Switzerland Solar Energy Market Size, Share, Trends and Forecast by Technology, Application, End User, and Region, 2026-2034

Switzerland Solar Energy Market Size and Share:

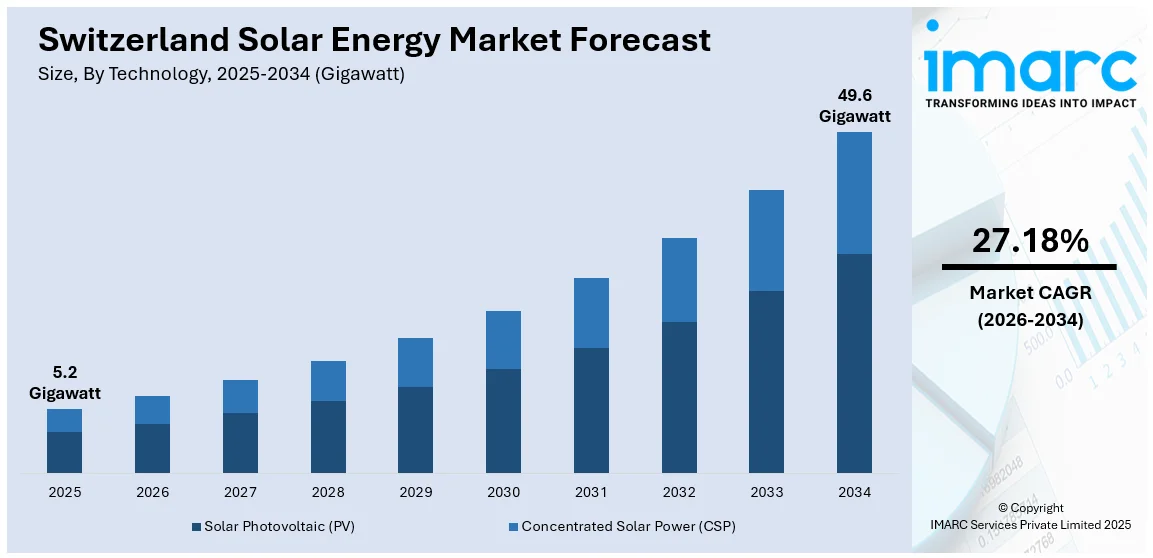

The Switzerland solar energy market size reached 5.2 Gigawatt in 2025. Looking forward, IMARC Group estimates the market to reach 49.6 Gigawatt by 2034, exhibiting a CAGR of 27.18% during 2026-2034. The market is driven by strong government support, rising electricity demand, and sustainability goals. Incentives such as feed-in tariffs and subsidies promote residential and commercial solar adoption. Besides, technological advancements and decentralized energy policies support the Switzerland solar energy market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 5.2 Gigawatt |

| Market Forecast in 2034 | 49.6 Gigawatt |

| Market Growth Rate (2026-2034) | 27.18% |

One of the primary factors driving Switzerland’s solar energy market is the government’s strong commitment to achieving net-zero emissions by 2050. Federal incentives such as investment subsidies, feed-in tariffs, and tax benefits have encouraged both households and businesses to adopt photovoltaic (PV) systems. For instance, industry reports indicate that about half of new residential solar installations in Switzerland now incorporate battery energy storage systems. Over the last three years, total BESS installations have almost doubled annually. In 2024, battery costs are estimated at $115 per kWh, and solar power is expected to supply 14% of the nation’s electricity demand. In addition, Switzerland’s decentralized energy system supports small-scale solar installations, enabling communities and cooperatives to contribute to the national grid. The growing awareness among citizens about climate change and environmental responsibility also fuels solar adoption, particularly in urban areas and public buildings.

To get more information on this market Request Sample

Another critical driver for Switzerland solar energy market growth is the increasing demand for sustainable electricity amid energy security concerns and rising fossil fuel prices. As electricity consumption rises, especially with the growth of electric vehicles and digital infrastructure, solar energy offers a resilient and cost-effective alternative. Technological advancements, such as high-efficiency PV modules and energy storage solutions, are also making solar more viable in Switzerland’s varied climate and terrain. Furthermore, building-integrated photovoltaics (BIPV) and rooftop installations help overcome land constraints, while innovative financing models and partnerships with local utilities reduce upfront costs. These factors, combined with a supportive regulatory environment and strong R&D capabilities, accelerate the market growth.

Switzerland Solar Energy Market Trends:

Policy Support and Government Initiatives

The growth of Switzerland's solar energy market is significantly influenced by robust policy support and government initiatives. For instance, in June 2024, Switzerland passed a new electricity law that requires the installation of photovoltaic (PV) systems on large buildings and provides incentives for PV development. The law also requires solar installations on new buildings larger than 300 m². The Swiss government has been proactive in its commitment to renewable energy, implementing a series of policies aimed at encouraging the adoption of solar energy. One of the key measures is the Energy Strategy 2050, which focuses on reducing dependence on nuclear energy and increasing the share of renewables in the energy mix. This strategy includes financial incentives for both residential and commercial solar installations, making it economically viable for consumers to invest in solar technology. Moreover, the government has introduced subsidies and tax rebates that lower the initial cost barriers associated with solar energy systems. Additionally, the Swiss government promotes research and development in solar technologies, providing grants and funding to innovate and improve efficiency in solar panels and related equipment, thereby aiding in the positive Switzerland solar energy market outlook.

Technological Advancements and Innovations

The market for solar energy in Switzerland is also driven by continuous technological advancements and innovations. Research institutions and private enterprises in Switzerland are at the forefront of developing cutting-edge solar technologies. Advancements in photovoltaic (PV) technology have significantly increased the efficiency and energy output of solar panels. Innovations such as bifacial solar panels, which can capture sunlight from both sides, and the development of thin-film solar cells have made solar installations more efficient and aesthetically appealing. Additionally, the integration of smart grid technologies and energy storage solutions has enhanced the reliability and stability of solar power systems. These technological breakthroughs enable more effective utilization of solar energy, reducing wastage and improving overall performance. For instance, in January 2025, Swiss startup Voltiris secured significant seed funding to expand its innovative solar-powered greenhouse technology. The investment round involved key venture capital firms, including EquityPitcher Ventures and 3M Ventures. Their solar modules improve greenhouse energy efficiency through advanced spectral filtering technology. The new funding will accelerate large-scale deployment, commercialization, and growth of their team in agronomy, solar project development, and sales.

Environmental Awareness and Consumer Demand

Rising environmental awareness and growing consumer demand for clean energy are pivotal drivers of the solar energy market in Switzerland. With increasing concern over climate change and environmental degradation, there is a strong shift toward sustainable and eco-friendly energy sources. Consumers are becoming more conscious of their carbon footprint and are actively seeking alternatives to conventional fossil fuels. Solar energy, being a clean and renewable source, fits well with the environmental goals of both individuals and businesses. The Swiss population, known for its high environmental consciousness, is increasingly opting for solar energy installations for residential, commercial, and industrial applications. Moreover, businesses are adopting solar energy as part of their corporate social responsibility initiatives and to meet regulatory requirements related to carbon emissions. This shift in consumer behavior is supported by educational campaigns and awareness programs that highlight the benefits of solar energy. For instance, in March 2025, the Swiss Federal Council approved a second set of ordinances in order to put the Federal Act on a Secure Electricity Supply from Renewable Energy Sources into effect. These new rules, which will go into effect on January 1, 2026, are intended to reduce the strain on the electrical grid by promoting the storage of solar production peaks. For photovoltaic (PV) installations having a 30 kW capacity, the minimum charge will be CHF 6 per kilowatt-hour (kWh). Installations between 30 kW and 150 kW will be eligible for a tariff of CHF 6.2 per kWh. Consequently, there is a growing market demand for solar products and services, which encourages further investment and development in the sector.

Switzerland Solar Energy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Switzerland solar energy market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on technology, application, and end user.

Analysis by Technology:

- Solar Photovoltaic (PV)

- Concentrated Solar Power (CSP)

Solar PV is prominent in Switzerland’s solar market due to its adaptability, cost-effectiveness, and suitability for decentralized energy production. It can be easily installed on rooftops and building facades, aligning with Switzerland’s limited land availability. Government subsidies and advancements in PV efficiency further drive its widespread adoption. On the other hand, concentrated solar power (CSP) drives niche growth in Switzerland’s solar market by offering thermal energy storage, enabling electricity generation even without sunlight. It supports grid stability and energy security, especially during peak demand. Additionally, CSP's potential in hybrid renewable systems adds value to future energy diversification strategies.

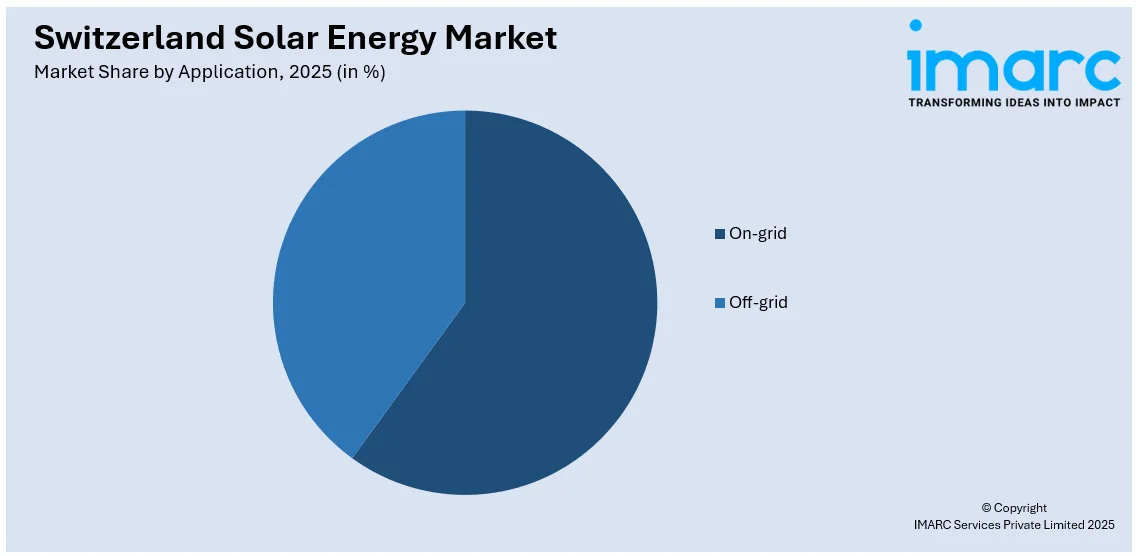

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- On-grid

- Off-grid

On-grid solar systems drive market growth in Switzerland by integrating renewable energy directly into the national grid, supporting the country’s energy transition goals. These systems benefit from government incentives and feed-in tariffs, encouraging residential and commercial installations. Their scalability and efficiency make them a preferred choice for urban and industrial use. Off-grid systems serve remote or mountainous regions with limited grid access, providing energy independence and reliability. They support sustainability in isolated communities, alpine facilities, and temporary infrastructure. Off-grid adoption is also rising among environmentally conscious consumers seeking self-sufficiency and backup energy solutions.

Analysis by End User:

- Residential

- Commercial

- Industrial

Residential users are major contributors to the Swiss solar energy market due to rising environmental awareness and supportive government incentives like subsidies and tax rebates. Homeowners increasingly install rooftop solar systems to reduce electricity bills and carbon footprints. High electricity prices further accelerate residential adoption. Commercial establishments adopt solar to lower operational costs and meet sustainability targets. Office buildings, retail spaces, and service providers benefit from rooftop or building-integrated PV systems. Solar energy also enhances brand reputation by demonstrating environmental responsibility. Industrial users leverage solar for long-term cost savings and energy security, especially in manufacturing and logistics. Large-scale installations help offset significant energy demands. With Switzerland’s push for green industry practices, industrial solar adoption continues to rise steadily.

Regional Analysis:

- Zurich

- Espace Mittelland

- Lake Geneva Region

- Northwestern Switzerland

- Eastern Switzerland

- Central Switzerland

- Ticino

Zurich leads in solar adoption due to its strong economic base, advanced infrastructure, and commitment to sustainability. High urban density and financial incentives drive rooftop solar installations. The city also supports clean energy through progressive municipal policies. Espace Mittelland benefits from favorable sunlight exposure and a mix of urban-rural areas ideal for both residential and agricultural solar use. Local governments and cooperatives actively promote renewable integration. The region’s balanced development supports steady solar growth. Lake Geneva Region sees strong solar uptake due to environmental awareness, international influence, and robust policy support. Wealthy households and institutions invest in solar to reduce emissions. Cross-border energy initiatives also boost solar interest. Northwestern Switzerland has industrial hubs adopting solar for cost efficiency and climate targets. Policy backing and land availability aid large-scale solar farms.

Competitive Landscape:

The competitive landscape of the Switzerland solar energy market is characterized by the establishment of domestic as well as international players offering a variety of solar technologies and services. Companies compete on parameters such as technological innovation, efficiency, pricing, and customer service. Strategic collaborations, government partnerships, and mergers and acquisitions are commonly adopted to expand market reach and improve capabilities. A strong emphasis is placed on R&D to develop advanced solar modules and energy storage solutions that meet the country’s stringent energy efficiency standards. For instance, in May 2025, ABB launched Battery Energy Storage Systems-as-a-Service (BESS-as-a-Service), a flexible, zero upfront cost solution designed to help businesses adopt renewable energy easily. This service shifts costs from capital expenditure to predictable operational fees, offering turnkey deployment, maintenance, and optimization. Compatible with all battery types, it includes performance guarantees and enables customers to benefit financially from energy trading. ABB aims to accelerate clean energy adoption across industries by removing financial and operational barriers to energy storage. Apart from this, local firms often leverage Switzerland's sustainability goals to align with federal and cantonal policies, while global entrants bring cutting-edge expertise. The Switzerland solar energy market forecast further projects an increasing demand for customized and integrated solar solutions, which is expected to drive competition across residential, commercial, and industrial segments.

The report provides a comprehensive analysis of the competitive landscape in the Switzerland solar energy market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Swiss start-up Sun-Ways inaugurated a removable solar power plant on an active railway line in Neuchâtel. Installed between the rails, the 18 kW system comprises 48 panels and is expected to generate 16 MWh annually.

- February 2025: Axpo initiated construction of NalpSolar, an 8 MW alpine solar plant in Tujetsch, Switzerland, situated 2,000 meters above sea level. Part of the federal Solar Express initiative, the project aims to generate 11 GWh annually, enough to power over 2,000 households, with a focus on winter production.

- January 2025: Swiss automotive corporation AMAG Group AG entered into a long-term offtake contract with cleantech firm Synhelion for solar gasoline, a renewable fuel manufactured using solar energy. The novel solar gasoline will be manufactured at Synhelion's first commercial solar fuel factory, RISE, in Spain. To lower the CO2 emissions of its current fleet, AMAG Group plans to buy 50,000 gallons of solar fuel annually beginning in 2027.

- January 2025: Switzerland commenced construction of the 12 MW Madrisa Solar alpine photovoltaic plant near Klosters, situated at 2,000 meters elevation. Developed by Madrisa Solar AG, a joint venture between EKZ, Repower AG, and the municipality of Klosters, the project aims to generate 17 GWh annually, powering approximately 3,500 households.

Switzerland Solar Energy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Gigawatt |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Solar Photovoltaic (PV), Concentrated Solar Power (CSP) |

| Applications Covered | On-grid, Off-grid |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, Ticino |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Switzerland solar energy market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Switzerland solar energy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Switzerland solar energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Switzerland solar energy market size reached 5.2 Gigawatt in 2025.

The Switzerland solar energy market is projected to exhibit a CAGR of 27.18% during 2026-2034, reaching a volume of 49.6 Gigawatt by 2034.

Key factors driving the Switzerland solar energy market include supportive government policies, financial incentives, and ambitious carbon neutrality goals. Advances in solar technology, increasing energy demand, and high public environmental awareness further fuel adoption. Additionally, Switzerland's commitment to phasing out nuclear energy accelerates the transition toward clean, renewable energy sources like solar power.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)