Steel Plate Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Steel Plate Price Trend, Index and Forecast

Track real-time and historical steel plate prices across global regions. Updated monthly with market insights, drivers, and forecasts.

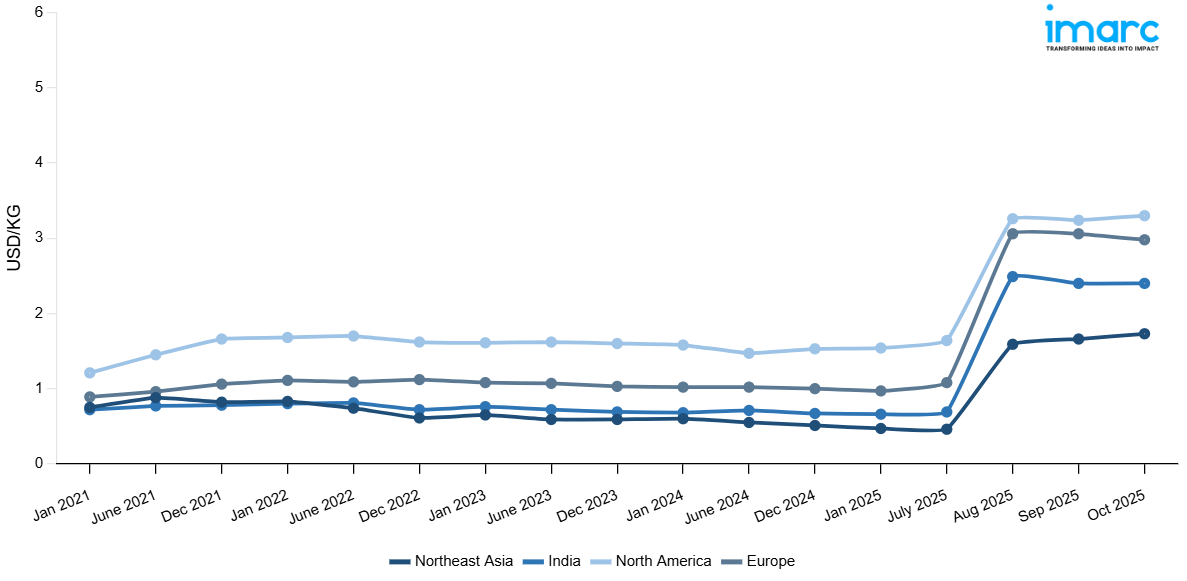

Steel Plate Prices October 2025

| Region | Price (USD/KG) | Latest Movement |

|---|---|---|

| Northeast Asia | 1.73 | 4.3% ↑ Up |

| Europe | 2.98 | -2.8% ↓ Down |

| India | 2.40 | -0.1% ↓ Down |

| North America | 3.30 | 2.0% ↑ Up |

Steel Plate Price Index (USD/KG):

The chart below highlights monthly steel plate prices across different regions.

Get Access to Monthly/Quaterly/Yearly Prices, Request Sample

Market Overview Q3 Ending September 2025

Northeast Asia: Northeast Asia’s steel plate pricing reflected a balance of steady domestic demand from construction and machinery sectors and persistent export-oriented supply dynamics. Demand-side pressures were driven by ongoing infrastructure projects and manufacturing restocking after mid-year maintenance cycles; however, industrial purchasers continued to prioritize cost optimization and grade-matching, placing selective pressure on higher-end plate grades. On the supply side, regional mills operated with broadly stable capacity utilization, but the mix of flat-rolled production and plate-specific output constrained the short-term ability to rapidly expand available plate tonnage. Currency fluctuations, notably local currency strength versus the US dollar, affected export price setting and import parity calculations for steel buyers trading across borders.

Europe: European steel plate exhibited limited upward pressure amid a mixed demand backdrop of sustained civil engineering projects offset by softer manufacturing demand in certain export-oriented segments. Construction-related plate consumption, bridges, structural sections, and heavy fabrication supported baseline volumes, but discretionary industrial fabricators delayed major purchases in response to margin compression and client budget controls. On the supply side, European mills continued to manage production schedules constrained by planned maintenance windows and environmental compliance workflows that influence available plate grades and batch sizes. Cost determinants included higher port handling and inland redistribution costs in northern European hubs, where congestion and seasonal maintenance cycles raised delivery lead times and premiums for just-in-time orders.

India: India’s steel plate pricing trend showed a modest downward movement, influenced by a combination of demand moderation in select industrial segments and continued emphasis on competitive sourcing by large infrastructure buyers. Domestic demand drivers, public infrastructure programs, steel-intensive construction and heavy equipment manufacturing, provided steady baseline consumption, but several private-sector projects moderated ordering patterns due to financing timing and contractor scheduling. Supply-side dynamics were characterized by ample domestic mill availability for standard plate sizes, with local producers maintaining commercial offers to protect market share in a price-sensitive environment. Port handling and customs had limited impact on domestically sourced plate but affected imported premium grades where duty and clearance processes added to landed cost. Currency depreciation or appreciation relative to the US dollar introduced occasional short-term volatility in import parity for specialized plate products, yet broad reliance on domestic production limited exposure.

North America: North American steel plate pricing showed slight downward pressure amid a nuanced demand profile: steady demand from energy and heavy equipment sectors was offset by softening order intake from certain manufacturing and automotive OEM segments. Demand-side dynamics were shaped by selective capital expenditure projects and a continued focus on inventory optimization among distributors and fabricators. On the supply side, regional domestic mills and plate-focused service centers ran with moderate utilization, and import flows of commodity plate provided an additional supply lever in spot markets. Principal cost drivers influencing pricing included domestic logistics and transloading fees, long-haul trucking rates and intermodal congestion influenced delivered prices notably for inland fabricators. Compliance, inspection, and material certification requirements for plate used in critical infrastructure or pressure equipment introduced incremental cost steps for specified lots.

Steel Plate Price Trend, Market Analysis, and News

IMARC's latest publication, “Steel Plate Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the steel plate market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of steel plate at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed steel plate prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting steel plate pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Steel Plate Industry Analysis

The global steel plate industry size reached USD 69.36 Billion in 2024. By 2033, IMARC Group expects the market to reach USD 87.38 Billion, at a projected CAGR of 2.47% during 2025-2033. The market is driven by the expanding infrastructure development projects worldwide, increasing demand from automotive lightweighting initiatives, growing shipbuilding and offshore energy applications, rising construction activity in emerging economies, and technological advancements in high-strength steel plate manufacturing.

Latest developments in the Steel Plate industry:

- February 2025: Swedish steelmaker SSAB unveiled the first-ever SSAB Zero™ steel plate within its renowned Hardox® product line at Bauma 2025. The highlight of the launch was Hardox® 450 wear plate manufactured using SSAB Zero™, which retained the exceptional strength, durability, and resistance to abrasion that have long established Hardox® as the global benchmark for premium wear plate.

- October 2023: Tata Steel held a groundbreaking ceremony for its upcoming 7,50,000 Tonnes per annum scrap-based electric arc furnace (EAF) steel plant in Ludhiana.

- September 2023: Tata Steel and the UK Government agreed on a proposal for the largest investment in the UK Steel Industry for the future of sustainable steelmaking in the UK.

Product Description

Steel plate is a flat-rolled steel product manufactured through hot rolling processes, characterized by its thickness typically exceeding 6mm and rectangular flat configuration. This fundamental steel product occupies a critical position in the global steel value chain, serving as an essential input material for numerous heavy industrial applications worldwide. Steel plates exhibit exceptional strength-to-weight ratios and structural integrity, making them indispensable for load-bearing applications across multiple sectors. Primary industrial applications include structural construction for buildings and bridges, pressure vessel manufacturing for chemical and energy industries, shipbuilding for marine vessel hulls and decking, heavy machinery fabrication, and offshore platform construction. The automotive sector utilizes specialized high-strength steel plates for chassis components and safety structures, while the energy sector relies on steel plates for pipeline construction, storage tank fabrication, and power generation equipment, enhancing structural performance and operational reliability across diverse industrial applications.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Steel Plate |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Steel Plate Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, Greece* North America: United States, Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of steel plate pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting steel plate price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The steel plate price charts ensure our clients remain at the forefront of the industry.

Key Questions Answered in This Report

The steel plate prices in October 2025 were 1.73 USD/Kg in Northeast Asia, 2.98 USD/Kg in Europe, 2.40 USD/Kg in India, and 3.30 USD/Kg in North America.

The steel plate pricing data is updated on a monthly basis.

We provide the pricing data primarily in the form of an Excel sheet and a PDF.

Yes, our report includes a forecast for steel plate prices.

The regions covered include North America, Europe, Asia Pacific, Middle East, and Latin America. Countries can be customized based on the request (additional charges may be applicable).

Yes, we provide both FOB and CIF prices in our report.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)