Spain Tiles Market Size, Share, Trends and Forecast by Type, Material, End User, and Region, 2026-2034

Spain Tiles Market Overview:

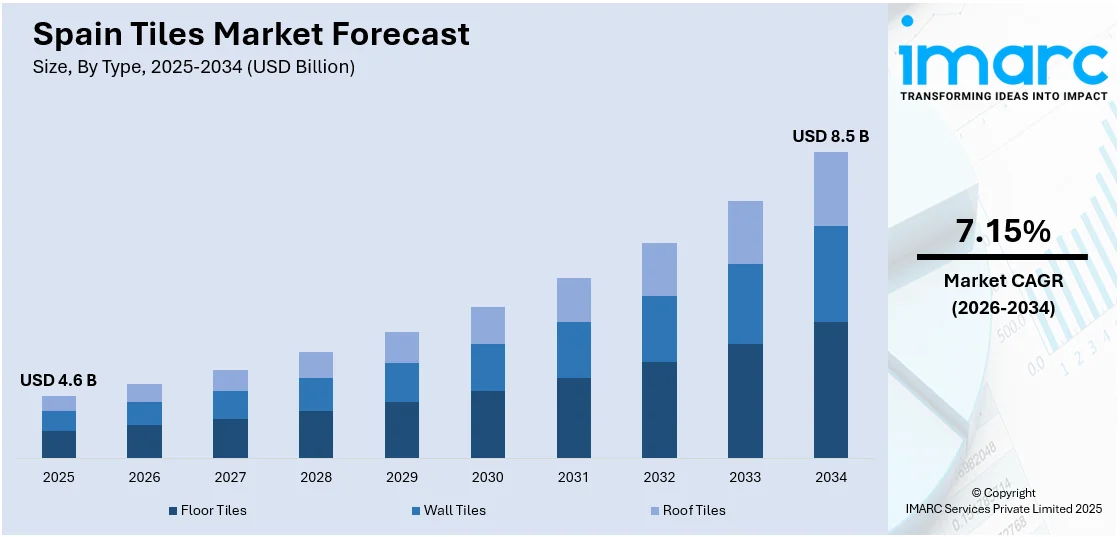

The Spain tiles market size reached USD 4.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 8.5 Billion by 2034, exhibiting a growth rate (CAGR) of 7.15% during 2026-2034. The market is growing due to increasing construction activities, rising demand for sustainable and aesthetically appealing designs, technological advancements in manufacturing, expanding exports, government support for infrastructure development, growth in renovation projects, and the rising popularity of ceramic and porcelain tiles for residential and commercial applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.6 Billion |

| Market Forecast in 2034 | USD 8.5 Billion |

| Market Growth Rate 2026-2034 | 7.15% |

Spain Tiles Market Trends:

Surge in Demand for Eco-Friendly and Sustainable Tiles

Sustainability is becoming a key focus in Spain’s tile industry, with manufacturers increasingly adopting eco-friendly practices. The demand for recycled materials, energy-efficient production processes, and low-emission tiles is rising as consumers and businesses prioritize environmental responsibility. Innovations such as water-based glazing, solar-powered kilns, and reduced carbon footprint materials are gaining traction. Additionally, green certifications and compliance with EU sustainability regulations are influencing purchasing decisions. Many Spanish tile producers are investing in closed-loop recycling systems to minimize waste and enhance resource efficiency. With heightened awareness about climate impact, sustainable tiles are now a major differentiator in the market, especially among architects, developers, and environmentally conscious consumers looking for both aesthetic appeal and reduced environmental impact in their construction projects. For instance, in December 2023, Mohawk Group partnered with Scanalytics, Inc. to integrate smart flooring technology aimed at reducing carbon emissions and energy waste in buildings. The sensor-embedded flooring optimizes HVAC operations, reducing energy waste by up to 35% annually while maintaining 90% occupant comfort. This initiative aligns with Mohawk’s sustainability goals, with plans to deploy millions of square feet of smart flooring.

To get more information on this market Request Sample

Expanding Export Market and Global Influence

Spain is one of the leading exporters of ceramic and porcelain tiles, with international markets driving significant growth. For instance, according to industry data, Spain ranked fifth among the world's top tile importers in 2023, with imports valued at USD 58.45 Million. In terms of import volume, Spain imported 5.88 million tons of tiles, making it one of the largest importers by quantity. Spanish tile manufacturers are expanding their presence in North America, the Middle East, and Asia, capitalizing on the high demand for premium-quality, durable, and stylish tiles. Competitive pricing, strong brand reputation, and continuous product innovation have strengthened Spain’s position in the global tile industry. Government-backed trade initiatives, participation in international exhibitions like CEVISAMA, and strategic partnerships with overseas distributors are further propelling exports. For instance, Cevisama 2025, running from February 24–28 in Valencia, Spain, will feature 400+ exhibitors, with 96% from Europe, emphasizing ‘Made in Europe’ quality. Spain (73%), Italy (13%), and Portugal (5%) lead exhibitor participation. The event will showcase ceramic tiles (44% of exhibits), bathroom furnishings, construction materials, and ceramic manufacturing technology.

Spain Tiles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, material, and end user.

Type Insights:

- Floor Tiles

- Wall Tiles

- Roof Tiles

A detailed breakup and analysis of the market based on the type have provided have also been provided in the report. This includes floor tiles, wall tiles, and roof tiles.

Material Insights:

- Ceramic

- Porcelain

- Natural Stone and Mosaic

- Others

A detailed breakup and analysis of the market based on the material have provided have also been provided in the report. This includes ceramic, porcelain, natural stone and mosaic, and others.

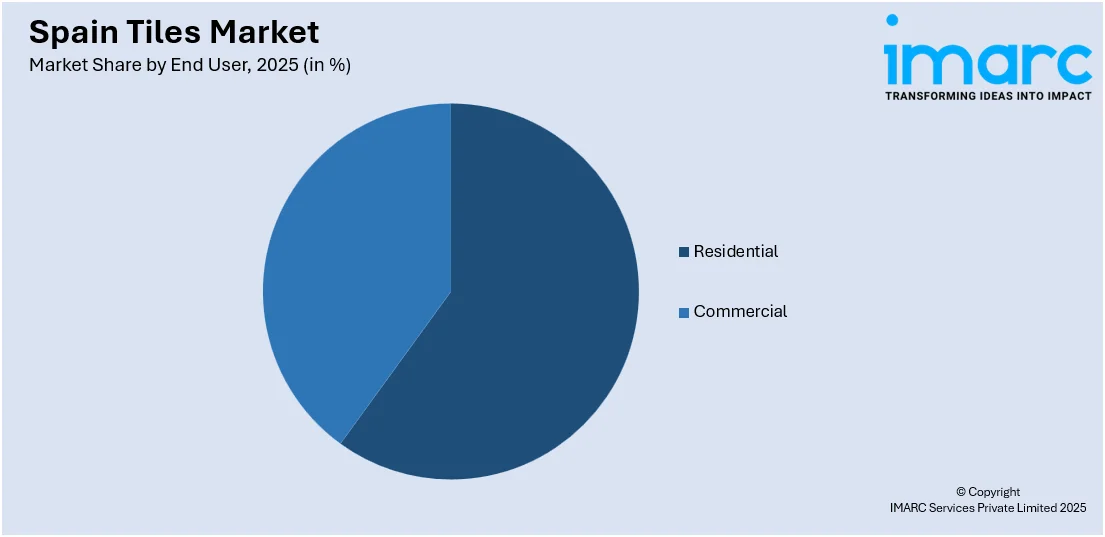

End User Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end user have provided have also been provided in the report. This includes residential and commercial.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Eastern, Southern, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Tiles Market News:

- In February 2023, Apavisa Porcelánico showcased eight new porcelain tile collections at Cevisama 2023, highlighting a fusion of elegance and modernity. The Roma Blue Collection emphasizes textured reliefs and warm tones, while the Suav Collection introduces large-format marble-effect slabs. These designs cater to interior designers and architects, aligning with contemporary decorative and technical trends.

- In January 2024, Vesco started clay extraction in Berge, Teruel, Spain, at the Encarnita deposit, marking the company's first EU production site. This step ensures regional supply and reduces logistics risks, aiming for an annual output of 100,000 tons of ceramic clay, primarily for Spanish tile manufacturers. Vesco has also invested €3 million in Spain, including an R&D hub in Andora, Teruel, to develop advanced ceramic formulations.

Spain Tiles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Floor Tiles, Wall Tiles, Roof Tiles |

| Materials Covered | Ceramic, Porcelain, Natural Stone and Mosaic, Others |

| End Users Covered | Residential, Commercial |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain tiles market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain tiles market on the basis of type?

- What is the breakup of the Spain tiles market on the basis of material?

- What is the breakup of the Spain tiles market on the basis of end user?

- What are the various stages in the value chain of the Spain tiles market?

- What are the key driving factors and challenges in the Spain tiles?

- What is the structure of the Spain tiles market and who are the key players?

- What is the degree of competition in the Spain tiles market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain tiles market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain tiles market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain tiles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)