Sweden Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2025-2033

Sweden Commercial Insurance Market Overview:

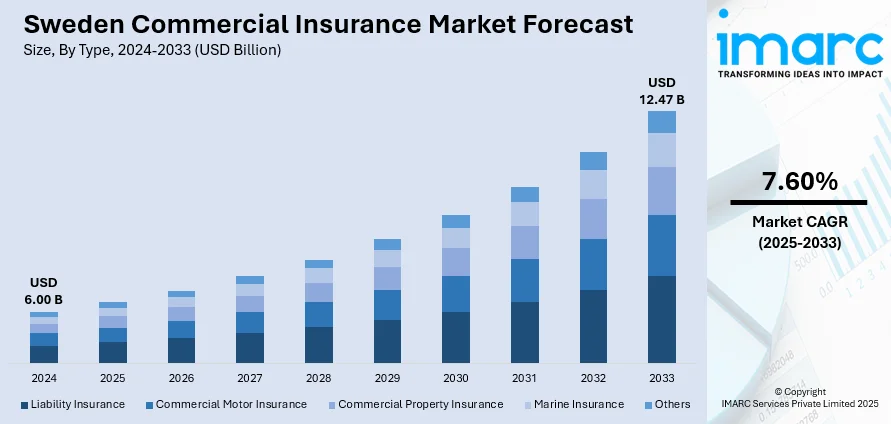

The Sweden commercial insurance market size reached USD 6.00 Billion in 2024. The market is projected to reach USD 12.47 Billion by 2033, exhibiting a growth rate (CAGR) of 7.60% during 2025-2033. Digital adoption in underwriting and claims, increased awareness of risk management, stricter regulatory compliance, rising demand for cyber insurance, growth in SMEs, expanding infrastructure projects, and insurers’ focus on customized policies to meet diverse business needs are some of the factors contributing to the Sweden commercial insurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.00 Billion |

| Market Forecast in 2033 | USD 12.47 Billion |

| Market Growth Rate 2025-2033 | 7.60% |

Sweden Commercial Insurance Market Trends:

Growth in Digital-First Insurance Platforms

Sweden’s commercial insurance market is showing strong adoption of digital-first models, where insurers are integrating online platforms, AI-driven underwriting, and automated claims management. Businesses increasingly prefer providers offering quick policy issuance, transparent pricing, and flexible add-on services through mobile and web platforms. Small and medium-sized enterprises (SMEs), which account for a large portion of Sweden’s business sector, are driving this demand as they seek cost-effective and easy-to-manage coverage. Insurers are responding by investing in AI-powered risk assessment, predictive analytics, and customer self-service tools that reduce administrative overhead. Partnerships with insurtech startups are also reshaping the market, leading to new products such as micro-duration policies and usage-based insurance tailored to specific industries like logistics, e-commerce, and manufacturing. This shift is not just about technology but about meeting client expectations for speed and convenience, making digital transformation one of the most significant competitive factors in Sweden’s commercial insurance space. These factors are intensifying the Sweden commercial insurance market growth.

To get more information on this market, Request Sample

Rising Focus on Climate and Sustainability Risks

Another noticeable trend is the increased importance of environmental and sustainability factors in business insurance. Sweden, which is extremely aware of climate change, is seeing insurers placing a greater focus on coverage for climate-related risks such as flooding, severe storms, and property damage caused by extreme weather. Companies are evaluated not just for operating risks, but also for climate adaptation strategies and sustainability policies. Insurance solutions that incentivize firms to implement green infrastructure, energy-efficient operations, and supply chain resilience are becoming increasingly popular. Larger firms with ESG (Environmental, Social, and Governance) commitments are seeking specialist policies that reflect their sustainability goals, while regulators are also putting pressure on insurers to report climate-related risks. This trend positions insurers as partners in Sweden’s transition toward a low-carbon economy, offering coverage that protects businesses from environmental losses while incentivizing responsible practices. The integration of climate risk models into underwriting highlights how sustainability is no longer optional but a central part of the commercial insurance market’s evolution in Sweden.

Sweden Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

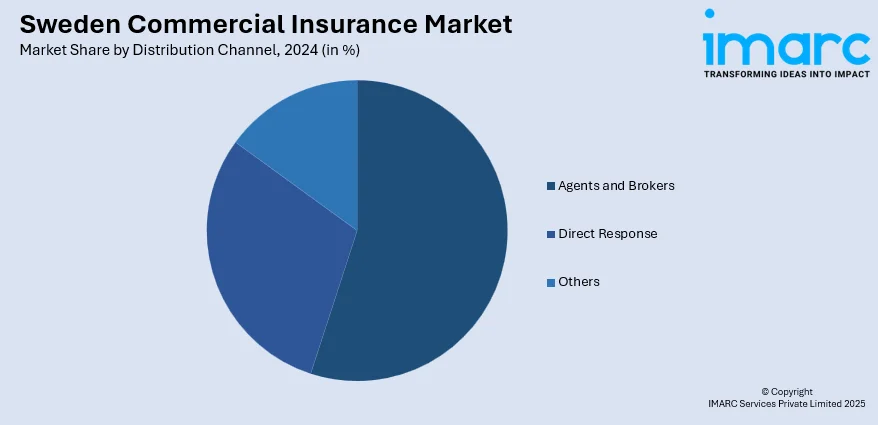

Distribution Channel Insights:

- Agents and Brokers

- Direct Response

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes transportation and logistics, manufacturing, construction, it and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- North Sweden

- Central Sweden

- South Sweden

The report has also provided a comprehensive analysis of all the major regional markets, which include North Sweden, Central Sweden, and South Sweden.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Sweden Commercial Insurance Market News:

- May 2025: Zurich Insurance Group launched a new SME digital insurance platform in Sweden, powered by US-based CoverWallet. This marks its second European rollout after Spain. The platform enables small businesses to get real-time quotes, purchase coverage, and manage policies online. Targeted at micro-enterprises and startups, it offers products including liability, property, and auto insurance. Zurich had earlier invested in CoverWallet to support its European expansion.

Sweden Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | North Sweden, Central Sweden, South Sweden |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Sweden commercial insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Sweden commercial insurance market on the basis of type?

- What is the breakup of the Sweden commercial insurance market on the basis of enterprise size?

- What is the breakup of the Sweden commercial insurance market on the basis of distribution channel?

- What is the breakup of the Sweden commercial insurance market on the basis of industry vertical?

- What is the breakup of the Sweden commercial insurance market on the basis of region?

- What are the various stages in the value chain of the Sweden commercial insurance market?

- What are the key driving factors and challenges in the Sweden commercial insurance market?

- What is the structure of the Sweden commercial insurance market and who are the key players?

- What is the degree of competition in the Sweden commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Sweden commercial insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Sweden commercial insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Sweden commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)