Sports Management Software Market Size, Share, Trends and Forecast by Offering, Deployment, Pricing Model, Application, End User, and Region, 2025-2033

Sports Management Software Market Size and Share:

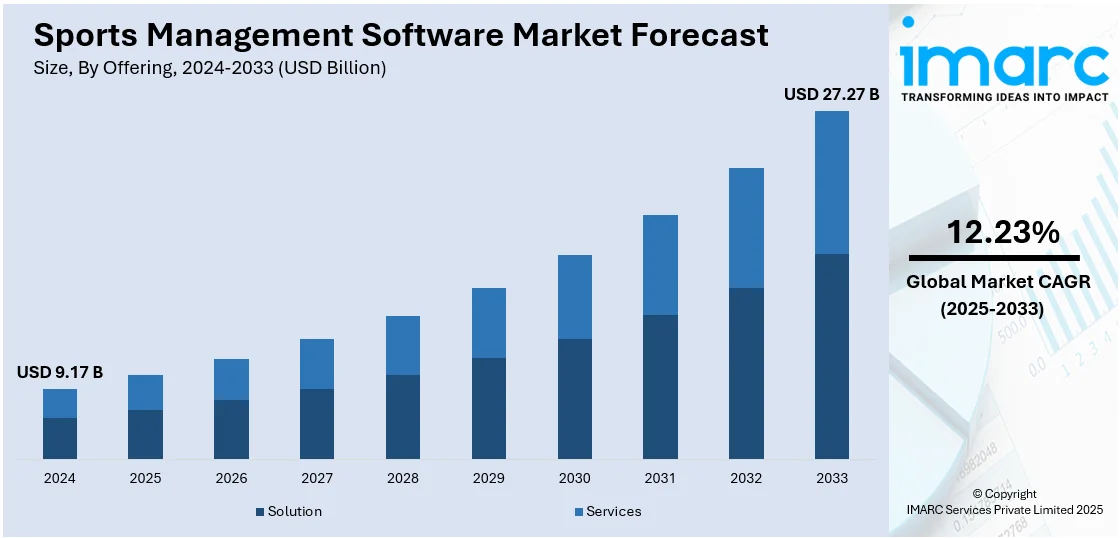

The global sports management software market size was valued at USD 9.17 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 27.27 Billion by 2033, exhibiting a CAGR of 12.23% during 2025-2033. North America currently dominates the market, holding a significant market share of around 37.5% in 2024. The market is fueled by innovations in data analytics for performance monitoring, rising demands for real-time decision-making, and escalating use of cloud and mobile-based solutions. The professionalization of grass-roots sports, more emphasis on injury prevention, and wearable technology integration are also improving software capabilities, making the market poised for consistent growth. Increased fan activism, particularly digital activism, as well as educational institutions' increased need for streamlined management, provides further evidence toward the expansion of sports management software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.17 Billion |

| Market Forecast in 2033 | USD 27.27 Billion |

| Market Growth Rate (2025-2033) | 12.23% |

The market is propelled by the increasing adoption of mobile-based solutions that enhance accessibility and real-time updates for teams and fans alike, streamlining operations and improving communication. The rising demand for data-driven decision-making in sports organizations is spurring the need for advanced analytics tools within management software, allowing for better player assessments and strategic decisions. The need for better financial management in sports organizations is fostering demand for integrated accounting and payment systems within these platforms. On May 3, 2025, Pri0r1ty Intelligence Group PLC announced its collaboration with Halfspace Limited to launch a new AI-powered sports analytics tool called "Capitano Ai." The tool will allow sports and media organizations in the UK and Europe to use conversational queries to extract insights from their data, with initial access provided for free to pilot customers like Team GB Snowsport and The Race Media, followed by a subscription model. Furthermore, the expansion of sports franchises into international markets is driving the need for localized software solutions that cater to various languages, currencies, and compliance requirements, therefore driving sports management software market growth. Increased focus on injury prevention and player health management is pushing teams to utilize software that integrates fitness tracking and medical history management.

To get more information on this market, Request Sample

The United States stands out as a key regional market, primarily driven by a growing need for robust marketing management tools to handle digital campaigns, fan engagement, and sponsorship deals. The rise in e-sports and digital sports is leading to a rise in demand for specialized software that can handle unique operational requirements, such as virtual event management, which is contributing to a positive sports management software market outlook in the US. On January 25, 2023, iSportz announced the expansion of its next-generation Sports Management and Engagement SaaS Platform, introducing new features powered by AI, machine learning, and blockchain technologies. The platform, which has processed more than 25,000 online transactions for registrations, experienced a 100% growth in the second half of 2022, and aims to serve a wide range of stakeholders, including clubs, teams, and fans, while addressing challenges in club management, member engagement, and event organization. Besides this, the greater emphasis on environmental and sustainability concerns is prompting sports organizations to seek management systems that streamline resource allocation and event planning to reduce their carbon footprint, thereby contributing to the ongoing growth of the market.

Sports Management Software Market Trends:

Continual technological advancements in sports analytics

One of the pivotal factors augmenting the demand for specialized management platforms in the sports sector is the rapid technological advancement in sports analytics. According to IMARC Group, the global sports analytics market size is expected to reach USD 5,511.1 Million by 2033, growing at a CAGR of 15.6% during 2025-2033. Modern analytics technology enables a multi-dimensional evaluation of performance, including player metrics, game strategies, and team dynamics. This granularity of data allows coaches, team managers, and even the athletes themselves to make real-time informed decisions, thereby not only elevating the level of play but also increasing the likelihood of victory. The software provides a central hub for collecting and analyzing this intricate data, subsequently making the information readily accessible for strategic planning and operational decision-making. In addition, as advancements such as artificial intelligence and machine learning become more intertwined with sports analytics, the capability of the software to integrate these emerging technologies adds another layer of indispensable utility.

Growing need for fan engagement beyond physical events

Another substantial driver in the market is the evolving requirement for heightened fan engagement beyond physical attendance at events. In a digitally connected world, fans seek more than just passive consumption of sports; they desire interactive, real-time engagement whether they are in the stadium or watching from home. As per a survey by the Television Bureau of Advertising (TVB), 82% of respondents watched sports on local TV channels from the comfort of their homes at least once a week in 2024. The software offers various modules that enable integration with social media platforms, virtual reality experiences, and live interactive polls and games, among other features. These interactive capabilities offer sports organizations new avenues for revenue generation through advertising, paid features, and enhanced viewership. Moreover, a satisfied and engaged fan base is likely to result in higher loyalty and retention, factors that directly contribute to an organization's long-term success. Thus, the software's proficiency in enabling multiple channels of fan engagement is an effective business imperative which is resulting in a positive outlook for the market.

Rise in sports investments by educational institutions

The growing investments in sports by educational institutions globally represent another considerable driver affecting the market. For instance, 1.9% of the budget for the Erasmus+ 2021-2027 program in the European Union was allocated to sport policy in 2024. Schools, colleges, and universities are increasingly recognizing the value of sports in holistic education and student well-being. As these institutions escalate their sports-related activities and events, the logistical complexity also increases, creating a dire need for efficient management solutions. From student-athlete performance tracking to compliance with educational and athletic standards, these platforms offer a wide array of functionalities tailored for educational institutions. They serve not just as tools for administrative convenience but as comprehensive solutions that enhance the quality of sports education, allow for better scouting of talent, and even assist in securing scholarships and other forms of financial aid for deserving athletes. Consequently, this growing segment of the market adds a substantial and sustained demand for advanced sports management systems.

Sports Management Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global sports management software market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on offering, deployment, pricing model, application, and end user.

Analysis by Offering:

- Solution

- Services

Solution stands as the largest component in 2024, holding around 67.4% of the market. In the solution segment, the key factors driving growth include the increasing need for data analytics in sports performance analysis, technological advancements in software solutions, and the growing demand for centralized systems to manage various operations. The emergence of IoT and artificial intelligence in sports technology is also contributing to market expansion. In addition, the need for streamlined communication between players, coaches, and administrators is pushing the demand for advanced solutions. Finally, the software also aids in logistics, scheduling, and talent management, adding to its indispensability. As sports organizations scale, there is a growing emphasis on integrating technology and analytics into their operations, thereby contributing to the segment growth.

Analysis by Deployment:

- On-Premises

- Cloud

Cloud leads the market with around 59.3% of market share in 2024. In the cloud deployment segment, various advantages such as scalability, flexibility, and cost-effectiveness are major drivers. Cloud-based sports management software is easier to implement and provides a robust platform for data storage and retrieval. This deployment model is also beneficial for teams or organizations that are geographically dispersed as it enables real-time communication and collaboration. Moreover, the growing trend of BYOD (Bring Your Own Device) in various organizations is increasing the adaptability of cloud solutions. The accessibility of cloud resources on a subscription basis makes it economically viable for even small and medium-sized enterprises. This widespread adoption of cloud-based solutions is reshaping the sports management landscape, offering unmatched efficiency, scalability, and real-time collaboration for organizations of all sizes.

Analysis by Pricing Model:

- Free

- Subscription

Subscription leads the market with around 72.1% of market share in 2024. The primary factors for growth include predictable expenses, reduced upfront costs, as well as easy scalability. A subscription model allows organizations to choose features they specifically need, avoiding unnecessary functionalities and expenses. It also provides the flexibility to scale up or down depending on the operational requirements. The model tends to create a constant revenue stream for vendors, and its periodic nature can often be synchronized with the sports seasons, making it convenient for both providers and users. Additionally, the subscription model fosters customer loyalty through continuous updates and improvements, ensuring that organizations always have access to the latest features and technology without the burden of large, one-time payments.

Analysis by Application:

- Team Management

- Event Management and Scheduling

- Training Management

- Marketing Management

- Player Fitness

- Performance Insight

- Payment Solution

- Others

Team management leads the market with around 34.7% of market share in 2024. Team management software is essential for streamlining operations such as player rotations, staffing, and communications. Teams are increasingly relying on sophisticated software to manage schedules and facilitate internal communication. The growing complexities of team dynamics and logistics make this segment especially relevant. Moreover, team management software helps coaches and managers track player performance, monitor progress, and maintain detailed records for better decision-making. With real-time updates, this software allows for quick adjustments to training schedules, game plans, and other logistical tasks. It also promotes seamless collaboration between coaches, players, and support staff, improving overall team efficiency and cohesion. As the demand for data-driven insights grows, team management software continues to evolve, offering advanced features such as AI-driven analytics and automated scheduling.

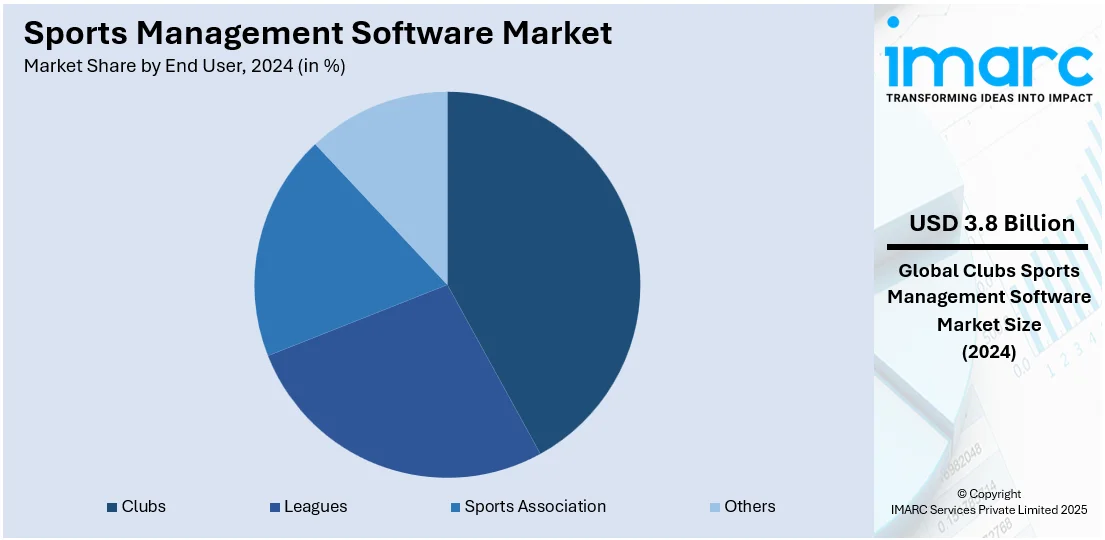

Analysis by End User:

- Clubs

- Leagues

- Sports Association

- Others

Clubs lead the market with around 41.5% of market share in 2024. Sports clubs are increasingly seeking comprehensive management solutions to handle everything from member management to facility booking. As sports clubs become more competitive and business-oriented, there is also a growing need to provide a seamless and efficient experience for members, which comprehensive management software can facilitate. This trend is propelling the demand for the software in this segment. Additionally, sports clubs are leveraging management software to streamline financial operations, enhance communication with members, and improve event coordination. With the increasing pressure to optimize resources and improve member satisfaction, clubs are turning to these solutions for better data management and decision-making. The ability to track performance, membership renewals, and facility utilization further boosts the demand for robust, all-in-one management platforms.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.5%. The market in the region is propelled by a combination of technological advancements, the strong presence of major market players, and a robust sporting culture. High levels of investment in sports at both professional and amateur levels contribute significantly to the market’s growth. Additionally, North America is the home base of several major sporting leagues and organizations that require sophisticated management solutions. Further, the region has a higher adoption rate of advanced technologies, including big data analytics, artificial intelligence, and cloud computing, thereby resulting in the rising adoption of sports management software. In addition to this, the high standard of living and increased spending capacity of consumers further facilitates the adoption of these technologies. Additionally, government initiatives and grants to promote sports are also contributing factors. As per the sports management software market forecast, considerable growth of e-sports along with a general inclination towards digitization in sports management are catalyzing the growth of the market in the region.

Key Regional Takeaways:

United States Sports Management Software Market Analysis

In 2024, the United States accounted for 88.20% of the total market share in North America. The market is primarily driven by the increasing digitization of sports organizations and the growing demand for efficient operations. Sports teams, leagues, and fitness centers are increasingly adopting software solutions to manage scheduling, ticketing, player performance, fan engagement, and financial transactions. The need for data-driven insights in areas such as player health, performance analytics, and fan preferences is also driving demand for sports management software, as it enables organizations to make more informed decisions. Additionally, the rise of e-sports and the expansion of amateur and youth sports leagues are further propelling industry expansion, as these organizations require scalable, user-friendly solutions. According to IMARC Group, the United States esports market size reached USD 489 Million in 2024 and is forecasted to reach USD 1,125 Million by 2033, growing at a CAGR of 9.7% during 2025-2033. Besides this, the increasing emphasis on fan engagement through mobile apps, digital platforms, and social media is encouraging sports organizations to invest in software that can streamline communication and enhance fan experience. As the sports industry continues to modernize and seek better ways to manage operations, the demand for integrated sports management software solutions is expected to keep growing in the United States.

Asia-Pacific Sports Management Software Market Analysis

The Asia-Pacific market is experiencing rapid growth due to increasing digitalization in the sports industry and rising demand for efficient operational solutions. Moreover, the growing focus on youth sports and fitness initiatives in the region is driving demand for management solutions in local and amateur sports leagues, contributing to industry expansion. Governments in the Asia Pacific are also increasingly investing in sports infrastructure and initiatives to promote physical activity, which has increased the demand for software that can manage community sports programs, recreational leagues, and youth sports organizations. For instance, as per the Press Information Bureau, the budget for the Ministry of Youth Affairs and Sports in India was INR 3397.32 crores for FY 2023-24, recording an increase of 11% from FY 2022-23. Moreover, the Khelo India program, which seeks to support athletes at the grassroots level, received a budget of INR 1,000 Crores for 2025-26. This rising federal investment in sports infrastructure is expanding the scope and adoption of sports management software in Asia-Pacific.

Europe Sports Management Software Market Analysis

The Europe market is expanding, driven by the rising adoption of cloud-based solutions, which provide scalability, flexibility, and cost-effectiveness to sports organizations of all sizes. As sports entities seek to streamline their operations and reduce overhead costs, cloud-based software allows for seamless access to data, real-time updates, and easy integration with other systems, improving overall efficiency. Moreover, the growing emphasis on compliance with data privacy regulations, such as the GDPR, is encouraging the development of secure software solutions that ensure the safe handling of sensitive player and fan data. The rise of mobile technology has also played a significant role in the market, as sports clubs and fitness centers now require software that can engage fans and athletes through apps, allowing for scheduling, ticketing, and personalized experiences on the go. Additionally, the growing popularity of fitness and recreational sports has led to a demand for software that can manage everything from membership tracking to class scheduling. According to Eurostat, in 2023, government expenditure on sporting and recreational services across the European Union accounted for 0.8% of total general government expenditure, equating to €67.6 Billion. The increasing trend of virtual sports events has also heightened the need for robust event management solutions capable of managing online and hybrid events, supporting overall market growth.

Latin America Sports Management Software Market Analysis

The Latin America market is greatly benefiting from the region’s increasing focus on sports professionalism and digital transformation. As local sports leagues and clubs strive to enhance their competitiveness, the demand for advanced tools to track player data, analyze performance, and improve team management is growing. For instance, the revenue in the Brazil sports market is projected to reach USD 2.29 Billion in 2025. Moreover, increasing urbanization in the region is creating a demand for efficient solutions to manage expanding sports programs, events, and facilities in cities. Additionally, the expansion of fitness and wellness apps is propelling the demand for software that can manage memberships, class schedules, and customer engagement for gyms and fitness centers.

Middle East and Africa Sports Management Software Market Analysis

The Middle East and Africa market is being increasingly propelled by the region’s rapid growth in sports infrastructure, fueled by significant investments in stadiums, sports complexes, and training facilities. With such big sporting events like the FIFA World Cup and local tournaments, there is a growing need for software solutions that are capable of managing events, tickets, and logistics in an efficient manner. The increasing popularity of e-sports and fitness programs is also widening the scope for specialized management software. The GCC esports market size was USD 22.2 Million in 2024 and is anticipated to grow at a CAGR of 12.88% during 2025-2033, says IMARC Group. Besides this, increasing government support for sports development programs is also encouraging the adoption of digital tools to manage registrations, schedules, and athlete performance.

Competitive Landscape:

Key players in the global market are actively pursuing strategic acquisitions and partnerships to consolidate resources and broaden their product portfolios, specifically targeting solutions for team management, event scheduling, and player performance tracking. These industry leaders are making significant investments in research and development (R&D) to introduce innovative features like AI-driven analytics and real-time communication tools, which provide a competitive edge in a rapidly evolving market. To expand their global footprint, key players are entering emerging markets through localized strategies that cater to regional sports cultures and operational needs. The dominant firms are also utilizing digital marketing channels, such as social media and specialized sports platforms, to engage with a broader consumer base, from professional teams to amateur clubs. With a focus on customer service, major companies are offering comprehensive support mechanisms, including customized onboarding and training, to foster client loyalty. Furthermore, to uphold data security and compliance, industry frontrunners are adhering to stringent regional and international regulations, ensuring that sensitive player data and performance metrics are securely managed.

The report provides a comprehensive analysis of the competitive landscape in the sports management software market with detailed profiles of all major companies, including:

- ACTIVE Network, LLC

- CourtReserve.com

- Jersey Watch

- Jonas Club Software

- LeagueApps

- Omnify

- SAP SE

- Sportlyzer LLC

- SportsEngine, Inc.

- SquadFusion, Inc.

- Stack Sports

- TeamSideline.com

Latest News and Developments:

- May 2025: The ECHL implemented a new league-wide Roster and Salary Cap Management System, developed in collaboration with PRL Sports Group and RockDaisy LLC. This platform offers real-time transaction tracking, salary cap compliance, and comprehensive athlete performance analytics. It streamlines operations, enhances data-driven decision-making, and modernizes player management.

- May 2025: Xiao-I Corporation introduced an AI-driven golf booking platform, marking its entry into sports and facility management. The platform features a 24/7 intelligent voice assistant capable of processing natural language booking requests, seamlessly integrating with existing golf course systems.

- April 2025: The Namibia Sports Commission launched a digital management system to enhance transparency, accountability, and governance in national sports administration. This platform is designed to streamline operations, improve data accuracy, and ensure compliance with regulatory standards, thereby strengthening institutional oversight and fostering trust within the sports community.

- December 2024: Kreeda App, a sports management smartphone application, was released in India by the Sports Authority of Andhra Pradesh (SAAP) with the goal of modernizing and streamlining sports administration throughout the state. By offering a single interface for managing extensive sports data, the app seeks to eradicate malpractices in the issue of sports quota certifications.

- November 2024: 360Player secured USD 25 million in funding from Five Elms Capital, a software investment company. The financing will help 360Player’s goals to reach new markets globally with its sports management software for parents, players, coaches, and clubs.

- October 2024: Tribes Communication launched Tribes Sports, a sports management software. Offering an extensive array of solutions for the sports and entertainment industries, Tribes Sports is a full-fledged sports management and marketing vertical.

- October 2024: Verdane, a specialty development investor based in Europe, and Eversports, a SaaS-enabled sports ticketing and booking platform, partnered to provide a centralized system to link sports and wellness enthusiasts with sports facilities and professionals. Through this collaboration, Eversports aims to expand internationally more quickly and add more suppliers and active consumers.

Sports Management Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Offerings Covered | Solution, Services |

| Deployments Covered | On-premises, Cloud |

| Pricing Models Covered | Free, Subscription |

| Applications Covered | Team Management, Event Management and Scheduling, Training Management, Marketing Management, Player Fitness, Performance Insight, Payment Solution, Others |

| End Users Covered | Clubs, Leagues, Sports Association, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ACTIVE Network, LLC, CourtReserve.com, Jersey Watch, Jonas Club Software, LeagueApps, Omnify, SAP SE, Sportlyzer LLC, SportsEngine, Inc., SquadFusion, Inc., Stack Sports, TeamSideline.com, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sports management software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global sports management software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sports management software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global sports management software market size was valued at USD 9.17 Billion in 2024.

The sports management software market is projected to exhibit a CAGR of 12.23% during 2025-2033, reaching a value of USD 27.27 Billion by 2033.

The market is driven by the increasing demand for scalable, flexible, and cost-effective solutions that streamline operations such as team management, event scheduling, and performance tracking. The growing adoption of cloud-based software, BYOD trends, and the need for real-time communication and collaboration among geographically dispersed teams are also major contributors to market growth.

North America currently dominates the market, holding a significant market share of around 37.5% in 2024, driven by high demand in both professional and amateur sports organizations, as well as widespread adoption of advanced technological solutions in the region.

Some of the major players in the sports management software market include ACTIVE Network, LLC, CourtReserve.com, Jersey Watch, Jonas Club Software, LeagueApps, Omnify, SAP SE, Sportlyzer LLC, SportsEngine, Inc., SquadFusion, Inc., Stack Sports, and TeamSideline.com.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)