Submersible Pumps Market Report by Type (Open Well, Borewell, Non-Clog), Operation (Single Stage, Multi-Stage), Power Rating (Low, Medium, High), Application (Water & Wastewater, Mining & Construction, Pulp & Paper, Energy & Power, Food & Beverages, Chemicals & Pharmaceuticals, and Others), and Region 2025-2033

Submersible Pumps Market Size:

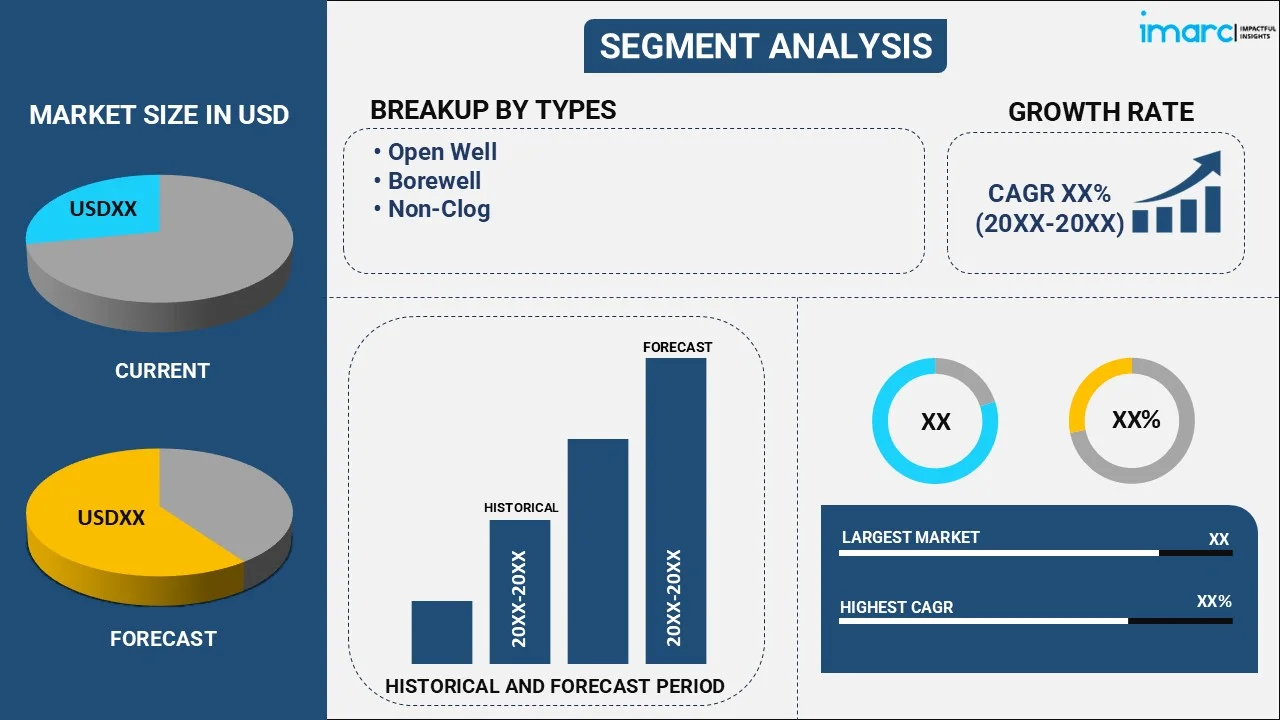

The global submersible pumps market size reached USD 13.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 19.9 Billion by 2033, exhibiting a growth rate (CAGR) of 4.4% during 2025-2033. The market is experiencing steady growth driven by the escalating demand for efficient water management systems, rising need for the extraction of oil and natural gas from deep underwater reservoirs, and increasing utilization of efficient irrigation systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 13.5 Billion |

|

Market Forecast in 2033

|

USD 19.9 Billion |

| Market Growth Rate 2025-2033 | 4.4% |

Submersible Pumps Market Analysis:

- Market Growth and Size: The market is witnessing stable growth, driven by rapid urbanization and industrialization, along with the rising need for efficient water management systems. The increasing demand for submersible pumps in water supply and wastewater management projects is also impelling the market growth.

- Technological Advancements: The development of smart submersible pumps with remote monitoring capabilities is propelling the market growth. Energy-efficient pump designs and materials are also used to enhance performance and durability.

- Industry Applications: The market is experiencing a rise in the demand from diverse industries, including agriculture, oil and gas, mining, water and wastewater, and construction. The shift towards the use of solar-powered submersible pumps in remote and off-grid areas is propelling the market growth.

- Geographical Trends: Asia Pacific leads the market on account of agricultural and industrial development. However, North America is emerging as a fast-growing market, driven by the rising need to replace and modernize aging infrastructure.

- Competitive Landscape: Key players are focusing on offering a wide range of pumps designed for applications, such as residential, commercial, and industrial water management. They are also introducing pumps with high reliability and performance in demanding environments.

- Challenges and Opportunities: While the market faces challenges, such as environmental concerns related to energy consumption and maintenance, it also encounters opportunities in expanding market presence in emerging economies and developing sustainable and energy-efficient pumps.

- Future Outlook: The future of the submersible pumps market looks promising, with rapid urbanization and the need for efficient water management. Sustainability and innovation will play a crucial role in shaping the future of this market.

To get more information on this market, Request Sample

Submersible Pumps Market Trends:

Increasing demand for efficient water management

The growing demand for efficient water management systems is offering a favorable market outlook. As urbanization and industrialization are rising, the need for effective water supply and wastewater management is increasing. Submersible pumps play a crucial role in providing reliable water distribution and drainage solutions. In urban areas, these pumps are used for municipal water supply, ensuring a consistent and uninterrupted flow of clean water to households and businesses. Additionally, submersible pumps are employed in wastewater treatment plants, facilitating the efficient removal of sewage and the treatment of wastewater before discharge. In agricultural activities, submersible pumps are vital for irrigation systems, helping farmers optimize water usage and improve crop yields.

Expansion of oil and gas exploration and production

The expansion of oil and gas exploration and production activities is facilitating the growth of the market. Submersible pumps play a crucial role in the extraction of oil and natural gas from deep underwater reservoirs. These pumps are designed to operate efficiently in harsh and challenging environments, making them indispensable for the energy industry. In offshore drilling operations, submersible pumps are utilized to lift crude oil, natural gas, and water from deep-sea wells. They are engineered to withstand high pressures and corrosive substances commonly found in subsea environments. The reliability and performance of submersible pumps are critical to ensure uninterrupted production in offshore oil rigs.

Thriving construction industry

Submersible pumps are essential tools in construction projects, particularly for dewatering purposes. They are used to remove excess water from construction sites, foundations, and excavations, ensuring a safe and stable working environment. In urban and infrastructure development, submersible pumps are employed to manage water levels during building construction, subway tunneling, and roadwork. These pumps help prevent flooding, soil erosion, and structural damage caused by water accumulation. Furthermore, the construction of underground facilities, such as basements, parking garages, and underground utilities often require the continuous operation of submersible pumps to keep excavation sites dry and safe.

Agricultural modernization and irrigation needs

Agricultural modernization and the increasing demand for efficient irrigation systems are strengthening the growth of the market. Agriculture is a fundamental sector in many countries, and the need for reliable water supply is crucial for crop cultivation. Submersible pumps are widely adopted in agriculture for their ability to efficiently lift and distribute water for irrigation.

These pumps are used to draw water from underground sources, such as wells, boreholes, and reservoirs, delivering it directly to fields. The ability of submersible pumps to get submerged in water makes them ideal for such applications. Submersible pumps enable farmers to optimize water usage, reduce manual labor, and improve crop yields.

Submersible Pumps Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, operation, power rating, and application.

Breakup by Type:

- Open Well

- Borewell

- Non-Clog

Borewell accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes open well, borewell, and non-clog. According to the report, borewell represented the largest segment.

Borewell submersible pumps are specifically designed for installation in boreholes or deep wells. They are known for their ability to efficiently lift water from significant depths, making them essential for agricultural irrigation, industrial processes, and municipal water supply systems. They are characterized by their robust construction, which allows them to operate effectively under high pressure and in harsh underground conditions. The versatility and reliability of borewell submersible pumps in accessing deep water sources are making them the preferred choice for various applications, contributing to the growth of the market.

Open well submersible pumps are designed for use in open wells, reservoirs, or tanks. They are typically used in situations where the water source is closer to the surface. These pumps are known for their ease of installation and maintenance. They are commonly employed in rural and agricultural settings to provide water for irrigation, livestock, and domestic use. They can efficiently draw water from shallow sources and distribute it for various purposes, making them an asset in regions with accessible groundwater.

Non-clog submersible pumps are specialized pumps designed to handle wastewater and fluids with high solids content without clogging. They are extensively used in municipal sewage treatment plants, industrial wastewater management, and drainage systems. These pumps feature robust impellers and passages that prevent the accumulation of debris and solids, ensuring uninterrupted flow and reducing the need for frequent maintenance. The non-clog segment addresses the critical requirement of efficiently managing wastewater, which is essential for maintaining public health and environmental standards, particularly in densely populated urban areas.

Breakup by Operation:

- Single Stage

- Multi-Stage

Single stage exhibits a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the operation. This includes single stage and multi-stage. According to the report, single stage represented the largest segment.

Single stage submersible pumps are characterized by their simplicity and efficiency in pumping fluids from a single impeller stage. They are widely used for various applications, including water supply, irrigation, residential and commercial drainage, and industrial processes. Single stage pumps are favored for their ease of maintenance and cost-effectiveness, making them a popular choice for both domestic and industrial users. They can handle a wide range of flow rates and are well-suited for pumping clean or slightly contaminated liquids. The simplicity of design and operation of these pumps are impelling the growth of the market.

Multi-stage submersible pumps are designed with multiple impeller stages stacked together within the pump housing. These pumps are engineered to provide higher pressure and greater head lift capabilities compared to single stage pumps. They are commonly used in applications where the water source is deep or where there is a need to pump water over long distances with significant elevation changes. Multi-stage submersible pumps are frequently employed in industrial processes, deep well water supply, and pressurized irrigation systems. The ability of these pumps to deliver water at higher pressures makes them suitable for applications requiring increased force, such as transferring water to elevated storage tanks or powering high-pressure spray systems.

Breakup by Power Rating:

- Low

- Medium

- High

Medium holds the largest share in the industry

A detailed breakup and analysis of the market based on the power rating have also been provided in the report. This includes low, medium, and high. According to the report, medium accounted for the largest market share.

Medium power-rated submersible pumps have power ratings ranging from a few kilowatts to several tens of kilowatts. They are versatile and commonly used in a wide range of applications, including residential and commercial water supply, irrigation, wastewater management, and industrial processes. Medium power-rated pumps create a balance between efficiency and capacity, making them suitable for both standard and moderately demanding tasks. They are often the preferred choice for users seeking reliable and cost-effective solutions that meet their water transfer and drainage needs.

Low power-rated submersible pumps are designed with lower power ratings, usually ranging from a few hundred watts to a few kilowatts. These pumps are ideal for applications where a lower flow rate and pressure head are sufficient, such as small-scale residential water supply, decorative fountains, and groundwater monitoring. They need lower power requirements that make them energy-efficient and cost-effective for tasks with lower demands. Low power-rated submersible pumps are characterized by their simplicity and ease of installation, making them suitable for various domestic and specialized uses.

High power-rated submersible pumps are engineered with substantial power ratings, often exceeding several tens of kilowatts to megawatts. These pumps are used in demanding industrial and municipal applications, such as large-scale water supply, wastewater treatment, mining dewatering, and deep-sea oil extraction. High power-rated pumps are capable of handling high flow rates and delivering water over long distances or at extreme depths. The robust design and powerful motors of these pumps enable them to tackle challenging tasks that require substantial force and capacity, ensuring efficient and reliable operation in critical environments.

Breakup by Application:

- Water and Wastewater

- Mining and Construction

- Pulp and Paper

- Energy and Power

- Food and Beverages

- Chemicals and Pharmaceuticals

- Others

Water and wastewater represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes water and wastewater, mining and construction, pulp and paper, energy and power, food and beverages, chemicals and pharmaceuticals, and others. According to the report, water and wastewater represented the largest segment.

Submersible pumps are extensively utilized in the water and wastewater sector for various purposes, including the supply of clean water to municipalities and industrial facilities, and the management of wastewater in treatment plants. These pumps play a critical role in ensuring the availability of safe drinking water and in treating and disposing of wastewater in an environmentally responsible manner. They are known for their efficiency and reliability in handling water-related applications, making them essential in addressing global water supply and sanitation challenges.

In the mining and construction segment, submersible pumps are used to handle dewatering tasks in mines, tunnels, and construction sites. These pumps efficiently remove groundwater, preventing flooding and maintaining safe working conditions. The ability of submersible pumps to operate in challenging environments, including underground, makes them indispensable in mining and construction operations. Submersible pumps contribute to efficient excavation, tunneling, and foundation work, supporting these industries in achieving their project goals.

Submersible pumps find application in the pulp and paper industry, particularly in paper mill wastewater treatment and paper pulp processing. They help manage the flow of liquids containing pulp, paper fibers, and chemicals. The reliable performance of these pumps is crucial in maintaining the continuity of the production process and ensuring the efficient handling of waste materials.

In the energy and power sector, submersible pumps are used in various applications, including cooling water circulation in power plants, offshore oil extraction, and geothermal energy production. These pumps are designed to withstand harsh conditions, such as exposure to seawater and corrosive substances, making them suitable for critical energy-related tasks.

Submersible pumps also play a role in the food and beverage (F&B) industry, where they are used for transferring liquids, including beverages, dairy products, and food ingredients. These pumps meet strict hygiene and sanitation requirements and contribute to efficient production processes in the food and beverage (F&B) manufacturing sector.

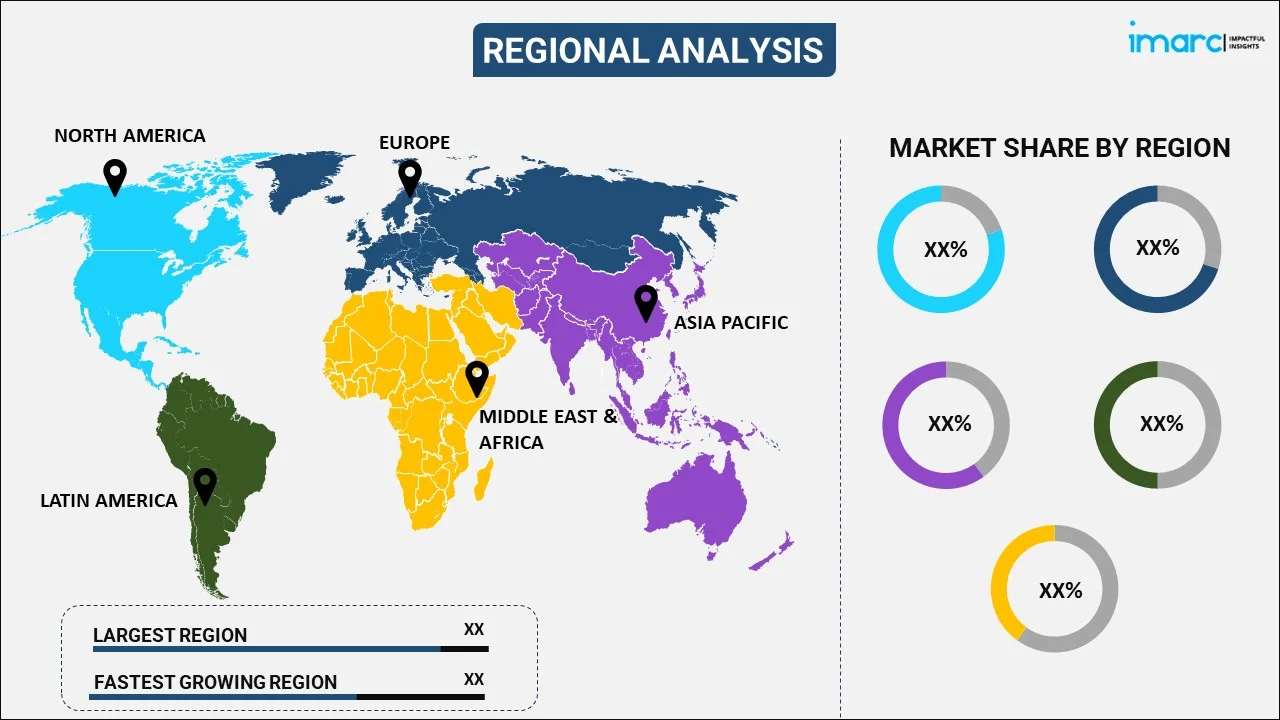

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest submersible pumps market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share due to rapid urbanization, industrialization, and agricultural expansion, particularly in countries like China and India. These nations have a substantial demand for submersible pumps in water supply, irrigation, construction, and industrial processes. In addition, the growing demand for submersible pumps on account of considerable efforts to improve water infrastructure and address water scarcity issues is offering a favorable market outlook in the region.

North America represents a mature submersible pumps market, driven by the replacement and modernization of existing infrastructure. These pumps are used in various applications, including municipal water supply, wastewater management, and oil and gas extraction. Environmental concerns and the need for energy-efficient solutions are propelling the growth of the market, with a focus on sustainability and technological advancements.

The submersible pumps market in Europe is characterized by its emphasis on energy efficiency and environmental sustainability. Countries in the region are prioritizing water management and wastewater treatment, driving the demand for submersible pumps. Additionally, the construction industry plays a significant role in the market, with pumps used for dewatering purposes in underground construction projects.

Latin America has a growing submersible pumps market due to rapid urbanization and infrastructure development. These pumps are used for water supply, irrigation, and mining activities in the region.

The Middle East and Africa region exhibit demand for submersible pumps, driven by the burgeoning oil and gas industry, along with the need for efficient water management in arid areas. Submersible pumps are used in various sectors, including agriculture, construction, and municipal services, to address water supply and wastewater challenges.

Leading Key Players in the Submersible Pumps Industry:

Key players in the market are actively engaged in several strategic initiatives to maintain and expand their market presence. These initiatives include continuous product innovation to develop more energy-efficient and environment friendly submersible pumps, often incorporating advanced materials and smart technologies for remote monitoring and control. Additionally, companies are focusing on expanding their global reach through strategic partnerships, acquisitions, and distribution agreements. They are also investing in research and development (R&D) activities to address specific industry needs, such as submersible pumps designed for offshore oil extraction, deep well drilling, and high-pressure applications. Furthermore, companies are increasingly emphasizing on sustainability and corporate social responsibility by offering pumps that align with green and eco-friendly practices, meeting the growing demand for environment conscious solutions in the submersible pumps market.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Atlas Copco

- Flowserve Corporation

- Grundfos Holding A/S

- ITT Gould’s Pumps Inc.

- Kirloskar Brothers Limited

- KSB Aktiengesellschaft

- Schlumberger

- Sulzer AG

- Weir Group Plc.

- Wilo SE

- Xylem Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- February 21, 2023: Atlas Copco developed a new versatile range of electric self-priming dewatering pumps for a wide variety of applications like sewage bypass, quarry/mine dewatering, and urban construction projects with access to a power source. E-pumps successfully manage demanding flows and large solids with a reduced CO2 footprint and lower total cost of ownership (TCO).

- October 18, 2023: Kirloskar Brothers Limited, a pioneer in fluid management solutions, announced the launch of its latest innovation, the ANIIKA-I and ANISA-I, I HP mini-series pumps. These state-of-the-art pumps mark a significant advancement in fluid handling technology, catering to the diverse needs of industries and households. They are manufactured from a superior Cathodic electro-deposited (CED) coating and ensure unmatched corrosion resistance and durability in challenging environments.

- October, 2023: KSB Aktiengesellschaft launched a new submersible pump in discharge tube with open multi-vane impeller, known as AmaCan D. Its main application is transporting large volumes of municipal or industrial water and wastewater from stormwater, drainage and irrigation pumping stations.

Submersible Pumps Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Open Well, Borewell, Non-Clog |

| Operations Covered | Single Stage, Multi-Stage |

| Power Ratings Covered | Low, Medium, High |

| Applications Covered | Water and Wastewater, Mining and Construction, Pulp and Paper, Energy and Power, Food and Beverages, Chemicals and Pharmaceuticals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Atlas Copco, Flowserve Corporation, Grundfos Holding A/S, ITT Gould’s Pumps Inc., Kirloskar Brothers Limited, KSB Aktiengesellschaft, Schlumberger, Sulzer AG, Weir Group Plc., Wilo SE, Xylem Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the submersible pumps market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global submersible pumps market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the submersible pumps industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global submersible pumps market was valued at USD 13.5 Billion in 2024.

We expect the global submersible pumps market to exhibit a CAGR of 4.4% during 2025-2033.

The rising adoption of submersible pumps to conduct extraction activities in deep-sea reserves, along with the introduction of product variants with improved operational efficiencies, is primarily driving the global submersible pumps market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous end-use industries for submersible pumps.

Based on the type, the global submersible pumps market has been segmented into open well, borewell, and non-clog. Currently, borewell holds the majority of the total market share.

Based on the operation, the global submersible pumps market can be divided into single stage and multi-stage, where single stage currently exhibits a clear dominance in the market.

Based on the power rating, the global submersible pumps market has been categorized into low, medium, and high. Among these, medium accounts for the majority of the global market share.

Based on the application, the global submersible pumps market can be segregated into water & wastewater, mining & construction, pulp & paper, energy & power, food & beverages, chemicals & pharmaceuticals, and others. Currently, the water & wastewater sector holds the largest market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

Some of the major players in the global submersible pumps market include Atlas Copco, Flowserve Corporation, Grundfos Holding A/S, ITT Gould’s Pumps Inc., Kirloskar Brothers Limited, KSB Aktiengesellschaft, Schlumberger, Sulzer AG, Weir Group Plc., Wilo SE, Xylem Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)