Sweden Fintech Market Size, Share, Trends and Forecast by Deployment Mode, Technology, Application, End User, and Region, 2025-2033

Sweden Fintech Market Overview:

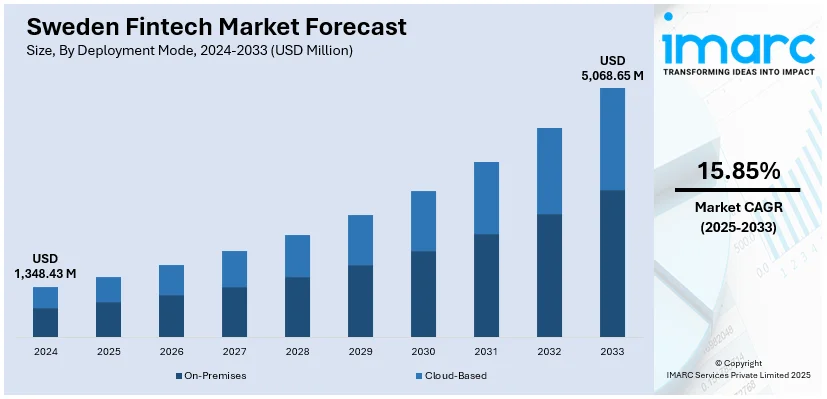

The Sweden fintech market size reached USD 1,348.43 Million in 2024. The market is projected to reach USD 5,068.65 Million by 2033, exhibiting a growth rate (CAGR) of 15.85% during 2025-2033.The market is increasing steadily, led by robust digital infrastructure and friendly regulation. The areas of interest are lending, wealth management, digital payments, and insurtech. The market is supported by innovation, increased investment, and high digital literacy of consumers. Policies of the government support the development of new financial technologies, leading to a competitive dynamic ecosystem. All these together are drivers of the ongoing growth and influence of the Sweden fintech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,348.43 Million |

| Market Forecast in 2033 | USD 5,068.65 Million |

| Market Growth Rate 2025-2033 | 15.85% |

Sweden Fintech Market Trends:

Digital Payment Revolution

Sweden's fintech sector is progressing rapidly, fueled by extensive use of digital payments and instant settlement arrangements. In August 2024, the Swedish Central Bank confirmed the persistent dominance of non-cash payments in everyday retail transactions, which is a sign of a profound shift in consumer culture and payment behavior. This large-scale use of digital payments inspires fintech firms to create solutions along the lines of speed, security, and user experience. Contactless payments, mobile wallets, and QR code payments are the reality with companies compelled to design products which integrate seamlessly into current infrastructure and have very high user expectations. In addition to this, the sector is shifting towards sophisticated technologies such as biometric identification and AI-powered fraud prevention without sacrificing user experience. Sweden's strong digital backbone and associated high confidence levels create the ideal context in which these technological developments can take place. The overall impact is a fintech ecosystem poised to serve an increasingly digitally native population with seamless, efficient payment options. This change is a basis for Sweden fintech market growth, solidifying its place as a global fintech leader.

To get more information on this market, Request Sample

Building Smarter Together with APIs

Sweden’s fintech landscape continues to evolve with a growing emphasis on open banking and API ecosystems, which are reshaping how financial services are delivered. In 2025, regulators acknowledged growing progress as more financial providers began implementing API access points that support third-party innovation. This shift is helping fintech firms and traditional institutions co-create solutions that offer consumers frictionless, personalized experiences. The emergence of standardized APIs makes it easier for fintech’s to access core banking functions such as payment initiation and account information while ensuring user consent and regulatory compliance. This environment has sparked new offers in personalized financial management, streamlined lending services, and efficient integrations for small businesses. Beyond regulatory compliance, the focus is on creating a collaborative spirit where banks and fintech play complementary roles. This shift marks a meaningful evolution for the sector, where openness and interoperability become the foundations for innovation. At the same time, Sweden fintech market trends reflect a marketplace increasingly centered on seamless data sharing, regulatory alignment, and trust, guiding the next generation of digital finance forward.

Regulation as a Strategic Springboard

Sweden’s financial authorities are increasingly turning regulation into a foundation for purposeful innovation in fintech. In August 2024, the Digital Operational Resilience Act (DORA) began to apply across the sector, introducing requirements that extend beyond traditional banking to fintech and ICT service providers. This isn’t about tape, it’s about resilience. The updated focus on operational robustness, cybersecurity, and crisis preparedness gives fintech firms a clearer foundation from which to build services that users can genuinely trust. Meanwhile, efforts to modernize the anti-money laundering framework are also gaining traction. Regulators are exploring ways to strengthen licensing, supervision, and oversight for emerging fintech models while maintaining innovation momentum. These regulatory developments prompt fintech’s to design systems and services with integrity and safety at their core, not as afterthoughts. The result is a more mature landscape where trust, transparency, and technological ambition go hand in hand. Far from slowing growth, smart regulation can highlight gaps and raise the bar making fintech solutions more reliable, long-lasting, and ready for the real world.

Sweden Fintech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on deployment mode, technology, application, and end user.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

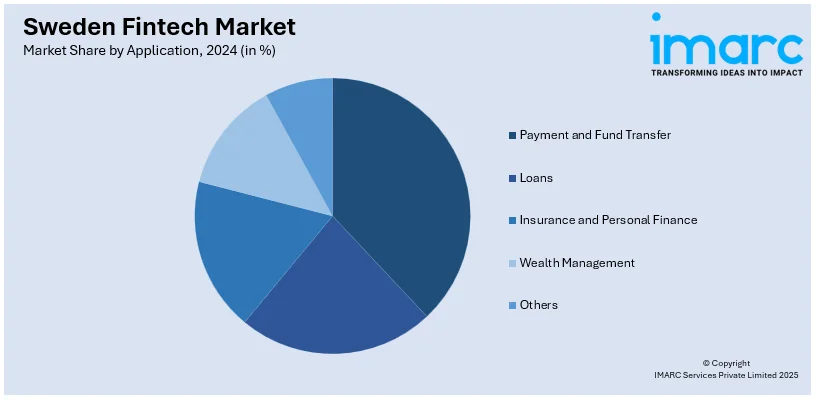

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes payment and fund transfer, loans, insurance and personal finance, wealth management, and others.

End User Insights:

- Banking

- Insurance

- Securities

- Others

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes banking, insurance, securities, and others.

Regional Insights:

- North Sweden

- Central Sweden

- South Sweden

The report has also provided a comprehensive analysis of all the major regional markets, which include North Sweden, Central Sweden, and South Sweden.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Sweden Fintech Market News:

- June 2025: Sweden’s crypto ecosystem gains momentum as OKX launches a fully regulated, centralized crypto trading platform accessible to users across the country. The platform delivers spot trading, staking, automated trading bots, and crypto‑earn products all within a compliant framework. Moritz Putzhammer will lead operations in Sweden and the broader Nordics, overseeing market development and regulatory engagement, while OKX emphasizes infrastructure reliability and transparency through regular proof‑of‑reserves publications. This expansion reflects Sweden’s growing embrace of regulated digital asset services.

- July 2025: Sweden's fintech industry keeps growing as Stockholm-based Mynt teams up with top bank Nordea to widen financial services to small and medium-sized enterprises. The two aim to provide a unified business credit card product paired with sophisticated spend management capabilities. Mynt has technology that simplifies handling expenses as well as accounting processes, while Nordea provides established financial know-how. This collaboration is an example of Sweden's continuous efforts in digital innovation and expands the role of fintech in facilitating local business activities.

Sweden Fintech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End Users Covered | Banking, Insurance, Securities, Others |

| Regions Covered | North Sweden, Central Sweden, South Sweden |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Sweden fintech market performed so far and how will it perform in the coming years?

- What is the breakup of the Sweden fintech market on the basis of deployment mode?

- What is the breakup of the Sweden fintech market on the basis of technology?

- What is the breakup of the Sweden fintech market on the basis of application?

- What is the breakup of the Sweden fintech market on the basis of end user?

- What is the breakup of the Sweden fintech market on the basis of region?

- What are the various stages in the value chain of the Sweden fintech market?

- What are the key driving factors and challenges in the Sweden fintech market?

- What is the structure of the Sweden fintech market and who are the key players?

- What is the degree of competition in the Sweden fintech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Sweden fintech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Sweden fintech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Sweden fintech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)