Spain Sports and Leisure Equipment Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2026-2034

Spain Sports and Leisure Equipment Market Summary:

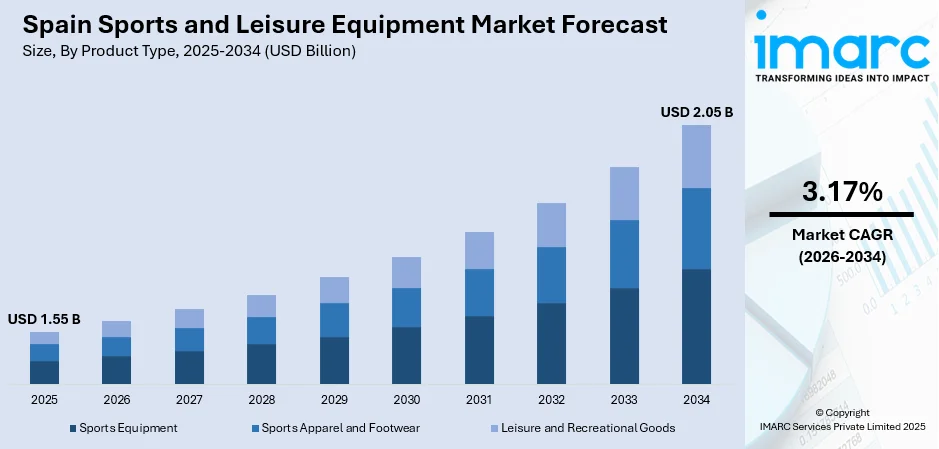

The Spain sports and leisure equipment market size was valued at USD 1.55 Billion in 2025 and is projected to reach USD 2.05 Billion by 2034, growing at a compound annual growth rate of 3.17% from 2026-2034.

The market growth is primarily driven by Spain's increasing health consciousness among its population, with rising participation in outdoor recreational activities and fitness programs. The convergence of sports tourism development, government investments in sports infrastructure, technological advancements in fitness equipment, and expanding e-commerce penetration is fundamentally reshaping the competitive landscape and creating substantial opportunities for market participants.

Key Takeaways and Insights:

-

By Product Type: Sports equipment dominates the market with a share of 45% in 2025, driven by strong demand for football, cycling, and fitness equipment, supported by Spain's passionate sports culture and the growing participation in outdoor recreational activities.

-

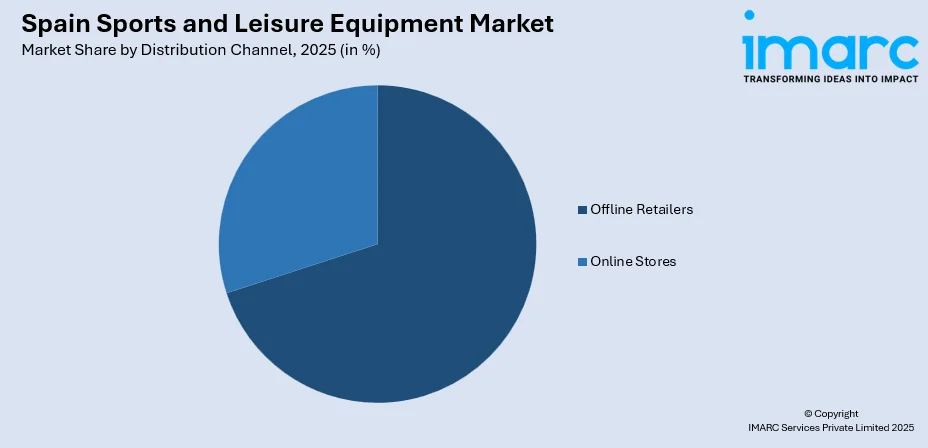

By Distribution Channel: Offline retailers lead the market with a share of 70% in 2025, This dominance is driven by individual preference for physical product examination, personalized expert advice, and the extensive retail network of specialized sports stores across Spain.

-

By End User: Individual consumers represent the largest segment with a market share of 60% in 2025, owing to rising health awareness, increasing disposable incomes, and the growing interest in personal fitness and recreational sports activities.

-

Key Players: The Spain sports and leisure equipment market exhibits moderate competitive intensity, with multinational sporting goods retailers competing alongside regional specialists and e-commerce platforms across diverse price segments and distribution channels.

To get more information on this market Request Sample

The Spain sports and leisure equipment market continues to strengthen as healthier lifestyles gain traction across different age groups and regions. People are committing to regular exercise both at home and through organized sports which is catalyzing the demand for durable apparel fitness tools and specialized gear. The trend is reinforced by broader developments in the wellness sector including the 2024 expansion of Gympak into Spain through a partnership with KMS Trading Solutions that brings fitness apparel in room workout equipment and wellness apps to hotels across the country. Tourism also adds momentum as visitors frequently purchase or rent gear for cycling hiking beach sports and other recreational activities. The growing interest in digital fitness platforms easier access to online retail and steady improvement in public fitness infrastructure help maintain consistent buying cycles. As purchasing power rises and people gravitate toward better designed and higher performance products the market maintains a clear upward path supported by both lifestyle changes and structural improvements.

Spain Sports and Leisure Equipment Market Trends:

Investment in Sports Equipment Distribution Networks

Spain’s sports and leisure equipment market is gaining momentum as retailers and logistics providers invest in modern distribution infrastructure. Enhanced warehousing systems, automation tools, and optimized delivery networks enable faster order fulfillment, better inventory management, and improved client service. These advancements help retailers maintain product availability, support the growing online and offline demand, and strengthen supply chain resilience. As companies upgrade logistics capabilities, the market benefits from smoother operations, greater efficiency, and wider access to high-quality sports gear across different regions. This is exemplified by GXO Logistics in 2024, which partnered with Forum Sport to manage two logistics centers in Vitoria, Spain, focused on sports equipment distribution. The partnership utilized GXO’s automation technology to streamline order preparation, distribution, and returns for Forum Sport's range of sports gear.

Growing Interest in Premium and Specialized Sports Gear

Many people are seeking high-quality, performance-driven products across categories like combat sports, fitness training, and outdoor activities. This is driven by the rising participation in organized sports, expanding gym culture, and increasing awareness about equipment quality encourage shoppers to invest in reliable, durable gear. Brands are responding to this trend by introducing specialized products that appeal to enthusiasts and athletes. For instance, in 2025, RDX Sports celebrated the expansion of Red Glove Boxing S.L. with the launch of a new shop in Madrid. This milestone marks the continued success of their partnership, which began in 2017, and reflects their commitment to promoting premium combat sports equipment in Spain. The renewed multi-million Euro agreement further solidifies their collaboration in driving brand visibility and growth across the Spanish market.

Rising Participation in Fitness and Wellness Activities

The sports and leisure equipment market in Spain to grow, as more individuals adopt structured fitness routines and prioritize personal health. The growing awareness about the benefits of regular exercise is leading to higher spending on home workout gear, gym accessories, and performance equipment. Urban areas are seeing increased interest in accessible fitness options, motivating individuals to equip themselves for flexible training habits. For instance, in 2024, Planet Fitness announced the opening of its first club in Spain, located in Sabadell, Barcelona. This marked the brand's first European location as part of its global expansion strategy, tapping into the potential of the Spanish fitness market. The company aimed to introduce its affordable, non-intimidating fitness model to a market where only 10% of the population currently holds a gym membership.

Market Outlook 2026-2034:

The Spain sports and leisure equipment market is experiencing notable growth, driven by a shift in individual preferences towards health and wellness. As more people embrace active lifestyles, demand for sports and leisure equipment continues to rise. The market generated a revenue of USD 1.55 Billion in 2025 and is projected to reach a revenue of USD 2.05 Billion by 2034, growing at a compound annual growth rate of 3.17% from 2026-2034. This growth highlights the increasing focus on fitness and well-being among individuals.

Spain Sports and Leisure Equipment Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Sports Equipment | 45% |

| Distribution Channel | Offline Retailers | 70% |

| End User | Individual Consumers | 60% |

Product Type Insights:

- Sports Equipment

- Sports Apparel and Footwear

- Leisure and Recreational Goods

Sports equipment dominates with a market share of 45% of the total Spain sports and leisure equipment market in 2025.

Sports equipment holds the biggest market share, driven by the high demand for both professional and recreational use. The popularity of sports like football, basketball, and tennis drives continuous sales and innovation in sports gear.

Additionally, the growing health awareness and fitness trends contribute to increased participation in sports activities. This rising interest in maintaining physical fitness ensures a steady demand for high-quality sports equipment, ranging from fitness gear to outdoor sports tools, sustaining its dominant market share.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Stores

- Offline Retailers

Offline retailers lead with a market share of 70% of the total Spain sports and leisure equipment market in 2025.

Offline retailers represent the largest segment, owing to the preference of shoppers to try items in person before buying. Feeling the fit, testing the weight, and getting quick guidance from store staff build trust, especially for higher-value gear like footwear, rackets, and fitness machines.

The advantage held by physical stores, derived from steady footfall, immediate availability, and expert support, is being aggressively maintained through significant investments, such as Decathlon's 2025 announcement of a €38 million investment to renovate over 70 stores across Spain with a focus on digital transformation and circular services.

End User Insights:

- Individual Consumers

- Sports Clubs and Academies

- Gyms and Fitness Centers

- Schools and Educational Institutions

Individual consumers exhibit a clear dominance with a 60% share of the total Spain sports and leisure equipment market in 2025.

Individual consumers dominate the market, as most purchases come from personal fitness routines, home workouts, and recreational sports. People increasingly invest in their own gear to support healthier lifestyles, driving the demand across categories ranging from apparel to small equipment.

The growing interest in outdoor activities, running, cycling, and gym training strengthens direct individual spending. With rising awareness about wellness and easy access to affordable products, individuals often choose to buy equipment for regular use at home or local facilities, keeping this segment at the forefront of overall sales.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Northern Spain shows steady demand for sports and leisure equipment, supported by outdoor activities like hiking, cycling, and coastal sports. Strong participation in community fitness programs and organized sports clubs encourages regular purchases across categories, helping the region maintain a consistent share of the market.

Eastern Spain benefits from a large population, active tourism, and widespread interest in water and beach sports. Cities with strong fitness cultures drive higher spending on personal gear. The mix of urban lifestyles and outdoor recreation makes the region a key contributor to overall market growth.

Southern Spain’s warm climate supports year-round outdoor activities, raising demand for equipment used in running, cycling, football, and water sports. Tourism adds to the consumer base, with visitors and residents buying gear for recreation. Retail presence and active sports communities help sustain strong market performance.

The presence of large urban centers in Central Spain drives the demand for gym, training, and team-sport equipment. Expanding fitness facilities and the growing interest in structured exercise programs encourage frequent purchases. A mix of recreational athletes, students, and working professionals keeps the region important for nationwide sales.

Market Dynamics:

Growth Drivers:

Why is the Spain Sports and Leisure Equipment Market Growing?

Strong Tourism and Recreational Culture

Spain’s strong appeal as an international destination continues to reinforce demand for sports and leisure equipment, supported by activities that range from coastal recreation to mountain-based outdoor pursuits. Spain welcomed 5.3 million international tourists in December 2024, marking a 1.1% rise from the previous year, with total arrivals reaching a record 93.8 million, as per the INE. These visitors consistently generate sales of rental gear, travel-friendly equipment, and convenience purchases, while residents drive sustained demand for higher-quality products suited to regular use. The combination of seasonal tourism peaks, active local participation, and frequent sporting events ensures steady turnover for retailers and maintains strong visibility for premium brands.

Rising Household Spending Power

Rising income levels across Spain continue to strengthen individual willingness to allocate more of their budgets to sports and leisure equipment, particularly in mid-range and premium categories where quality and durability play a larger role in purchasing decisions. According to the 2024 Household Budget Survey (HBS), overall household spending increased by 4.4% to 34,044 euros per household, while per-capita spending reached 13,626 euros, with notable growth in recreational, sports, and cultural activities. This financial shift encourages families to invest in upgraded equipment and branded products throughout the year, reducing price sensitivity and driving the demand in both mainstream and specialized market segments.

Expansion of E-Commerce and Digital Purchasing Behavior

Online retail continues to play an increasingly influential role in the expansion of Spain’s sports and leisure equipment market, as people shift toward digital platforms that offer wider assortments, competitive pricing, and convenient home delivery. The strength of this transition is supported by the scale of the national e-commerce landscape, which reached USD 431.3 Billion in 2024, according to the IMARC Group, reflecting broad adoption of online purchasing habits. Digital channels enable retailers to manage inventory more efficiently, present extensive product ranges, and provide detailed information that supports confident decision-making. This environment also allows emerging brands to access nationwide demand, contributing to the market growth.

Market Restraints:

What Challenges the Spain Sports and Leisure Equipment Market is Facing?

Intense Competition from Low-Cost Imports

The Spain sports equipment market faces competitive pressure from low-cost imported products that challenge established brands and local manufacturers. The availability of affordable alternatives through online marketplaces creates pricing pressures that constrain margins for domestic retailers and manufacturers, particularly in entry-level and mid-range product segments. This environment forces domestic companies to differentiate through quality, durability, and brand reputation, yet the constant influx of cheaper imports keeps competition tight.

Economic Sensitivity and Discretionary Spending Constraints

Sports and leisure equipment is often purchased with discretionary income, which means demand shifts quickly when households face financial strain. Inflation, rising living costs, and broader economic uncertainty encourage people to delay non-essential purchases or prioritize budget-friendly options. Premium brands, especially those selling advanced or specialized equipment, feel the most pressure as clients trade down or postpone upgrades.

Seasonal Demand Fluctuations

Seasonality shapes purchasing patterns across Spain sports leisure equipment market, leading to uneven demand cycles that vary by sport and region. Winter-focused items, water sports gear, and outdoor recreation products experience concentrated sales windows, making accurate forecasting essential. Retailers must strike a careful balance to avoid excess stock in off-seasons while ensuring availability during peak periods. Weather variability, tourism waves, and shifting recreational habits further complicate planning. These fluctuations increase logistical and inventory risks, prompting retailers and brands to refine supply chain decisions throughout the year.

Competitive Landscape:

The Spain sports and leisure equipment market exhibits moderate competitive intensity characterized by the presence of multinational sporting goods retailers alongside regional specialists and e-commerce platforms competing across diverse price segments and distribution channels. Market dynamics reflect strategic positioning ranging from premium, innovation-driven offerings emphasizing advanced technology and performance to value-oriented products targeting cost-conscious individuals. The competitive landscape is increasingly shaped by omnichannel retail strategies, sustainability initiatives, e-commerce capabilities, and brand marketing effectiveness. Major players are investing in store modernization, logistics infrastructure, and digital integration to enhance client experience and operational efficiency.

Recent Developments:

-

In November 2025, JD Sports opened its largest European store, a 1,500-square-meter flagship at 9 Portal de l'Àngel, Barcelona. The two-floor location, housed in historic palaces, offers a curated sneaker and sportswear experience from brands like Nike and Adidas. JD aims to enhance its retail presence in Spain while integrating local architecture and culture.

-

In July 2025, Columbia Sportswear opened a new store in San Sebastián, Spain, located in the Garbera shopping center. The 121-square-meter store features outdoor gear, performance apparel, footwear, and accessories. This expansion strengthens Columbia's retail presence in northern Spain, complementing existing stores in Madrid and Barcelona.

Spain Sports and Leisure Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sports Equipment, Sports Apparel and Footwear, Leisure and Recreational Goods |

| Distribution Channels Covered | Online Stores, Offline Retailers |

| End Users Covered | Individual Consumers, Sports Clubs and Academics, Gyms and Fitness Centers, Schools and Educational Institutions |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain sports and leisure equipment market size was valued at USD 1.55 Billion in 2025.

The Spain sports and leisure equipment market is expected to grow at a compound annual growth rate of 3.17% from 2026-2034 to reach USD 2.05 Billion by 2034.

The Sports equipment segment dominated the market with a share of approximately 45% in 2025, driven by strong demand for football, cycling, and fitness equipment supported by Spain's passionate sports culture and growing participation in outdoor recreational activities.

Key factors driving the Spain sports and leisure equipment market include the rise of structured fitness routines and the growing health awareness among the masses. Spending on home workout gear and accessories is increasing, supported by urban demand for flexible training. Planet Fitness entered Spain in 2024, targeting a market with only 10% gym membership.

Major challenges include intense competition from low-cost imported products, economic sensitivity affecting discretionary spending on sports equipment, seasonal demand fluctuations for sport-specific products, and the need for continuous innovation to meet evolving consumer preferences for smart and sustainable equipment solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)