Spain Vegan Cosmetics Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Spain Vegan Cosmetics Market Overview:

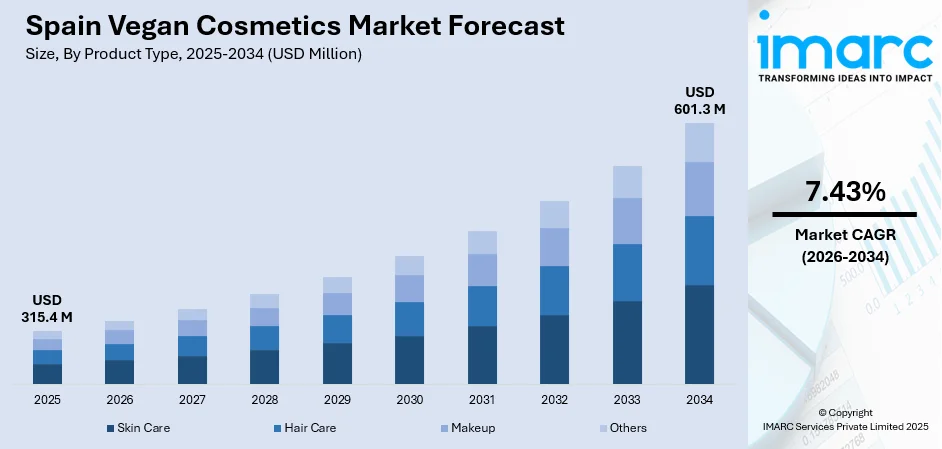

The Spain vegan cosmetics market size reached USD 315.4 Million in 2025. Looking forward, the market is expected to reach USD 601.3 Million by 2034, exhibiting a growth rate (CAGR) of 7.43% during 2026-2034. The market is fueled by growing consumer consciousness regarding animal welfare, environmentalism, and clean ingredients. Cultural transformation toward healthier living, coupled with the impact of Mediterranean natural remedies, has increased the popularity of plant-based beauty products. Greater availability of vegan cosmetics in pharmacies, supermarkets, and online platforms has also made them more accessible. Complementary EU regulations and domestic innovation support product development, further contributing to the Spain vegan cosmetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 315.4 Million |

| Market Forecast in 2034 | USD 601.3 Million |

| Market Growth Rate 2026-2034 | 7.43% |

Spain Vegan Cosmetics Market Trends:

Conscious Consumerism and Mediterranean Ingredient Innovation

Within Spain, the vegan cosmetics industry is being defined by a strong cultural fondness for Mediterranean plants like olive oil, aloe vera, citrus extracts, rosemary, lavender, almond oil, and local honey. Spanish brands tend to draw upon this rich heritage of natural ingredients that are strong related to regional identity and combine them with plant-based formulations in order to engage both ethical and performance-oriented consumers. Spanish-produced vegan skincare ranges often promote these Mediterranean extracts prominently, labeling them as natural and fundamentally connected to Spanish terroir. This local anchoring has a very strong resonance with local consumers who view classic Spanish ingredients as credible and powerful. In recent years, local vegan cosmetic manufacturers have been making investments in green chemistry methods and environmentally friendly sourcing procedures, such as renewable farm by-products of Andalusian olive trees or Valencia citrus orchards, to benefit regional economies as well as environmentally aware consumers. Thus, Spain's vegan cosmetics industry is imitating international clean beauty trends while also drawing on its own tradition to distinguish products in ways that resonate with the Spanish consumer, which further contributes to the Spain vegan cosmetics market growth.

To get more information on this market Request Sample

Spanish Urban and Provincial Retail Landscape and Distribution

The evolution of vegan cosmetics in Spain mirrors retail evolution in both Spain's major cities such as Madrid, Barcelona, Valencia, and provincial towns. In town centers, conventional supermarkets and pharmacies like Mercadona, Carrefour, El Corte Inglés, Druni and Primor now offer an expanding range of vegan‑certified cosmetics and makeup, making ethical beauty more accessible to mass consumers. At the same time, in towns of lesser size, particularly Galicia, Alicante province, or some areas of Andalusia, vegan supporters tend to depend on herbolarios (organic special stores) or cyber platforms in order to access cruelty‑free goods, evidencing a slow crossover from specialty to general availability. Local differences also play a role in purchasing patterns: coastal and tourism regions are adopting faster, more from international visitors with higher counts of health‑food stores and outlets located in such regions, while inland rural provinces tend to lag a bit, they are catching up quickly through mobile e‑commerce and national delivery services. Spanish distribution channels are adapting to include both premium artisanal vegan brands and lower-priced domestic lines, constituting a market that mirrors Spain's rich retail geography.

Brand Positioning, Digital Engagement, and Local Innovation Dynamics

The Spanish vegan cosmetics market is situated in an unusual convergence of robust heritage brands such as Natura Bissé, Sesderma, ISDIN, and Alqvimia with new niche operators targeting only vegan and cruelty-free credentials. These well-established names are beginning to launch vegan sub-lines or certifications, usually borrowing the known Spanish dermatological credibility in order to enter ethical beauty while not sacrificing perceived effectiveness. At the same time, boutique vegan brands and artisanal companies are leveraging influencer partnerships and eco-transparent messaging to establish trust through digital means. The Spanish beauty sector is sensitive to straightforward labeling and certification by organizations such as Ecocert, Cosmebio, or the Vegan Society, and brands prefer to highlight plant‑based origin, local production and refill formats. When it comes to innovation, some are using biotechnology or formulation platforms powered by AI in order to formulate vegan skincare products that can be adapted to specific needs, a trend that is backed by the wider Spanish wellness and beauty‑tech movement. This blend of domestic ingredient ego, new digital marketing acumen, and national consumer education initiatives is making Spain's vegan cosmetics both culturally relevant and cutting-edge.

Spain Vegan Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Skin Care

- Hair Care

- Makeup

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin care, hair care, makeup, and others.

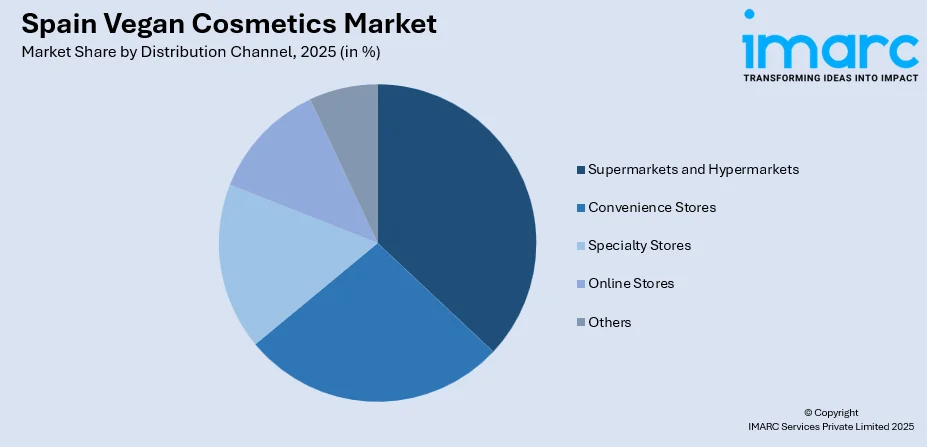

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Vegan Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin Care, Hair Care, Makeup, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain vegan cosmetics market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain vegan cosmetics market on the basis of product type?

- What is the breakup of the Spain vegan cosmetics market on the basis of distribution channel?

- What is the breakup of the Spain vegan cosmetics market on the basis of region?

- What are the various stages in the value chain of the Spain vegan cosmetics market?

- What are the key driving factors and challenges in the Spain vegan cosmetics market?

- What is the structure of the Spain vegan cosmetics market and who are the key players?

- What is the degree of competition in the Spain vegan cosmetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain vegan cosmetics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain vegan cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain vegan cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)