Switzerland E-Commerce Market Size, Share, Trends and Forecast by Type, Transaction, and Region, 2026-2034

Switzerland E-Commerce Market Summary:

The Switzerland e-commerce market size was valued at USD 122.30 Billion in 2025 and is projected to reach USD 700.89 Billion by 2034, growing at a compound annual growth rate of 21.41% from 2026-2034.

Switzerland has emerged as a major digital commerce hub in Europe, driven by high internet penetration, affluent consumer groups, and a highly developed logistics network. Its e-commerce environment benefits from a multilingual population with strong purchasing power, widespread use of secure digital payment systems, and a stable, transparent regulatory framework that supports innovation, cross-border trade, and long-term online retail growth.

Key Takeaways and Insights:

-

By Type: Groceries dominate the market with a share of 23.05% in 2025, driven by accelerated adoption of online food shopping, enhanced cold-chain logistics capabilities, and growing consumer preference for convenient home delivery of fresh produce and daily essentials.

-

By Transaction: Business-to-Business leads the market with a share of 78.07% in 2025, fueled by digital transformation initiatives across enterprises, adoption of API-based procurement systems, and increasing demand for transparent pricing and streamlined supply chain solutions.

-

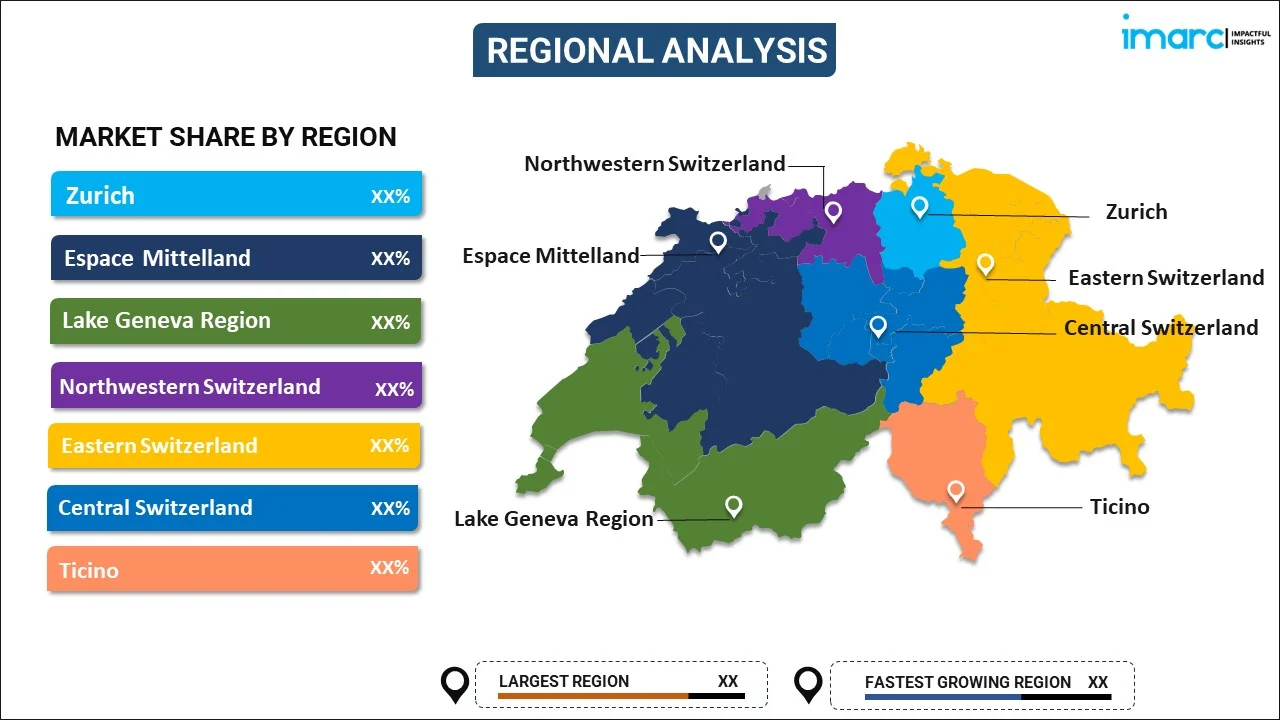

By Region: Zurich dominates the market with a share of 22% in 2025, attributed to its position as Switzerland's largest economic and financial hub, concentration of e-commerce headquarters, advanced digital infrastructure, and high-income consumer population driving premium online purchases.

-

Key Players: The Switzerland e-commerce market features a moderately concentrated competitive environment, where established domestic companies and global platforms compete across multiple product segments, business models, and transaction formats, driving innovation while intensifying competition within the digital retail ecosystem.

The Switzerland e-commerce market continues to demonstrate remarkable resilience and growth potential, supported by one of the world's highest internet penetration rates and a digitally sophisticated consumer base. For example, Swiss consumers spent nearly CHF 15 billion online in 2024, with cross-border purchases, particularly small parcels from Asia, rising sharply, highlighting robust domestic demand and growing international e-commerce activity. Swiss consumers increasingly prefer online shopping channels that offer convenience, product variety, and seamless payment integration. The market benefits significantly from advanced logistics networks, including Swiss Post's extensive delivery infrastructure and private courier services offering same-day delivery in major urban centers. The growing emphasis on omnichannel retail strategies, coupled with rising cross-border shopping activities, particularly from neighboring EU countries and Asian marketplaces, continues to reshape the competitive dynamics of the Swiss e-commerce ecosystem.

Switzerland E-Commerce Market Trends:

Mobile Commerce Revolution and TWINT Dominance

The rapid adoption of smartphone-based shopping continues to reshape Swiss e-commerce, with mobile devices now driving most online transactions. TWINT, Switzerland’s domestic mobile payment solution, surpassed 6 million users by mid-2025, reinforcing its central role in digital payments. Its deep integration with Swiss banks, broad merchant acceptance across online and physical retail, and strong security features, including biometric authentication, have positioned TWINT ahead of traditional card payments, particularly among younger consumers and frequent mobile-first online shoppers nationwide.

Rise of Sustainable and Recommerce Platforms

Swiss consumers show strong preferences for sustainability and ethical sourcing, driving growth in eco-conscious e-commerce. According to 2024 reports, SMG Swiss estimates that second-hand transactions on Ricardo, tutti.ch, and anibis.ch avoided over 71,000 tonnes of CO₂e in 2024. Recommerce has moved mainstream, with second-hand luxury, refurbished electronics, and sustainable fashion gaining traction, alongside urban-focused platforms for zero-waste, artisanal, and locally sourced goods, supported by rising consumer awareness, regulatory backing, and retailer sustainability commitments nationwide.

Cross-Border E-Commerce Expansion

International online shopping is gaining momentum as Swiss consumers increasingly buy from foreign e-commerce platforms offering competitive prices and wider product ranges. In January 2025 study reported that 52% of Swiss consumers purchased from a Chinese online retailer in 2024, with Temu accounting for nearly half of these transactions. Beyond pricing, shoppers value access to products unavailable domestically. The removal of industrial import duties has further boosted cross-border purchases, while Asian and neighboring European platforms continue to gain traction.

Market Outlook 2026-2034:

The Switzerland e-commerce market is positioned for sustained expansion throughout the forecast period, driven by continued digital transformation across retail sectors, evolving consumer preferences toward online shopping convenience, and technological advancements in payment and logistics infrastructure. The integration of artificial intelligence for personalized recommendations, expansion of same-day delivery networks, and development of innovative fulfillment solutions will further enhance market growth. The market generated a revenue of USD 122.30 Billion in 2025 and is projected to reach a revenue of USD 700.89 Billion by 2034, growing at a compound annual growth rate of 21.41% from 2026-2034.

Switzerland E-Commerce Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Groceries | 23.05% |

| Transaction | Business-to-Business | 78.07% |

| Region | Zurich | 22% |

Type Insights:

To get detailed segment analysis of this market, Request Sample

- Home Appliances

- Apparel, Footwear and Accessories

- Books

- Cosmetics

- Groceries

- Others

The groceries dominate with a market share of 23.05% of the total Switzerland e-commerce market in 2025.

Switzerland’s grocery e-commerce segment is undergoing rapid transformation, supported by advances in cold-chain logistics and last-mile delivery. In November 2025, Migros Online announced plans to invest in a 38,000 m² semi-automated distribution centre in Regensdorf, set to open in 2026, to expand temperature-controlled fulfillment and enable faster delivery options. Major retailers are strengthening dedicated fulfillment and chilled distribution networks, while testing logistics partnerships to improve doorstep delivery. Consumers increasingly use digital platforms for fresh and packaged groceries, valuing convenience and time savings.

The segment benefits from sophisticated inventory management systems, real-time stock visibility, and personalized recommendation engines that enhance the shopping experience. Subscription-based delivery models have gained popularity, providing consumers with regular replenishment of household essentials while offering retailers predictable revenue streams. The integration of sustainable packaging solutions and locally sourced product options aligns with Swiss consumer preferences for environmentally responsible shopping practices.

Transaction Insights:

- Business-to-Consumer

- Business-to-Business

- Consumer-to-Consumer

- Others

The business-to-business leads with a share of 78.07% of the total Switzerland e-commerce market in 2025.

This is evidenced by the rapid pace of digital transformation underway in enterprises of all sizes, propelling the B2B e-commerce segment as the leading force in Switzerland's digital commerce landscape. Institutions are increasingly migrating their procurement activities online, where transparent pricing, streamlined ordering, and frictionless integration with enterprise resource planning systems are within reach. API-based procurements adopt automated purchasing workflows and real-time inventory synchronization.

Swiss companies use B2B e-commerce platforms for streamlining supply chain operations, minimizing procurement costs, and improving the overall capability of vendor management. There is greater demand for punch-out catalogs, consolidated invoicing, and customized product configurations to meet complex business requirements. Mid-sized manufacturers and corporate buyers increasingly prefer digital channels that shorten quote cycles and provide comprehensive product information alongside competitive pricing structures.

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Zurich

- Espace Mittelland

- Lake Geneva Region

- Northwestern Switzerland

- Eastern Switzerland

- Central Switzerland

- Ticino

Zurich exhibits a clear dominance with a 22% share of the total Switzerland e-commerce market in 2025.

Zurich maintains its position as Switzerland's premier e-commerce hub, benefiting from the highest concentration of digital commerce enterprises, technology companies, and financial services organizations. The region's substantial population base, combined with above-average disposable incomes and strong digital literacy, creates an ideal environment for e-commerce growth. Major domestic platforms including Digitec Galaxus maintain headquarters in the greater Zurich area, contributing to the region's e-commerce ecosystem development.

The metropolitan area benefits from superior logistics infrastructure enabling same-day and sub-same-day delivery services that foster impulse purchasing and enhance customer satisfaction. Zurich serves as the primary hub for specialized marketplace platforms catering to sustainable fashion, artisanal products, and premium goods categories. The region's multilingual workforce and international connectivity position it as a strategic gateway for cross-border e-commerce operations targeting broader European markets.

Market Dynamics:

Growth Drivers:

Why is the Switzerland E-Commerce Market Growing?

Advanced Digital Infrastructure and High Internet Penetration

Switzerland has world-class digital infrastructure with nationwide fiber-optic coverage, comprehensive 5G deployment, and internet penetration exceeding ninety-five percent. In October 2025, swissnet Group expanded its partnership with a major European retailer to modernize network and Wi-Fi infrastructure using Wi-Fi 7, improving connectivity and digital customer experiences across hundreds of stores. This strong infrastructure supports seamless online shopping, bandwidth-intensive applications like video demos and virtual try-ons, and fosters innovation in e-commerce platforms, payment solutions, and fulfillment technologies that drive consumer engagement and market growth.

Affluent Consumer Base with High Disposable Income

Switzerland’s status as one of the world’s wealthiest nations drives significant e-commerce potential, with consumers willing to pay premium prices for quality products and seamless shopping experiences. In October 2025, Digitec Galaxus surpassed Google as the top starting point for product searches, highlighting strong trust in domestic online retailers. Swiss shoppers maintain higher average basket values than European counterparts, reflecting both purchasing power and preference for premium categories. High disposable incomes support widespread adoption of subscription services, express delivery, and luxury e-commerce segments, sustaining market growth and premium-margin opportunities across the sector.

Sophisticated Logistics and Fulfillment Networks

Switzerland’s e‑commerce market is supported by world-class logistics infrastructure, anchored by Swiss Post and private courier services. In October 2025, Swiss Post opened its largest logistics hub in Villmergen, a 35,000 sqm facility enhancing warehousing, fulfillment, and distribution for retail and medical clients, reflecting logistics’ vital role in e‑commerce growth. Investments in automated sorting, temperature-controlled centers, and last-mile innovations allow retailers to meet high expectations for speed and reliability. Same-day delivery, extensive pickup networks, and carrier partnerships provide flexible fulfillment, improving the online shopping experience and encouraging wider e‑commerce adoption.

Market Restraints:

What Challenges the Switzerland E-Commerce Market is Facing?

High Operating Costs and Price Competition from Cross-Border Platforms

Swiss e-commerce operators face high operating costs driven by elevated labor wages, premium real estate, and strict regulatory compliance. Meanwhile, cross-border platforms benefit from lower-cost supply chains and aggressive pricing strategies. This intensifies price competition, especially in price-sensitive categories, making it difficult for Swiss retailers to protect margins while remaining competitive on value.

Complex Regulatory Environment and Data Protection Requirements

The Swiss e-commerce market is shaped by stringent data protection and consumer rights regulations that place heavy compliance demands on online retailers. Businesses must manage complex requirements related to data handling, consumer transparency, and cross-border reporting, which increase operational complexity, raise costs, and restrict the use of advanced personalization and data-driven marketing tools.

Geographic Challenges and Last-Mile Delivery Constraints

Switzerland’s mountainous geography and widely dispersed rural populations pose logistical challenges for e-commerce operators. Deliveries outside major cities incur higher costs and longer fulfillment times, particularly in Alpine regions. Extended shipping durations can lower conversion rates for time-sensitive purchases, while nationwide delivery coverage requires significant infrastructure investment, pressuring overall profitability.

Competitive Landscape:

The Switzerland e-commerce market demonstrates a moderately concentrated competitive structure characterized by domestic market leaders, established international platforms, and emerging specialized marketplaces. The competitive landscape continues to evolve through strategic partnerships, technology investments, and expansion of product categories and fulfillment capabilities. Market participants differentiate through service quality, delivery speed, product assortment depth, and customer experience innovations. The B2B segment witnesses increasing competition as traditional distributors develop digital channels while specialized procurement platforms expand market presence. Competitive intensity is expected to increase as international players strengthen Swiss market positions and domestic leaders pursue European expansion strategies.

Recent Developments:

-

In August 2025, German electronics retailer MediaMarkt announced plans to expand its online marketplace into Switzerland as part of its broader European expansion strategy. The move aims to boost product selection for Swiss shoppers and compete with both local and international e-commerce platforms.

Switzerland E-commerce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Home Appliances, Apparel, Footwear and Accessories, Books, Cosmetics, Groceries, Others |

| Transactions Covered | Business-to-Consumer, Business-to-Business, Consumer-to-Consumer, Others |

| Regions Covered | Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, Ticino |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Switzerland e-commerce market size was valued at USD 122.30 Billion in 2025.

The Switzerland e-commerce market is expected to grow at a compound annual growth rate of 21.41% from 2026-2034 to reach USD 700.89 Billion by 2034.

The groceries segment dominated the type category with a market share of 23.05%, driven by enhanced cold-chain logistics, growing online food delivery adoption, and consumer preference for convenient home delivery of fresh products and daily essentials.

Key factors driving the Switzerland e-commerce market include advanced digital infrastructure with high internet penetration, affluent consumer base with substantial purchasing power, sophisticated logistics networks enabling rapid delivery, widespread adoption of digital payment solutions, and growing cross-border shopping activities.

Major challenges include high operating costs impacting competitiveness against international platforms, complex regulatory and data protection requirements, geographic constraints elevating delivery costs in mountainous regions, intensifying price competition from cross-border marketplaces, and the need for continuous technology investment to meet evolving consumer expectations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)