Switzerland Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Region, 2025-2033

Switzerland Cryptocurrency Market Overview:

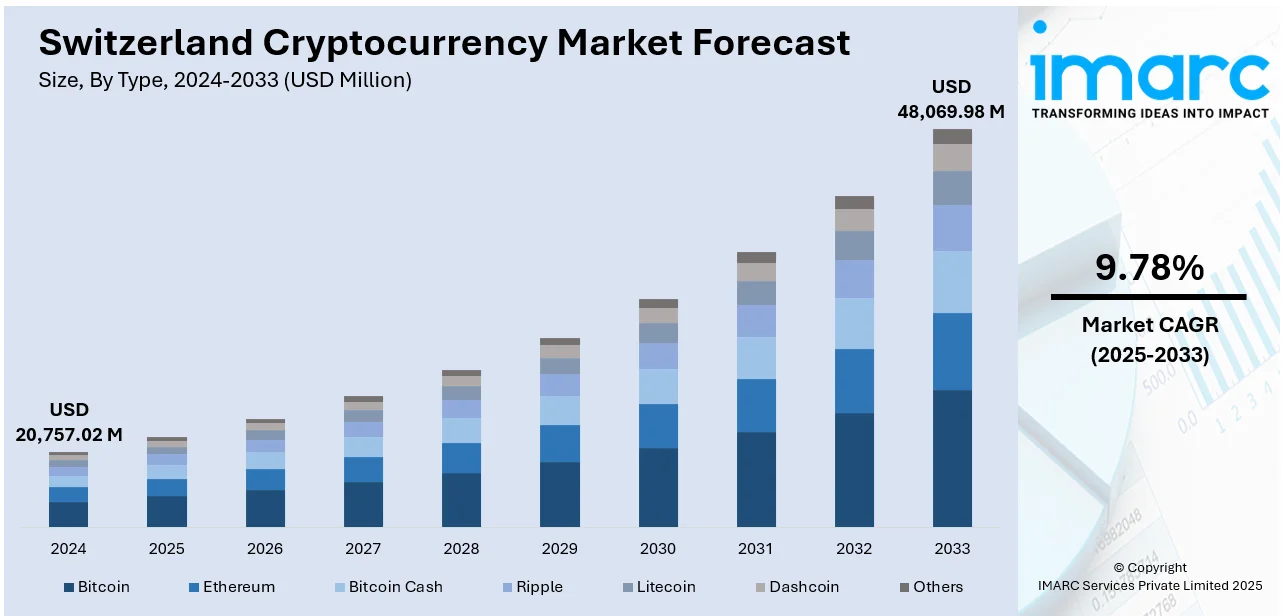

The Switzerland cryptocurrency market size reached USD 20,757.02 Million in 2024. The market is projected to reach USD 48,069.98 Million by 2033, exhibiting a growth rate (CAGR) of 9.78% during 2025-2033. The market is experiencing steady growth due to the development of regulated crypto financial products, which aid in increasing investor confidence, promoting transparency, and encouraging broader participation in digital asset trading. Besides this, banks are incorporating cryptocurrencies into their systems and launching services that adhere to the financial regulations of the country. This supportive environment is expandingthe Switzerland cryptocurrency market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 20,757.02 Million |

| Market Forecast in 2033 | USD 48,069.98 Million |

| Market Growth Rate 2025-2033 | 9.78% |

Switzerland Cryptocurrency Market Trends:

Rising acceptance by banks

As more banks in Switzerland are offering crypto-related services, such as trading and custody, institutional clients are gaining easier and safer access to cryptocurrencies. This shift is not only enhancing trust in digital assets but also bridging the gap between conventional finance and blockchain-based innovation. For instance, as per industry reports, AMINA Bank became Switzerland’s most rapidly expanding crypto bank with 69% revenue increase in 2024. This growth signals rising client interest and institutional adoption of crypto banking services. Banks are integrating cryptocurrencies into their portfolios and infrastructure, introducing services that comply with Swiss financial regulations. This increasing acceptance is also attracting international investors and fintech companies to Switzerland, further enhancing its status as an international crypto hub. Additionally, the involvement of traditional banks ensures better risk management, transparent reporting, and refined security for crypto-related transactions. As a result, this institutional trust is encouraging broader public participation and fostering a more stable and scalable crypto ecosystem.

To get more information on this market, Request Sample

Growing development of regulated crypto financial products

Increasing development of regulated crypto financial products is propelling the Switzerland cryptocurrency market growth. With the introduction of secure, transparent, and compliant financial instruments like exchange traded products (ETPs), both retail and institutional investors are more inclined to participate in the digital asset space. In February 2025, BlackRock, the leading global asset manager, revealed plans to launch a Bitcoin-based ETP in Switzerland. This would mark BlackRock’s initial investment vehicle for a cryptocurrency beyond the United States. Such developments position Switzerland as a progressive hub for crypto finance, combining innovation with stringent financial oversight. Regulated products also help minimize risks related to fraud, volatility, and asset custody, making cryptocurrencies more accessible and acceptable in mainstream portfolios. Moreover, the presence of such solutions supports better integration of crypto with traditional financial markets, enhancing liquidity. Swiss investors benefit from a legally sound environment that fosters innovations, making the country attractive for blockchain enterprises and international financial institutions alike. Overall, the growth of regulated crypto products is not only strengthening the market structure but also accelerating Switzerland’s emergence as a leader in the cryptocurrency ecosystem.

Switzerland Cryptocurrency Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, process, and application.

Type Insights:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bitcoin, ethereum, bitcoin cash, ripple, litecoin, dashcoin, and others.

Component Insights:

- Hardware

- Software

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware and software.

Process Insights:

- Mining

- Transaction

The report has provided a detailed breakup and analysis of the market based on the process. This includes mining and transaction.

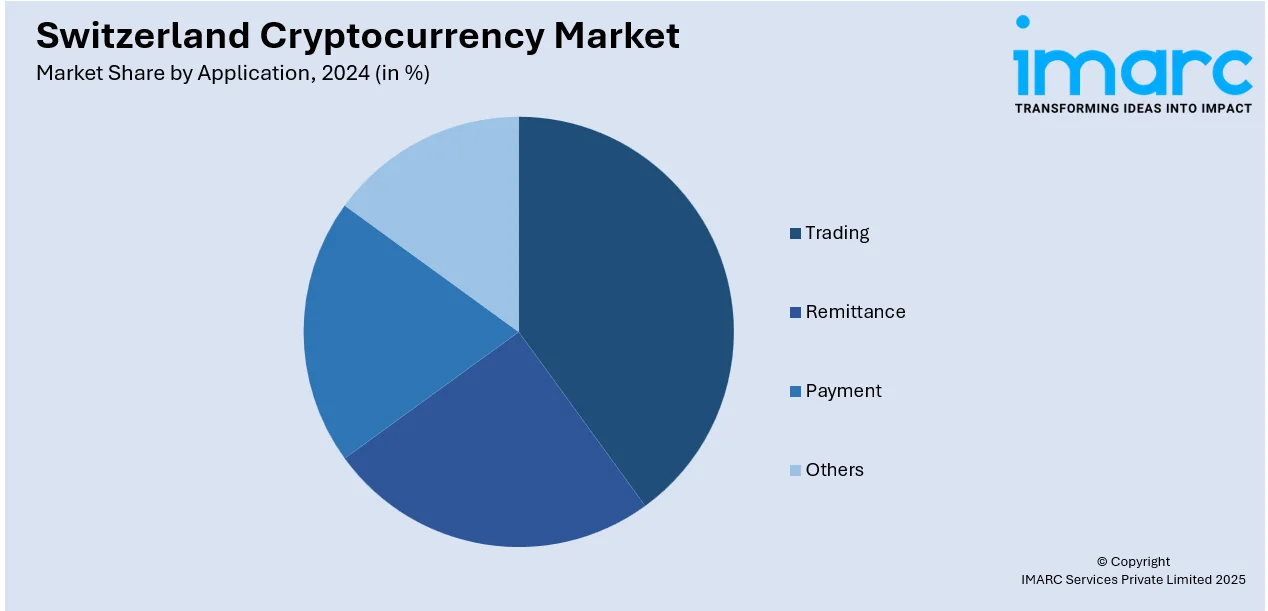

Application Insights:

- Trading

- Remittance

- Payment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes trading, remittance, payment, and others.

Regional Insights:

- Zurich

- Espace Mittelland

- Lake Geneva Region

- Northwestern Switzerland

- Eastern Switzerland

- Central Switzerland

- Ticino

The report has also provided a comprehensive analysis of all the major regional markets, which include Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, and Ticino.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Switzerland Cryptocurrency Market News:

- In July 2025, Blockstream revealed the purchase of Elysium Lab, a Swiss company focusing on Bitcoin authentication and developer resources, along with the formation of Blockstream CH SAGL as its Switzerland hub to enhance Bitcoin infrastructure. The organization aimed to focus on initiatives that could tackle scalability issues, improve Bitcoin interoperability, and investigate cross-border payment and decentralized finance (DeFi) applications.

- In April 2025, SPAR Supermarket started accepting Bitcoin payments at its Zug, Switzerland location, highlighting a big achievement in Switzerland’s forward-thinking stance on Bitcoin adoption. The firm employed the ‘Lightning Network’ via DFX Swiss’s OpenCryptoPay solution, allowing immediate transactions at the point of sale (POS).

Switzerland Cryptocurrency Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, Others |

| Components Covered | Hardware, Software |

| Processes Covered | Mining, Transaction |

| Applications Covered | Trading, Remittance, Payment, Others |

| Regions Covered | Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, Ticino |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Switzerland cryptocurrency market performed so far and how will it perform in the coming years?

- What is the breakup of the Switzerland cryptocurrency market on the basis of type?

- What is the breakup of the Switzerland cryptocurrency market on the basis of component?

- What is the breakup of the Switzerland cryptocurrency market on the basis of process?

- What is the breakup of the Switzerland cryptocurrency market on the basis of application?

- What is the breakup of the Switzerland cryptocurrency market on the basis of region?

- What are the various stages in the value chain of the Switzerland cryptocurrency market?

- What are the key driving factors and challenges in the Switzerland cryptocurrency market?

- What is the structure of the Switzerland cryptocurrency market and who are the key players?

- What is the degree of competition in the Switzerland cryptocurrency market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Switzerland cryptocurrency market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Switzerland cryptocurrency market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Switzerland cryptocurrency industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)