Switzerland Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2025-2033

Switzerland Commercial Insurance Market Overview:

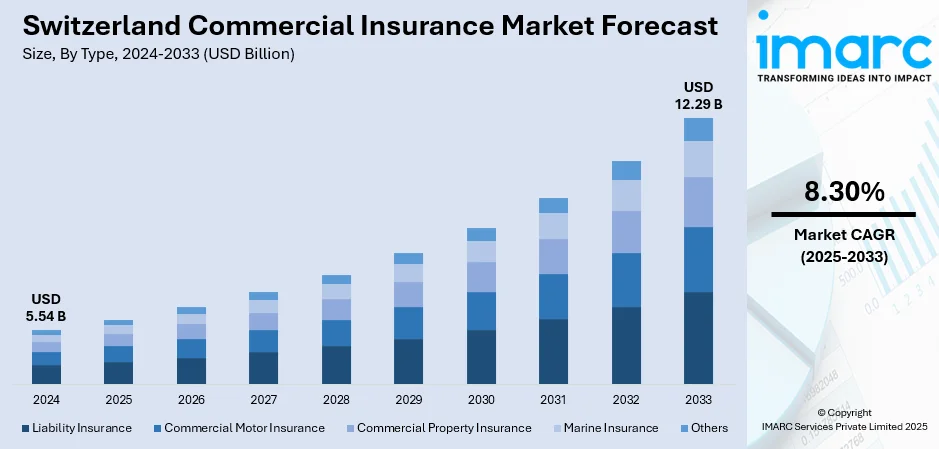

The Switzerland commercial insurance market size reached USD 5.54 Billion in 2024. The market is projected to reach USD 12.29 Billion by 2033, exhibiting a growth rate (CAGR) of 8.30% during 2025-2033. Strong demand for liability and property coverage among SMEs, growing regulatory requirements, rising healthcare and employee benefit costs, digitalization of claims and distribution, increased awareness of cyber threats, and heightened risk management needs in a competitive business environment are some of the factors contributing to the Switzerland commercial insurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.54 Billion |

| Market Forecast in 2033 | USD 12.29 Billion |

| Market Growth Rate 2025-2033 | 8.30% |

Switzerland Commercial Insurance Market Trends:

Digitalization and Data-Driven Underwriting

The Swiss commercial insurance sector in Switzerland is rapidly becoming more digitally integrated. Insurers are using sophisticated analytics, machine learning models, and automation to improve underwriting and save operating costs. The move enables insurers to better analyze risks in businesses like manufacturing, shipping, and finance by using real-time data rather than past assumptions. This change is also changing the way clients engage. Businesses want smooth digital onboarding, speedier claim settlements, and open policy changes. Online platforms and self-service portals are replacing conventional broker-led procedures, particularly among small and medium-sized businesses. Beyond efficiency, digital adoption allows insurers to personalize coverage by exploiting sector-specific data, which increases customer retention. Cybersecurity is a priority, as the expansion of digital activities increases susceptibility to cyber hazards. Swiss insurers have responded by including cyber insurance products in larger business packages. This digital transformation trend not only increases insurers' competitiveness, but it also aligns with Switzerland's reputation for financial innovation and accuracy. These factors are intensifying the Switzerland commercial insurance market growth.

To get more information on this market, Request Sample

Sustainability and Climate Risk Integration

Sustainability is shaping the Swiss commercial insurance market in an entirely different direction. Climate change has increased the frequency and severity of natural catastrophes across Europe, and Switzerland is not immune. Flooding, hailstorms, and landslides pose serious risks to commercial infrastructure, supply chains, and real estate. Insurers are under pressure to reassess their risk models and incorporate climate scenarios into pricing and capital allocation. This shift is driven not only by regulatory requirements under Swiss Solvency Test (SST) but also by mounting demand from corporate clients committed to ESG (Environmental, Social, Governance) principles. Many large Swiss insurers are embedding sustainability clauses into policies, incentivizing companies to adopt greener practices in exchange for premium reductions. Reinsurers are also influencing this movement by requiring primary insurers to factor sustainability into their portfolios. Additionally, investment strategies are being aligned with low-carbon objectives, reinforcing the connection between insurance and sustainable finance. The trend shows that commercial insurers are evolving into risk partners who guide businesses through both environmental adaptation and regulatory compliance.

Switzerland Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

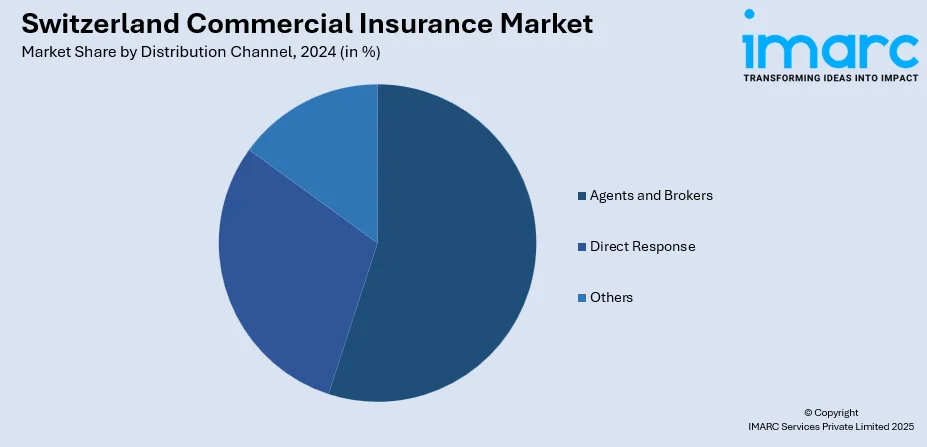

Distribution Channel Insights:

- Agents and Brokers

- Direct Response

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes transportation and logistics, manufacturing, construction, it and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- Zurich

- Espace Mittelland

- Lake Geneva Region

- Northwestern Switzerland

- Eastern Switzerland

- Central Switzerland

- Ticino

The report has also provided a comprehensive analysis of all the major regional markets, which include Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, and Ticino.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Switzerland Commercial Insurance Market News:

- April 2025: Zurich Insurance Group launched a new SME digital insurance platform in Switzerland, powered by US-based CoverWallet. This marks its second European rollout after Spain. The platform enables small businesses to get real-time quotes, purchase coverage, and manage policies online. Targeted at micro-enterprises and startups, it offers products including liability, property, and auto insurance. Zurich had earlier invested in CoverWallet to support its European expansion.

Switzerland Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, Ticino |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Switzerland commercial insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Switzerland commercial insurance market on the basis of type?

- What is the breakup of the Switzerland commercial insurance market on the basis of enterprise size?

- What is the breakup of the Switzerland commercial insurance market on the basis of distribution channel?

- What is the breakup of the Switzerland commercial insurance market on the basis of industry vertical?

- What is the breakup of the Switzerland commercial insurance market on the basis of region?

- What are the various stages in the value chain of the Switzerland commercial insurance market?

- What are the key driving factors and challenges in the Switzerland commercial insurance market?

- What is the structure of the Switzerland commercial insurance market and who are the key players?

- What is the degree of competition in the Switzerland commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Switzerland commercial insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Switzerland commercial insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Switzerland commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)