Switzerland Family Offices Market Size, Share, Trends and Forecast by Type, Office Type, Asset Class, Service Type, and Region, 2026-2034

Switzerland Family Offices Market Summary:

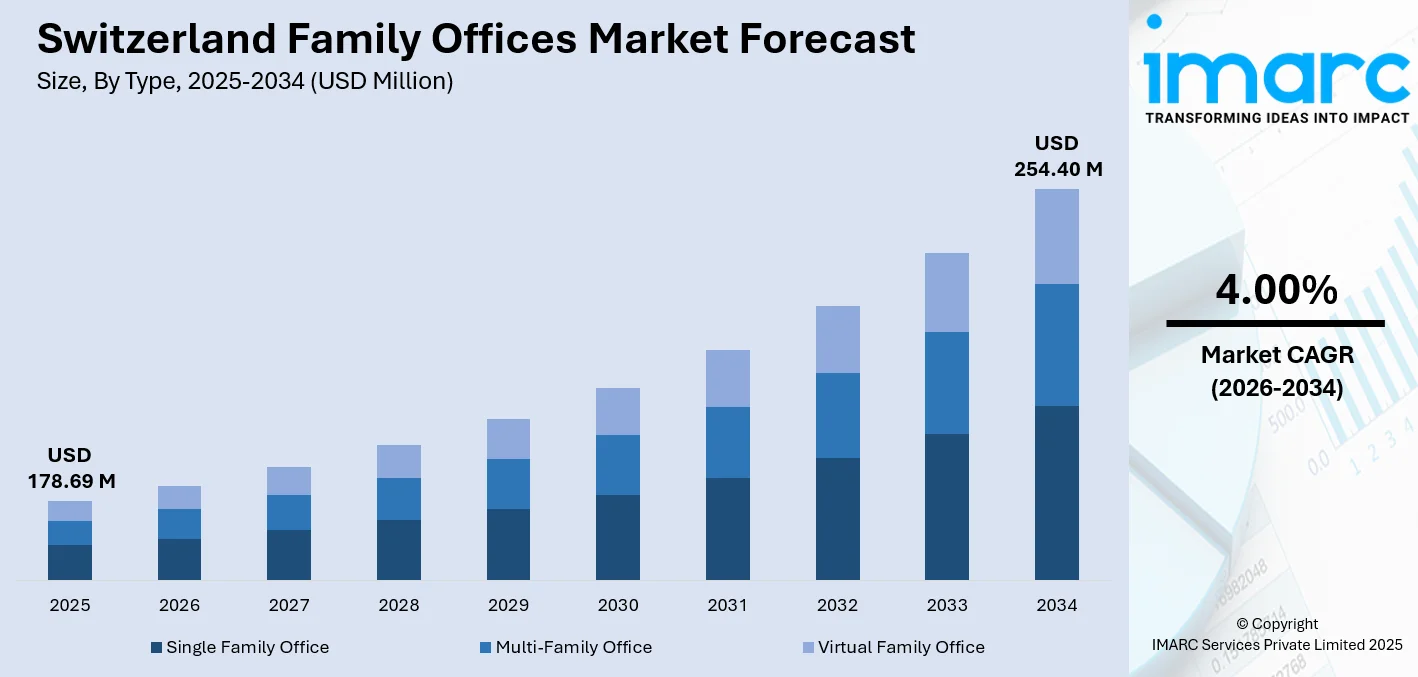

The Switzerland family offices market size was valued at USD 178.69 Million in 2025 and is projected to reach USD 254.40 Million by 2034, growing at a compound annual growth rate of 4.00% from 2026-2034.

Switzerland maintains its position as a premier European destination for family office operations, driven by political stability, favorable regulatory frameworks, and sophisticated financial infrastructure. Ultra-high-net-worth families increasingly consolidate comprehensive asset management, succession planning, and investment advisory services under unified structures. Growing emphasis on sustainable investing strategies, advanced technology integration for portfolio optimization, and multigenerational wealth preservation strategies collectively expand the Switzerland family offices market share.

Key Takeaways and Insights:

- By Type: Single family office dominates the market with a share of 48.65% in 2025, reflecting ultra-wealthy families' preference for dedicated, private wealth management structures.

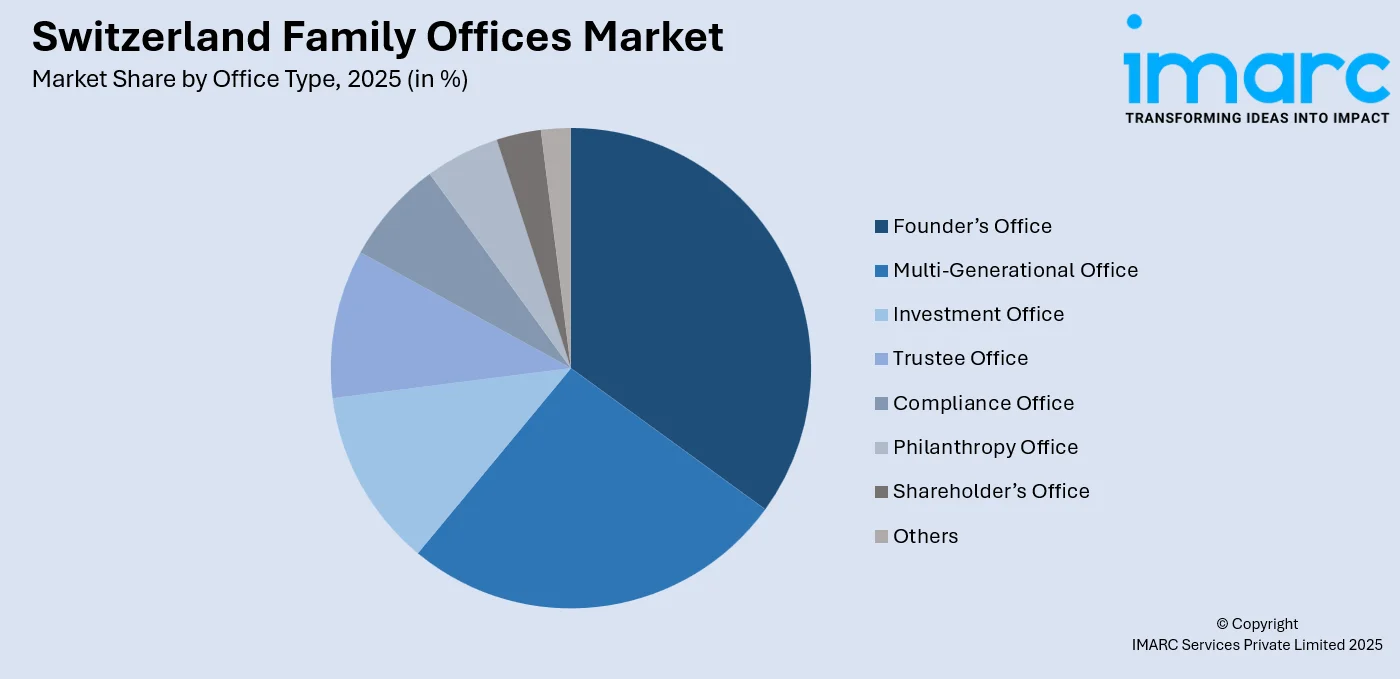

- By Office Type: Founder's office leads the market with a share of 21.1% in 2025, driven by entrepreneurial wealth creators seeking specialized and favorable governance frameworks.

- By Asset Class: Equalities represent the largest segment with a market share of 34.06% in 2025, aligning with Swiss family offices' substantial and comprehensive traditional equity allocations.

- By Service Type: Financial planning leads the market with a share of 29.24% in 2025, driven by the heightened need for comprehensive estate planning and succession strategies.

- By Region: Zurich represents the largest segment with a market share of 23% in 2025, leveraging its status as Switzerland's primary financial hub hosting substantial family office concentration.

- Key Players: The Switzerland family offices market exhibits concentrated activity among specialized wealth managers, multi-family office platforms, and independent advisory firms serving ultra-high-net-worth clientele across major Swiss financial centers.

To get more information on this market Request Sample

Switzerland's family office ecosystem benefits from hosting approximately 250 to 300 single family offices collectively managing CHF 600 billion in assets, positioning the nation as Europe's premier wealth management hub. The market demonstrates sophisticated evolution through next-generation family members driving technology adoption, collaborative club deal structures, and sustainability-focused investment portfolios integrating environmental and social impact objectives. Swiss family offices increasingly favor outbound investments, with international allocations rising since 2015, reflecting strategic pivots toward global opportunities beyond domestic markets. In June 2024, HarbourVest Partners relocated to expanded premises in Zurich, strengthening its Switzerland presence with enhanced institutional and private wealth capabilities spanning private equity, credit, real assets, and infrastructure investment solutions. This expansion underscores Switzerland's continuing appeal for global family office operations.

Switzerland Family Offices Market Trends:

Sustainable Investing and ESG Integration

Swiss family offices crossed a milestone threshold in 2024 with over 50 percent of investments allocated toward impact-focused strategies, marking fundamental portfolio transformation beyond traditional financial returns. Environmental, social, and governance considerations now drive investment selection across renewable energy infrastructure, education initiatives, healthcare innovation, and microfinance platforms. The Swiss Platform for Impact Investing, launched at Building Bridges conference, established collaborative frameworks connecting specialist asset managers, institutional investors, and public sector stakeholders. Family offices increasingly prioritize measurable social outcomes alongside financial performance, with education and renewable energy sectors receiving certain percent of total impact investments. This strategic shift reflects younger generation influence emphasizing sustainability principles while maintaining rigorous return expectations.

Technology Adoption and Digital Transformation

Family offices accelerate integration of artificial intelligence (AI), machine learning (ML) algorithms, and automated platforms for enhanced portfolio management, data consolidation, and operational efficiency. Digital architecture priorities shifted from reactive tool selection toward designing integrated systems delivering reconciliation accuracy, onboarding speed, and comprehensive data lineage across multiple custodians and asset classes. Swiss family offices embed AI capabilities within reconciliation workflows, transaction classification engines, anomaly detection systems, and personalized reporting experiences. Technology vendors emphasize explainable AI, data trust frameworks, and secure Swiss hosting architectures addressing family offices' confidentiality requirements. On 12 February 2025, the Federal Council released a summary of potential regulatory strategies for artificial intelligence (AI) in Switzerland. Based on this, it has opted for a Swiss strategy aimed at enhancing Switzerland as an innovation hub, protecting fundamental rights (including economic liberties), and boosting public confidence in AI. The Swiss Bankers Association (SBA) supports the Federal Council’s goals and its plan to maintain reliance on established principles of technology-neutral, principles-based, and focused regulation.

Wealth Transfer and Next Generation Influence

Historic intergenerational wealth transfer drives unprecedented succession planning activity as family offices prepare leadership transitions across multiple generations. Approximately 53 percent of family offices globally maintain formal wealth succession plans, yet 47 percent of Swiss family businesses report inadequate succession preparation with no concrete next-generation integration measures. The NextGen effect transforms family office strategies through tech-savvy, sustainability-driven perspectives emphasizing startup investments, collaborative club deals, and impact-driven portfolios. Younger family members trained externally before joining family enterprises bring fresh perspectives on investment diversification, technology adoption, and social responsibility integration. However, succession challenges persist around tax-efficient wealth transfer mechanisms, equitable capital distribution among heirs, and preparing subsequent generations for responsible wealth stewardship aligned with family values and legacy objectives.

Market Outlook 2026-2034:

Switzerland family offices market demonstrates sustained expansion trajectory supported by secure financial infrastructure, regulatory confidence, and sophisticated service offerings across wealth preservation, investment management, and succession planning domains. Digital transformation initiatives, sustainable investment strategies, and collaborative deal structures position Swiss family offices for enhanced operational efficiency and portfolio performance. The market generated a revenue of USD 178.69 Million in 2025 and is projected to reach a revenue of USD 254.40 Million by 2034, growing at a compound annual growth rate of 4.00% from 2026-2034. Zurich, Geneva, and other major Swiss financial centers continue attracting international family office establishments seeking political stability, tax optimization frameworks, and access to premium financial services infrastructure.

Switzerland Family Offices Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Single Family Office |

48.65% |

|

Office Type |

Founder's Office |

21.1% |

|

Asset Class |

Equalities |

34.06% |

|

Service Type |

Financial Planning |

29.24% |

|

Region |

Zurich |

23% |

Type Insights:

- Single Family Office

- Multi-Family Office

- Virtual Family Office

Single family office dominates with a market share of 48.65% of the total Switzerland family offices market in 2025.

Single family offices represent dedicated wealth management structures serving individual ultra-high-net-worth families seeking complete privacy, customized investment strategies, and comprehensive family governance frameworks. Switzerland hosts approximately 250 to 300 single family offices collectively managing CHF 600 billion in assets, reflecting the country's exceptional appeal for establishing exclusive family wealth management operations. These offices provide full-spectrum services spanning investment management, succession planning, tax optimization, philanthropic coordination, and lifestyle management tailored precisely to family preferences and values.

The single family office model delivers maximum control, confidentiality, and alignment with family-specific objectives while enabling direct investment capabilities, alternative asset access, and multi-generational wealth preservation strategies. Swiss family offices maintain highest allocations to real estate, cash holdings, and art collections to global peers, demonstrating distinctive asset diversification approaches. Private equity represents core allocation for a majority percentage of Swiss family offices with steadily increasing commitments year over year, alongside direct company investments generating income streams and strategic fund diversification spreading portfolio risks across multiple managers and geographies.

Office Type Insights:

Access the comprehensive market breakdown Request Sample

- Founder’s Office

- Multi-Generational Office

- Investment Office

- Trustee Office

- Compliance Office

- Philanthropy Office

- Shareholder’s Office

- Others

Founder's office leads with a share of 21.1% of the total Switzerland family offices market in 2025.

Founder's offices manage wealth accumulated through entrepreneurial success, focusing on first-generation wealth preservation while establishing governance structures for eventual family succession. These offices emphasize investment strategies reflecting founders' business acumen, risk tolerance, and industry expertise developed through operational experience. Apart from this, Switzerland primarily attracts founder-led family offices through favorable tax frameworks, secure banking systems, and proximity to European business opportunities supporting ongoing entrepreneurial activities and strategic investments in the country.

Founder's offices balance wealth preservation priorities with growth objectives, often maintaining higher alternative investment allocations including private equity, venture capital, and direct company stakes aligned with founders' operational backgrounds. Many Swiss founder's offices engage collaborative club deals co-investing with other family offices, spreading risks while leveraging shared expertise and network access. Tax-efficient wealth transfer planning becomes increasingly critical as founders contemplate succession, requiring sophisticated estate planning, trust structures, and next-generation preparation ensuring smooth leadership transitions while preserving family unity and business continuity.

Asset Class Insights:

- Bonds

- Equalities

- Alternatives Investments

- Commodities

- Cash or Cash Equivalents

Equalities exhibit a clear dominance with a 34.06% share of the total Switzerland family offices market in 2025.

Traditional equity allocations constitute fundamental portfolio components for Swiss family offices seeking capital appreciation through developed market exposures and selective emerging market opportunities. Swiss family office portfolios allocate 34 percent to equities within broader traditional asset class holdings accounting for 56 percent of total portfolios, reflecting balanced approach combining growth potential with stability considerations. Family offices increasingly lift developed market equity weightings seeking liquid opportunities for capital growth and yield amid volatile economic conditions.

Equity allocation strategies incorporate both public market exposures through diversified portfolios and private equity commitments driving substantial value creation across entrepreneurial investments and buyout opportunities. Between 2016 and 2024, Swiss family offices significantly increased private equity allocations by 24 percentage points, demonstrating strategic shift from traditional real estate holdings toward direct company investments and fund commitments. Equity portfolios increasingly incorporate sustainability screens, ESG integration, and impact investment objectives particularly influenced by next-generation family members emphasizing environmental stewardship, social responsibility, and governance excellence alongside financial return objectives.

Service Type Insights:

- Financial Planning

- Strategy

- Governance

- Advisory

- Others

Financial planning leads with a share of 29.24% of the total Switzerland family offices market in 2025.

Comprehensive financial planning services form foundational pillars for Swiss family offices coordinating complex wealth management across multiple generations, jurisdictions, and asset categories. Family offices provide integrated estate planning, succession strategies, and tax advisory services under unified frameworks facilitating multigenerational wealth preservation and efficient capital allocation. Apart from this, Switzerland's secure financial infrastructure and favorable regulatory environment enable sophisticated planning approaches addressing international tax optimization, trust structures, and cross-border wealth transfer mechanisms.

Financial planning encompasses scenario modeling assessing different wealth distribution approaches, succession timing considerations, and tax implications across various jurisdictions where family members and assets reside. Approximately 53 percent of family offices globally maintain formal succession plans, yet implementation gaps persist with a certain percent of families without plans believing they have sufficient time for preparation. Swiss family offices increasingly adopt specialized software enabling sophisticated scenario analysis, tax projection capabilities, and comprehensive estate planning aligned with family values, philanthropic objectives, and long-term wealth preservation goals ensuring financial security across subsequent generations.

Regional Insights:

- Zurich

- Espace Mittelland

- Lake Geneva Region

- Northwestern Switzerland

- Eastern Switzerland

- Central Switzerland

- Ticino

Zurich exhibits a clear dominance with a 23% share of the total Switzerland family offices market in 2025.

Zurich, as the largest region in the Switzerland Family Offices market, holds a dominant position due to its reputation as a global financial hub. The city offers a stable and secure environment, making it an attractive location for high-net-worth individuals (HNWIs) seeking wealth management services. Zurich is home to numerous family offices that manage substantial assets, providing a wide range of services, including investment advisory, estate planning, tax optimization, and philanthropic management. The presence of well-established financial institutions, combined with strong regulations and high levels of confidentiality, creates a robust infrastructure for family offices to thrive.

The region’s economic stability and wealth accumulation have made it a prime destination for family offices looking to preserve and grow generational wealth. Zurich is not only an ideal location for financial services but also a hub for innovation in the wealth management sector. The city has increasingly embraced fintech and digital transformation, allowing family offices to diversify their strategies and leverage cutting-edge technologies for more efficient asset management. As a result, Zurich’s appeal is expanding beyond traditional financial services, attracting more global family offices seeking sophisticated investment strategies. The city’s business-friendly environment, coupled with a strong legal framework and tax advantages, further strengthens its position as the largest and most influential market for family offices in Switzerland.

Market Dynamics:

Growth Drivers:

Why is the Switzerland Family Offices Market Growing?

Secure Financial Infrastructure and Favorable Regulatory Framework

Switzerland's reputation as a premier financial haven drives family office growth through exceptional political stability, neutral international positioning, and sophisticated banking regulations safeguarding client assets and confidentiality. Due to the worsening security conditions, the Federal Council is adjusting Switzerland's security policy for the upcoming years. For this purpose, it has established a security policy strategy that integrates the resources of the federal government alongside the cantons. The Federal Council aims to tackle the increased threat level by bolstering Switzerland's resilience, enhancing protective and preventive measures, and upgrading the nation’s defense capabilities. During its meeting on 12 December, it initiated the consultation process and directed the appropriate departments to commence implementation.

Comprehensive Wealth Management and Multi-Asset Investment Strategies

Swiss family offices deliver integrated service platforms consolidating asset management, succession planning, tax advisory, estate planning, and philanthropic coordination under unified governance structures serving ultra-wealthy families. Comprehensive offerings eliminate coordination complexity across fragmented service providers while ensuring alignment with family values, risk preferences, and long-term legacy objectives. Family offices provide full-spectrum investment capabilities spanning traditional asset classes including equities, fixed income, and real estate alongside sophisticated alternative investments encompassing private equity, venture capital, hedge funds, and direct company stakes. In 2025, A new multi-family office, Aion Wealth Partners SA, has been established in Geneva, Switzerland. Established by ex-UBS staff Rémi Beuxe and Hugo Revollet, Aion Wealth Partners provides guidance to families and high net worth individuals regarding their financial and non-financial goals using a holistic, unbiased, and customized strategy.

Sustainable Finance and Impact Investing Momentum

Switzerland establishes global leadership in sustainable finance infrastructure with family offices increasingly embedding environmental, social, and governance principles throughout investment frameworks and portfolio construction methodologies. More than 2,000 attendees participated in Switzerland's biggest sustainable finance event, conducted in Geneva from 30 September to 2 October 2025. Family office impact strategies incorporate rigorous measurement protocols utilizing frameworks including Impact Reporting and Investment Standards, Global Impact Investing Rating System, and Sustainability Accounting Standards Board ensuring accountability and transparency. Younger generation family members drive sustainability emphasis reflecting values prioritizing environmental stewardship, social equity, and responsible governance alongside wealth preservation objectives. Swiss asset managers demonstrate global innovation leadership launching first impact funds available to private investors and pioneering sustainable investment products establishing Switzerland as premium sustainable finance hub.

Market Restraints:

What Challenges the Switzerland Family Offices Market is Facing?

Regulatory Compliance Complexity and Evolving Requirements

Swiss family offices navigate increasingly sophisticated regulatory landscapes encompassing data protection, cybersecurity, anti-money laundering, tax reporting, and financial supervision obligations across multiple jurisdictions. The Information Security Act mandatory reporting requirements for cybersecurity incidents affecting critical infrastructure entered force April 2025, imposing systematic incident disclosure obligations on family offices managing substantial assets and sensitive client information. Compliance demands continue escalating through Federal Data Protection Act alignment with European standards, revised Financial Market Supervisory Authority circulars requiring enhanced operational resilience, and evolving international tax transparency frameworks including Common Reporting Standard and Foreign Account Tax Compliance Act implementations. Regulatory technology adoption becomes essential for automating compliance workflows, consolidating data across platforms, and managing reporting obligations efficiently while reducing manual processing errors.

Cybersecurity Threats and Data Protection Vulnerabilities

Family offices face escalating cyber threats from sophisticated attackers targeting sensitive financial data, investment strategies, and personal family information for exploitation through ransomware, phishing campaigns, and advanced persistent threats. Growing digitalization of wealth management operations expands attack surfaces across cloud platforms, mobile applications, and interconnected systems managing portfolio data, banking relationships, and custody arrangements. Cybersecurity investments require substantial resources implementing encryption, multi-factor authentication, regular security audits, employee training programs, and incident response protocols protecting against evolving threat landscapes. Supply chain vulnerabilities introduce additional risks as family offices depend on third-party service providers including custodians, fund administrators, and technology platforms requiring rigorous vendor due diligence and ongoing security monitoring.

Succession Planning Preparedness and Wealth Transfer Challenges

Swiss family businesses demonstrate inadequate succession preparation with 47 percent taking no concrete measures for next-generation integration despite approaching leadership transitions across thousands of enterprises. Only a small percent of family offices globally maintain formal wealth succession plans for family members, while merely few establish succession frameworks for overall family office governance and operations. Tax-efficient wealth transfer represents greatest succession challenge, requiring sophisticated planning across trust structures, gift strategies, and jurisdictional optimization minimizing transfer costs while preserving family unity. Preparing next generation for responsible wealth stewardship presents significant difficulty with only a small percent consulting younger family members during succession planning processes, limiting engagement and understanding of family values, investment philosophies, and governance expectations.

Competitive Landscape:

The Switzerland family offices market demonstrates concentrated activity among specialized wealth managers, multi-family office platforms, and independent advisory firms serving ultra-high-net-worth families across Zurich, Geneva, and other major Swiss financial centers. Established players leverage decades of Swiss banking heritage, regulatory expertise, and global investment networks providing comprehensive services spanning asset management, succession planning, tax optimization, and philanthropic coordination. Multi-family offices manage billions in assets through diversified investment approaches incorporating traditional securities, alternative investments, and impact strategies. These platforms benefit from economies of scale consolidating operations, research capabilities, and manager relationships while maintaining personalized service delivery aligned with individual family requirements. Independent single family offices operate discretely serving individual families with complete customization and privacy, supported by specialized service providers including legal advisors, tax consultants, and technology platforms enabling sophisticated operations.

Switzerland Family Offices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single Family Office, Multi-Family Office, Virtual Family Office |

| Office Types Covered | Founder’s Office, Multi-Generational Office, Investment Office, Trustee Office, Compliance Office, Philanthropy Office, Shareholder’s Office, Others |

| Asset Classes Covered | Bonds, Equalities, Alternatives Investments, Commodities, Cash or Cash Equivalents |

| Service Types Covered | Financial Planning, Strategy, Governance, Advisory, Others |

| Regions Covered | Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, Ticino |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Switzerland family offices market size was valued at USD 178.69 Million in 2025.

The Switzerland family offices market is expected to grow at a compound annual growth rate of 4.00% from 2026-2034 to reach USD 254.40 Million by 2034.

Single family office dominated the market with approximately 48.65% revenue share in 2025, driven by ultra-wealthy families' preference for dedicated private wealth management structures offering complete control, customization, and confidentiality.

Key factors driving the Switzerland Family Offices market include Switzerland's secure financial infrastructure and favorable regulatory framework providing political stability and sophisticated banking regulations; comprehensive wealth management services consolidating asset management, succession planning, and tax advisory under unified platforms; and sustainable finance momentum with Swiss family office investments dedicated to impact strategies in 2024.

Major challenges include regulatory compliance complexity with evolving requirements across data protection, cybersecurity, and international tax transparency frameworks; escalating cybersecurity threats targeting sensitive financial data requiring substantial security investments; and succession planning preparedness gaps with Swiss family businesses taking no concrete next-generation integration measures despite approaching leadership transitions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)