Switzerland Animal Feed Market Size, Share, Trends and Forecast by Form, Animal Type, Ingredient, and Region, 2025-2033

Switzerland Animal Feed Market Size and Share:

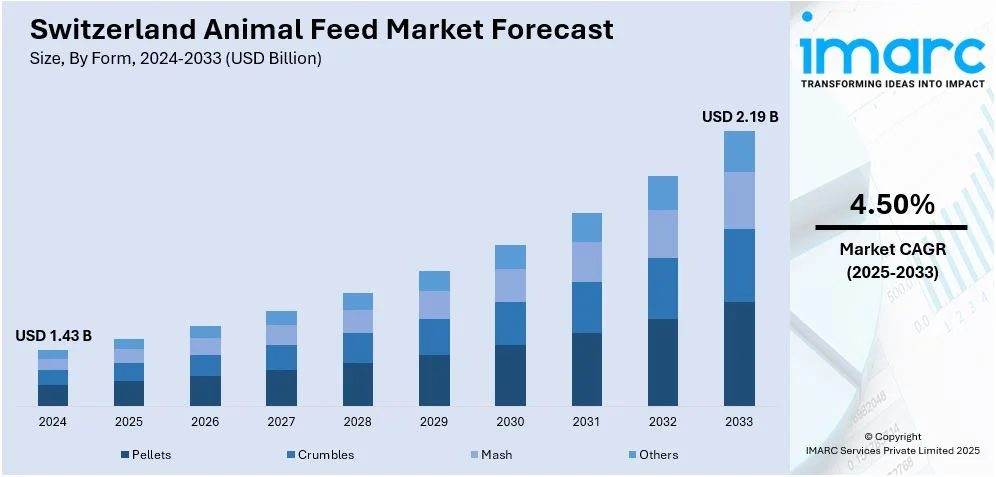

The Switzerland animal feed market size was valued at USD 1.43 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.19 Billion by 2033, exhibiting a CAGR of 4.50% from 2025-2033. The market is driven by increasing demand for organic and nutritious feed, advancements in feed formulations, a focus on sustainability, rising meat consumption, and growing awareness of animal health.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.43 Billion |

| Market Forecast in 2033 | USD 2.19 Billion |

| Market Growth Rate (2025-2033) | 4.50% |

The Switzerland animal feed market growth is largely fueled by the increasing demand for organic and sustainable feed products in the region. As consumers become more health conscious and environmentally aware, there is an increased preference for organic and non-genetically modified organism (GMO) animal feed, supporting the market growth. This trend aligns with the strong emphasis of Switzerland on sustainability and eco-friendly agricultural practices, thus providing an impetus to the market. For example, in 2023 Swiss government officials proposed feed regulations that permit processed animal protein use so pigs and poultry can feed from one another's products. The proposed program targets enhanced animal nutrition while maximizing resource usage efficiency. Additionally, ongoing advancements in animal nutrition, such as precision feeding and tailored formulations, are enhancing feed quality and efficiency, supporting the overall health of livestock and fueling the Switzerland animal feed market demand.

Concurrent with this, the rising consumption of meat, particularly in urban areas, fueled by higher income levels and changing dietary preferences is contributing to the market expansion. As demand for animal-based products like meat and dairy increases, so does the need for efficient and high-quality animal feed, strengthening the Switzerland animal feed market share. For instance, in 2024, Nuproxa has been the pioneering force behind incorporating polyherbal ingredients into animal feed to advance sustainable natural animal nutritional approaches, aligning with the growing demand for eco-friendly and health-conscious feed solutions. Moreover, the growing focus on improving livestock health and welfare is leading to greater demand for specialized feed solutions that promote overall well-being, impelling the market growth. The combination of these factors is fostering a dynamic and competitive animal feed market in Switzerland, pushing the industry toward greater sustainability and technological advancement.

Switzerland Animal Feed Market Trends:

Shift Toward Organic and Sustainable Feed

Organic and sustainable animal feed options represent a leading in the Switzerland animal feed market trends. Farmer supplies alongside feed manufacturer production of organic and non-GMO feed increases in response to consumers who want better and environmentally friendly products. According to reports, animal feed production occupies more than 70% of the total Swiss agricultural land territory. The research also indicates the possibility of developing at least fifty percent of current animal feed cropland into vegetable, fruit, and cereal cultivation to enhance agricultural efficiency. Besides this, government regulations and changing customer preferences have been the driving forces behind the increasing demand for sustainable animal feed systems. Apart from this, the increasing demand for organic livestock products is spurring both sustainable practice development and innovation throughout the industry, thereby propelling the market forward.

Technological Advancements in Feed Formulation

Ongoing technological advancements in the development of feedstock are enhancing the Switzerland animal feed market outlook. Precision nutrition along with tailored diets has become increasingly common as advances occur in feed formulation technology. Moreover, farmers benefit from innovations that improve their feed efficiency and increase their livestock growth rates while minimizing their production expenses. For instance, an initiative presented in August 2024 urges Switzerland to produce 70% of its food domestically, highlighting that 60 percent of arable land in the country serves to grow animal feed. This indicates the need to move towards plant-based food cultivation, which would maximize calorie production per hectare and agricultural efficiency. Furthermore, the integration of digital applications for data analytics and feed management enables the production of personalized nutritional diets that target specific requirements within animal populations. These developments create a sustainable animal feed industry that prioritizes both improved animal performance and increased profitability through precision nutritional approaches, thus impelling the market growth.

Increased Focus on Animal Health and Welfare

The Switzerland animal feed market prioritizes animal health and welfare as the main focus while developing feeds specifically to enhance animal well-being. In line with this, the growing interest in diet-related health effects creates elevated demand for specialized feed products that strengthen livestock immunity and minimize diseases in livestock. Besides this, the rising consumer demand for ethically produced animals and healthy livestock has led producers to focus on nutrition-based feed solutions that improve animal health and production longevity. For example, in April 2024, Nuproxa Group started a partnership with Bluejais to develop advanced animal healthcare solutions and nutrition products focused on poultry pigs, and aquatic species, further contributing to innovative, health-driven feed solutions. As a result, the improving functional feeds along with probiotics and supplements are boosting the market share as they help protect animal health while reducing reliance on antibiotics, thereby influencing the Switzerland animal feed market price.

Switzerland Animal Feed Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Switzerland animal feed market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on form, animal type, and ingredient.

Analysis by Form:

- Pellets

- Crumbles

- Mash

- Others

Pellets are a popular form of animal feed due to their ease of handling, storage, and improved feed conversion efficiency. Their compact form ensures a steady supply of nutrients, making them well-suited for both livestock and poultry. This format enhances feed intake and minimizes wastage.

Crumbles are finely ground feed formed into small, irregular pieces. They are particularly beneficial for young livestock, poultry, and pets, as they are easier to consume and digest. They also offer better texture and palatability, which encourages feed consumption and growth.

Mash is a ground, unprocessed form of animal feed consisting of coarse particles. It provides flexibility in feeding, particularly for smaller or specialty animals, as it can be mixed with liquids, and it is often chosen for its cost-effectiveness and nutritional customization.

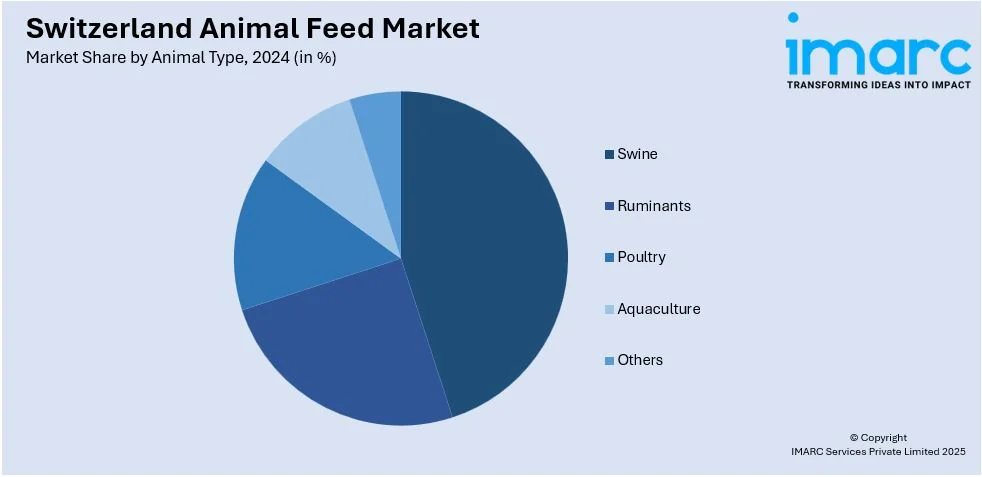

Analysis by Animal Type:

- Swine

- Starter

- Finisher

- Grower

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Turkeys

- Others

- Aquaculture

- Carps

- Crustaceans

- Mackeral

- Milkfish

- Mollusks

- Salmon

- Others

- Others

Swine feed products are developed to match different stages of pig growth for healthy development. Starter feed offers vital nutritional components as it is essential in the early growth of piglets. Whereas the grower feed enables pigs to increase weight steadily with proper development advancements during their mid-age. Additionally, finisher feed satisfies developing pigs which approach market size by supporting muscle development to achieve optimal production objectives.

The ruminant feed has been optimized to provide the distinctive nutritional requirements of multiple livestock categories. Early development support and essential nutrient provision are built into calf feeds through their special formulation. Besides this, the main purpose of dairy cattle feed is to enhance milk production while delivering energy along with protein to maximize milk output. Furthermore, beef cattle feed systems provide the correct nutrient mixture to achieve both efficient weight accumulation and superior meat quality for healthy swift development.

Poultry feed is specially designed to cater to the distinct requirements of broilers, layers, and turkeys. The nutrient composition of broiler feed aims to deliver optimized development of broiler chickens for getting the most efficient meat output. Besides this, layer feed contains essential nutrients that support both egg production quality and egg quantity. Moreover, the consumption of turkey feed helps turkeys grow to their market specifications by supporting healthy development and focusing on improving final meat quality.

Aquaculture feed is customized to meet the dietary requirements of various aquatic species, enabling rapid species growth and greater production efficiency. The consumption of carp feed results in improved growth rates together with better feed conversion ratios which supports fish health. Additionally, crustacean feed, such as for shrimp, supports efficient growth and immune function. Moreover, the specialized mackerel feed serves to nourish mackerel growth in fish farming whereas milkfish feed promotes both development and reproductive health. Furthermore, mollusk feed delivers critical nutrients to enhance shellfish growth. Also, salmon feed containing high protein provides rapid development and excellent health conditions for farm-raised salmon.

Analysis by Ingredient:

- Cereals

- Oilseed Meal

- Molasses

- Fish Oil and Fish Meal

- Additives

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Feed Enzymes

- Feed Acidifiers

- Others

- Others

Cereals are a primary source of energy in animal feed, providing essential carbohydrates and nutrients. They are used for various animals, from livestock to poultry. Additionally, common cereals include corn, wheat, and barley, offering digestible energy that supports growth and production.

Oilseed meal is a valuable source of both protein and energy, frequently utilized in animal feed. This oilseed meal is derived from crops like soybeans, sunflower, and canola, oilseed meal offers amino acids and healthy fats, supporting muscle growth and efficient weight gain in animals.

Molasses is a by-product of sugar production and is used in animal feed for its energy content and palatability. It is high in sugars, offering a rapid energy boost for animals. Molasses also helps improve feed intake and bind other feed ingredients together.

Fish oil and fish meal are vital protein and fat sources in animal feed, especially for poultry, swine, and aquaculture. They are rich in omega-3 fatty acids and support healthy growth and immune function, improving feed digestibility and overall animal health.

Additives are used in animal feed to enhance nutritional value, health, and feed efficiency. Antibiotics provide disease prevention with growth enhancement benefits and vitamins maintain metabolic efficiency and support healthy animal development and welfare status. The protection of feed quality through antioxidant interventions helps control oxidative stress to achieve favorable results for feed quality along with animal health preservation. Moreover, through muscle growth and protein synthesis amino acids help build muscles and feed enzymes to improve digestion to enhance nutrient absorption. Apart from this, animal performance improves, and digestive function strengthens through the utilization of feed acidifiers which maintain their gut health and decrease dangerous microbial populations.

Regional Analysis:

- Zurich

- Espace Mittelland

- Lake Geneva Region

- Northwestern Switzerland

- Eastern Switzerland

- Central Switzerland

- Ticino

Zurich, Switzerland's economic hub, drives demand for high-quality animal feed, particularly in urban and industrial areas. The region's robust agricultural practices, coupled with its proximity to research and innovation centers, contribute to a growing demand for specialized and sustainable feed solutions.

Espace Mittelland, located in central Switzerland, has a strong agricultural presence, focusing on dairy and livestock farming. The region's demand for animal feed is driven by its extensive farming community, which seeks efficient, high-nutrient feed to support the health and productivity of livestock.

The Lake Geneva region is recognized for its varied agricultural landscape, which includes dairy farming and poultry production. The demand in the region is influenced by traditional farming practices and the growing trend of sustainable and organic agriculture, prompting the need for high-quality, eco-friendly feed solutions.

Northwestern Switzerland, with its strong agricultural sector, is a key area for animal feed demand, particularly for cattle and poultry. The region’s focus on livestock farming, coupled with growing interest in animal health and feed efficiency, drives the need for specialized feed ingredients.

Eastern Switzerland is home to a variety of livestock, including cattle and sheep, creating a steady demand for animal feed. The region’s agricultural practices emphasize quality and sustainability, pushing the market for innovative feed solutions that promote animal health and productivity.

Central Switzerland has a picturesque agricultural landscape and supports a mix of dairy and meat production. The demand for animal feed in this region is fueled by the need for balanced nutrition for livestock, with an increasing focus on organic and sustainable feed options.

Ticino, located in southern Switzerland, has a smaller but growing agricultural sector, with a focus on high-quality livestock production. The demand for animal feed is driven by both traditional farming methods and the increasing adoption of sustainable practices that require innovative, nutrient-dense feed formulations.

Competitive Landscape:

The Switzerland animal feed market contains both worldwide firms and domestic enterprises that deliver diverse feed products for various animal types. The top companies within this industry engage in product advancement by developing sustainable and organic feeding choices and improved nutritional combinations to support rising requirements of high-performance animal nutrition meeting health requirements. Market leaders implement digital technologies together with precision feeding solutions that enhance feed efficiency in their business operations. Furthermore, strong competition between industry participants continues to push improvements and investments toward better quality and cost-effective solutions alongside regulatory compliance standards.

The report provides a comprehensive analysis of the competitive landscape in the Switzerland animal feed market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, ForFarmers entered into a collaboration with Remediiate to improve the advancement of feed circularity systems. The collaborative initiative analyzes microalgae as a sustainable animal feed component to enhance circular agriculture systems.

- In December 2024, BASF announced a Force Majeure for its vitamin A, vitamin E, and carotenoid products, as well as certain aroma ingredients. This announcement created disruptions throughout the supply chain of these feed additives.

- In November 2024, Evonik presented its dedication to sustainability in animal nutrition at the EuroTier 2024 exhibition. The company demonstrated how its feed ingredients combined with its feeding concepts enable sustainable production of animal protein.

- In June 2024, Nutreco inaugurated their Garden of the Future in Switzerland which specializes in developing PhytoComplexes for animal food. This innovative animal feeding technique produces network-based responses while enhancing animal function.

- In June 2024, ADM Animal Nutrition broadened its existing recall to include extra lots of their multiple feed product ranges because of elevated sodium calcium, and phosphorus content, ensuring livestock safety.

- In April 2024, Intraco Ltd and trinamiX GmbH joined forces to provide mobile feed analysis using trinamiX’s handheld NIR Spectroscopy Solution. Through their partnership Intraco's distributors can determine feed nutrient levels instantly to help farmers maintain balanced nutrition feeds at economical prices.

Switzerland Animal Feed Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Pellets, Crumbles, Mash, Others |

| Animal Types Covered |

|

| Ingredients Covered |

|

| Regions Covered | Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, Ticino |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Switzerland animal feed market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Switzerland animal feed market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Switzerland animal feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Switzerland animal feed market was valued at USD 1.43 Billion in 2024.

Key factors driving the growth of the Switzerland animal feed market include rising demand for organic feed, advancements in nutritional formulations, sustainability initiatives, increasing meat consumption due to higher incomes, and growing awareness of animal health, all contributing to an expanded and more efficient feed industry.

IMARC estimates the Switzerland animal feed market to exhibit a CAGR of 4.50% during 2025-2033, reaching a value of USD 2.19 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)