Steel Long Products Market by Type (Rebars, Wire Rods, Tubes, Sections), Application (Construction, Automotive and Aerospace, Railway and Highway, and Others), and Region 2026-2034

Market Overview:

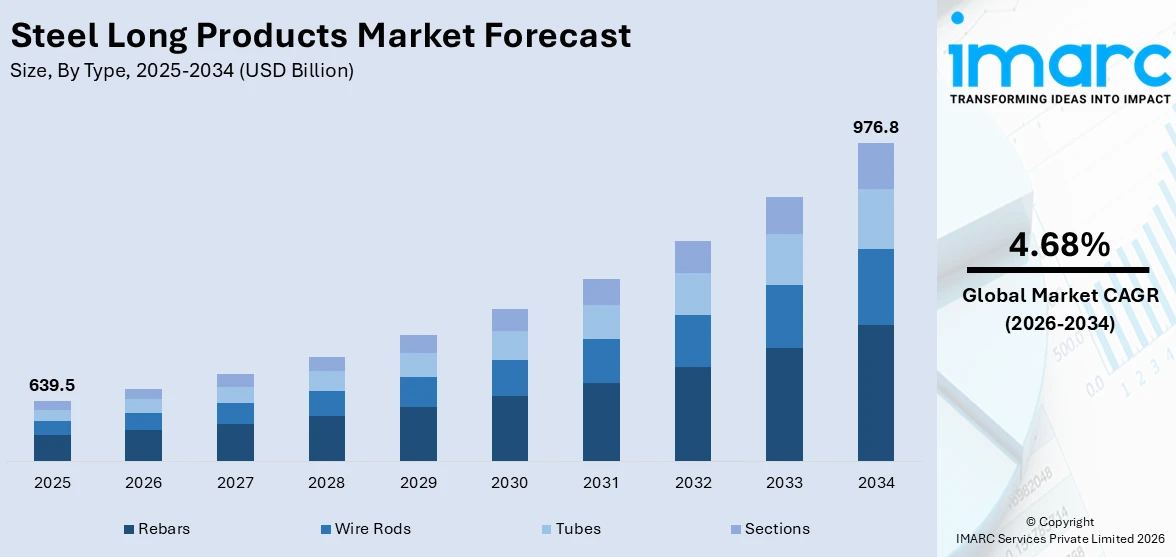

The global steel long products market size reached USD 639.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 976.8 Billion by 2034, exhibiting a growth rate (CAGR) of 4.68% during 2026-2034. The widespread product adoption in the construction industry, extensive research and development (R&D) activities, and growing infrastructural developments represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 639.5 Billion |

| Market Forecast in 2034 | USD 976.8 Billion |

| Market Growth Rate 2026-2034 | 4.68% |

Steel long products are specially fabricated materials that represent a crucial category within the vast steel industry. Typically, they include items such as rebars, wire rods, tubes, rails, and drawn wires, each of which is known for their elongated structure. Crafted with remarkable precision, these items boast immense tensile strength and durability, making them highly sought after for construction, infrastructure, and various manufacturing applications. These products are the result of meticulous procedures involving heating, rolling, and cooling of steel, exploiting the material's inherent malleability and ductility. As a consequence, the resulting items can withstand enormous stress and wear, and can be readily tailored to specific dimensions required for their diverse uses.

To get more information on this market Request Sample

The global market is primarily driven by the escalating demand from the construction sector due to the increasing number of infrastructural development projects. In line with this, the burgeoning automobile industry involving the manufacturing of vehicles demands robust, resilient materials that can endure high stress and wear is catalyzing the market. Moreover, the growing transition to renewable energy has necessitated the construction of wind turbines, transmission towers, and other infrastructure, which is fueling the product demand. In addition to this, the introduction of steel grades with improved corrosion resistance, higher strength-to-weight ratios, and more cost-effective designs is positively influencing the market. Furthermore, continual technological advancements manufacturing processes allowing for higher yield, better quality, and increased production speed are stimulating the overall market productivity and profitability.

Steel Long Products Market Trends/Drivers:

Increasing shipbuilding activities

One of the crucial drivers catalyzing the market growth for elongated steel products is the augmenting shipbuilding activities across the globe. Maritime transportation remains a vital cog in global commerce, and the industry has been seeing a resurgence of late. From bulk carriers, tankers, to passenger ships, steel long products serve as the backbone, offering the structural integrity necessary for these colossal sea vessels. The longevity, strength, and formability of these products ensure that ships can withstand the harsh marine environment and maintain their functionality over extended periods. Additionally, with the increased focus on the reduction of carbon emissions, the shipping industry is embracing innovation. The construction of technologically advanced, eco-friendly ships has become a priority, leading to the increased usage of high-strength steel products that enable lighter, more fuel-efficient designs. Thus, the upswing in the global shipbuilding industry is expected to continue driving the demand for these steel products in the foreseeable future.

Rapid expansion in the aerospace industry

The aerospace industry is another vital market driver for steel long products. Despite temporary setbacks due to global events, the aerospace industry is projected to witness substantial growth. In the realm of aviation, safety, durability, and weight are paramount considerations, and these steel products, known for their high strength-to-weight ratios, prove ideal. From landing gear components, engines, to fuselage structures, these elongated steel components form the core of various critical aircraft components. The rising demand for commercial aircraft, driven by an expanding middle class, especially in emerging economies, coupled with the increased defense spending worldwide, is set to amplify the demand for these steel products. With the continued advancements in aerospace technology, the demand for high-strength, durable, and lightweight steel materials is expected to remain robust.

The emergence of high-speed rail networks

The development of high-speed rail networks globally also contributes significantly to the demand for elongated steel products. The push for more efficient, faster, and eco-friendly modes of transportation has led to considerable investment in high-speed rail infrastructure. These steel products, recognized for their durability, tensile strength, and resistance to wear, are indispensable in the construction of these rail networks. From the rails themselves to various components of the trains, these steel items are integral to the overall system's reliability and performance. The push for high-speed rail systems, particularly in regions such as Europe and Asia, has led to a steady demand for these products. As more nations shift towards sustainable and efficient transportation solutions, the demand for these robust, reliable steel products in rail network construction is to stay on an upward trajectory.

Steel Long Products Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global steel long products market report, along with forecasts at the global, regional, and country levels from 2026-2034. Our report has categorized the market based on type and application.

Breakup by Type:

- Rebars

- Wire Rods

- Tubes

- Sections

Rebars represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the type. This includes rebars, wire rods, tubes, and sections. According to the report, rebars represented the largest segment.

Rebars, or reinforcing bars, are a critical component in the construction sector, where they are used to reinforce concrete structures, providing improved tensile strength. The growing demand from construction sectors worldwide, particularly in regions experiencing fast-paced urban development, drives the market for rebars.

On the other hand, wire rods are versatile steel products used in a variety of sectors, from automotive to construction, due to their flexibility and strength. Their key drivers include the growing manufacturing sector which uses wire rods for producing fasteners, wires, and cables, and the construction industry which utilizes them for reinforcing concrete.

Moreover, tubes are predominantly used in construction, automotive, and oil & gas industries. The rise in infrastructure development projects, the growing demand for automobiles, and increasing energy needs are some of the factors driving the tubes segment.

Additionally, sections, or structural steel shapes, play a pivotal role in the construction industry, especially in the building of commercial structures such as bridges, warehouses, and towers. Their high-strength, flexibility, and the ability to withstand extreme conditions are crucial for such applications, thus boosting their demand. The expansion of commercial construction projects globally contributes significantly to the segment growth.

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Construction

- Automotive and Aerospace

- Railway and Highway

- Others

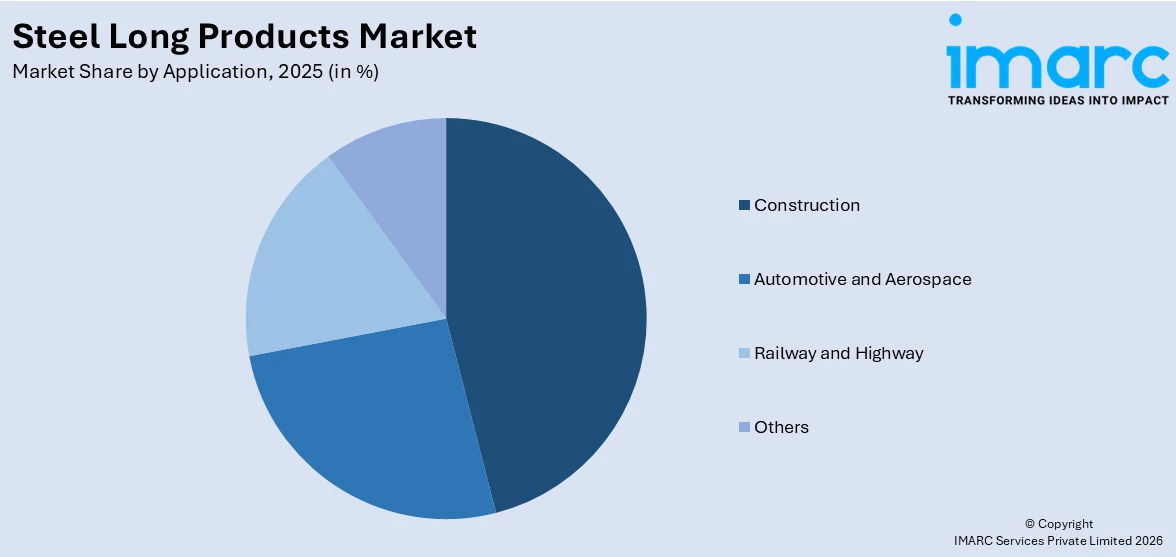

Construction accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes construction, automotive and aerospace, railway and highway, and others. According to the report, construction represented the largest segment.

The construction segment has a significant demand for elongated steel components due to their superior structural integrity and tensile strength. Rapid urbanization and population growth worldwide have amplified the need for robust residential and commercial infrastructure. Moreover, the trend toward constructing taller, more compact buildings, especially in densely populated urban areas, calls for materials that can deliver exceptional strength and durability without compromising the weight and space.

On the other hand, the automotive and aerospace industries have been instrumental in fueling demand for these steel components. The need for lightweight, high-strength materials that can withstand harsh conditions and high stress is crucial in these sectors. For the automotive industry, durability and safety are paramount, making these steel components essential in manufacturing various vehicle parts. Meanwhile, in the aerospace sector, the requirement for materials with an excellent strength-to-weight ratio is vital to maintain aircraft performance and fuel efficiency.

Furthermore, the railway and highway sectors represent another significant demand area. The construction and maintenance of railway tracks and highways require durable, high-strength materials to withstand constant wear and tear. This demand stems from the necessity of building robust, long-lasting infrastructure that ensures safe, efficient transport networks.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest steel long products market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represented the largest market.

The Asia Pacific region has been a strong driver for the market due to its rapid economic growth, booming construction industry, and burgeoning automotive sector. Increasing urbanization and population growth have led to significant demand for improved infrastructure, while the region's expanding middle class fuels the demand for automobiles.

Additionally, the region's manufacturing prowess, coupled with government initiatives to promote industrial growth, contribute to the escalating demand. The region is a manufacturing hub for various industries, including automotive, machinery, and shipbuilding. These industries utilize steel long products extensively in the production of components, structures, and machinery parts. The growing manufacturing sector in the region drives the demand for steel long products, especially for use in machine tools, equipment, and heavy machinery. Various countries in the Asia Pacific region have implemented policies to promote industrial growth and infrastructure development. Governments offer incentives, subsidies, and infrastructure spending to boost economic growth and encourage domestic steel production.

Competitive Landscape:

Key players in the elongated steel product market are implementing a range of strategies to ensure growth, enhance their market position. The major companies are continuously investing in R&D to innovate and improve the quality, durability, and strength-to-weight ratio of their steel products. These research initiatives also focus on devising more efficient and environmentally friendly production methods to reduce carbon emissions and align with global sustainability goals. The prominent players are also augmenting their production capabilities to meet the growing global demand. This includes building new manufacturing facilities, upgrading existing ones, and investing in state-of-the-art machinery and technology to improve efficiency and production speed. Furthermore, they are collaborating with other firms to gain a competitive edge, diversify their portfolio, increase their customer base, and expand their geographic reach. With growing awareness about the environmental impact of industrial activities, companies are taking significant steps towards sustainability, including adopting cleaner production methods, recycling and reusing waste, and introducing eco-friendly products.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ArcelorMittal S.A

- Baosteel Group

- Evraz plc

- Gerdau S/A

- Hbis Group Co. Ltd.

- Hyundai Steel

- JFE Steel Corporation

- Nippon Steel Corporation

- POSCO Holdings Inc.

- Tata Steel Long Products Limited

Recent Developments:

- In June 2023, ArcelorMittal S.A. and John Cockerill, a group leading the development of steel processing facilities and electrolysers announced plans to construct the world’s first industrial-scale low temperature, iron electrolysis plant. The Volteron plant, which in a first phase will produce between 40,000 and 80,000 tonnes a year of iron plates, is targeted to start production in 2027.

- In May 2023, BaoSteel Co announced a joint venture agreement with Saudi Aramco and the Public Investment Fund (PIF) to establish a steel plate manufacturing base in Saudi Arabia, with Baosteel holding a 50% stake, and Saudi Aramco and PIF each holding 25%. The new venture, pending regulatory approval, aims to produce an annual capacity of 2.5 million tonnes of direct reduced iron and 1.5 million tonnes of steel plate.

- In July 2023, HBIS Shisteel, a part of Hbis Group Co. Ltd., successfully delivered its designated high titanium alloy welding wires to its client and test results show that the strength of wires reaches 90Kg class, beating foreign wires. These wires will be used to manufacture engineering machinery, giving great support to marketing efforts downstream.

Steel Long Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Rebars, Wire Rods, Tubes, Sections |

| Applications Covered | Construction, Automotive and Aerospace, Railway and Highway, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ArcelorMittal S.A, Baosteel Group, Evraz plc, Gerdau S/A, Hbis Group Co. Ltd., Hyundai Steel, JFE Steel Corporation, Nippon Steel Corporation, POSCO Holdings Inc., Tata Steel Long Products Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global steel long products market performed so far and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global steel long products market?

- What are the key regional markets?

- Which countries represent the most attractive steel long products markets?

- What is the breakup of the market based on the type?

- What is the breakup of the market based on the product application?

- What is the competitive structure of the global steel long products market?

- Who are the key players/companies in the global steel long products market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the steel long products market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global steel long products market.

- The study maps the leading as well as the fastest growing regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the steel long products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)