Switzerland Fintech Market Size, Share, Trends and Forecast by Deployment Mode, Technology, Application, End User, and Region, 2026-2034

Switzerland Fintech Market Summary:

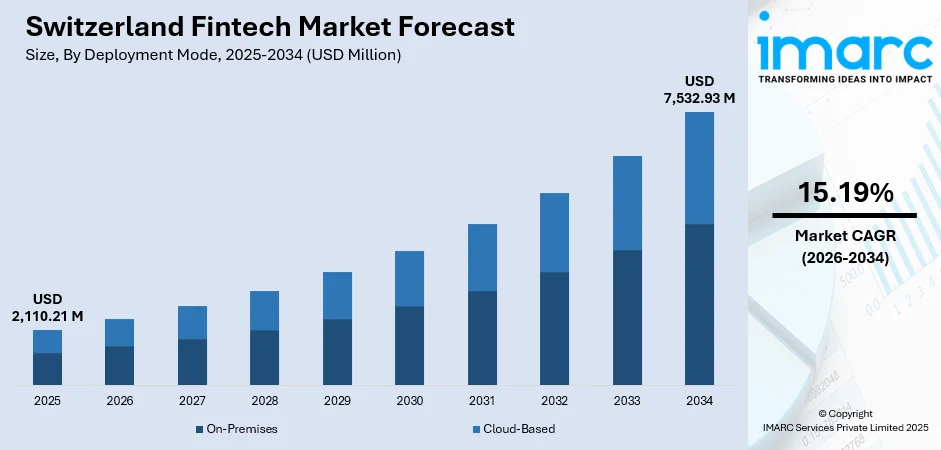

The Switzerland fintech market size was valued at USD 2,110.21 Million in 2025 and is projected to reach USD 7,532.93 Million by 2034, growing at a compound annual growth rate of 15.19% from 2026-2034.

Switzerland represents one of the most sophisticated fintech ecosystems in Europe, which has been driven by its legacy as a global financial hub, a progressive regulatory environment, and strong technological infrastructure. But the convergence of traditional banking with digital innovation-aided, abetted, and further strengthened by world-class research institutions and a skilled workforce-the market benefits from increased consumer demand for seamless digital financial services, while institutional adoption of advanced technologies across industries continues to propel the Switzerland fintech market share.

Key Takeaways and Insights:

- By Deployment Mode: On-premises dominates the market with a share of 35.1% in 2025, driven by banking institutions prioritizing data security and regulatory compliance requirements for sensitive financial information.

- By Technology: Application programming interface leads the market with a share of 25.04% in 2025, attributed to growing open banking initiatives and seamless integration demands between financial service providers.

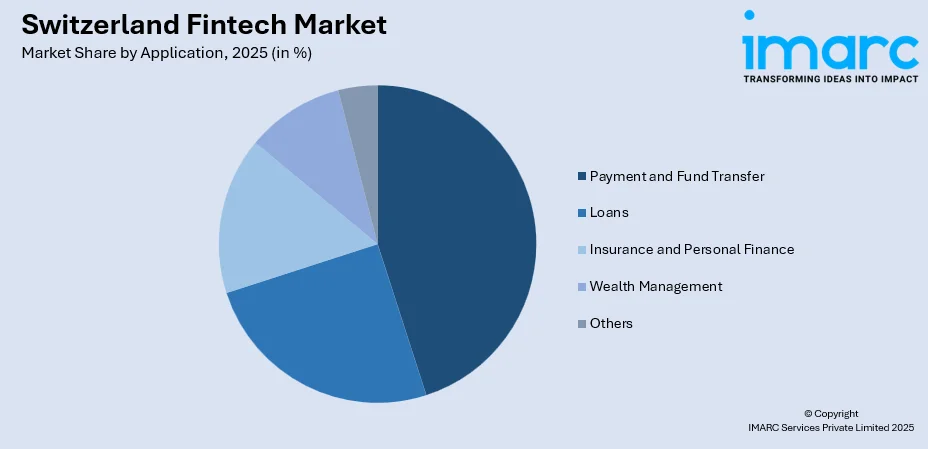

- By Application: Payment and fund transfer dominates the market with a share of 45.06% in 2025, reflecting the widespread adoption of digital payment solutions and instant transfer capabilities.

- By End User: Banking leads the market with a share of 50.06% in 2025, owing to substantial digital transformation investments by traditional financial institutions.

- By Region: Zurich dominates the market with a share of 20% in 2025, owing to its dense financial ecosystem, skilled talent availability, investor presence, and fintech-friendly regulations.

- Key Players: The Switzerland fintech market exhibits a dynamic competitive landscape characterized by the coexistence of established banking institutions undergoing digital transformation, specialized fintech startups, and international technology providers competing across diverse financial service segments.

To get more information on this market Request Sample

Switzerland has emerged as a leading hub for fintech innovation, driven by a principle-based regulatory framework that balances technological progress with financial stability. In October 2025, the Swiss Federal Council launched a consultation on proposed amendments to the Financial Institutions Act to better integrate crypto and stablecoin services into its regulatory framework, aiming to strengthen the attractiveness of the Swiss financial centre for innovative fintech and blockchain firms. A mature financial ecosystem, strong legal clarity, and advanced digital infrastructure support continuous innovation. Close collaboration between established financial institutions and emerging technology-driven firms further strengthens market development. Innovation-friendly policies, a skilled workforce, and a culture of trust enable rapid adoption of digital financial solutions. Together, these factors position Switzerland as a key global influencer in the evolution of next-generation financial services.

Switzerland Fintech Market Trends:

Rising Integration of Artificial Intelligence in Financial Services

The Switzerland fintech sector is rapidly adopting artificial intelligence and machine learning across banking operations, investment management, and customer service. A 2025 FINMA survey shows that about 50% of Swiss financial institutions already use AI in daily operations, with an average of five applications deployed and nine more in development. Financial firms apply advanced algorithms to strengthen fraud detection, personalize customer interactions through chatbots, and improve risk assessment. This growing integration supports faster decision making and higher operational efficiency across the financial services value chain.

Expansion of Open Banking and API-Based Solutions

Swiss banks and fintech companies are increasingly adopting open banking frameworks to improve interoperability and deliver personalized financial products. In November 2025, Swiss financial infrastructure provider SIX launched the bLink open banking platform, enabling customers of eight banks and two licensed third-party providers to aggregate accounts and securely share data through standardized APIs, with backing from more than 30 banks. Broader API adoption supports seamless data exchange, drives customer-centric innovation, and enables integrated financial ecosystems offering comprehensive visibility across multiple banking relationships.

Growing Focus on Sustainable Finance and ESG Integration

Environmental, social, and governance factors are increasingly central to fintech development in Switzerland, with regulators requiring climate-related risk assessments. In July 2025, Swiss banking technology leader Temenos was recognized by TIME magazine as the fourth most sustainable company globally, highlighting its ESG transparency, climate commitments, and sustainable banking technology leadership. Rising demand for responsible financial products has spurred green fintech solutions, including ESG reporting, carbon tracking, and impact investing, while Switzerland continues to attract sustainable fintech companies driving innovation in environmentally and socially responsible financial services.

Market Outlook 2026-2034:

The Switzerland fintech market demonstrates robust growth prospects driven by continued digital transformation across financial services, supportive regulatory frameworks, and increasing consumer preference for convenient financial solutions. The strategic shift toward business-to-business services among Swiss fintech companies reflects market maturation and emphasis on scalable infrastructure solutions. Ongoing innovations in blockchain technology, digital asset management, and instant payment systems position Switzerland to maintain its competitive advantage in the global fintech landscape. The market generated a revenue of USD 2,110.21 Million in 2025 and is projected to reach a revenue of USD 7,532.93 Million by 2034, growing at a compound annual growth rate of 15.19% from 2026-2034.

Switzerland Fintech Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Deployment Mode |

On-Premises |

35.1% |

|

Technology |

Application Programming Interface |

25.04% |

|

Application |

Payment and Fund Transfer |

45.06% |

|

End User |

Banking |

50.06% |

|

Region |

Zurich |

20% |

Deployment Mode Insights:

- On-Premises

- Cloud-Based

The on-premises dominates with a market share of 35.1% of the total Switzerland fintech market in 2025.

Swiss financial institutions continue to favor on‑premises deployment due to strict data sovereignty and regulatory compliance requirements. In November 2025, the Swiss Bankers Association updated its Cloud Guidelines to guide banks on legal and supervisory obligations when using cloud services, emphasizing risk assessment and control over sensitive data. Maintaining on‑site infrastructure allows banks to safeguard customer information, implement tailored security measures, and ensure compliance with Swiss data protection laws and fiduciary responsibilities, reinforcing cautious adoption of cloud technologies.

On-premises solution gives more flexibility to financial institutions regarding the configuration of system requirements as per the requirements of the institution and the risk management strategies of the firm. Large-scale organizations and financial institutions have been favoring this mode of implementation to facilitate the existing security setup and the use of new fintech functionality.

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

The application programming interface leads with a share of 25.04% of the total Switzerland fintech market in 2025.

The emergence of application programming interfaces has become a bedrock for the fintech ecosystem in Switzerland, which has ensured sound connectivity for various providers of financial services. The Swiss banking system has incorporated the ideology of open banking to deliver new approaches to banking infrastructure, which involve identity management systems, information platforms, and financial compliance. The rising memorandum of understanding signed by leading banks encouraging the practice of multibanking bears witness to improved connectivity.

APIs will also enable the creation of customized financial solutions through secure data exchange between traditional banks, fintech startups, and third-party service providers. This technology enables the development of holistic financial management platforms that can bundle services of several institutions. Common API standards for the Swiss financial industry reduce integration efforts and shorten time-to-market for new financial offerings.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

The payment and fund transfer dominates with a market share of 45.06% of the total Switzerland fintech market in 2025.

Payment and fund transfer applications are Switzerland’s most advanced and widely adopted fintech segment, supported by robust digital infrastructure and strong consumer acceptance of electronic transactions. In September 2025, Bivial AG launched 24/7 instant Swiss Franc payments via the SIC Instant Payments system, allowing transfers in under 10 seconds year-round, demonstrating real-time payment adoption. Since the market-wide rollout in August 2024, real-time transfers now cover most Swiss retail payment flows. Mobile payments and contactless transactions are also increasingly popular among consumers and businesses.

The segment benefits from ongoing innovation in cross-border payment solutions that leverage Switzerland's position as a global financial center. Digital wallet adoption and peer-to-peer payment platforms have expanded significantly, driven by consumer demand for convenient and secure transaction methods. Integration of advanced security features, including biometric authentication and encrypted communication protocols, supports continued growth in digital payment adoption across demographic segments.

End User Insights:

- Banking

- Insurance

- Securities

- Others

The banking leads with a share of 50.06% of the total Switzerland fintech market in 2025.

Banking organizations are considered the main adopters as well as drivers of fintech adoption within the Swiss economy, making significant investments within the field of digital transformation to improve service delivery and efficiency. Conventional banks are using the collaboration and acquisition strategy to transform and develop their core to cater to different sectors within the retail and business segments. The launching of digital bank licences has made possible the provision of paperless banking through an app.

Swiss banks are increasingly deploying advanced technologies including artificial intelligence for customer service, blockchain for transaction processing, and data analytics for risk management. The competitive pressure from neobanks and international digital challengers motivates continued investment in technological infrastructure. Collaboration between established financial institutions and fintech startups creates opportunities for innovation while maintaining the stability and trust associated with Switzerland's banking sector.

Regional Insights:

- Zurich

- Espace Mittelland

- Lake Geneva Region

- Northwestern Switzerland

- Eastern Switzerland

- Central Switzerland

- Ticino

Zurich exhibits a clear dominance with a 20% share of the total Switzerland fintech market in 2025.

Zurich is revealed to be the leading region in the Switzerland fintech industry, given its stronghold over the country as a financial hub, along with being the base for large global tech companies such as research and development operations for large global tech firms. The region boasts world-class infrastructure, talented workforce from leading varsities, and a collaborative ecosystem that brings together the financial and tech sectors.

The presence of banking HQs, insurance, and fintech startups in Zurich ensures a conducive environment for innovation and partnership-building. Accessibility in the region’s regulatory frameworks, as well as the existence of venture capital, ensures the development of new fintech businesses as well as testing grounds for existing institutions in fintech innovation. Zurich is ranked among the best global locations for fintech, thanks to investments in financial services infrastructure in digital technologies, as well as enabling city regulations.

Market Dynamics:

Growth Drivers:

Why is the Switzerland Fintech Market Growing?

Supportive Regulatory Environment and Innovation-Friendly Policies

Switzerland provides a regulatory environment that fosters fintech innovation while protecting market integrity and consumers. In March 2025, FINMA licensed BX Digital, a Swiss unit of the Stuttgart Stock Exchange, to operate a blockchain-based trading system for tokenised assets, illustrating how principle‑based, technology-neutral oversight enables innovation within existing safeguards. Swiss frameworks are designed to accommodate new technologies without excessive compliance burdens, applying consistent rules across delivery models. Flexible provisions allow emerging firms to pilot financial solutions in controlled settings, lowering entry barriers, encouraging experimentation, and supporting the sustainable growth of innovative business models.

Strong Digital Infrastructure and Technological Advancement

Switzerland’s advanced digital infrastructure underpins its strong fintech ecosystem. In June 2025, Microsoft announced a $400 million investment to expand cloud and AI infrastructure, upgrading data centres in Geneva and Zurich to support regulated sectors like finance and enhance digital skills nationwide. Reliable connectivity, secure data environments, and efficient payment networks enable sophisticated financial services. Academic institutions also contribute, with the University of Zurich’s Swiss FinTech Innovation Lab conducting cross-disciplinary research that links fintech, finance, and technology, providing actionable insights. A digitally skilled population further supports adoption, helping fintech providers scale solutions effectively across diverse user segments.

Convergence of Traditional Finance Expertise with Digital Innovation

Switzerland’s long-standing financial expertise is paired with a strong culture of technological innovation. At the Singapore Fintech Festival 2025, the Swiss Pavilion participated for the ninth consecutive year, highlighting Swiss fintech excellence and promoting collaboration between banks, startups, regulators, and global partners to advance cross-border solutions. Proximity to experienced professionals, sophisticated clients, and established institutions enables fintech firms to exchange knowledge, refine products, and accelerate market entry. This combination of trust, expertise, and innovation supports the growth of advanced digital financial services with impact beyond Switzerland.

Market Restraints:

What Challenges the Switzerland Fintech Market is Facing?

Regulatory Complexity and Cross-Border Compliance Requirements

Swiss fintech companies face challenges navigating regulatory requirements when expanding into European Union markets, particularly following implementation of Markets in Crypto-Assets regulation affecting crypto-related businesses with EU ties. The need to maintain compliance across multiple jurisdictions increases operational complexity and costs for companies pursuing international growth strategies. Evolving regulatory interpretations regarding novel business models create uncertainty that can delay product launches and market entry decisions.

Talent Competition and Operational Cost Pressures

Switzerland's high cost of living and wage expectations create challenges for fintech companies competing with international markets for specialized technology talent. The limited domestic market size constrains scalability opportunities, requiring companies to pursue international expansion earlier in their development. Competition from well-funded international fintech companies and established financial institutions intensifies pressure on emerging players to demonstrate sustainable business models.

Cybersecurity Threats and Data Protection Obligations

Increasing sophistication of cyber threats targeting financial services requires substantial ongoing investment in security infrastructure and compliance capabilities. Stringent data protection requirements, while building consumer trust, impose operational burdens on companies managing sensitive financial information across systems. The interconnected nature of digital financial services creates systemic vulnerabilities that require coordinated industry responses and continuous vigilance.

Competitive Landscape:

The Switzerland fintech market exhibits a diverse competitive environment characterized by the interplay between established financial institutions undergoing digital transformation and innovative technology companies disrupting traditional service delivery models. Large banking groups leverage substantial resources and customer relationships to develop comprehensive digital platforms while maintaining regulatory compliance capabilities. Specialized fintech startups compete by offering focused solutions addressing specific market needs, often partnering with incumbent institutions to gain market access and credibility. International fintech companies and neobanks present additional competitive pressure, driving innovation and service quality improvements across the sector. The market increasingly favors business-to-business models providing infrastructure solutions, reflecting maturation toward sustainable and scalable business approaches.

Recent Developments:

- In September 2025, Switzerland’s Swiss Financial Innovation Desk (FIND) will be integrated early into the State Secretariat for International Finance to meet surging fintech demand, signaling stronger government backing for innovation and regulatory support in digital finance.

Switzerland Fintech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End Users Covered | Banking, Insurance, Securities, Others |

| Regions Covered | Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, Ticino |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Switzerland fintech market size was valued at USD 2,110.21 Million in 2025.

The Switzerland fintech market is expected to grow at a compound annual growth rate of 15.19% from 2026-2034 to reach USD 7,532.93 Million by 2034.

On-premises deployment held the largest market share of 35.1%, driven by banking institutions prioritizing data security, regulatory compliance, and direct control over sensitive financial information within their infrastructure.

Key factors driving the Switzerland fintech market include supportive regulatory frameworks enabling innovation, advanced digital infrastructure, convergence of traditional finance expertise with technological capabilities, and increasing consumer adoption of digital financial services.

Major challenges include regulatory complexity for cross-border operations, high operational costs and talent competition, evolving cybersecurity threats, data protection obligations, and intensifying competition from international fintech entrants.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)