Sustainable Finance Market Size, Share, Trends and Forecast by Investment Type, Transaction Type, Industry Vertical, and Region, 2026-2034

Sustainable Finance Market Size and Share:

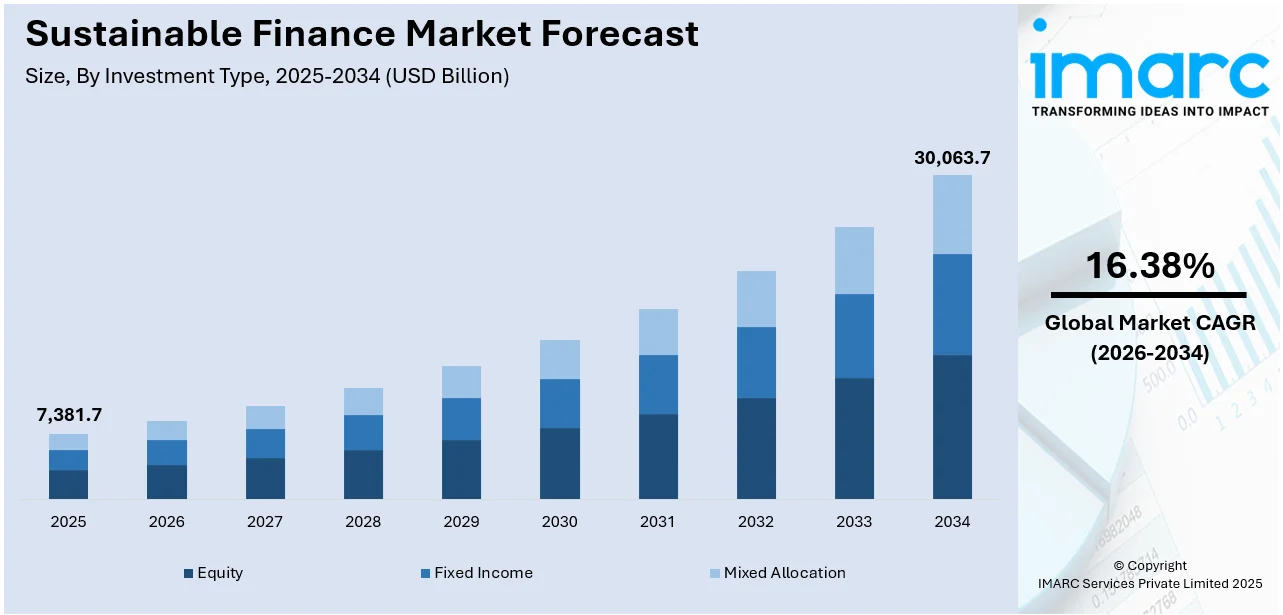

The global sustainable finance market size was valued at USD 7,381.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 30,063.7 Billion by 2034, exhibiting a CAGR of 16.38% from 2026-2034. North America currently dominates the market, holding a market share of 39.5% in 2025. Growing awareness of sustainability is encouraging individuals to adopt eco-friendly practices, boosting demand for green products and services. Governments are actively supporting this shift through favorable policies, incentives, and regulations that promote environmental responsibility. Additionally, businesses and consumers alike are focusing on reducing their carbon footprints, leading to increased investments in sustainable technologies. These combined efforts are significantly driving sustainable finance market share across various sectors, from renewable energy and electric vehicles (EVs) to sustainable packaging and green construction.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 7,381.7 Billion |

|

Market Forecast in 2034

|

USD 30,063.7 Billion |

| Market Growth Rate 2026-2034 | 16.38% |

The growing desire for ethical and responsible investing is one of the main factors propelling the sustainable finance business. In order to match portfolios with long-term sustainability objectives, investors are increasingly taking Environmental, Social, and Governance (ESG) factors into account when making financial decisions. This trend is fueled by growing awareness of climate change, social justice, and the need for transparent governance. Reflecting this shift, ESG-focused mutual funds and ETFs reached approximately $572 billion in total assets in May 2025, with net inflows of nearly $25 billion that month. In response, financial institutions are expanding offerings such as green bonds and sustainability-linked loans, making responsible investing a central force in sustainable finance market growth.

To get more information on this market Request Sample

The U.S. plays a key role in the sustainable finance market, supported by strong policy frameworks, corporate responsibility, and growing investor interest in ESG-focused investments, holding a market share of 88.90%. Government initiatives are advancing clean energy, low-carbon infrastructure, and sustainable business models. Financial institutions are increasingly embedding environmental and social considerations into their strategies. Notably, U.S. stewardship policies now cover 79% of market assets about $41.5 trillion demonstrating widespread institutional adoption of ESG practices. Collaboration between public and private sectors further fuels innovation in green finance. This momentum is reinforced by rising consumer demand for responsible investing, driving the expansion of sustainability-linked financial products and a long-term shift toward climate-conscious economic strategies.

Sustainable Finance Market Trends:

Growing Investor Focus on ESG Integration

Investors are increasingly aligning their financial goals with broader environmental and social values, leading to a surge in demand for strategies that incorporate Environmental, Social, and Governance (ESG) criteria. ESG integration allows investors to assess long-term risks and opportunities by evaluating how companies address sustainability-related challenges. In 2024, 88% of institutional investors reported increasing their use of ESG information, highlighting a strong shift toward responsible investing. Companies with strong ESG performance are often seen as more resilient and better governed, which boosts investor confidence. As a result, institutional investors, asset managers, and pension funds are embedding ESG metrics into their decision-making processes. This approach not only supports better risk-adjusted returns but also fosters responsible corporate behavior. Ultimately, this trend is accelerating capital flow into businesses and projects that prioritize sustainability, transparency, and ethical governance across industries and markets.

Regulatory Support and Government Policies

Government regulations and policy frameworks are playing a pivotal role in advancing sustainable finance by providing clear guidelines and strong incentives for green investments. These policies foster an environment where capital can flow more confidently toward sustainable development goals. Key tools include tax benefits, mandatory sustainability reporting, and structured frameworks for green bonds and climate risk disclosures. A prime example is the rapid growth of the green bond market, which saw annual issuance reach approximately US $1.1 trillion in 2024—largely driven by regulations like the EU Green Bond Standard and enhanced disclosure requirements. Regulatory bodies are also prioritizing transparency in ESG reporting, enabling investors to make informed decisions. Across various regions, governments are partnering with financial institutions to support low-carbon infrastructure and renewable energy. As these standards become more globally aligned, they enhance investor confidence and embed sustainability more deeply into mainstream finance.

Corporate Commitment to Sustainability Goals

Corporations are increasingly integrating sustainability into their core business strategies, recognizing the importance of long-term environmental and social impact. This shift is often driven by stakeholder expectations, reputational concerns, and the desire to remain competitive in a rapidly changing market. Many companies are committing to net-zero targets, sustainable supply chains, and ethical labor practices, all of which require access to sustainable finance. By issuing green bonds, sustainability-linked loans, or participating in ESG-focused initiatives, businesses demonstrate accountability and transparency to investors and consumers. This proactive approach not only improves brand reputation but also helps companies attract long-term capital. As more firms adopt sustainability metrics and set measurable goals, they contribute to the overall growth and maturity of the sustainable finance ecosystem, influencing industry standards and investor behavior.

Sustainable Finance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global sustainable finance market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on investment type, transaction type, and industry vertical.

Analysis by Investment Type:

- Equity

- Fixed Income

- Mixed Allocation

Equity-based sustainable investments involve purchasing shares in companies with strong ESG practices. Investors seek long-term capital growth by supporting firms that prioritize environmental responsibility, ethical governance, and social impact. These investments are popular for their growth potential and alignment with values-based investing strategies.

Additionally, the fixed income sustainable investments include instruments like green bonds and sustainability-linked bonds. They provide stable returns while financing projects that address climate change, infrastructure, or social development. This investment type appeals to risk-averse investors seeking predictable income while contributing to environmental and social objectives.

Moreover, the mixed allocation combines equity and fixed income assets in a single portfolio, offering balanced exposure to sustainable investments. This approach diversifies risk while targeting both growth and income. It suits investors aiming for moderate returns with a commitment to ESG values across multiple asset classes.

Analysis by Transaction Type:

- Green Bond

- Social Bond

- Mixed-Sustainability Bond

Based on the sustainable finance market forecast, the green bond account for the majority of shares of 35.7% due to their clear purpose, transparency, and alignment with environmental goals. These fixed-income instruments are especially made to finance environmentally beneficial initiatives, like green buildings, sustainable water management, energy efficiency, and renewable energy. Their structure appeals to both issuers and investors by offering a familiar financial format while addressing climate-related objectives. Issuers benefit from enhanced reputations and access to a growing pool of sustainability-focused investors, while investors gain the opportunity to support environmentally responsible initiatives without compromising returns. Regulatory support and standardized reporting frameworks have also boosted investor confidence in green bonds. As climate concerns become increasingly urgent, the demand for transparent, purpose-driven financial tools continues to rise—solidifying green bonds as a dominant force in the sustainable finance market.

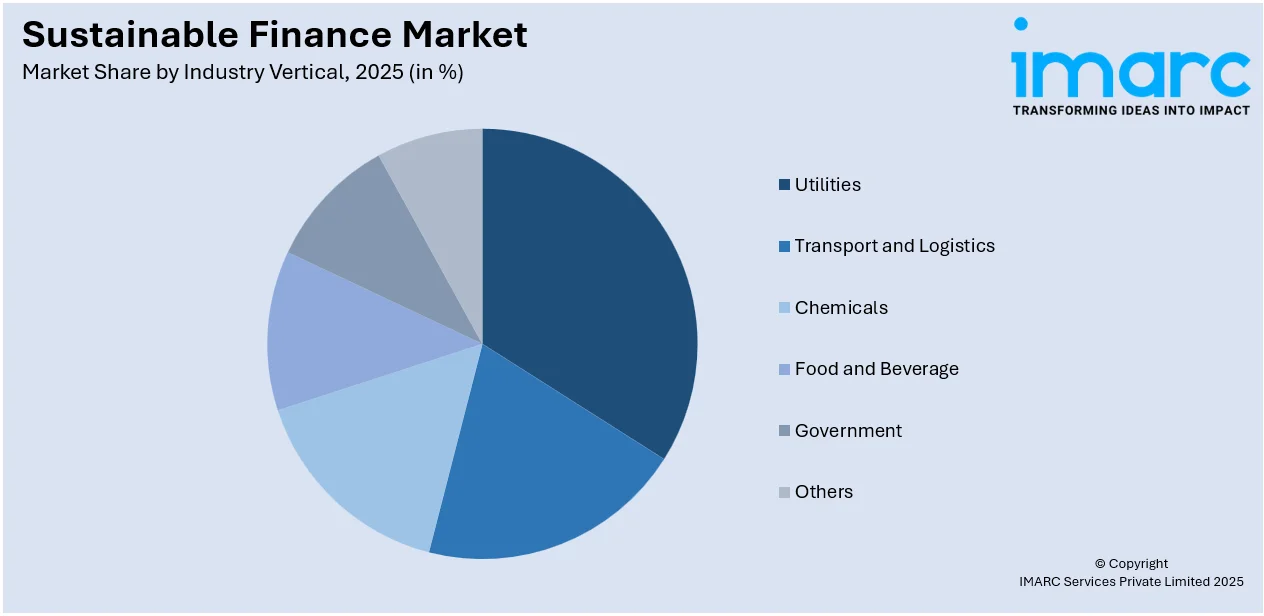

Analysis by Industry Vertical:

Access the comprehensive market breakdown Request Sample

- Utilities

- Transport and Logistics

- Chemicals

- Food and Beverage

- Government

- Others

Utilities dominate the sustainable finance market growth due to their central role in the global transition to clean and renewable energy. As key providers of electricity and water, utility companies are under pressure to reduce carbon emissions, modernize infrastructure, and invest in sustainable energy sources like solar, wind, and hydropower. These transformations require significant capital, driving demand for green bonds, sustainability-linked loans, and other forms of sustainable financing. Additionally, regulatory mandates and climate policies are pushing utilities to improve energy efficiency and reduce reliance on fossil fuels. Investors are also favoring utilities with strong ESG practices, recognizing their long-term value and resilience. This alignment of policy, investment, and environmental goals positions the utility sector as a major driver of sustainable finance growth globally.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

According to the sustainable finance market analysis, the North America is the leading region with a share of 39.5% driven by the strong regulatory environment, growing investor demand for ESG-focused investments, and proactive corporate sustainability strategies. Government initiatives promoting clean energy, carbon neutrality, and green infrastructure are encouraging financial institutions to channel funds into environmentally responsible projects. Investors in the region are increasingly prioritizing ethical and impact-driven portfolios, which is pushing financial markets to integrate sustainability into mainstream investment practices. Additionally, technological advancements in ESG data and analytics are helping institutions make more informed decisions. The presence of mature capital markets, innovation in green financial products, and public-private collaboration further contribute to North America's leadership in driving sustainable finance across diverse sectors such as energy, transportation, and real estate.

Key Regional Takeaways:

United States Sustainable Finance Market Analysis

The United States sustainable finance market is primarily driven by the enforcement of stricter regulatory frameworks, compelling businesses to meet developing climate disclosure requirements. In line with this, growing institutional investor demand for ESG-focused portfolios, which is stimulating the structuring of green bonds and sustainability-linked loans, is driving market growth. By the end of 2024, investments in the US carrying a sustainability or ESG label reached USD 6.5 Trillion. A survey of 265 US SIF member institutions revealed that 73% expect this market to continue growing over the next few years. Furthermore, the introduction of federal and state incentives, including tax credits for renewable energy initiatives, is further supporting expansion in the market. Similarly, the strategic establishment of sustainable finance divisions within major banks, encouraging the development of tailored green funding solutions, is strengthening market demand. The growing consumer demand for eco-friendly brands is pushing firms to embed sustainability in core operations, bolstering market development. Apart from this, robust cross-sector collaboration among public, private, and global partners is providing an impetus to the sustainable finance market demand.

Europe Sustainable Finance Market Analysis

The EU Taxonomy Regulation, which establishes precise criteria for categorizing sustainable economic activity, is driving expansion in the European sustainable finance industry. In accordance with this, the enforcement of the Sustainable Finance Disclosure Regulation (SFDR) is enhancing transparency by requiring asset managers to provide detailed ESG risk reporting. Similarly, the European Green Deal’s push for carbon neutrality by 2050, driving significant capital into renewable energy and circular economy initiatives, is impelling the market. The growing focus on green hydrogen development is expanding opportunities in low-carbon industrial processes. As such, in May 2025, the EU approved nearly EUR 1 Billion for 15 green hydrogen projects, aiming to produce 2.2 million tonnes, reduce 15 million tonnes of CO₂, enhance energy security, and establish a competitive, integrated hydrogen market. Furthermore, the increasing issuance of sovereign green bonds by EU countries is strengthening investor confidence and market liquidity. Additionally, financial institutions aligning their loan portfolios with Paris Agreement targets to manage climate risks more effectively are stimulating market accessibility. Besides this, cross-border cooperation through the European Investment Bank’s Climate Bank Roadmap is impacting sustainable finance market trends.

Asia Pacific Sustainable Finance Market Analysis

The Asia Pacific market is largely driven by the introduction of mandatory climate risk disclosures, compelling companies to incorporate ESG metrics into regular reporting practices. Furthermore, regional central banks rolling out green lending frameworks to steer capital flows into low-carbon industries are propelling the market expansion. The increasing demand from corporations for sustainable supply chain financing is encouraging stricter ESG compliance among regional suppliers. Additionally, the growth of sustainability-linked loans and transition bonds, which offer adaptable funding options for sectors transitioning to greener operations, is stimulating market appeal. As such, in January 2025, IFC approved a USD 100 Million Sustainability-Linked Loan to JK Tyre, supporting the expansion of tyre production at two plants. This first SLL in India’s tyre industry aims to expand energy efficiency, local supply chains, and jobs. Moreover, the numerous collaborations between stock exchanges and regulators on green taxonomies are enhancing transparency and attracting more investors to the Asia Pacific market.

Latin America Sustainable Finance Market Analysis

In Latin America, the sustainable finance market is advancing due to stronger government climate commitments, reflected in updated Nationally Determined Contributions under the Paris Agreement. Similarly, the Inter-American Development Bank and other regional lenders are directing concessional capital into renewable energy, sustainable agriculture, and resilient infrastructure, strengthening market momentum. The region’s major commodity exporters are increasingly adopting green financing tools to meet the sustainability standards of global buyers and secure continued market access. Accordingly, in April 2025, Colombia, the first in the Americas to adopt a Green Taxonomy, trained over 2,700 people, reviewed COP 10.8 Trillion portfolios, and issued COP 334.7 billion in sustainable finance tools, promoting regional leadership. Furthermore, the rapid expansion of voluntary carbon markets in countries such as Brazil and Colombia is encouraging companies to invest in certified emissions reduction projects, spurring nature-based solutions and reforestation efforts.

Middle East and Africa Sustainable Finance Market Analysis

Ambitious national climate policies, including Saudi Arabia's Vision 2030 and the United Arab Emirates' Net Zero 2050 roadmap, are major drivers of the Middle East and African industry. In addition to this, the introduction of green sukuk and Sharia-compliant sustainable finance instruments by regional banks is broadening market access. Similarly, sovereign wealth funds are increasing their allocations to renewable energy, water security, and climate-resilient agriculture, thereby reinforcing the market sustainability trends. As such, in June 2025, the Middle East advanced water security with Saudi Arabia’s USD 1.61 Billion network expansion, Oman’s RO 45.6 million dam, UAE’s units producing 15,000 m³ daily, and Egypt’s USD 332 Million irrigation plan. Moreover, growing multilateral partnerships with global climate funds and development banks are advancing blended finance and creating lucrative market opportunities.

Competitive Landscape:

The competitive landscape is dynamic and evolving, shaped by increasing demand for ESG-aligned investments and the growing importance of sustainability in long-term value creation. Innovative green financial products, such as sustainability-linked loans, ESG funds, and green bonds, are being offered by financial institutions, asset managers, and specialist businesses in competition. The market is also witnessing heightened collaboration between public and private sectors to finance sustainable infrastructure and climate projects. Technological advancements in ESG data analytics and reporting tools are further influencing competition. Companies are striving to differentiate themselves through transparency, robust ESG performance, and integration of sustainability into their core financial strategies. Additionally, regulatory developments and global sustainability goals are raising the bar, pushing market participants to continuously adapt. This evolving environment fosters innovation, accountability, and a focus on long-term impact, driving healthy competition across regions and sectors.

The report provides a comprehensive analysis of the competitive landscape in the sustainable finance market with detailed profiles of all major companies, including:

- Acuity Knowledge Partners

- BNP Paribas

- Deutsche Bank AG

- Goldman Sachs Group Inc.

- KPMG International Limited

- London Stock Exchange Group plc

- Nomura Holdings Inc.

- PricewaterhouseCoopers LLP

- South Pole Group.

Latest News and Developments:

- May 2025: EMSTEEL launched its first Green Finance Framework to fund low-carbon projects like renewable energy and energy-efficient tech. Backed by Moody’s SQS2 rating and partners ING and FAB, the initiative aligns EMSTEEL’s funding with its 2030 goals to cut emissions in steel and cement production.

- May 2025: Natixis announced a merger of its sustainable investing arm Mirova with Thematics Asset Management. The combined unit aims to expand global thematic and impact investment offerings, leverage Mirova’s sustainability expertise and Thematics AM’s focus areas, and double assets by 2030 while augmenting positive environmental and social impact.

- February 2025: Sumitomo Mitsui Trust Bank launched “Impact Finance for Nature” to help clients assess and improve their impact on nature. Aligned with global biodiversity goals and TNFD standards, IFN supports nature-related risk disclosure, monitors KPIs, and promotes sustainability management to build more sustainable societies.

- October 2024: In the US, UK, UAE, South Africa, Singapore, and Hong Kong, Standard Chartered introduced sustainable finance versions of its Borrowing Base Trade Loans (BBTL), which tie funding to ESG standards and provide rewards to companies that achieve sustainability goals like reduced emissions and increased use of renewable energy.

- October 2024: The Sustainable Finance Knowledge Center for Francophone Africa was established by the World Bank Group and its partners. This online resource, which is available in both English and French, attempts to assist companies and financial organizations in developing the abilities necessary to control sustainability risks, promote climate action, and develop green finance in the area.

- October 2024: The ICC launched the Principles for Sustainable Trade Finance (PSTF) at Sibos in Beijing. Created with major banks and BCG, the PSTF sets clear guidelines for sustainable trade finance, aiming to combat greenwashing and support green, sustainability-linked, and social trade finance globally.

Sustainable Finance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Investment Types Covered | Equity, Fixed Income, Mixed Allocation |

| Transaction Types Covered | Green Bond, Social Bond, Mixed-Sustainability Bond |

| Industry Verticals Covered | Utilities, Transport and Logistics, Chemicals, Food and Beverage, Government, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acuity Knowledge Partners, BNP Paribas, Deutsche Bank AG, Goldman Sachs Group Inc., KPMG International Limited, London Stock Exchange Group plc, Nomura Holdings Inc., PricewaterhouseCoopers LLP, South Pole Group., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sustainable finance market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global sustainable finance market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sustainable finance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sustainable finance market was valued at USD 7,381.7 Billion in 2025.

The sustainable finance market is projected to exhibit a CAGR of 16.38% during 2026-2034, reaching a value of USD 30,063.7 Billion by 2034.

Key factors driving the sustainable finance market include rising demand for ESG-aligned investments, supportive government policies, and growing awareness of climate change and social issues. Investors seek long-term value and risk mitigation, while corporations and regulators emphasize transparency, accountability, and sustainability in financial practices and strategic decision-making.

North America currently dominates the sustainable finance market, accounting for a share of 39.5% driven by strong regulatory support, robust investor interest in ESG-aligned assets, and corporate commitment to sustainability. Government policies promoting clean energy, climate risk disclosures, and green infrastructure are fostering market growth. Additionally, advanced financial markets and increasing consumer demand for ethical investing further strengthen North America’s leadership in driving sustainable finance across diverse sectors.

Some of the major players in the sustainable finance market include Acuity Knowledge Partners, BNP Paribas, Deutsche Bank AG, Goldman Sachs Group Inc., KPMG International Limited, London Stock Exchange Group plc, Nomura Holdings Inc., PricewaterhouseCoopers LLP, South Pole Group., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)