Spain Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2026-2034

Spain Steel Tubes Market Overview:

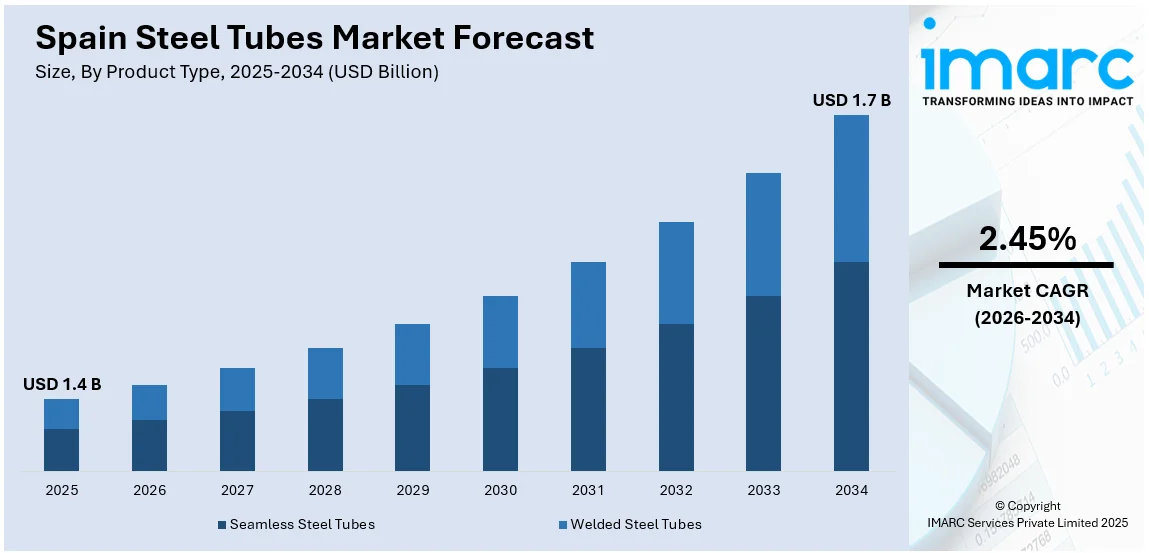

The Spain steel tubes market size reached USD 1.4 Billion in 2025. The market is projected to reach USD 1.7 Billion by 2034, exhibiting a growth rate (CAGR) of 2.45% during 2026-2034. The market is advancing steadily, propelled by rising demand across construction, automotive, oil & gas, and industrial infrastructure. Innovation and automation are enhancing production efficiency, while sustainability efforts such as green hydrogen technologies and electrical furnaces are reshaping the manufacturing landscape. Key challenges include competition, supply‑chain volatility, and regulatory pressures, yet investment in advanced materials and eco‑friendly practices is opening new growth avenues. These dynamics are defining the evolving Spain steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.4 Billion |

| Market Forecast in 2034 | USD 1.7 Billion |

| Market Growth Rate 2026-2034 | 2.45% |

Spain Steel Tubes Market Trends:

Resilient Domestic Output Fuels Foundations

In February 2025, Spain’s national steel industry published its latest annual data, reflecting a significant rise in domestic steel output over the previous year, according to sources. This increases signals more than a statistical bump it marks the return of stability and reliability across core segments, especially steel tubes. When local production runs consistently, the effect cascades throughout the supply chain. Fabricators benefit from fewer sourcing delays, while construction and industrial buyers experience fewer interruptions in procurement cycles. For steel tubes, which serve structural, mechanical, and infrastructure roles, steady raw material input means fewer fluctuations in project timelines. This reliability supports more strategic planning among developers and contractors. Rather than being driven by reactive sourcing or imports, steel tube production is increasingly backed by Spain’s own renewed industrial capacity. That grounded supply picture proves especially valuable as demand aligns with regional recovery. Supported by robust upstream activity, the Spain steel tubes market growth appears increasingly anchored to strong and sustainable domestic output.

To get more information on this market Request Sample

Strengthened Export Presence Across EU

In January 2025, official trade data revealed that Spain ranked among the top exporters of tubes, pipes, and hollow profiles in the EU, contributing a notable share of regional shipments. This isn’t just about numbers it means Spanish steel tube makers are seen as reliable partners across borders, trusted for quality and delivery. As broader EU export volumes declined, Spain’s consistency stood out. That dependable export base supports mid- and long-term planning for buyers and logistics teams, as they know orders will arrive as promised, even when overall trade softens. In the practical day-to-day, that means fewer surprises, smoother schedules, and better stakeholder confidence. These export rhythms are quietly reshaping sourcing behaviour making Spain a go-to regional source. Export health isn’t high drama, but a quiet strength that counts; it underpins not just volumes but credibility. Taken together, these shifts illustrate that Spain steel tubes market trends are increasingly driven by reliable export performance, building steadier cross‑border relationships.

Shift Toward Increased Local Steel Tube Sourcing

In April 2024, Spanish customs data revealed a steady increase in domestic steel tube production, with a notable drop in imports of welded tubes and pipes compared to previous year. This shift reflects Spain’s growing capacity to meet internal demand through local manufacturing rather than relying heavily on imports. For fabricators and construction firms, this means shorter lead times and fewer uncertainties linked to international logistics. It also points to stronger control over quality and specifications, which is critical for sectors requiring precision-engineered tubes. Domestic sourcing reduces exposure to global market fluctuations, allowing buyers and planners to align projects with more predictable supply chains. This trend isn’t about sudden change but a gradual, strategic realignment to reinforce supply chain resilience. As the manufacturing base expands and internal capabilities strengthen, Spain’s steel tube ecosystem becomes more self-sufficient and competitive. Consequently, the Spain steel tubes market is increasingly supported by this shift toward reliable, locally sourced steel tubes.

Spain Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

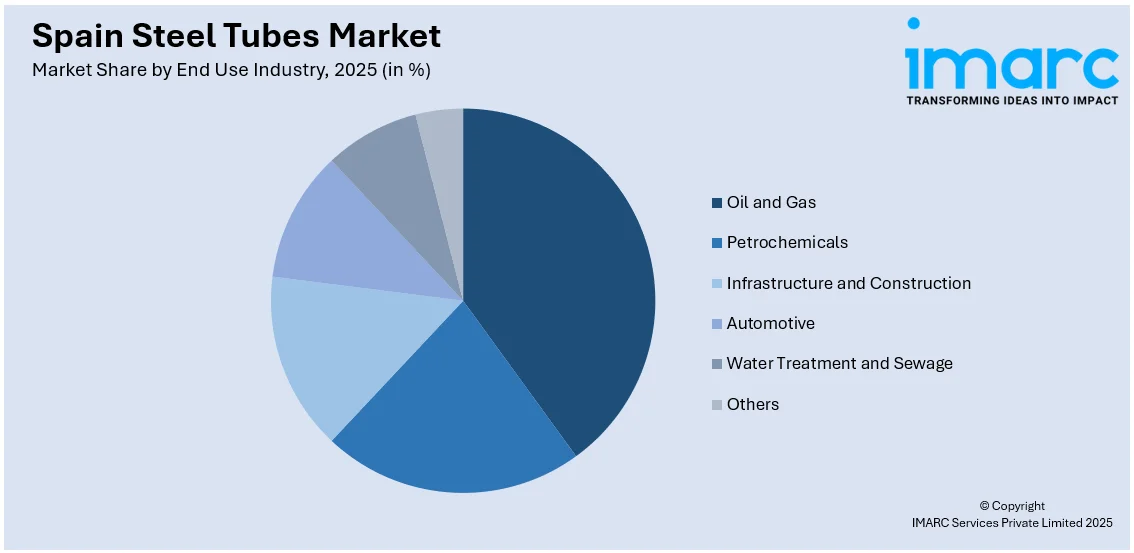

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Northern Spain

- Southern Spain

- Eastern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northern Spain, Southern Spain, Eastern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Steel Tubes Market News:

- April 2025: Spain’s Transmesa is expanding its presence in the country with a significant investment at its Sant Ramon facility in Catalonia. The company is installing a new stainless steel tube production line designed for applications in hybrid and hydrogen-powered vehicles, rail systems, and semiconductor gas-handling equipment. This strategic enhancement includes advanced machinery and additional buildings across the plant’s footprint. The expansion positions Transmesa to diversify beyond carbon steel offerings and strengthen its foothold in Spain’s evolving industrial landscape.

- August 2025: Tosyali Holding has embarked on an expansion of its Spanish operations by investing in Baika Steel Tubular Systems (STS), acquired earlier in a year. This strategic move supports capacity enhancement at the plant, reinforcing its role as a vital hub for green steel production in Europe. The initiative underscores operations in Spain as a pivotal growth driver in the company’s European strategy, aligning with broader goals of sustainable development and market diversification.

Spain Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Types Covered | Carbon Steel, Stainless Steel, Alloy Steel, Other |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Northern Spain, Southern Spain, Eastern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain steel tubes market on the basis of product type?

- What is the breakup of the Spain steel tubes market on the basis of material type?

- What is the breakup of the Spain steel tubes market on the basis of end use industry?

- What is the breakup of the Spain steel tubes market on the basis of region?

- What are the various stages in the value chain of the Spain steel tubes market?

- What are the key driving factors and challenges in the Spain steel tubes market?

- What is the structure of the Spain steel tubes market and who are the key players?

- What is the degree of competition in the Spain steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain steel tubes market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)