Superconducting Materials Market Report by Product Type, End Use Industry, Region, and Forecast 2025-2033

Superconducting Materials Market Size and Share:

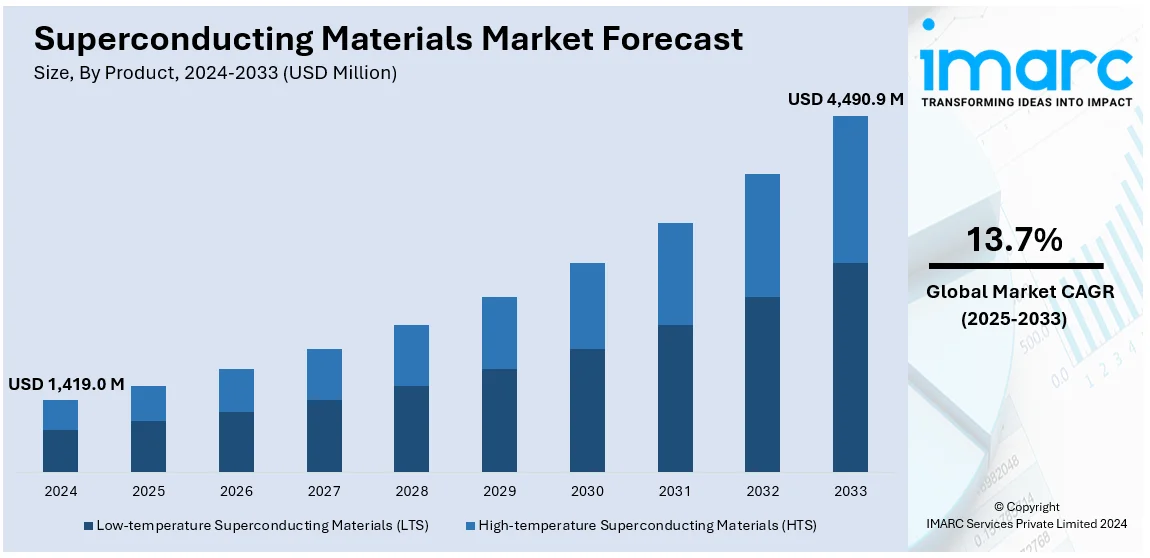

The global superconducting materials market size was valued at USD 1,419.0 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 4,490.9 Million by 2033, exhibiting a CAGR of 13.7% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 41% in 2024. The extensive applications of metallic compounds or alloys in consumer electronics and medical industries are primarily propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,419.0 Million |

|

Market Forecast in 2033

|

USD 4,490.9 Million |

| Market Growth Rate 2025-2033 | 13.7% |

The superconducting materials market is experiencing significant growth primarily driven by the growing demand for advanced medical imaging technologies, such as magnetic resonance imaging (MRI) and the widespread adoption of energy-efficient transmission solutions. Expanding applications in quantum computing, particle accelerators and renewable energy systems further propels the market growth. In line with this, increasing investment in research and development (R&D) and advancements in cryogenic technology are fostering innovation, which, in turn, is enhancing the practicality of superconducting materials across various industries, thereby creating a positive outlook for the market growth.

The United States represents a significant regional market for superconducting materials. The market in the country is propelled by the growing need for advanced medical imaging technologies, particularly MRI systems, and increasing investments in quantum computing research. For instance, in September 2024, the United States Department of Energy announced its plans to invest USD 65 million in quantum computing research, funding ten projects focused on software, control systems, and algorithms. The demand for energy-efficient power grids and high-performance electronics is also boosting market growth. Government funding for defense and aerospace applications, along with advancements in cryogenic infrastructure, further supports adoption. Expanding applications in particle accelerators and renewable energy storage systems are solidifying the market's position in the United States industrial landscape

Superconducting Materials Market Trends:

Improvements in Medical Imaging

Numerous advancements in medical imaging technologies, particularly magnetic resonance imaging (MRI), are stimulating the market, as superconducting materials are crucial in MRI machines due to their ability to create stable magnetic fields without significant power loss. For example, in October 2023, Bangalore-based Voxelgrids Innovations Private Limited developed the first MRI scanner produced in India that is characterized by various innovations, including bottom-up software design, avoiding reliance on scarcely available liquid helium, and customized hardware. Additionally, in January 2023, Imricor, one of the global leaders in real-time interventional cardiac magnetic resonance (iCMR) ablation products, entered into a Memorandum of Understanding (MOU) with GE HealthCare to introduce MRI systems that use superconducting magnets to provide high-resolution images with faster scan times. Apart from this, the rising emphasis of prominent players on enhancing the overall efficiency of healthcare services is anticipated to propel the market in the coming years. For instance, in June 2024, researchers from the King's Department of Engineering collaborated with the Japan Science and Technology Agency, the National Institute for Materials Science, the Tokyo University of Agriculture and Technology, and the Kyushu University to develop an iron-based superconducting magnet using AI for medical imaging machines. Furthermore, in May 2024, Siemens Healthineers invested approximately US$ 250 Million in a new UK production facility aimed at manufacturing superconducting magnets to be used in MRI devices.

Extensive Research Activities

The increasing number of R&D activities for applications across industries, including electronics and defense, is bolstering the overall market. For instance, in December 2023, the Attoscience and Ultrafast Optics group introduced attosecond soft-X-ray absorption spectroscopy to study the composition of superconductive materials or substances. Similarly, in December 2023, Harvard researchers advanced superconductor technology by creating a high-temperature superconducting diode using cuprates. This development is crucial for quantum computing and represents a significant step in understanding exotic materials. Moreover, the inflating need for alloys to create the powerful magnetic fields needed to accelerate particles to high speeds is also contributing to the market growth. For example, in February 2024, a team of scientists in China launched a novel high-power microwave (HPM) weapon powered by a stirling engine and using superconducting materials. This innovation addresses the challenges of low efficiency and limited range faced by HPMs. Furthermore, the weapon's compact size and powerful capabilities make it crucial for turning off sensitive electronics. Also, North American scientists found the first superconductor that operates at room temperature. The material is superconducting below temperatures of about 15 Celsius 59 Fahrenheit). Advances such as these are infusing the demand for superconducting materials.

Innovations in Quantum Computing

Superconducting qubits, which are the building blocks of quantum computers, usually rely on superconducting materials to perform complex calculations and maintain quantum coherence at high speeds. In March 2023, RIKEN and Fujitsu introduced 64-qubit superconducting quantum computers at the RIKEN RQC-Fujitsu Collaboration Center. Moreover, continuous advancements in material are further acting as significant growth-inducing factors. For example, in November 2023, Google DeepMind unveiled a novel AI tool called Graph Networks for Materials Exploration (GNoME) that uses two pipelines for discovering low-energy (stable) materials. Additionally, in February 2024, Multiverse Computing and Single Quantum, one of the providers of superconducting nanowire single-photon detectors, announced an industrial materials science R&D project under a US$ 1.4 Million contract with the German Aerospace Center’s Quantum Computing Initiative (DLR QCI) to enable quantum applications that outperform classical methods. In line with this, in February 2024, a team of researchers at Penn State unveiled superconducting materials that could provide the basis for more robust quantum computing.

Superconducting Materials Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global superconducting materials market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, end-use industry, and region.

Analysis by Product Type:

- Low-temperature Superconducting Materials (LTS)

- High-temperature Superconducting Materials (HTS)

Low-temperature superconducting materials (LTS) stand as the largest product type in 2024, holding around 83% of the market share. Low-Temperature Superconducting Materials (LTS) dominate the superconducting materials market as the largest product segment, accounting for the majority of demand and revenue. LTS, typically requiring cooling with liquid helium to achieve superconductivity, are essential in numerous high-performance applications. Key areas include medical imaging devices like MRI machines, particle accelerators in scientific research, and various applications in the energy sector such as power cables and magnetic energy storage systems. The robust performance, proven reliability, and extensive infrastructure supporting LTS technologies contribute to their widespread adoption. Additionally, ongoing advancements and investments in LTS research continue to enhance their efficiency and expand their application scope, solidifying their leading position in the market. For instance, in August 2024, Scientists identified a new topological superconductor made from rhodium, selenium, and tellurium, which exhibits superconductivity at very low temperatures. Its unique quasiparticle behavior could advance quantum computing and other fields. Overall, the continuous progress in LTS technology is set to drive significant innovations and growth across various industries.

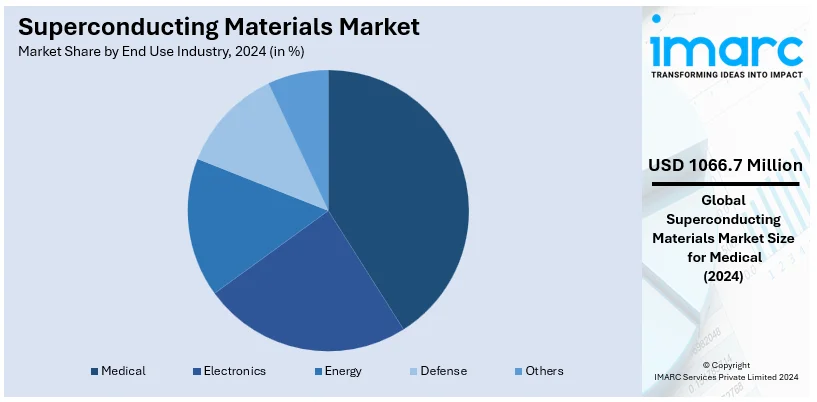

Analysis by End Use Industry:

- Medical

- Electronics

- Energy

- Defense

- Others

Medical leads the market with over 75% of market share in 2024. The medical sector leads the superconducting materials market end-use mainly driven by essential applications and ongoing technological advancements. Superconducting materials are integral to advanced medical imaging systems like MRI and CT scanners which require high precision and reliability for accurate diagnostics. In line with this, these materials support the development of cutting-edge therapeutic devices and facilitate groundbreaking biomedical research. The increasing demand for non-invasive diagnostic tools and enhanced medical equipment efficiency further propels the sector’s dominance. In lien with this, in September 2024, Tokamak Energy launched TE Magnetics, a new division dedicated to high temperature superconducting (HTS) magnet technology. Aimed at various applications, including fusion energy, renewable energy, and medical diagnostics, TE Magnetics plans to revolutionize performance in multiple sectors. Investments in healthcare infrastructure and continuous innovation in medical technologies ensure that the medical industry remains the primary driver of growth and adoption in the superconducting materials market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 41%. The market in Asia Pacific is driven by rapid advancements in technology and increasing investments in healthcare and energy infrastructures. For instance, Japan's RIKEN Center for Emergent Matter Science is a prominent leader in superconducting research. At the same time, China has made substantial investments in developing superconducting materials for power grids and high-speed maglev trains. Additionally, South Korea and Taiwan are enhancing their capabilities in superconducting technologies, fostering innovation in electronics and renewable energy sectors. Governments across the region are implementing supportive policies and funding research initiatives to accelerate the adoption of superconducting materials. The expanding industrial base and rising demand for energy-efficient solutions further bolster the market's growth. Collaborative efforts between academic institutions and industries are driving breakthroughs, ensuring that the Asia Pacific remains at the forefront of the superconducting materials landscape.

Key Regional Takeaways:

North America Superconducting Materials Market Analysis

North America is a prominent player in the superconducting materials market driven by advancements in healthcare, energy infrastructure and quantum technology. The United States leads the region, driven by increasing investments in MRI systems and other healthcare applications that rely on superconducting magnets. The shift towards renewable energy including the adoption of superconducting cables for efficient power transmission aligns with national goals for energy sustainability. Additionally, robust funding from institutions like the Department of Energy (DOE) supports research and development in superconducting technologies. The region's leadership in quantum computing with firms such as Google and IBM leveraging superconductors for qubits further drives market growth. Collaborative efforts between government agencies, academia and private companies continue to fuel innovation and strengthen North America's position in this industry.

United States Superconducting Materials Market Analysis

In 2024, the United States accounted for around 91% of the superconducting materials market share in North America. High temperature semiconducting (HTS) wires are used in power applications such as HTS power cables, HTS fault current limiters, HTS transformers for the grid, HTS generators for wind energy, and energy storage. There is high demand for efficient power grids in the United States and the country is likely to invest significantly on power grid infrastructure in the next 10 years. The advances in HTS industry are helping to scale-up existing power systems and develop efficient tools to ease the performance and capacity limitations. Recently, scientists in United States found the first superconductor that operates at room temperature. The material is superconducting below temperatures of about 15° Celsius (59° Fahrenheit). Advances such as these are infusing the demand for superconducting materials in North America.

The industry is also driven by the growing emphasis on renewable energy, especially in the implementation of advanced grid systems. In line with the United States' shift to a more sustainable energy infrastructure, superconducting materials are essential for creating effective power connections and energy storage solutions. Additionally, the rapidly developing field of quantum computing, in which firms such as Google and IBM have made significant investments in quantum technologies, makes use of superconducting materials because of their low-resistance qualities in qubits, which increases their uptake. Other factors that promote innovation and market expansion include government financing from organizations like the Department of Energy (DOE) and partnerships between academia and business.

Europe Superconducting Materials Market Analysis

The market for superconducting materials in Europe is supported by the region's emphasis on energy efficiency, developments in particle physics, and expanding healthcare applications. Superconducting materials are essential for high-energy particle accelerators, and nations like Germany, the UK, and France are making significant investments in high-tech research institutions like CERN. These programs encourage innovation in the industry in addition to creating demand. Superconducting materials are employed in power grid improvements to reduce energy losses; therefore, the energy industry is also crucial. Investments in superconducting technology for renewable energy applications are being stimulated by the European Union's ambitious climate goals, which seek to achieve carbon neutrality by 2050. Furthermore, the healthcare sector makes a substantial contribution due to the growing use of MRI and other cutting-edge imaging technologies that depend on superconducting magnets. The European market is further driven by government assistance and cooperative R&D initiatives.

Latin America Superconducting Materials Market Analysis

Growing investments in energy efficiency and medical infrastructure are driving the demand for superconducting materials in Latin America. Superconducting material-based MRI systems are becoming more widely used as nations like Brazil and Mexico improve their healthcare systems. Furthermore, the region's increasing emphasis on smart grids and renewable energy is opening doors for superconducting technology to increase the efficiency of electricity transmission. The sector is further supported by government-backed infrastructure modernization projects and partnerships with multinational corporations.

Middle East and Africa Superconducting Materials Market Analysis

The market for superconducting materials in the Middle East and Africa is mostly driven by energy efficiency projects and improvements in healthcare facilities. MRI scanners and other technologies requiring superconducting materials are being more widely used because of investments made in sophisticated medical facilities by nations like Saudi Arabia and the United Arab Emirates. The demand is further fueled by the drive for energy-efficient power systems, which is backed by government programs like Saudi Arabia's Vision 2030. Collaborations with international research institutes are also encouraging innovation and the region's use of superconducting technologies.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:

- American Superconductor Co.

- Evico GmbH

- Hitachi Ltd.

- Hyper Tech Research Inc.

- Metal Oxide Technologies, Inc.

- Siemens AG

- Sumitomo Electric Industries Ltd.

- Superconductor Technologies Inc.

- SuperPower Inc. (The Furukawa Electric Co. Ltd.)

- Western Superconducting Technologies Co. Ltd

Latest News and Developments:

- June 2024: Researchers from the King's Department of Engineering collaborated with the Japan Science and Technology Agency, the National Institute for Materials Science, the Tokyo University of Agriculture and Technology, and Kyushu University to develop an iron-based superconducting magnet using AI for medical imaging machines.

- May 2024: Siemens Healthineers invested approximately US$ 314 Million in a new UK production facility aimed at manufacturing superconducting magnets to be used in MRI devices. The production facility will be spread in an area of 56,000-square-meter and is expected to generate more than 1,300 skilled jobs. The site will focus on producing DryCool technology, which reduces helium usage in MRI scanners from 1,500 liters to less than one liter.

- February 2024: A team of scientists in China introduced a novel high-power microwave (HPM) weapon powered by a stirling engine and adopting superconducting materials. The system employs four compact Stirling engines to convert thermal energy into mechanical energy, enabling the generation of high-power microwave (HPM) waves capable of neutralizing drones, military aircraft, and satellites.

- July 2023: A team of MIT scientists, in collaboration with their partners, developed a superconducting diode capable of significantly enhancing current transfer efficiency in electronic systems. This device, which functions as a switch, has the potential to address escalating energy consumption challenges in high-power computing systems. Early results show that it is more than twice as efficient as similar technologies previously reported.

- November 2022: Royal Philips has partnered with U.S.-based MagCorp to research the development of superconducting magnets for MRI scanners that operate without the need for ultra-low temperature cooling using liquid helium. This collaboration aims to explore sustainable alternatives to helium-cooled magnets, which could lower costs and expand access to advanced MR imaging.

Superconducting Materials Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Low-temperature Superconducting Materials (LTS), High-temperature Superconducting Materials (HTS) |

| End Use Industries Covered | Medical, Electronics, Energy, Defense, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Superconductor Co., evico GmbH, Hitachi Ltd., Hyper Tech Research Inc., Metal Oxide Technologies, Inc., Siemens AG, Sumitomo Electric Industries Ltd., Superconductor Technologies Inc., SuperPower Inc. (The Furukawa Electric Co. Ltd.), Western Superconducting Technologies Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Superconducting Materials market from 2019-2033.

- The Superconducting Materials market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Superconducting Materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Superconducting materials are specialized substances that conduct electricity without resistance when cooled below specific temperatures. They are essential in various high-tech applications, including medical imaging, quantum computing, energy transmission, and advanced transportation systems, due to their exceptional efficiency and performance capabilities.

The superconducting materials market was valued at USD 1,419 Million in 2024.

IMARC estimates the global superconducting materials market to exhibit a CAGR of 13.7% during 2025-2033.

The market is driven by increasing demand for advanced medical imaging technologies, energy-efficient transmission solutions, and expanding applications in quantum computing and renewable energy systems. Additionally, substantial investments in research and development (R&D) and advancements in cryogenic technology are fostering innovation and growth.

In 2024, low-temperature superconducting materials (LTS) represented the largest segment by product type, driven by their superior performance and versatility in various applications.

Medical leads the market by end-use industry owing to the essential applications of superconducting materials in advanced medical imaging systems like MRI and CT scanners.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global Superconducting Materials market include American Superconductor Co., evico GmbH, Hitachi Ltd., Hyper Tech Research Inc., Metal Oxide Technologies, Inc., Siemens AG, Sumitomo Electric Industries Ltd., Superconductor Technologies Inc., SuperPower Inc. (The Furukawa Electric Co. Ltd.), Western Superconducting Technologies Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)