Stress Urinary Incontinence Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

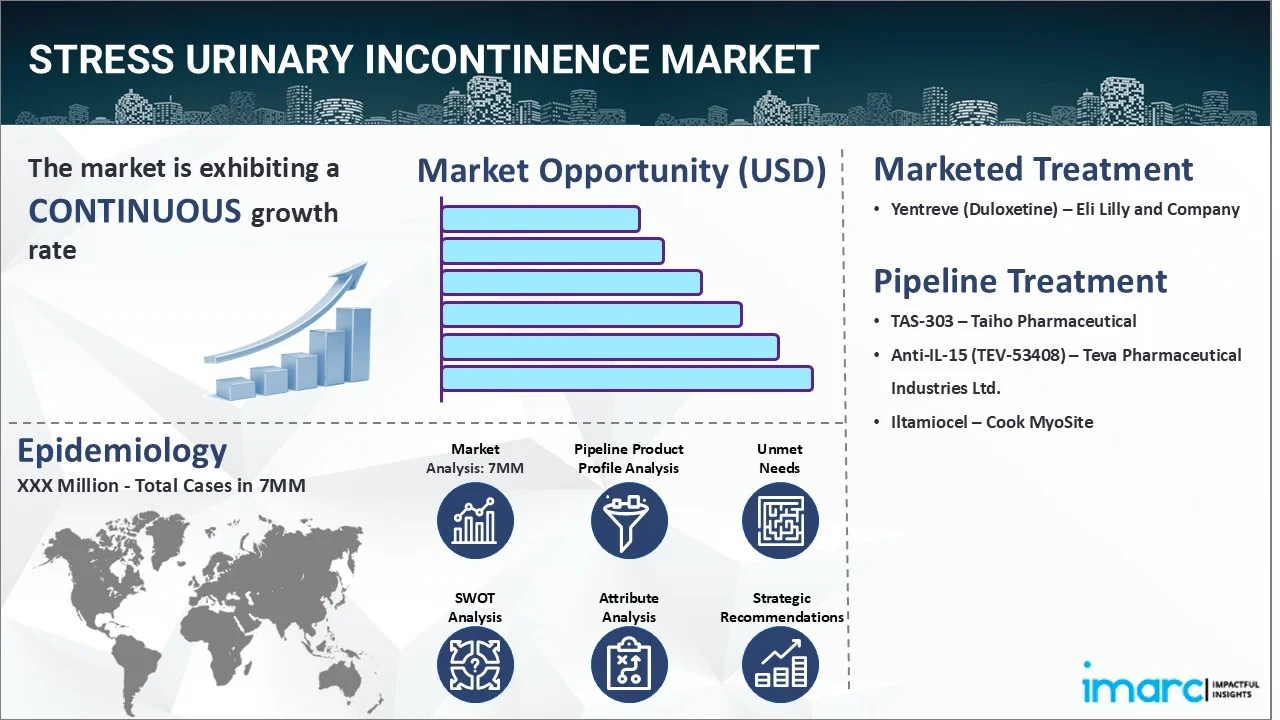

The top 7 (US, EU4, UK, and Japan) stress urinary incontinence markets are expected to exhibit a CAGR of 6.33% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2035

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2035 | 6.33% |

The stress urinary incontinence market has been comprehensively analyzed in IMARC's new report titled "Stress Urinary Incontinence Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Stress urinary incontinence is a common condition characterized by the unintentional leakage of urine during activities that put pressure on the bladder. It occurs when the muscles and tissues that support the bladder and control the release of urine become weakened or damaged. The condition is more prevalent in women, especially those who have gone through pregnancy and childbirth, but it can also affect men. The primary symptom of the ailment is the unintentional leakage of urine, which can range from a few drops to a significant amount. Diagnosing stress urinary incontinence involves a comprehensive evaluation by a healthcare professional. The diagnostic process typically includes a thorough medical history and physical examination, where the healthcare provider may assess pelvic floor muscle strength and perform tests to reproduce SUI symptoms. Additional diagnostic procedures, such as urodynamic testing, which evaluates bladder function and measures the amount of urine leakage during various activities, may be conducted. Numerous other tests may include urine analysis to rule out infections and imaging studies to evaluate the urinary tract and pelvic organs.

To get more information on this market, Request Sample

The increasing cases of vaginal delivery, which can stretch and damage pelvic floor muscles, thereby compromising their ability to provide adequate support to the bladder and urethra, are primarily driving the stress urinary incontinence market. Apart from this, the rising incidences of various associated risk factors, including hormonal changes, chronic coughing, lack of regular exercise, certain connective tissue disorders like Ehlers-Danlos syndrome, prior pelvic surgery, participation in high-impact activities, etc., are also bolstering the market growth. Furthermore, the widespread adoption of estrogen creams to restore the tissue health and elasticity of the urethral tissues, as well as reduce urine leakage, is creating a positive outlook for the market. Besides this, the escalating utilization of pelvic floor physical therapy, which uses a variety of strategies, including manual therapy, biofeedback, electrical stimulation, etc., to help patients regain control over their pelvic floor muscles and alleviate disease symptoms, is also augmenting the market growth. Additionally, the emerging popularity of neuromodulation techniques, such as sacral nerve stimulation (SNS) and percutaneous tibial nerve stimulation (PTNS), for modulating neural signals and improving urinary control is expected to drive the stress urinary incontinence market in the coming years.

IMARC Group's new report provides an exhaustive analysis of the stress urinary incontinence market in the United States, EU4 (Germany, Spain, Italy, and France), the United Kingdom, and Japan. This includes treatment practices, in-market and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for stress urinary incontinence and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario, unmet medical needs, etc., have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the stress urinary incontinence market in any manner.

Key Highlights:

- Stress urinary incontinence, the most common type of incontinence among women, affects an estimated 15 million adult women in the United States.

- Stress urinary continence has an observed prevalence of 4% to 35%.

- Women over 60 were more likely to experience urge incontinence, while younger women were more likely to experience stress urinary continence.

- In women over 30, the prevalence of stress urinary continence is 24-45%.

Drugs:

Yentreve (duloxetine) is a dual reuptake inhibitor that balances serotonin and norepinephrine levels. The medicine treats stress urine incontinence by inhibiting the reuptake of serotonin and norepinephrine in the spinal cord, which encourages greater activity of the pudendal nerve that controls the external urethral sphincter. This stimulation is anticipated to promote contraction of the external urethral sphincter, hence reducing unintentional pee leaks during physical activity.

TAS-303 is a small-molecule drug developed by Taiho Pharmaceutical to treat stress urinary incontinence. It's a selective norepinephrine reuptake inhibitor that increases urethral pressure in rats, which may indicate its potential as a therapeutic agent for stress urinary incontinence.

Iltamiocel, also known as Autologous Muscle Derived Cells for Urinary Sphincter Repair (AMDC-USR), is a cell therapy used to treat stress urinary incontinence in women. It works by injecting a suspension of a patient's own (autologous) muscle-derived cells into the tissues surrounding the urethra. These cells are thought to regenerate and strengthen the damaged or weakened muscle tissue, improving urethral closure and reducing urine leakage.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the stress urinary incontinence market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the stress urinary incontinence market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current stress urinary incontinence marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Yentreve (Duloxetine) | Eli Lilly and Company |

| TAS-303 | Taiho Pharmaceutical |

| Iltamiocel | Cook MyoSite |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the stress urinary incontinence market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the stress urinary incontinence across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the stress urinary incontinence across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of stress urinary incontinence across the seven major markets?

- What is the number of prevalent cases (2019-2035) of stress urinary incontinence by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of stress urinary incontinence by gender across the seven major markets?

- What is the number of prevalent cases (2019-2035) of stress urinary incontinence by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with stress urinary incontinence across the seven major markets?

- What is the size of the stress urinary incontinence patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend stress urinary incontinence of?

- What will be the growth rate of patients across the seven major markets?

Stress Urinary Incontinence: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for stress urinary incontinence drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the stress urinary incontinence market?

- What are the key regulatory events related to the stress urinary incontinence market?

- What is the structure of clinical trial landscape by status related to the stress urinary incontinence market?

- What is the structure of clinical trial landscape by phase related to the stress urinary incontinence market?

- What is the structure of clinical trial landscape by route of administration related to the stress urinary incontinence market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)