breakup and analysis of the market based on the species. This includes penaeus vannamei, penaeus monodon, macrobrachium rosenbergii, and others.

Shrimp Size Insights:

- <21

- 21-25

- 26-30

- 31-40

- 41-50

- 51-60

- 61-70

- >70

The report has provided a detailed breakup and analysis of the market based on the shrimp size. This includes <21, 21-25, 26-30, 31-40, 41-50, 51-60, 61-70, and >70.

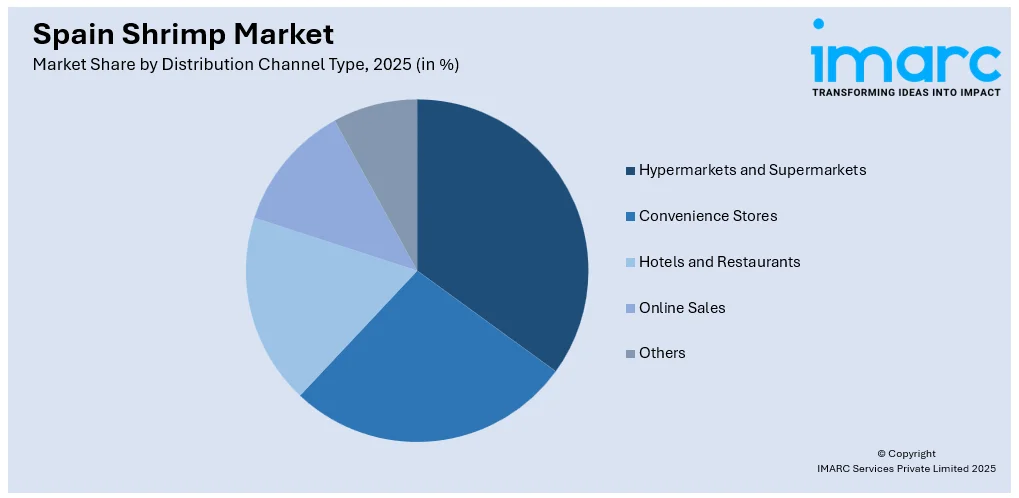

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Hypermarkets and Supermarkets

- Convenience Stores

- Hotels and Restaurants

- Online Sales

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, convenience stores, hotels and restaurants, online sales, and others.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Shrimp Market News:

- June 2025: Spain’s Froxa launched premium shrimp brands with new packaging technology to strengthen exports and retail presence worldwide. This move helped ease supply chain pressures and improved Spain shrimp market development by boosting quality standards, shelf appeal, and global competitiveness for local processors.

- November 2024: Oceanloop secured a €35 Million loan from the European Investment Bank to expand its RAS shrimp farms in Germany and Gran Canaria. This step supported Spain’s shrimp market by boosting local supply, advancing sustainable land-based farming, and reducing import reliance.

Spain Shrimp Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Environments Covered | Farmed Shrimp, Wild Shrimp |

| Species Covered | Penaeus Vannamei, Penaeus Monodon, Macrobrachium Rosenbergii, Others |

| Shrimp Sizes Covered | <21, 21-25, 26-30, 31-40, 41-50, 51-60, 61-70, >70 |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Hotels and Restaurants, Online Sales, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain shrimp market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain shrimp market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain shrimp industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The shrimp market in Spain reached USD 1.2 Billion in 2025.

The Spain shrimp market is projected to exhibit a CAGR of 4.31% during 2026-2034, reaching USD 1.8 Billion by 2034.

Rising seafood consumption, growing popularity of Mediterranean cuisine, increasing imports of frozen and processed shrimp, expanding retail and HoReCa channels, and consumer preference for protein-rich diets are driving the Spain shrimp market. Sustainability trends and improved cold chain logistics also support growth in both domestic and imported segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)