Switzerland Leisure Travel Market Size, Share, Trends and Forecast by Traveler Type, Age Group, Expenditure Type, Sales Channel, and Region, 2026-2034

Switzerland Leisure Travel Market Summary:

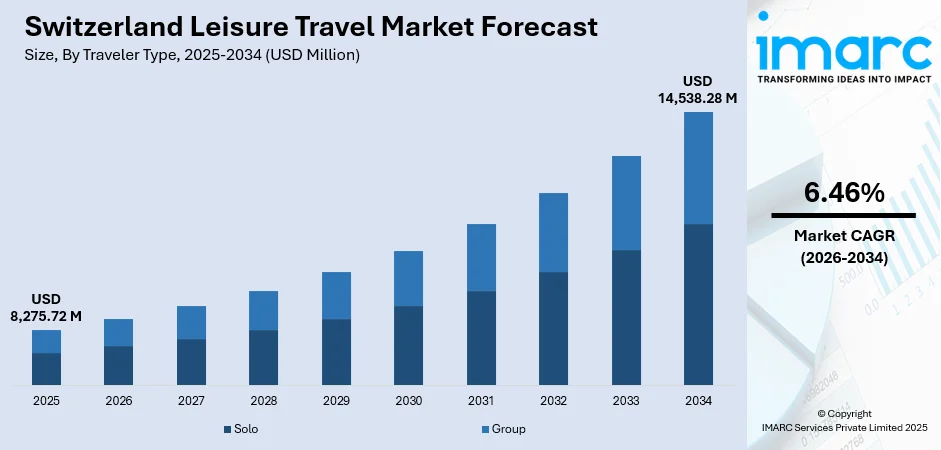

The Switzerland leisure travel market size was valued at USD 8,275.72 Million in 2025 and is projected to reach USD 14,538.28 Million by 2034, growing at a compound annual growth rate of 6.46% from 2026-2034.

The market expansion is primarily driven by Switzerland's sustained appeal as a premium alpine destination, reinforced by strategic initiatives promoting sustainable tourism and enhanced digital booking infrastructure. Growing international visitor arrivals from North American and Asian markets, combined with robust domestic demand for experiential travel, continue to strengthen Switzerland's position in the global leisure tourism landscape. The country's comprehensive public transport network powered by renewable energy, creates favorable conditions for sustained growth in the Switzerland leisure travel market share.

Key Takeaways and Insights:

- By Traveler Type: Group dominates the market with a share of 60% in 2025, driven by increasing popularity of small-group tour packages offering personalized experiences through curated itineraries with 8-16 travelers.

- By Age Group: Millennial leads the market with a share of 35% in 2025, reflecting this demographic's preference for experiential and adventure-focused travel activities.

- By Expenditure Type: Lodging represents the largest segment with a market share of 30% in 2025, with accommodations ranging from luxury alpine resorts to boutique city hotels.

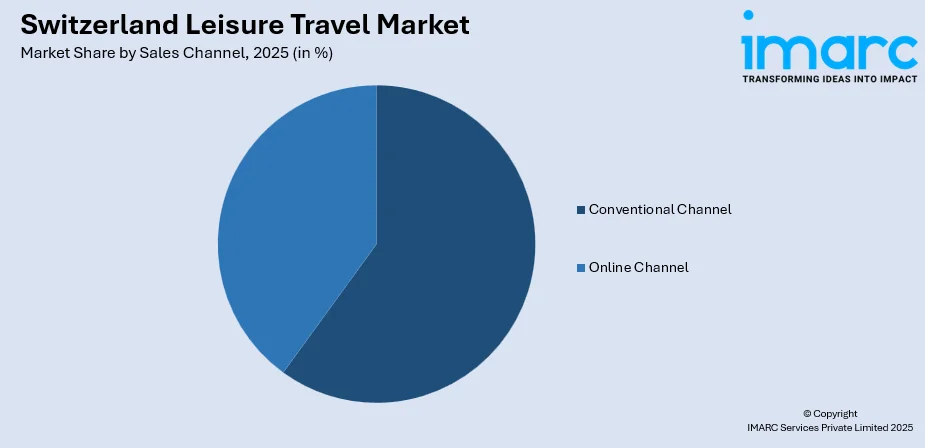

- By Sales Channel: Conventional channel leads the market with a share of 55% in 2025, as tour operators and travel agencies continued to facilitate substantial booking volumes.

- Key Players: The Switzerland leisure travel market exhibits moderate competitive intensity, with established international tour operators competing alongside regional specialists across multiple price segments. Major players differentiate through sustainable tourism certifications, exclusive destination access, and integrated booking platforms combining accommodation, transportation, and experiential components tailored to diverse traveler preferences.

To get more information on this market, Request Sample

Switzerland's leisure travel sector demonstrates remarkable resilience supported by strategic positioning as a premium sustainable destination. The country recorded 42.8 million total overnight stays in 2024, marking a sustained recovery with foreign visitors contributing 22 million stays. Government initiatives through the State Secretariat for Economic Affairs focus on infrastructure enhancement and digital transformation to maintain competitive advantage. Enhanced visa policies including China's March 2024 expansion of visa-free entry to Switzerland facilitate easier access for emerging markets. Combined with technological innovations in booking platforms and loyalty programs, these factors position the market for sustained growth through enhanced visitor experiences and operational efficiency improvements across the tourism value chain. Moreover, the government is taking initiatives to encourage brands to provide curated travel plans for eco-conscious travelers.

Switzerland Leisure Travel Market Trends:

Sustainable and Eco-Friendly Tourism Expansion

Switzerland continues to strengthen its leadership in sustainable leisure travel through comprehensive environmental initiatives integrated across the tourism value chain. The Swisstainable program encompasses over 2,200 participating tourism businesses across three certification levels, with properties achieving leading status demonstrating comprehensive sustainability credentials audited by third parties. Moreover, innovative infrastructure includes the Solar Cableway Staubern, introduced in 2024 as the world's first battery-powered cableway operating exclusively on solar energy. Apart from this, hotels are prioritizing energy efficiency, organic food sourcing, and waste reduction programs aligned with visitor expectations for environmentally responsible travel options that preserve Switzerland's pristine landscapes for future generations.

Digital Transformation and Online Booking Dominance

Digital platforms are revolutionizing how travelers discover, plan, and book Swiss leisure experiences through sophisticated online ecosystems. Switzerland Travel Centre launched a comprehensive website first quarter of 2025 featuring state-of-the-art user experience design and search engine optimization, enabling seamless customization of multi-destination itineraries. Mobile applications are also providing digital access to loyalty rewards, Swiss Travel Pass benefits, and real-time travel information enhancing visitor convenience. Artificial intelligence (AI) and data analytics enable personalized marketing strategies and dynamic pricing optimization helping operators maximize revenue while meeting individual traveler preferences.

Surge in North American and Asian Long-Haul Travel

Switzerland experienced remarkable growth in long-haul visitor arrivals particularly from North American and Asian source markets seeking alpine experiences and cultural attractions. United States travelers contributed 4.6 million overnight stays in 2024, representing a robust 13.9% increase compared to the 2023. December 2024 witnessed exceptional demand with foreign overnight stays surging 10.7% driven by winter tourism activities and holiday travel patterns. China's Ministry of Foreign Affairs expanded visa-free entry policies in 2024 to include Switzerland among six European countries benefiting from 15-day visa exemptions, facilitating easier access for Chinese tourists and supporting gradual market recovery.

Market Outlook 2026-2034:

The Switzerland leisure travel market is positioned for experiencing robust growth driven by technological innovation, demographic shifts, and strategic positioning as a premium sustainable destination. The market generated a revenue of USD 8,275.72 Million in 2025 and is projected to reach a revenue of USD 14,538.28 Million by 2034, growing at a compound annual growth rate of 6.46% from 2026-2034. The market will benefit from continued government investment in tourism infrastructure including transportation networks, digital platforms, and sustainability initiatives that enhance Switzerland's competitive positioning.

Switzerland Leisure Travel Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Traveler Type | Group | 60% |

| Age Group | Millennial | 35% |

| Expenditure Type | Lodging | 30% |

| Sales Channel | Conventional Channel | 55% |

Traveler Type Insights:

- Solo

- Group

Group dominates with a market share of 60% of the total Switzerland leisure travel market in 2025.

Small-group leisure tours provide personalized attention and curated experiences that solo travel arrangements cannot easily replicate across Switzerland's diverse destinations. Tour operators specializing in 8 to16 person groups report sustained popularity as travelers value the balance between structured itineraries and flexible exploration time. Premium tour packages combine luxury accommodations with exclusive access to alpine experiences, cultural attractions, and culinary offerings across regions from the Bernese Oberland to Lake Geneva.

Conventional travel agencies and tour operators maintain strong distribution presence through established relationships with Swiss hotels, railways, and attraction providers. Switzerland Travel Centre, the official tour operator, reported record sales of 118 million Swiss Francs in 2024 representing 7% growth, with customizable package holidays combining accommodations and public transport remaining extremely popular across North American, German, and UK source markets. Group bookings provide operational efficiency for hotels and transportation providers through guaranteed capacity utilization and simplified coordination compared to individual reservations.

Age Group Insights:

- Baby Boomers

- Generation X

- Millennial

- Generation Z

Millennial leads with a share of 35% of the total Switzerland leisure travel market in 2025.

Millennial travelers prioritize authentic experiences, outdoor adventures, and sustainable tourism practices that align with personal values and social consciousness. Specialized tour operators developed offerings specifically targeting 18–35-year-olds through budget-friendly group trips emphasizing hiking, skiing, and cultural immersion in Switzerland's alpine and urban destinations. Key market players are providing packages for adventurers aged 18-29 featuring inclusive pricing covering flights, accommodations, and activities with flexible payment plans enabling broader accessibility.

Digital engagement channels resonate strongly with millennial preferences for online research, social media inspiration, and mobile booking platforms. In 2024, Switzerland is attempting to convince business travelers to lengthen their visits with a fresh marketing initiative. Titled "Fly another day," the initiative includes a 30-second video advertisement urging business travelers to come to Switzerland a few days before or after their trip and "enjoy some time for yourself." In a montage, audiences observe Swiss fondue and cheese, pristine lakes, along with the famous Matterhorn and Schilthorn in the Alps.

Expenditure Type Insights:

- Lodging

- Transportation

- Food and Beverages

- Events and Entertainment

- Others

Lodging exhibits a clear dominance with a 30% share of the total Switzerland leisure travel market in 2025.

Accommodation expenses constitute the primary expenditure component as Switzerland's hotel industry positions itself as a premium destination offering diverse lodging options from luxury alpine resorts to boutique urban properties. Hotels invest in service differentiation through wellness facilities, gourmet dining experiences, and sustainability certifications attracting affluent guests willing to pay premium rates for exceptional hospitality standards. Independent hotels dominated while chain hotels recorded fastest expansion through strategic portfolio growth and brand repositioning initiatives.

Major accommodation developments reinforce capacity expansion in key tourism hubs addressing growing demand. In 2024, the Houte Couture brand Elie Saab unveiled its ultra-luxury hotel-residence project in Switzerland. The complex beautifully highlights Saab's renowned refined aesthetic, merging modern elegance with timeless Alpine allure. Twenty-one designer rooms and nineteen private residences feature meticulously selected items from the elite Elie Saab Maison collection. This is Alpine opulence transformed, an effortless blend of history and modernity.

Sales Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Conventional Channel

- Online Channel

Conventional channel leads with a 55% share of the total Switzerland leisure travel market in 2025.

Conventional channels remain resilient through personalized service offerings, comprehensive package customization, and established relationships across Switzerland's tourism ecosystem. Switzerland Travel Centre achieved record financial results with booking volumes increasing to 118 million Swiss Francs in 2024, with hotel accommodation sales to tour operators worldwide growing significantly alongside customizable package holidays combining transportation and accommodations. Tour operators provide value-added services including destination expertise, multi-city itinerary planning, and group coordination that individual online bookings cannot easily replicate for complex Switzerland vacations.

Conventional channels excel at facilitating multi-day panoramic train tours that remained extremely popular among international travelers seeking signature Swiss rail experiences. Switzerland Travel Centre's North American, German, and UK markets contributed significantly to growth, with travelers from these regions preferring packaged solutions combining Swiss Travel Pass benefits with curated accommodation selections and exclusive experiences. Tour operators leverage purchasing power negotiating favorable hotel rates and transportation packages passing cost savings to consumers while maintaining service quality standards.

Regional Insights:

- Zurich

- Espace Mittelland

- Lake Geneva Region

- Northwestern Switzerland

- Eastern Switzerland

- Central Switzerland

- Ticino

Zurich region maintains leadership as Switzerland's primary urban tourism hub combining financial center business travel with leisure visitors attracted to cultural attractions and alpine accessibility. The region recorded strong overnight stay growth supported by expanding hotel capacity including the 447-room Radisson Hotel & Suites Zurich. Zurich serves as the primary international gateway through Switzerland's largest airport facilitating easy arrival for foreign tourists beginning Swiss leisure itineraries.

Espace Mittelland encompasses the capital region of Bern along with renowned destinations like Interlaken and Grindelwald attracting adventure tourism and cultural heritage visitors. The region benefits from UNESCO World Heritage status of Bern's medieval old town combined with dramatic alpine landscapes providing skiing, hiking, and mountaineering opportunities. Small group tours frequently include Espace Mittelland destinations within multi-region itineraries showcasing Swiss diversity.

Lake Geneva Region combines French-influenced cultural sophistication with spectacular alpine and lakeside scenery attracting luxury travelers and wine tourism enthusiasts. Cities including Geneva, Lausanne, and Montreux host international events while providing gateways to renowned ski resorts and UNESCO-listed Lavaux vineyards. The region's multilingual environment and international character appeal particularly to European and North American source markets.

Northwestern Switzerland centered on Basel attracts cultural tourism through world-class museums and art festivals while providing convenient access to both German and French borders. Basel's Rhine location offers unique riverfront experiences complementing Switzerland's traditional alpine offerings. The region benefits from strong European visitor arrivals leveraging proximity to major German and French population centers.

Eastern Switzerland including St. Gallen and the Appenzell region showcases traditional Swiss culture through preserved rural landscapes and architectural heritage. The region appeals to travelers seeking authentic cultural experiences away from heavily touristed alpine resorts while still offering mountain hiking and winter sports opportunities in areas like Arosa.

Central Switzerland featuring Lucerne serves as Switzerland's geographic and tourism heart with iconic lake and mountain scenery including Mount Pilatus and Mount Rigi. Lucerne's medieval architecture and central location within panoramic rail routes make it a cornerstone destination for group tours and independent travelers exploring Switzerland's classic landscapes.

Ticino provides Switzerland's Mediterranean-influenced southern region combining Italian language and culture with alpine and lakeside settings. The region attracts visitors seeking milder climate, culinary tourism focused on Italian-Swiss fusion cuisine, and access to lake resort destinations like Locarno and Lugano offering distinct character from German-speaking alpine regions.

Market Dynamics:

Growth Drivers:

Why is the Switzerland Leisure Travel Market Growing?

Record International Tourism Recovery Exceeding Pre-Pandemic Levels

Switzerland achieved unprecedented tourism milestones with international visitor arrivals and overnight stays surpassing pre-pandemic performance levels. In 2024, Switzerland's hotel sector achieved a historic milestone, with the government reporting an unprecedented 42.8 million overnight stays, approaching pre-crisis peaks while major urban centers including Zurich, Basel, and Geneva experienced particularly strong performance driven by business and leisure travel convergence. December 2024 witnessed exceptional growth with foreign overnight stays surging, reflecting strong winter tourism demand and holiday travel patterns across alpine and urban destinations. The combination of strategic government support, infrastructure excellence, and Switzerland's inherent natural and cultural attractions creates favorable conditions for sustained tourism expansion.

Enhanced Sustainable Transport Infrastructure and Swisstainable Certification Program

Switzerland's comprehensive sustainable tourism initiatives differentiate the destination through authentic environmental commitments attracting eco-conscious travelers prioritizing responsible travel practices. Sustainable transport infrastructure provides competitive advantages through extensive public transit networks powered predominantly by renewable hydroelectric energy. Swiss Railways announed its plans to solely run of renewable electricity form 2025 and will stop using this electricity for train operations and will instead sell it on the electricity market. The transition to entirely renewable traction electricity is a component of the company's sustainability plan. The goal is to contribute to the Paris Climate Agreement and reduce operational greenhouse gas emissions by 50% by 2030. Swiss Railways intends to cut greenhouse gas emissions by more than 90% by the year 2040.

Government Tourism Strategy and Digital Infrastructure Investment

Government tourism strategy initiatives implemented by the State Secretariat for Economic Affairs focus on enhancing framework conditions through collaboration with industry stakeholders. Strategic investments in digital marketing campaigns, infrastructure modernization, and sustainability initiatives strengthen Switzerland's competitive positioning in global leisure markets. Tourism contributes significantly to national economic performance supporting approximately 167,000 full-time jobs equivalent to 4% of the workforce while generating nearly 3% of gross domestic product. Strategic government initiatives through comprehensive tourism policies and digital infrastructure investments strengthen Switzerland's market positioning and operational efficiency. These strategic interventions address structural challenges while capitalizing on emerging opportunities in luxury wellness tourism, adventure experiences, and cultural heritage preservation.

Market Restraints:

What Challenges the Switzerland Leisure Travel Market is Facing?

Strong Swiss Franc Reducing International Price Competitiveness

The persistently strong Swiss franc relative to major currencies diminishes Switzerland's price competitiveness compared to alternative European destinations offering similar alpine and cultural experiences. The currency strength reduces purchasing power for international visitors particularly from Europe where Austria, France, Italy, and Spain provide comparable mountain tourism at substantially lower costs. American travelers benefit from favorable dollar exchange rates supporting continued growth, but European markets face economic headwinds where Swiss vacation costs appear prohibitive relative to domestic options or competing destinations. The franc's strength affects both accommodation and dining expenses where Switzerland's high cost of living translates into premium pricing across tourism services potentially deterring price-sensitive travelers.

Labor Shortages and High Operational Costs Constraining Industry Profitability

Switzerland's hospitality sector confronts structural labor shortages and elevated operational costs impacting profit margins and service delivery capabilities. The industry struggles to attract and retain qualified hospitality professionals amid Switzerland's broader labor market dynamics where other sectors offer competitive compensation with less demanding schedules. High wages necessary to attract workers in Switzerland's expensive labor market compress profit margins particularly for mid-scale properties unable to command premium rates justifying elevated staffing costs. Operational expenses including energy, food procurement, and property maintenance remain substantially higher than competing European destinations reducing financial flexibility for reinvestment and expansion initiatives.

Climate Change Impacts on Winter Tourism and Snow Reliability

Climate change poses existential challenges to Switzerland's winter tourism industry through reduced snowfall reliability and shortened ski seasons at lower elevation resorts. Warming temperatures force ski areas to invest heavily in snowmaking equipment and energy-intensive artificial snow production increasing operational costs while raising environmental concerns. Some traditional ski destinations face uncertain futures as natural snow coverage declines, potentially shifting tourism patterns toward higher-elevation resorts equipped for climate adaptation. The industry must balance short-term operational demands with long-term sustainability considerations as global warming threatens the natural alpine conditions fundamental to Switzerland's winter tourism appeal.

Competitive Landscape:

The Switzerland leisure travel market demonstrates moderate to high competitive intensity characterized by diverse participants spanning international tour operators, regional specialists, online travel agencies, and direct-to-consumer hotel brands. International operators including G Adventures, Intrepid Travel, and Trafalgar leverage global distribution networks and brand recognition to attract customers through comprehensive package offerings combining accommodations, transportation, and guided experiences across Swiss destinations. Regional specialists like Switzerland Travel Centre maintain competitive advantages through deep local expertise, established relationships with Swiss accommodation and transport providers, and official designation as the country's largest tour operator with offices in Zurich, London, Stuttgart, and Hong Kong. Online travel agencies capture substantial market share through user-friendly digital platforms, extensive inventory, and competitive pricing enabled by direct supplier relationships and technology-driven operational efficiency. Competition intensifies as direct hotel booking channels invest in customer relationship management systems, loyalty programs, and dynamic pricing capabilities to recapture margins traditionally lost to third-party intermediaries.

Recent Developments:

- In November 2025, Switzerland's tourism industry is poised for a significant enhancement as SWISS International Air Lines (SWISS) reveals the forthcoming introduction of its redesigned long-haul cabins. These modifications are set to transform air travel, showcasing Swiss hospitality at its best from the moment of departure, enhancing Switzerland's appeal to luxury travelers worldwide. Through the updated market is positioned for sustained expansion driven by demographic shifts, technological SWISS Senses cabin features, SWISS is enhancing not only the flying experience but also the overall journey to Switzerland. This strategic decision is expected to attract more visitors, especially from Asia and the Middle East, to view Switzerland as their upcoming vacation spot.

- In November 2025, Fred Holidays has unveiled its 2026 Switzerland rail holidays catalog in collaboration with Switzerland Tourism and Travel Switzerland. The latest collaboration in publishing arises as the operator reports a 63% increase in bookings for Swiss holidays compared to the previous year, with 89% generated via the trade. The 2026 Switzerland Rail Holidays booklet presents eight new excursions that delve into lesser-explored areas of Switzerland, in addition to increased city break options in Zurich and Basel.

- In September 2025, Rail Europe has launched an appealing promotion aimed at increasing advisor earnings during the typically slower travel period. The company is providing complimentary additional travel days with the purchase of Swiss Travel Passes, delivering outstanding value for travelers and generating new opportunities for travel agents. The promotion features two attractive packages: individuals who buy a four-day consecutive Swiss Travel Pass will receive one extra free day, whereas those who opt for an eight-day consecutive pass will benefit from two additional travel days.

Switzerland Leisure Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Traveler Types Covered | Solo, Group |

| Age Groups Covered | Baby Boomers, Generation X, Millennial, Generation Z |

| Expenditure Types Covered | Lodging, Transportation, Food and Beverages, Events and Entertainment, Others |

| Sales Channels Covered | Conventional Channel, Online Channel |

| Regions Covered | Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, Ticino |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Switzerland leisure travel market size was valued at USD 8,275.72 Million in 2025.

The Switzerland leisure travel market is expected to grow at a compound annual growth rate of 6.46% from 2026-2034 to reach USD 14,538.28 Million by 2034.

The group travel segment dominated the market with 60% share, driven by strong demand for small-group tour experiences offering personalized attention and curated itineraries across Switzerland's diverse alpine and urban destinations.

Key factors driving the Switzerland leisure travel market include record international tourism recovery with foreign overnight stays, enhanced sustainable transport infrastructure through Swisstainable certification program encompassing over 2,200 participating businesses, and government tourism strategy investments in digital marketing and infrastructure development.

Major challenges include the strong Swiss franc reducing price competitiveness against alternative European destinations offering similar alpine experiences at lower costs, climate change impacts threatening winter tourism through reduced snow reliability requiring costly artificial snowmaking investments, and seasonal demand fluctuations creating capacity utilization challenges for accommodation providers and transportation services.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)