Sugar Market Size, Share, Trends and Forecast by Product Type, Form, End-Use Sector, Source, and Region, 2025-2033

Sugar Market Size and Share:

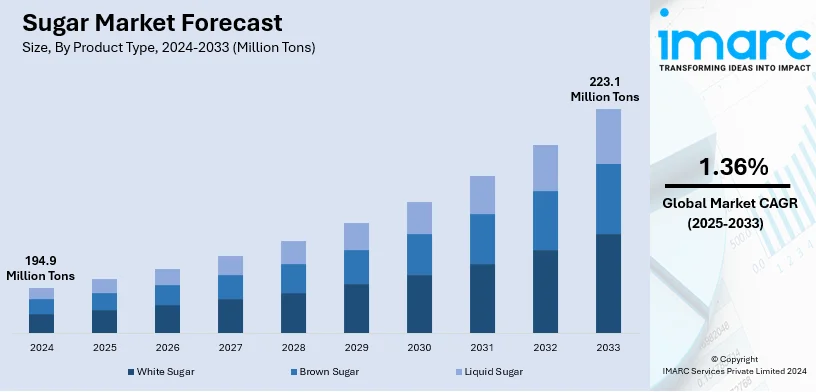

The global sugar market size was valued at 194.9 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 223.1 Million Tons by 2033, exhibiting a CAGR of 1.36% during 2025-2033. Brazil currently dominates the market, holding a significant market share of 25.0% in 2024. The growing consumption of various processed food products among individuals, rising adoption in the pharmaceutical industry, and wide availability through various distribution channels represents some of the major factors bolstering the growth of the market in Brazil.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 194.9 Million Tons |

| Market Forecast in 2033 | 223.1 Million Tons |

| Market Growth Rate 2025-2033 | 1.36% |

A key factor that is catalyzing the market for sugar is the growing consumption of processed foods and drinks. Soft drinks, confectionery, bakery, snacks and many other items contain sugars as an ingredient. A rise in population especially in urban areas and shift of diets from traditional meals to junk foods and convenience food has led to higher demand for sugar since most these foods rely on sugar for flavor and preservation. Another factor considered is the increase in the food service market particularly in the developing countries to which demand on sugar is still escalating. The case of sugar is that the demand is highly responsive to other consumption patterns that incline toward sweet and luxurious food and drinks products.

The United States has emerged as a key regional market for sugar. Due to expansion in confectionery and bakery sectors, sugar market in United States is experiencing significant growth. These industries have been growing because of higher disposable income, higher spending and inclination toward quality and gourmet foods and beverages, and beverages. Sugar is an essential ingredient in cakes, pastries, chocolates, candies, etc., its consumption depends on the growth in cake, pastries, chocolates, and candies markets. Foods containing sugar also incorporate more sugar during festivities, events, and other festivities and celebrations. Many novelties at the moment within the industry such as low calorie and exotically flavored products also help to preserve the demand for sugar in US.

Sugar Market Trends:

Increasing consumption of beverages

One of the major uses of sugar is to enhance the taste and color of beverages that require incorporation of this substance. It also contributes to increasing the flavour, and texture as well as improving shelf-life, moderating acidity and lending viscosity or thickness across different types of beverages. In addition to this, increasing number of requests for numerous types of drinks including mojitos, cocktails, mocktails, energy drinks, sports drinks, and shakes, among different people across the world is also fostering the sugar market. A survey among the consumers and cocktails in 2022 reported that 45% of Indians have a desire to consume cocktails with high spirits and flavors. Further, the rising daily consumption of sugar in tea and coffee in households is a factor that increases the market growth significantly. Thus, the consumer preferences and increasing demand for diverse beverage options are significantly influencing the sugar industry trends, reflecting in higher sugar utilization for flavor enhancement and functional benefits in drinks.

Rising sales of personal care products

The rising consumer preference for natural ingredients in personal care products that do not harm the skin or cause allergies is strengthening the growth of the market. The global beauty and personal care products market size reached USD 529.5 Billion in 2024. As a result, there is a rise in the demand for sugar in scrubs as it assists in providing smooth and moisturized skin while reducing the signs of aging. It also aids in removing layers of dead cells on the skin and adding silky texture to hair by preventing limpness. This, coupled with the increasing utilization of sugar to lighten and brighten the skin tone, is propelling the market growth. The global sugar market trends are increasingly influenced by the shift towards natural cosmetic ingredients, with sugar being a key component in skincare and haircare products for its exfoliating and hydrating properties.

Wide availability through different distribution channels

At present, the wide availability of sugar across various distribution channels is strengthening the growth of the market. Moreover, sugar is economical, and its easy availability provides convenience and comfort to individuals across the globe. According to the NIH, the population in United States consumes around 300% of daily recommended intake of sugar. In line with this, it is an essential product that is utilized daily and available in different colors, forms, and textures to attract a wide consumer base. Apart from this, the rising sales of sugar through online platforms around the world is propelling the growth of the market. Furthermore, the sugar industry reports highlight the role of enhanced distribution channels, online sales growth, and consumer accessibility in driving the sustained expansion of the market.

Sugar Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global sugar market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, form, end-use sector, and source.

Analysis by Product Type:

- White Sugar

- Brown Sugar

- Liquid Sugar

White sugar dominates the sugar market with 67.5% in 2024. White sugar holds the biggest sugar market share owing to its extensive application in various industries and homes. Its elegant character and mild flavor render it extremely adaptable, appropriate for various uses including baking, sweets, drinks, and processed foods. White sugar's ability to dissolve quickly and blend seamlessly enhances its appeal for both industrial and home cooking purposes.

Brown sugar provides a plentiful source of minerals like iron and calcium, and it differs in color and taste when compared to white sugar. It helps lessen fatigue and support the maintenance of healthy red blood cells (RBCs) in the body. In addition to this, the increasing popularity of brown sugar among health-aware individuals, due to its role in enhancing bone and dental health, is driving the market's expansion.

Liquid sugar is typically employed to improve the flavor and appearance of different food items, especially baked goods. Moreover, it helps to avoid food dehydration and prolongs the freshness of various items.

Analysis by Form:

- Granulated Sugar

- Powdered Sugar

- Syrup Sugar

Granulated sugar leads the market with around 79.0% of market share in 2024. Granulated sugar is white in color, undergoes processing and is widely available in the form of grains. It easily dissolves, melts, and blends in a variety of other ingredients. Moreover, it is extracted from sugar beets or sugarcane and utilized to prepare desserts.

Powdered sugar easily dissolves at room temperature and provides a smooth texture to the product. In addition, it is used in cakes, cookies, and muffins as an alternative to regular granulated sugar.

Syrup sugar is less processed, has a lower glycemic index and a longer shelf life as compared to granulated sugar. Moreover, the rising preference for syrup sugar in beverages and baked goods due to its easy dissolving property is offering a favorable sugar market outlook.

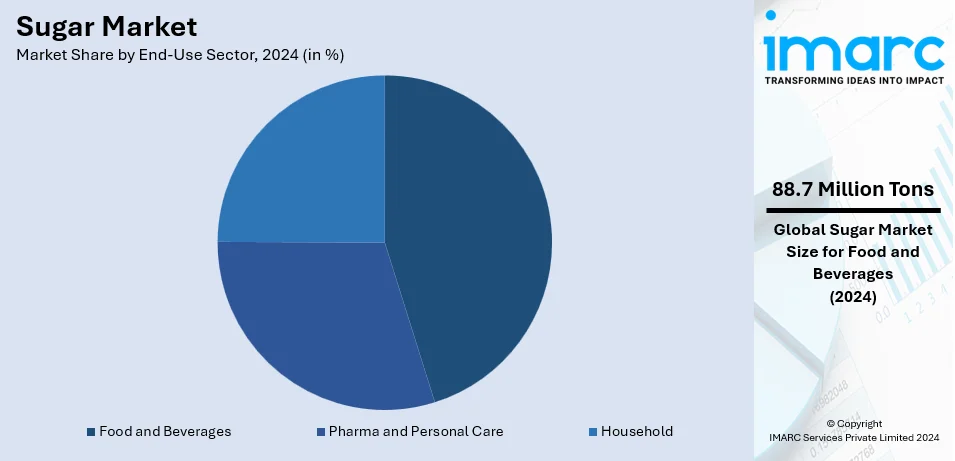

Analysis by End-Use Sector:

- Food and Beverages

- Pharma and Personal Care

- Household

Food and beverages leads the market with around 45.5% of market share in 2024. Sugar is extensively used in the F&B sector due to the increasing demand for beverages among individuals across the globe. In line with this, it finds application in the production of bakery products, such as cakes, cookies, ice creams, and chocolate bars, which is contributing to the growth of the market.

It is also utilized in pharma as an excipient to add bulk and consistency to tablets, and assist with appearance and ease of transport and storage. Besides this, it is used in personal care products on account of its exfoliating capabilities.

Sugar is also used to prepare daily beverage items, such as tea, coffee, juice, and milkshakes in households. In addition, the growing demand for sugar, as it assists in enhancing the flavor of a product by providing a sweet taste, is creating a positive market outlook.

Analysis by Source:

- Sugarcane

- Sugar Beet

As per the sugar industry market research, sugarcane leads the market with around 77.8% of market share in 2024. Sugarcane is the primary crop that is utilized in the production of sugar and mainly cultivated in tropical and sub-tropical regions. Sugarcane juice is extracted, purified, filtered, and crystalized into raw sugar. Technological advancements in the production of sugarcane crops to enhance their quality and yield is impelling the growth of the market. There is a rise in the utilization of sugarcane due to the increasing demand for sugar among individuals around the world.

Sugar beet is swiftly becoming more popular because it requires less water than sugarcane, driving market expansion. Moreover, prominent manufacturers are promoting the use of sugar beet by building factories or production facilities, thereby driving market growth.

Regional Analysis:

- Brazil

- India

- United States

- European Union

- China

- Thailand

- Others

In 2024, Brazil accounted for the largest market share of over 25.0%. Brazil held the biggest sugar market share as it is the leading producer of sugar due to the favorable climatic conditions. Moreover, governing agencies of the country are implementing stringent rules and regulations and providing subsidies to encourage local output, which is supporting the growth of the market. In addition, the growing demand for beverages and confectioneries among individuals in the country is offering a favorable market outlook.

Apart from this, other countries, such as India and the United States are also witnessing increasing demand for sugar on account of the rising adoption of processed food products among the masses.

Key Regional Takeaways:

United States Sugar Market Analysis

In 2024, the United States accounts for over 73.70% of the sugar market in North America. The sugar market in the United States is driven by the growing demand for sugar in the food and beverage industry, with significant consumption in soft drinks, snacks, and processed foods. However, there is a noticeable shift towards health-conscious behaviors. As per CDCP, more than 63% of adults aged 18 or older stated drinking sugar-sweetened beverages once or more daily. Also, according to the Agriculture and Agrifood, Canada, baked goods sales in the United States increased at a CAGR of 5.9%. Thus, the rising baked goods is also driving the market growth. The rising production of biofuels, particularly ethanol from sugarcane and corn, further supports the market’s growth, especially due to government incentives. Trade policies, such as tariffs on sugar imports, also impact domestic producers and consumer prices. Despite the health trend, sugar remains a dominant ingredient, and evolving consumer preferences are expected to shape future market dynamics.

Asia Pacific Sugar Market Analysis

The sugar market in the Asia-Pacific (APAC) region is primarily driven by the expanding food and beverage industry, particularly in rapidly urbanizing countries like China and India. With India’s urban population projected to reach 675 Million by 2035, becoming the second-largest urban population globally after China, the demand for sugar is expected to surge. This growth, accelerated by changing lifestyles post-COVID-19, is particularly evident in the rising consumption of processed foods and beverages, which require substantial sugar inputs. While the pandemic temporarily slowed urbanization, global urban population growth, projected to add 2.2 Billion people by 2050, is expected to reignite demand for sugar-based products. In addition, strong local sugar production in countries like India, Thailand, and China, combined with government support for sugarcane farming, continues to drive market expansion.

Europe Sugar Market Analysis

In Europe, the sugar market remains robust, primarily driven by the high consumption of sugar in the food and beverage industry, particularly within confectionery, baked goods, and beverages. Germany is the second-largest consumer of sugar globally, with the average German consuming 102.9 Grams of sugar daily, according to the Washington Post. This high level of consumption highlights the region's strong reliance on sugar, especially in processed foods and drinks. The sugar beet industry is also a critical contributor to Europe's sugar market, with countries like France, Germany, and the UK playing a significant role in its production. The EU's common agricultural policy, which provides subsidies to local sugar producers, helps ensure a stable and consistent supply of sugar within the region. Additionally, the increasing production of biofuels, driven by renewable energy targets, has further bolstered the demand for sugar beets and sugarcane for ethanol production, thus supporting overall market growth. The combination of high domestic consumption, strong industry infrastructure, and government support helps maintain a thriving sugar market in Europe.

Latin America Sugar Market Analysis

In Latin America, the sugar market is primarily driven by large-scale sugarcane production, with Brazil leading as one of the world’s largest producers. Brazil’s sugarcane fields performed exceptionally well in the marketing year from April 2023 to March 2024, producing a record 705 Million Metric Tons (MMT). This remarkable production supports both the domestic demand for sugar and the export market. The shift towards more modern and urban lifestyles increases the consumption of confectionery, baked goods, and beverages, driving continued growth in the region's sugar market. Additionally, the growing popularity of biofuels, particularly ethanol derived from sugarcane, continues to be a significant driver in countries like Brazil and Argentina.

Middle East and Africa Sugar Market Analysis

In the Middle East, the sugar market is influenced by the increasing demand for sugar in food and beverages, particularly in countries with rapidly growing urban populations like Saudi Arabia and the UAE. The Gulf Cooperation Council (GCC) region is one of the most highly urbanized areas globally, with 85% of the population currently living in cities, a figure expected to rise to 90% by 2050. This urbanization, along with rising disposable incomes, is driving the consumption of processed and sugary foods.

Competitive Landscape:

Leading sugar manufacturers are broadening their product ranges beyond conventional white sugar to encompass brown sugar, organic sugar, liquid sugar, and specialty sugars such as icing sugar. These items target specialized markets like health-aware consumers and the food and drink sector, enabling businesses to access new income sources. Additionally, due to increasing environmental issues, major stakeholders are embracing sustainable methods, such as eco-friendly agricultural practices, conserving water, and encouraging renewable energy in sugar manufacturing. This not only matches consumer preferences for ethical goods but also assists companies in adhering to stricter environmental regulations. Furthermore, companies are enhancing their international reach by tapping into emerging markets in Asia, Africa, and South America, where there is an increase in sugar consumption. This involves setting up new manufacturing plants, collaborating with regional distributors, and focusing on rapidly expanding sectors such as packaged food and drinks.

The report provides a comprehensive analysis of the competitive landscape in the sugar market with detailed profiles of all major companies, including:

- Al Khaleej Sugar

- Associated British Foods plc

- Canal Sugar

- Dwarikesh Sugar Industries Limited

- Lantic Inc.

- Louis Dreyfus Company

- Michigan Sugar Company

- Mitr Phol Sugar Co., Ltd.

- Nordzucker

- Rajshree Sugars & Chemicals Ltd

- Suedzucker AG

- Tereos

- Thai Roong Ruang Group

- Wilmar International Limited

Latest News and Developments:

- January 2025: Kodiak introduced a special edition of Apple Brown Sugar Pecan Oatmeal, which contains 14 grams of protein, prebiotic fiber, and healthy components such as chia and pumpkin seeds. The product seeks to provide a more nutritious breakfast choice while encouraging outdoor activities and safeguarding the environment.

- December 2024: Dunkin’ introduced "Sabrina’s Brown Sugar Shakin’ Espresso," a seasonal iced drink developed in partnership with singer Sabrina Carpenter. The beverage blends Dunkin's strong espresso, brown sugar, and oat milk, accompanied by an entertaining advertisement featuring Carpenter.

- September 2024: GoodSAM Foods launched a new line of organic chocolate bars using raw cane sugar, chocolate-coated nuts, and fruit. These products are made from cacao and cane sugar that are farmed using regenerative farming, which supports sustainability and fair trade principles.

- June 2024: Amul has said it plans to expand its range of organic products with the introduction of organic sugar, jaggery, and tea next month. The company is eyeing the Indian market, which currently stands at $1.3 billion and is expected to rise to $4.6 billion by 2028.

- June 2024: The Gujarat Cooperative Milk Marketing Federation has expanded the portfolio of organic products it offers by launching sugar, jaggery, and tea. It now offers 24 products to its consumers, including wheat flour, rice, and pulses, and is looking for an expansion in its product portfolio. The managing director verified the imminent launch.

- March 2024: Food technology firm Incredo, Inc. has introduced Incredo Sugar G2, a potent variant of its acclaimed sugar reduction product, Incredo Sugar. This sugar-carrier complex, which is clean-label and patent-pending, is intended for application in baked items, chocolates, spreads, and gummies. Incredo Sugar G2 is now accessible to food producers and CPGs in North America and Europe.

Sugar Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | White Sugar, Brown Sugar, Liquid Sugar |

| Forms Covered | Granulated Sugar, Powdered Sugar, Syrup Sugar |

| End-Use Sectors Covered | Food and Beverages, Pharma and Personal Care, Household |

| Sources Covered | Sugarcane, Sugar Beet |

| Regions/Countries Covered | European Union, Brazil, India, United States, China, Thailand |

| Companies Covered | Al Khaleej Sugar, Associated British Foods plc, Canal Sugar, Dwarikesh Sugar Industries Limited, Lantic Inc., Louis Dreyfus Company, Michigan Sugar Company, Mitr Phol Sugar Co., Ltd., Nordzucker, Rajshree Sugars & Chemicals Ltd, Suedzucker AG, Tereos, Thai Roong Ruang Group, Wilmar International Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sugar market from 2019-2033.

- The sugar market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sugar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Sugar is a type of carbohydrate that provides energy to the body. It is a naturally occurring substance found in many foods, including fruits, vegetables, and dairy products. Chemically, sugar is composed of carbon, hydrogen, and oxygen atoms, and it exists in various forms such as glucose, fructose, and sucrose.

The sugar market was valued at 194.9 Million Tons in 2024.

IMARC estimates the global sugar market to exhibit a CAGR of 1.36% during 2025-2033.

The wide availability through various distribution channels, growing consumption of various processed food products among individuals, and rising adoption in the pharmaceutical industry represents some of the major factors bolstering the growth of the market.

In 2024, white sugar represented the largest segment by product type, driven by its usage in producing numerous bakery products and rising adoption in cafes, restaurants, hotels, bakeries, and other food chain stores.

Granulated sugar leads the market by form owing to its blending properties in various ingredients as is extracted from sugar beets or sugarcane and utilized to prepare desserts.

The food and beverages represent the leading segment by end use sector, driven by rising usage of sugar in various food items. Moreover, it finds application in the production of bakery products such as cookies, ice creams, cakes and chocolate bars.

Sugarcane is the leading segment by source as sugarcane is the primary crop that is utilized to produce sugar and is mainly cultivated in tropical and sub-tropical regions.

On a regional level, the market has been classified into Brazil, India, the United States, the European Union, China, Thailand, and others, wherein Brazil currently dominates the global market.

Some of the major players in the global sugar market include Al Khaleej Sugar, Associated British Foods plc, Canal Sugar, Dwarikesh Sugar Industries Limited, Lantic Inc., Louis Dreyfus Company, Michigan Sugar Company, Mitr Phol Sugar Co., Ltd., Nordzucker, Rajshree Sugars & Chemicals Ltd, Suedzucker AG, Tereos, Thai Roong Ruang Group, Wilmar International Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)