Sugar Substitutes Market Size, Share, Trends and Forecast by Product Type, Application, Origin, and Region 2025-2033

Sugar Substitutes Market Size and Share:

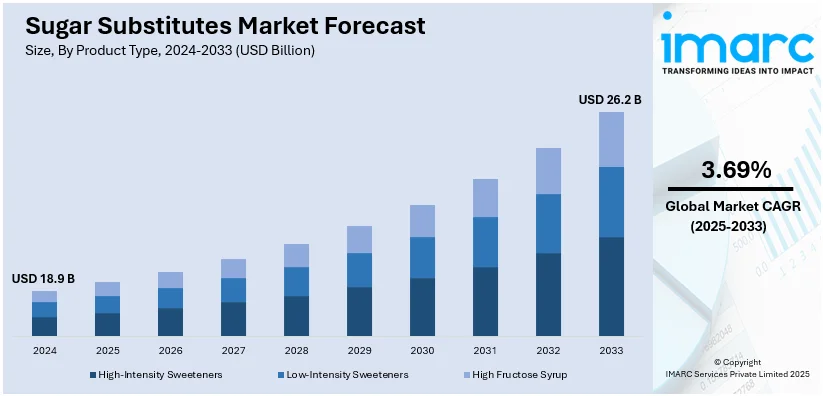

The global sugar substitutes market size was valued at USD 18.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 26.2 Billion by 2033, exhibiting a CAGR of 3.69% during 2025-2033. North America currently dominates the market, holding a significant market share of over 34.7% in 2024. The rising health-conscious consumer preferences, increasing prevalence of diabetes and obesity, and various innovations by the food and beverage industry in creating sugar-free and low-sugar products are some of the major factors driving the sugar substitutes market share across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 18.9 Billion |

| Market Forecast in 2033 | USD 26.2 Billion |

| Market Growth Rate (2025-2033) | 3.69% |

The global market for sugar alternatives is fueled by a growing awareness about health among consumers, an uptick in lifestyle-related illnesses such as diabetes and obesity, and an increasing desire for low-calorie and sugarless items. According to the Heart Organization, 9.7 million adults suffer from undiagnosed diabetes, whereas 29.3 million individuals globally are diagnosed with the disease. As consumers seek healthier options to sugar, food and drink producers are altering products to incorporate sugar replacements such as stevia, aspartame, sucralose, and sugar alcohols. Government efforts to encourage lower sugar intake and implement labeling rules also support market expansion. Furthermore, progress in food technology has enhanced both the flavor and efficacy of sugar alternatives, increasing their attractiveness. The increase in plant-derived and natural sweeteners corresponds with the rising trend for clean-label and organic items, boosting demand. The growing use of sugar alternatives in pharmaceuticals, sweets, baking, and drinks drives market expansion. Ultimately, a greater awareness about weight control and the global accessibility of various product options contribute to the sugar substitutes market growth.

The United States stands out as a key market disruptor, driven by growing awareness about health consciousness as well as increased prevalence of chronic diseases such as diabetes and obesity. Consumers are proactively searching for low-calorie and sugar-free products to avoid sugar, resulting in an ever-increasing demand for sugar alternatives such as stevia, sucralose, and erythritol. The policies of the government and public health initiatives for low sugar consumption are fueling this trend. Diet-friendly and functional foods, as well as increased interest in clean-label and plant-based products, continue to drive market expansion.

Sugar Substitutes Market Trends:

Growing health consciousness among the masses

An increased perception of the dangers that excessive consumption of sugar imposes on health remains one of the growth drivers. Consumers, having become more and more health conscious, are proactively searching for ways to minimize sugar consumption. Consuming more than the safe limits of sugar consumption leads to severe health problems such as obesity, type 2 diabetes, and tooth decay. According to studies, the global number of diabetes patients is such likely to reach 643 million in 2030. This revelation has made the public look for sugar alternatives that can allow them to enjoy sweet tastes without causing adverse health effects. Consequently, sugar alternatives that do not add calorie burden to the diet while conferring sweetness have emerged as an ideal choice among health-conscious consumers who wish to regulate their body weight and decrease the risk of chronic diseases. This heightened awareness about the impact of excessive consumption of sugar is expected to lead to a significant sugar alternatives market demand in numerous food and beverages.

Escalating demand for low-calories and sugar-free products

The other vital factor driving this sugar substitutes market is the emerging demand for lower calorie and low-sugar diets and beverages. It has been reported that 38 percent of urban Indians consume foods made with artificial sweeteners every month. Consumers' needs are progressively going toward achieving the dietary behavior preference, a great deal that will include keeping off added calories and sugars. Sugar substitutes allow food and beverage companies to respond to this demand by formulating products that are lower in calories and free from added sugars. Whether it is sugar-free sodas, reduced-sugar snacks, or desserts with fewer calories, sugar substitutes play a pivotal role in creating these offerings. This trend is further fueled by consumer demand for healthier dietary choices, growing interest in weight management and well-being, further creating a positive sugar alternatives market outlook.

Favorable government initiatives

Government policies and programs designed to decrease sugar consumption in food and drink products significantly influence the market for sugar substitutes. Health officials and policymakers acknowledge the public health issues created by high sugar intake and have implemented measures to tackle them. These actions consist of mandating explicit labeling of added sugars on product packaging and establishing sugar reduction goals for different food categories. According to the FDA, the Dietary Guidelines for Americans suggest that calories from added sugars should be kept to under 10% of total daily calorie intake. Consequently, food producers are encouraged to modify their recipes with sugar substitutes to adhere to these regulations and satisfy health standards. This regulatory framework establishes a beneficial market setting for sugar alternatives, promoting their use to lower sugar levels in various consumer goods.

Sugar Substitutes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global sugar substitutes market, along with forecasts at the global, and regional levels from 2025-2033. The market has been categorized based on product type, application, and origin.

Analysis by Product Type:

- High-Intensity Sweeteners

- Stevia

- Aspartame

- Cyclamate

- Sucralose

- Saccharin

- Others

- Low-Intensity Sweeteners

- D-Tagatose

- Sorbitol

- Maltitol

- Xylitol

- Mannitol

- Others

- High Fructose Syrup

High-intensity sweeteners stand as the largest component in 2024, holding around 70.0% of the market. High-intensity sweeteners are sugar substitutes known for their intense sweetness, hundreds or thousands of times sweeter than sugar, yet adding virtually no calories. These include aspartame, saccharin, sucralose, and steviol glycosides derived from stevia, which are used to make foods and beverages sweeter without the caloric impact of sugar. It targets the increasing concern of consumers to calorie intake and health issues resulting from sugar. It also serves the need of sweet-tasting products that do not contain calories.

Analysis by Application:

- Foods

- Beverages

- Health and Personal Care

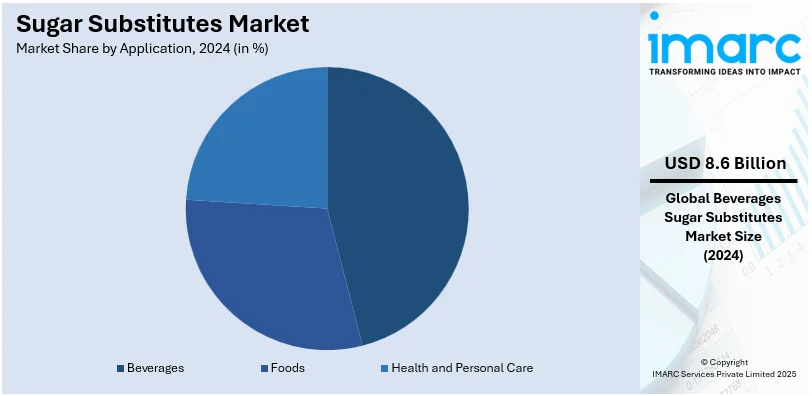

Beverages lead the market with around 45.6% of market share in 2024. They encompass a wide range of liquid products, such as soft drinks, fruit juices, energy beverages, and numerous others. Producers are increasingly utilizing sugar alternatives in drinks due to their prevalence and the increasing consumer preference for low-sugar and low-calorie choices. With rising health awareness, consumers are progressively looking for healthier drink options to decrease their sugar consumption and control their weight. Drinks have become the primary source of extra sugars in diets, and sugar alternatives offer a beneficial path to enjoy sweetness while lowering calorie and sugar consumption. The implementation of sugar taxes and regulations has accelerated the adoption of sugar alternatives in drinks. This has led beverage manufacturers to alter their formulations with sugar alternatives to comply with regulatory requirements and align with consumer demand for healthier choices, thereby boosting segment growth.

Analysis by Origin:

- Artificial

- Natural

Natural leads the market in 2024. With ongoing health consciousness and government backing to lower sugar consumption, the market is being propelled even more. The regulations are pushing food and beverage companies to investigate and create additional sugar substitutes to meet consumer demands and comply with the rules. Nations such as Mexico, Brazil, and Chile have implemented sugar taxes and labeling laws to address rising instances of obesity and diabetes. Estimates suggest that by 2030, the number of diabetics in Brazil is expected to hit 19,224.1.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 34.7%, as a result of growing health awareness and heightened understanding of the adverse health effects of excessive sugar intake, leading consumers to look for alternatives. The request for less sugar and low-calorie items has driven the inclusion of sugar alternatives in various food and drink products. Additionally, beneficial regulatory measures in North America, such as sugar taxes and required labeling of added sugars, have urged food and beverage producers to alter their products by incorporating sugar substitutes to satisfy both regulatory standards and consumer demands. In addition to this, the incidence of obesity and diabetes in North America has resulted in increased focus on reducing sugar and making healthier food choices. Consequently, sugar alternatives have become essential to the area’s food sector, fostering innovation and expansion in the market. Moreover, North America's robust food and beverage industry, along with the incorporation of sugar alternatives by leading brands, enhances market growth in the area.

Key Regional Takeaways:

United States Sugar Substitutes Market Analysis

In 2024, the United States accounts for over 84.5% of the sugar substitutes market in North America. Awareness about health and the rise of lifestyle-related diseases such as obesity, diabetes, and heart disease drive the demand for sugar alternatives in the United States. The National Center for Health Statistics stated that, between August 2021 and August 2023, the overall diabetes prevalence was 15.8% among adults in the U.S. Consequently, there is an increasing market demand for sweeteners that have few calories and a low glycemic index. Consumers are progressively looking for sugar alternatives such as stevia, aspartame, and sucralose for healthier options in drinks, snacks, and baked products. In line with this, the food and beverage sector are firmly rooted in the U.S. and aids in market expansion. Businesses are incorporating sugar alternatives into their offerings to appeal to health-aware consumers and comply with FDA regulations regarding sugar reduction. For instance, prominent beverage companies are currently altering their formulations to decrease added sugars while maintaining flavor. Another significant aspect is the progress in technology related to manufacturing methods and the finding of new plant-derived sugar alternatives. The interest in natural sweeteners and clean-label options, such as monk fruit extract, attracts consumers seeking clarity regarding the ingredients in their food and drinks. Furthermore, regulatory backing through GRAS status awarded to various sugar alternatives is enhancing sales growth. Ultimately, e-commerce websites and platforms are providing broader consumer access to alternative sugar products. E-commerce platforms enable businesses to tap into broader markets, aiding them in enhancing their market reach.

Asia Pacific Sugar Substitutes Market Analysis

Asia Pacific sugar substitutes market is growing strongly, driven by rapid urbanization, changing dietary habits, and increasing health awareness. With increased migration to cities, the way of life of individuals is becoming more urbanized, and thus their dietary choices are also being altered to fit into convenient, healthy food and beverage choices. As indicated by the Press Information Bureau, it is predicted that by 2030, India's population would be majorly urban and in excess of 40% will be staying in cities. It is also noticing a growing prevalence of lifestyle diseases among its residents and this change has been promoting an increase in demand for sugar-free food alternatives, including artificial sweeteners. In addition to this, rising middle-class income levels and changing consumer preferences are fueling the uptake of sugar substitutes in food and beverages. China, Japan, and India are seeing a rise in demand for low-calorie products, especially in soft drinks, bakery, and dairy. In addition to this, multinational companies and local players are introducing sugar-reduced products that are suitable for the taste buds of the region, thereby boosting the market growth. Other drivers to the market include the growing food and beverages sector in Asia Pacific. Country governments such as India and Indonesia are imposing taxes on sugar for the reduction of sugar usage, and manufacturers are innovating their use with sugar alternatives. Also, scientific advancement in agriculture and biotechnology is enhancing production and reducing cost of plant-based sugar substitutes including stevia and monk fruit extracts in the region.

Europe Sugar Substitutes Market Analysis

The Europe sugar substitutes market is fueled by stringent government regulations aimed at reducing sugar consumption and combating obesity and diabetes. The European Union's "Farm to Fork" strategy and sugar tax initiatives in countries such as the UK and France encourage the use of alternative sweeteners in food items. These regulations align with rising consumer awareness about the adverse health effects of high sugar intake, fostering a shift toward sugar substitutes. In line with this, the growing popularity of low-calorie and sugar-free products, especially among health-conscious millennials and aging populations, is a significant driver. Aging populations is prioritizing low-calorie alternatives to lower the risks associated with chronic conditions such as cardiovascular diseases and metabolic disorders. According to reports, on 1 January 2023, the EU population was estimated at 448.8 Million individuals and more than one-fifth (21.3 %) of it was aged 65 years and over. These demographic groups are also influenced by trends such as clean eating and fitness, leading to increased demand for sugar-free beverages, snacks, and desserts. This shift significantly propels the sugar substitutes market. Besides this, consumers in Europe are increasingly preferring natural sweeteners such as stevia, erythritol, and xylitol due to their perceived health benefits and compatibility with dietary trends, such as keto and low-carb diets. Moreover, advancements in sugar-reduction technologies, such as fermentation and enzymatic processes, are enabling the production of better-tasting sugar substitutes that mimic the sweetness of sugar without the calories.

Latin America Sugar Substitutes Market Analysis

With constant health awareness, as well as government support toward reducing sugar intake, the market is being driven further. The policies are driving the food and beverage companies to research and develop more sugar alternatives to satisfy the regulations and demands of the consumers. Countries, such as Mexico, Brazil, and Chile, have introduced sugar taxes and labeling regulations to tackle growing cases of obesity and diabetes. According to estimates, the population of diabetics in Brazil is likely to reach 19,224.1 by 2030. In addition, the middle class and lifestyle of the region are changing their dietary habits and are thus creating a huge demand for low-calorie and natural sweeteners. Consumers are switching to healthier options such as stevia, agave syrup, and monk fruit extract in beverages, snacks, and desserts. The rising popularity of fitness and well-being trends, which are more in vogue among younger groups, is also fueling the growth in sugar-free and low-calorie product categories.

Middle East and Africa Sugar Substitutes Market Analysis

The rapid urbanization and the increase in individual incomes in the countries of UAE, Saudi Arabia, and South Africa have led to a rise in low-calorie and sugar-free product adoption. Increasingly, individuals are adopting clean-label and organic products, which also results in increased demand for plant-based sugar substitutes. As individuals inspect food labels more closely for artificial additives and ingredients, manufacturers increasingly add natural sweeteners to their formulations. Notwithstanding this, governing authorities in the region continue to promote the awareness about campaigns for health concerns and introduce a sugar tax with a view of controlling sugar intakes. Again, the increase in the sector of food and beverages, most essentially bakery, confectionery, and beverages create a greater increase of using sugar substitute. The penetration of e-commerce in the regions makes the access to the product even wider hence the market extension. Saudi Arbia's electronic commerce generated revenue worth USD 10 Billion for 2023, according to reports.

Competitive Landscape:

Major participants in the sugar alternatives market are boosting growth via strategic efforts such as product development, collaborations, and promotional campaigns. Firms such as Cargill, Tate & Lyle, and Archer Daniels Midland (ADM) are putting funds into R&D to create natural and plant-derived sweeteners such as stevia and monk fruit, matching consumer preferences for healthier, clean-label options. Partnerships with food and drink producers facilitate customized answers for particular uses, such as sugar-free candies or drinks. Major companies are also increasing production capacities and implementing sustainable sourcing methods to satisfy rising demand and tackle environmental issues. Marketing initiatives concentrate on informing consumers about the advantages of sugar alternatives and highlighting the introduction of new products. Moreover, businesses are utilizing digital platforms and online shopping avenues to broaden their outreach. By focusing on regulatory compliance and upholding quality standards, these companies are strengthening their market position and driving the overall expansion of the sugar substitutes sector.

The report provides a comprehensive analysis of the competitive landscape in the sugar substitutes market with detailed profiles of all major companies, including:

- Tate & Lyle PLC

- Cargill, Incorporated

- PureCircle Limited

- Roquette Frères S.A.

- E. I. du Pont de Nemours and Company

- Archer Daniels Midland Company

- Ajinomoto Co. Inc.

- Ingredion Incorporated

- Flavors Holdings Inc.

- Jk Sucralose Inc.

Latest News and Developments:

- July 2024: Tate & Lyle PLC (Tate & Lyle), a world leader in ingredient solutions for healthier food and beverages, unveiled its new stevia composition, OPTIMIZER STEVIA® 8.10. This innovative ingredient delivers the highly desired premium taste profile closest to sugar, even at high sugar replacement levels, while offering a more cost-effective solution than other premium sweeteners.

- January 2024: Avansya, the joint venture between Cargill and dsm-firmenich, announced that the EverSweet® stevia sweetener received a positive safety opinion from both the European Food Safety Authority (EFSA) and the UK Food Standards Agency (FSA), bringing the advanced sweetener one step closer to commercial availability in the European Union and UK. EverSweet® stevia sweetener brings to life the sweetest and cleanest tasting components of the stevia leaf – steviol glycosides Reb M and Reb D.

- January 2024: FoodTech start-up Better Juice, Ltd., collaborated with Ingredion, Inc., a leading global provider of specialty ingredients to the food and beverage industry. Ingredion Ventures, Ingredion's venture investment arm, will lead the Series A funding round for Better Juice which will fast-track penetration of its breakthrough sugar reduction solution into the US juice market. Ingredion Partners with Better Juice to offer sugar reduction solutions. Better Juice's innovative sugar reduction technology removes simple sugars in juice-based beverages, concentrates and other natural sugar-containing liquids.

- November 2023: Ingredion is expanding its PureCircle stevia production facility in Malaysia. The expansion enables Ingredion to grow its PureCircle’s bioconversion technology capacity. PureCircle is a zero-calorie sweetening solution formulated from the stevia plant, which may provide a clean taste solution.

Sugar Substitutes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Foods, Beverages, Health and Personal Care |

| Origins Covered | Artificial, Natural |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Tate & Lyle PLC, Cargill, Incorporated, PureCircle Ltd., Roquette Frères S.A., E. I. du Pont de Nemours and Company, Archer Daniels Midland Company, Ajinomoto Co. Inc., Ingredion Incorporated, Flavors Holdings Inc., JK Sucralose Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sugar substitutes market from 2019-2033.

- The sugar substitutes market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sugar substitutes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sugar substitutes market was valued at USD 18.9 Billion in 2024.

IMARC estimates the sugar substitutes market to exhibit a CAGR of 3.69% during 2025-2033.

The global sugar substitutes market is driven by increasing health awareness, rising prevalence of lifestyle diseases such as diabetes and obesity, demand for low-calorie products, and advancements in natural and clean-label sweeteners.

North America dominates the market due to high consumer health awareness, widespread prevalence of diabetes and obesity, strong demand for low-calorie products, and significant innovation by key industry players.

Some of the major players in the sugar substitutes market include Tate & Lyle PLC, Cargill, Incorporated, PureCircle Ltd., Roquette Frères S.A., E. I. du Pont de Nemours and Company, Archer Daniels Midland Company, Ajinomoto Co. Inc., Ingredion Incorporated, Flavors Holdings Inc., JK Sucralose Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)