Switzerland CCTV Camera Market Size, Share, Trends and Forecast by Type, End User Vertical, and Region, 2026-2034

Switzerland CCTV Camera Market Summary:

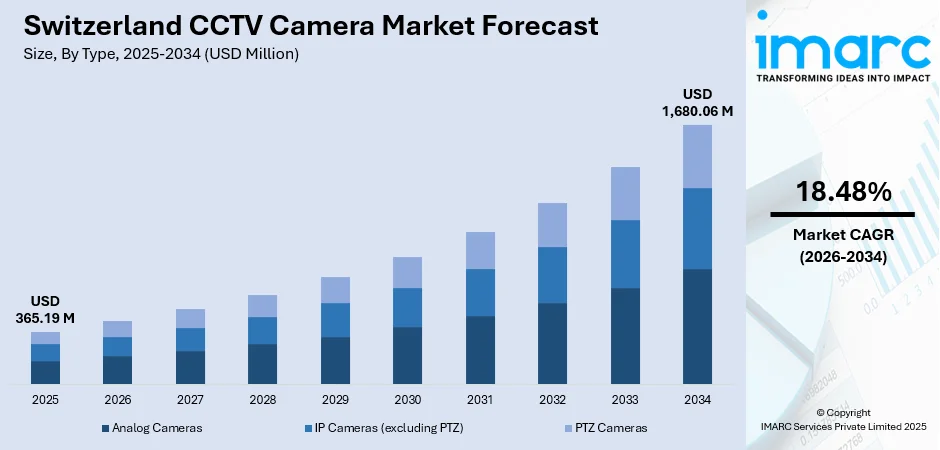

The Switzerland CCTV camera market size was valued at USD 365.19 Million in 2025 and is projected to reach USD 1,680.06 Million 2034, growing at a compound annual growth rate of 18.48% from 2026-2034.

The Switzerland CCTV camera market is experiencing robust expansion driven by escalating security requirements across government, commercial, and residential sectors. Smart city initiatives, particularly in major urban centers like Zurich and Geneva, are accelerating the deployment of advanced surveillance infrastructure. The transition from traditional analog systems to sophisticated IP-based solutions, coupled with increasing integration of artificial intelligence capabilities for real-time analytics and threat detection, is fundamentally reshaping the Switzerland CCTV camera market share.

Key Takeaways and Insights:

- By Type: IP Cameras (excluding PTZ) dominated the market with approximately 60% revenue share in 2025, driven by superior image resolution, seamless network integration capabilities, and advanced analytics features that enable real-time monitoring and remote accessibility across diverse surveillance applications.

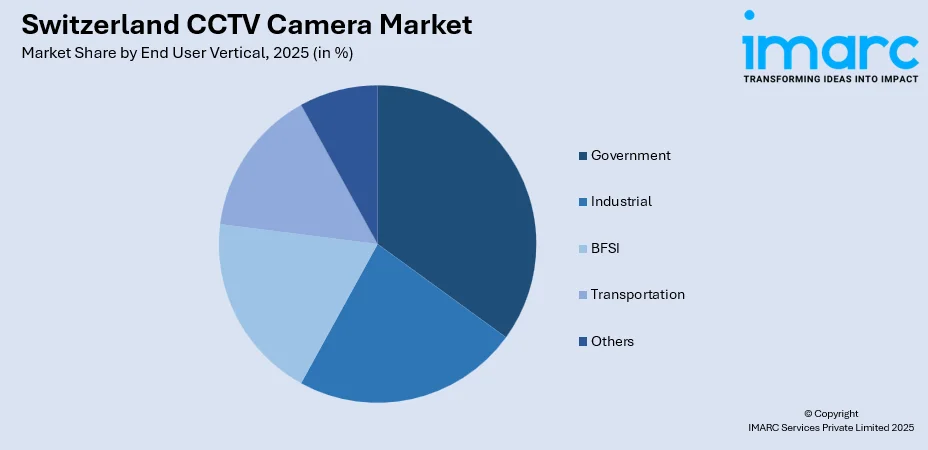

- By End User: Government sector exhibits a clear dominance with 25% share in 2025, propelled by extensive public safety investments, critical infrastructure protection requirements, and smart city surveillance deployments across federal, cantonal, and municipal administrative levels.

- Key Players: The Switzerland CCTV camera market exhibits moderate competitive intensity, with established multinational surveillance technology corporations competing alongside specialized European security solution providers. Market dynamics are shaped by technological innovation, cybersecurity compliance, and strategic partnerships with system integrators.

To get more information on this market, Request Sample

The Switzerland CCTV camera market is advancing as organizations across sectors prioritize enhanced security infrastructure and intelligent monitoring capabilities. A major development shaping this progress is the growing emphasis on integrated security ecosystems that combine video surveillance with access control and analytics platforms. For instance, Axis Communications launched AXIS Secure Entry for XProtect in September 2025, an all-in-one solution uniting access control and video surveillance within the Milestone XProtect interface, enabling operators to monitor door activities and review live or recorded video from a unified platform. This integration reflects the broader industry trend toward comprehensive, AI-powered security solutions that enhance operational efficiency while meeting stringent European data protection requirements.

Switzerland CCTV Camera Market Trends:

Adoption of AI-Powered Surveillance Solutions

The Switzerland CCTV camera market is increasingly adopting artificial intelligence to enhance the effectiveness and efficiency of surveillance systems. Modern CCTV setups are integrating features such as facial recognition, behavior analysis, license plate detection, and automated alerts. These intelligent systems facilitate real-time threat detection and faster response times, particularly in high-security environments including airports, banking facilities, and critical public infrastructure. Businesses and government authorities are leveraging AI-driven analytics to monitor crowd behavior, identify anomalies, and proactively prevent security incidents, driving Switzerland CCTV camera market growth. In November 2025, the Federal Council of Switzerland amended the Aviation Act to permit biometric processing at airports — a move that would enable use of facial-recognition cameras for identity verification during check-in, boarding, etc.

Transition to IP-Based Network Camera Systems

The market continues witnessing accelerated migration from legacy analog systems to network-based IP camera infrastructure across commercial, government, and residential segments. IP cameras offer significant advantages including superior resolution quality reaching eight megapixels and beyond, seamless integration with existing IT networks, remote accessibility through mobile devices and web interfaces, and enhanced scalability for expanding surveillance requirements. Network infrastructure enables centralized management, simplified maintenance, and integration with advanced analytics platforms.

Cloud Storage and Remote Access Capabilities

Cloud-based surveillance solutions are gaining significant traction in Switzerland, enabling organizations to access live and recorded footage through smartphones, tablets, and computer interfaces regardless of physical location. This flexibility proves particularly valuable for multi-site enterprises requiring centralized security operations centers, while reducing on-premises storage infrastructure investments. Axis Communications launched Axis Cloud Connect in April 2024, an open cloud-based platform providing secure, flexible, and scalable security solutions. The platform includes AXIS Camera Station Pro for on-premise VMS, AXIS Camera Station Edge for cam-to-cloud connectivity, and AXIS Camera Station Center for multi-site aggregation. Cloud solutions complement existing security protocols while providing enhanced redundancy and disaster recovery capabilities.

Market Outlook 2026-2034:

The Switzerland CCTV camera market demonstrates exceptional growth potential throughout the forecast period, supported by accelerating digital transformation initiatives and evolving security requirements across all sectors. The market revenue of USD 365.19 Million in 2025 and is projected to reach USD 1,680.06 Million by 2034, growing at a compound annual growth rate of 18.48% from 2026-2034. This indicates strong market momentum as smart city programs mature, AI-powered analytics gain broader adoption, and regulatory frameworks continue supporting comprehensive security deployments across government, commercial, and residential applications.

Switzerland CCTV Camera Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

IP Cameras (excl. PTZ) |

60% |

|

End User Vertical |

Government |

25% |

Type Insights:

- Analog Cameras

- IP Cameras (excluding PTZ)

- PTZ Cameras

The IP Cameras (excluding PTZ) segment accounted for a revenue share of 60% of the total Switzerland CCTV camera market in 2025.

IP cameras have proven exceptionally beneficial for organizations requiring high-resolution surveillance with network integration capabilities, remote accessibility, and compatibility with advanced video analytics platforms. The segment's market leadership is attributable to several factors including superior image quality enabling forensic-level detail capture, seamless integration with existing IT infrastructure reducing deployment complexity, Power over Ethernet (PoE) capability simplifying installation requirements, and native support for edge-based AI analytics enabling real-time threat detection. Axis Communications unveiled four next-generation AI-powered bullet cameras at GSX 2025 (AXIS P1475-LE, P1485-LE, P1487-LE, P1488-LE) offering resolutions from 2MP to 8MP, built on ARTPEC-9 with OptimizedIR for surveillance in pitch darkness up to 50 meters. Hanwha Vision's 2nd generation X Series AI cameras powered by Wisenet 9 SoC feature dual NPU architecture with separate processors for image optimization and AI analytics. The IP camera segment benefits from ongoing technology evolution enabling increasingly sophisticated capabilities at competitive price points.

End User Vertical Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Government

- Industrial

- BFSI

- Transportation

- Others

The Government segment accounted for the largest revenue share of approximately 25% in the Switzerland CCTV camera market in 2025.

Government sector dominance reflects Switzerland's comprehensive approach to public safety and critical infrastructure protection. Federal, cantonal, and municipal authorities deploy extensive surveillance networks across administrative buildings, public spaces, transportation hubs, and border facilities. The segment benefits from consistent budget allocations for security modernization, with particular emphasis on upgrading legacy systems to IP-based platforms with enhanced analytics capabilities. Smart city initiatives in major urban centers are driving substantial investments in integrated surveillance infrastructure.

The industrial and BFSI sectors represent significant growth opportunities, with manufacturing facilities, financial institutions, and banking networks requiring sophisticated monitoring solutions for asset protection, operational oversight, and regulatory compliance. The transportation sector continues expanding surveillance coverage across railway networks, airports, and public transit systems to enhance passenger safety and operational efficiency.

Regional Insights:

- Zurich

- Espace Mittelland

- Lake Geneva Region

- Northwestern Switzerland

- Eastern Switzerland

- Central Switzerland

- Ticino

Zurich represents the largest regional market for CCTV cameras in Switzerland, driven by the concentration of financial institutions, corporate headquarters, and critical infrastructure. The region's status as a global banking center necessitates sophisticated surveillance systems for high-value asset protection and regulatory compliance.

The Espace Mittelland region, encompassing the federal capital Bern, demonstrates strong demand for government and institutional surveillance solutions. Federal administrative buildings, diplomatic facilities, and public transportation networks require comprehensive security coverage, with particular emphasis on integration with existing security management systems.

The Lake Geneva Region, including Geneva and Lausanne, represents a significant market driven by international organizations, luxury hospitality, and pharmaceutical industry requirements. The presence of United Nations agencies and multinational corporations creates sustained demand for high-specification surveillance systems meeting international security standards.

Northwestern Switzerland, with Basel as its primary urban center, exhibits strong market activity driven by pharmaceutical manufacturing, chemical industries, and cross-border commercial facilities. Industrial surveillance requirements and logistics security applications represent key demand drivers in this economically significant region.

Eastern Switzerland demonstrates growing surveillance infrastructure investment across manufacturing, tourism, and commercial sectors. The region's industrial base and border proximity support demand for comprehensive monitoring solutions addressing both operational security and asset protection requirements.

Central Switzerland combines tourism-driven surveillance requirements with residential and commercial security applications. The region's scenic attractions and visitor facilities necessitate discrete yet effective monitoring systems, while growing commercial development supports expanded infrastructure investments.

Ticino, Switzerland's Italian-speaking canton, presents distinct market characteristics influenced by cross-border commerce, tourism activities, and residential security requirements. The region's geographic position and economic ties with northern Italy create specialized surveillance demands addressing both local and international security considerations.

Market Dynamics:

Growth Drivers:

Why is the Switzerland CCTV Camera Market Growing?

Smart City Initiatives Accelerating Surveillance Infrastructure Deployment

Switzerland is implementing comprehensive smart city programs across major urban centers, fundamentally reshaping infrastructure investment patterns and creating structural long-term growth drivers for the surveillance camera market. Municipal governments are deploying integrated monitoring solutions combining video surveillance with traffic management, environmental monitoring, and public safety applications. These initiatives require extensive camera networks capable of feeding data to centralized analytics platforms enabling predictive policing, crowd management, and emergency response coordination. The Swiss Federal Council adopted the Digital Switzerland Strategy 2025, setting priorities for digital transformation. The strategy emphasizes implementation of the 'digital first principle' and coordination between federal departments and the Federal Chancellery.

Financial Sector Security Requirements Driving Premium Camera Adoption

Switzerland's position as a global financial center creates substantial demand for sophisticated surveillance infrastructure across banking facilities, wealth management offices, and financial technology operations. The concentration of private banking, asset management, and international financial institutions in Zurich and Geneva generates sustained investment in security systems meeting stringent regulatory requirements and client confidentiality expectations. Financial institutions require comprehensive monitoring covering branch offices, data centers, vault facilities, and executive areas, creating diverse camera deployment requirements across multiple facility types. The Swiss National Bank's Financial Stability Report 2025 notes that banking sector profitability improved in 2024, with the final Basel III standards entering into force in January 2025. FINMA's Circular 2023/01 'Operational risks and resilience - banks' entered into force on January 1, 2024, clarifying supervisory practice regarding information and communication technology, critical data handling, and cyber risks. FINMA guidance from 2024 requires banks to report certain cyber-attacks within 24 hours of becoming aware of incidents. The regulatory environment continues strengthening security mandates, driving ongoing investment in surveillance technology.

Critical Infrastructure Protection Mandates Expanding Surveillance Coverage

Switzerland's energy production facilities, transportation networks, and healthcare institutions face increasing pressure to implement comprehensive surveillance as part of critical infrastructure protection programs. Federal regulations mandate specific security measures for designated critical infrastructure operators, driving adoption of advanced video monitoring systems with analytics capabilities enabling threat detection and access control integration. Transportation authorities responsible for railway networks, airport facilities, and highway systems require extensive camera deployments enabling passenger safety monitoring, incident documentation, and operational coordination. The mandatory reporting obligation for cyberattacks on critical infrastructure came into force on April 1, 2025, under the revised Information Security Act (ISA). Operators of critical infrastructure including energy and drinking water suppliers, transport companies, and cantonal and municipal administrations must report cyberattacks to the National Cyber Security Centre (NCSC) within 24 hours of discovery.

Market Restraints:

What Challenges Switzerland CCTV Camera Market is Facing?

Stringent Data Protection Regulations Complicating Deployment

Switzerland's comprehensive data protection framework, aligned with European GDPR standards, imposes significant compliance requirements on surveillance system deployments. Organizations must navigate complex regulations governing video capture, storage, and processing while ensuring appropriate consent and transparency mechanisms. These requirements increase implementation costs and extend deployment timelines, particularly for applications involving public spaces or employee monitoring.

High Technology Investment Costs Limiting Small Business Adoption

The capital-intensive nature of advanced IP camera systems with AI analytics capabilities presents adoption barriers for small and medium enterprises. Premium surveillance solutions incorporating edge computing, cloud integration, and sophisticated analytics require substantial upfront investment and ongoing operational expenditure. Budget constraints among smaller organizations limit market penetration despite growing security awareness.

Cybersecurity Concerns Affecting Product Selection Decisions

Increasing awareness of cybersecurity vulnerabilities in networked surveillance systems influences procurement decisions and extends evaluation processes. Concerns regarding potential exploitation of camera systems as network entry points prompt organizations to conduct extensive security assessments. This scrutiny favors manufacturers demonstrating robust cybersecurity credentials while potentially limiting options from newer market entrants.

Competitive Landscape:

The Switzerland CCTV camera market exhibits moderate competitive intensity characterized by the presence of established multinational surveillance technology corporations alongside specialized European security solution providers. Market dynamics reflect strategic positioning emphasizing AI-powered analytics, cybersecurity compliance, and comprehensive integration capabilities. The competitive landscape is increasingly shaped by partnerships between camera manufacturers and video management software developers, enabling unified security platforms addressing complex enterprise requirements. European manufacturers benefit from GDPR compliance expertise and localized support infrastructure, while global players leverage extensive product portfolios and established distribution networks. Innovation in edge AI processing, cloud connectivity, and sustainable product design are emerging as key differentiators influencing procurement decisions across government, commercial, and industrial segments.

Recent Developments:

- In June 2025, Hanwha Vision introduced the second-generation X Series AI cameras powered by the Wisenet 9 AI-native System on Chip. The new camera line features dual neural processing units enabling simultaneous image processing and advanced object detection analytics, delivering enhanced AI capabilities for diverse security environments across European markets including Switzerland.

Switzerland CCTV Camera Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Cameras, IP Cameras (excluding PTZ), PTZ Cameras |

| End User Verticals Covered | Government, Industrial, BFSI, Transportation, Others |

| Regions Covered | Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, Ticino |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Switzerland CCTV camera market size was valued at USD 365.19 Million in 2025.

The Switzerland CCTV camera market is expected to grow at a compound annual growth rate of 18.48% from 2026-2034 to reach USD 1,680.06 Million by 2034.

IP Cameras (excluding PTZ) dominated the market with a revenue share of 60%, driven by superior image resolution, network integration capabilities, and compatibility with advanced AI-powered analytics platforms enabling real-time monitoring and remote accessibility.

Key factors driving the Switzerland CCTV camera market include smart city initiatives accelerating surveillance infrastructure deployment, financial sector security requirements driving premium camera adoption, critical infrastructure protection mandates expanding surveillance coverage, and AI-powered analytics enabling enhanced threat detection capabilities.

Major challenges include stringent data protection regulations complicating deployment processes, high technology investment costs limiting small business adoption, cybersecurity concerns affecting product selection decisions, and the complexity of integrating legacy systems with modern IP-based surveillance platforms.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)