Switzerland Used Car Market Size, Share, Trends and Forecast by Vehicle Type, Vendor Type, Fuel Type, Sales Channel, and Region, 2026-2034

Switzerland Used Car Market Summary:

The Switzerland used car market size was valued at USD 2.26 Billion in 2025 and is projected to reach USD 4.22 Billion by 2034, growing at a compound annual growth rate of 7.20% from 2026-2034.

The Switzerland used car market is experiencing steady growth driven by strong consumer preference for cost-effective vehicle ownership solutions. Rising new vehicle prices are encouraging buyers to explore pre-owned alternatives. The expansion of digital platforms and organized dealerships has enhanced transparency and trust in second-hand transactions. Increasing demand for versatile vehicle types and flexible financing options further supports market expansion across Swiss regions.

Key Takeaways and Insights:

- By Vehicle Type: Sports utility vehicle dominates the market with a share of 36% in 2025, owing to their spacious interiors, advanced safety features, and capability to navigate Switzerland's mountainous terrain. Consumer preference for versatile vehicles suitable for both urban commuting and alpine adventures continues driving strong demand across all regions.

- By Vendor Type: Organized leads the market with a share of 59% in 2025, which is accredited to comprehensive warranty programs, transparent vehicle history documentation, and professional inspection services that significantly enhance consumer trust and purchasing confidence among first-time buyers and risk-averse customers.

- By Fuel Type: Gasoline exhibits a clear dominance in the market with 70% share in 2025, reflecting strong consumer preference for affordable, widely available vehicles with established service networks and lower initial costs compared to alternative fuel options in the secondary market.

- By Sales Channel: Offline represents the largest segment with a market share of 71% in 2025, driven by continued consumer preference for physical vehicle inspection, test drives, and in-person negotiation that provides tangible assurance and personalized service experiences.

- Key Players: Key players drive the Switzerland used car market by expanding dealership networks, enhancing digital platforms, improving financing options, and strengthening certified pre-owned programs. Their investments in customer service and transparency boost buyer confidence and accelerate market adoption.

The Switzerland used car market is advancing as consumers increasingly prioritize affordable mobility solutions amid rising new vehicle costs. Switzerland's new vehicle registrations declined by approximately five percent in 2024 compared to the previous year, creating favorable supply-demand dynamics that benefit the secondary automotive market. Growing awareness of value retention in pre-owned vehicles, combined with professional reconditioning standards, is strengthening buyer confidence across all segments. Urban areas are witnessing heightened demand for flexible ownership models, while rural regions prefer practical vehicles suited to diverse driving conditions. In August 2024, AutoScout24 launched AutoScout24 Direct, a new platform enabling private sellers to connect with its nationwide dealer network, demonstrating the market's digital evolution. The organized sector continues to gain ground through strategic acquisitions, technology investments, and partnerships with financing providers that enhance customer accessibility. Younger demographics are increasingly drawn to transparent pricing mechanisms and comprehensive vehicle history reports offered by structured dealerships. The integration of online convenience with physical inspection services ensures continued growth in Switzerland's pre-owned vehicle sector. Environmental awareness is also influencing buyer preferences, with growing interest in hybrid and electric options within the used car inventory, reshaping long-term market dynamics and sustainability considerations.

Switzerland Used Car Market Trends:

Digital Transformation Reshaping Consumer Experience

The Switzerland used car market growth is being accelerated by rapid digitalization across buying and selling channels. Online platforms now provide comprehensive vehicle history reports, virtual showrooms, and AI-based price guidance tools that enhance transparency. Younger consumers prefer seamless digital experiences, driving dealers to invest in technology infrastructure. Virtual inspections and contactless purchasing options have become standard offerings, fundamentally transforming how Swiss consumers discover, evaluate, and acquire pre-owned vehicles in an increasingly connected marketplace.

Growing Preference for Certified Pre-Owned Vehicles

Swiss consumers are presently increasingly gravitating toward certified pre-owned programs offered by organized dealerships. These programs provide rigorous multi-point inspections, extended warranties, and buy-back guarantees that mitigate risks associated with second-hand purchases. First-time buyers and risk-averse consumers particularly value the quality assurance and professional after-sales support accompanying certified vehicles. This trend is shifting transactions from informal private markets to structured dealership channels, enhancing overall market professionalization and consumer protection standards.

Rise of Subscription-Based Mobility Models

Alternative ownership models, including car subscriptions that bundle insurance, taxes, and maintenance into monthly fees, are gaining traction in Switzerland. These flexible solutions appeal to consumers seeking simplified vehicle access without long-term financial commitments. Industry projections suggest subscription models could capture significant market share as urbanization intensifies and younger demographics prioritize flexibility over ownership. This evolution is encouraging dealerships to diversify service offerings and explore new revenue streams beyond traditional sales.

Market Outlook 2026-2034:

The Switzerland used car market is positioned for sustained expansion as economic factors, technological advancements, and evolving consumer preferences converge to strengthen demand. Rising new vehicle prices, due to mandatory driver assistance systems, continue pushing budget-conscious buyers toward quality pre-owned alternatives. The market generated a revenue of USD 2.26 Billion in 2025 and is projected to reach a revenue of USD 4.22 Billion by 2034, growing at a compound annual growth rate of 7.20% from 2026-2034. Digital platforms will continue enhancing buyer accessibility and price transparency, while organized dealerships expand certified pre-owned offerings. Favorable financing conditions, supported by competitive interest rates from Swiss banks, will sustain purchasing activity. The market's resilience is underpinned by Switzerland's high-quality road infrastructure that preserves vehicle condition, ensuring strong residual values and consumer confidence in pre-owned purchases throughout the forecast period.

Switzerland Used Car Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Vehicle Type |

Sports Utility Vehicle |

36% |

|

Vendor Type |

Organized |

59% |

|

Fuel Type |

Gasoline |

70% |

|

Sales Channel |

Offline |

71% |

Vehicle Type Insights:

To get more information on this market, Request Sample

- Hatchbacks

- Sedan

- Sports Utility Vehicle

- Others

Sports utility vehicle dominates with a market share of 36% of the total Switzerland used car market in 2025.

Sports utility vehicles offer numerous advantages that align perfectly with Swiss lifestyle requirements and geographic conditions. The elevated driving position provides enhanced visibility on winding mountain roads and during challenging weather conditions, improving driver confidence and safety. SUVs deliver superior ground clearance essential for navigating snow-covered streets during winter months and accessing remote alpine destinations that sedans cannot reach comfortably. The spacious interiors accommodate families alongside bulky recreational equipment including skis, snowboards, hiking gear, and camping supplies that active Swiss consumers regularly transport.

All-wheel-drive systems standard in many SUV models provide exceptional traction on steep gradients and slippery surfaces common throughout Swiss mountainous regions. The robust construction and advanced safety features protect occupants during adverse driving conditions while offering peace of mind for long-distance travel across varied terrain. Additionally, modern SUVs combine practical utility with refined comfort levels, featuring premium interiors and advanced technology that satisfy discerning Swiss buyers seeking versatility without compromising on quality or driving experience. The cargo flexibility supports diverse lifestyle needs from daily commuting to weekend adventures.

Vendor Type Insights:

- Organized

- Unorganized

Organized leads with a share of 59% of the total Switzerland used car market in 2025.

The organized used car sector has expanded considerably in Switzerland, led by established dealerships and certified pre-owned initiatives. These professional sellers offer comprehensive warranties, financing solutions, and thorough vehicle inspection reports that significantly enhance consumer confidence compared to private sales. Major automotive groups operate extensive networks across multiple locations nationwide, providing standardized quality assurance and professional after-sales support. The organized segment benefits from economies of scale in procurement, certified reconditioning processes, and bundled financing options that make used vehicle ownership more accessible.

Organized dealers also provide buy-back guarantees and trade-in services, adding significant convenience for customers seeking streamlined transactions. Although prices tend to be marginally higher than informal private sales, the guarantee of quality and comprehensive post-sales service makes formal outlets particularly attractive for young buyers and first-time car purchasers. Recent interest rate reductions by the Swiss National Bank have enhanced consumer purchasing power, making financing more accessible and affordable through organized dealer channels that offer structured payment solutions.

Fuel Type Insights:

- Gasoline

- Diesel

- Others

Gasoline exhibits a clear dominance with a 70% share of the total Switzerland used car market in 2025.

Gasoline vehicles dominate Switzerland's used car market due to their affordability, general availability, and robust second-hand demand. Urban motorists particularly favor gasoline models for their seamless performance characteristics and lower initial costs compared to diesel or electric alternatives. The widespread established service network for gasoline vehicles ensures convenient maintenance access throughout the country, with mechanics and technicians possessing extensive expertise in servicing these powertrains. Despite growing environmental consciousness, gasoline vehicles remain the practical choice for budget-conscious consumers seeking reliable transportation without the premium pricing associated with alternative fuel technologies. The familiarity of gasoline technology reduces ownership anxiety for first-time buyers entering the used car market.

The sustained dominance of gasoline vehicles reflects practical considerations including extensive fueling infrastructure, familiar technology, and predictable long-term ownership costs. Swiss consumers appreciate the convenience of widespread petrol stations across urban centers and rural regions alike. The combination of lower purchase prices, widespread parts availability, and established repair expertise ensures gasoline vehicles maintain their leading position throughout the forecast period as consumers prioritize immediate value over long-term transition considerations. Additionally, the proven reliability and resale value stability of gasoline models reinforce continued buyer confidence.

Sales Channel Insights:

- Online

- Offline

Offline represents the leading segment with 71% share of the total Switzerland used car market in 2025.

Offline sales channels maintain dominance in Switzerland's used car market as consumers continue valuing physical vehicle inspection, test drives, and in-person negotiation experiences. Major dealership groups operate extensive showroom networks throughout the country, with leading automotive retailers maintaining approximately ninety locations across Switzerland. Physical dealerships offer immediate vehicle availability, personalized consultation services, and the tangible assurance that comes from directly examining potential purchases. Professional sales staff guide customers through financing options, warranty selections, and trade-in evaluations.

Despite digital transformation trends, Swiss consumers demonstrate continued preference for traditional purchasing experiences where they can physically assess vehicle condition, comfort, and suitability before committing to significant expenditures. Dealerships complement physical operations with digital tools including online inventory browsing and appointment scheduling while maintaining the personal service that builds customer trust. The integration of offline expertise with digital convenience creates hybrid purchasing journeys where research occurs online but final transactions and vehicle collection happen through established physical channels.

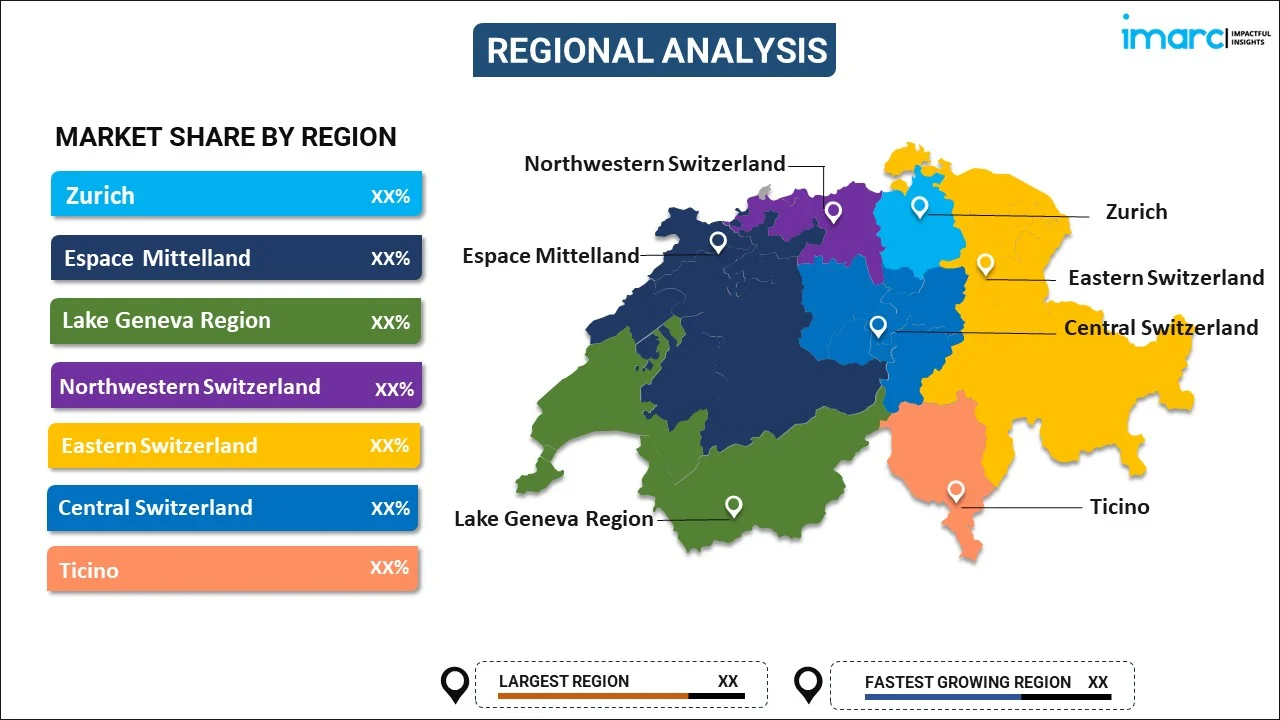

Regional Insights:

To get more information on this market, Request Sample

- Zurich

- Espace Mittelland

- Lake Geneva Region

- Northwestern Switzerland

- Eastern Switzerland

- Central Switzerland

- Ticino

Zurich, being Switzerland's financial center and largest city, is a leading force driving the used car market. Strong purchasing power guarantees consistent demand for luxury used vehicles, especially sedans and SUVs from premium brands. High activity from organized dealerships and digital marketplaces characterizes this region, while growing emphasis on sustainability drives increasing interest in hybrid and electric used cars.

Espace Mittelland represents a significant regional market encompassing the federal capital Bern and surrounding areas. The region demonstrates balanced demand across vehicle categories with practical family vehicles and efficient commuter cars commanding strong interest. Organized dealers maintain substantial presence while competitive pricing characterizes the market due to moderate income levels compared to major financial centers.

The Lake Geneva region, including Geneva and Lausanne, represents a premium market segment with strong demand for luxury used vehicles. International business presence and high-net-worth residents drive appetite for prestigious brands at secondary market prices. The region's proximity to France facilitates cross-border trade dynamics while cosmopolitan consumer preferences shape inventory requirements for sophisticated vehicle offerings.

Northwestern Switzerland, centered around Basel, benefits from proximity to both German and French borders, creating dynamic cross-border trade opportunities. The pharmaceutical industry presence supports strong purchasing power for quality used vehicles. German automotive brands enjoy particular popularity reflecting cultural and geographic affinities, while organized dealerships provide comprehensive services to demanding professional clientele.

Eastern Switzerland, including cantons like St. Gallen and Graubünden, has a vibrant used car market influenced by its blend of urban and rural areas. Buyers prefer practical vehicles like SUVs and smaller cars that perform across varied driving conditions including mountainous terrain. Cross-border trade with Germany and Austria supports import availability and competitive pricing dynamics.

Central Switzerland demonstrates steady used car market activity driven by tourism-related mobility needs and local residential demand. The region's scenic landscapes and outdoor recreation focus support demand for versatile vehicles capable of navigating varied terrain. Organized dealers maintain presence in key population centers while serving surrounding communities through established service networks and flexible financing arrangements.

Ticino, situated close to the Italian border, boasts a distinct used car market influenced by cross-border trade and cultural affinity. Italian automobile brands enjoy stronger market presence compared to other Swiss regions. Proximity to Italy enhances import availability while many consumers prefer smaller, fuel-efficient vehicles ideal for urban driving alongside growing SUV popularity across the region.

Market Dynamics:

Growth Drivers:

Why is the Switzerland Used Car Market Growing?

Rising New Vehicle Prices Driving Pre-Owned Demand

The Switzerland used car market is experiencing substantial growth as new vehicle prices continue escalating, pushing cost-conscious consumers toward quality pre-owned alternatives. Mandatory driver assistance systems and advanced safety technologies have increased average new car costs significantly, making second-hand options increasingly attractive. Swiss consumers, traditionally quality-focused, recognize that well-maintained used vehicles offer premium features at accessible price points. The country's excellent road infrastructure and stringent maintenance standards ensure pre-owned vehicles remain in superior condition compared to other markets. High new car taxation and registration costs further enhance the value proposition of used purchases. First-time buyers, young professionals, and families seeking budget-friendly mobility solutions are particularly drawn to this segment. The depreciation curve works favorably for used car buyers, who acquire vehicles after initial value drops while retaining significant remaining utility and modern technology features.

Digital Transformation Enhancing Market Accessibility

Rapid digitalization is fundamentally reshaping Switzerland's used car market by improving transparency, accessibility, and consumer confidence in pre-owned transactions. Online platforms now provide comprehensive vehicle history reports, price comparison tools, and virtual inspection capabilities that reduce information asymmetry between buyers and sellers. AI-powered valuation models enable accurate pricing while digital financing integrations streamline purchase processes. Younger demographics, accustomed to seamless digital experiences, are increasingly comfortable completing significant transactions online. Dealers investing in technology infrastructure gain competitive advantages through enhanced customer reach and operational efficiency. Digital marketplaces connect private sellers with professional dealer networks, expanding inventory availability and transaction volumes. Social media marketing and targeted advertising enable precise customer acquisition, while data analytics inform inventory optimization strategies.

Favorable Financing Environment Supporting Purchases

Switzerland's accommodative monetary policy and competitive lending environment are strengthening used car market growth by enhancing consumer purchasing power. The Swiss National Bank's interest rate adjustments have improved financing accessibility, making vehicle loans more affordable for broader demographic segments. Swiss banks offer competitive car loan products with transparent terms and flexible repayment options that suit diverse buyer profiles. Dealerships increasingly integrate financing solutions into sales processes, simplifying purchase decisions and reducing transaction friction. Alternative financing models, including subscription services and flexible leasing arrangements, provide additional accessibility pathways for consumers preferring lower commitment options. Strong consumer credit profiles in Switzerland enable favorable lending terms that support confident purchasing decisions. The tax deductibility of loan interest provides additional financial incentives for financed purchases versus cash transactions. Partnership between financial institutions and organized dealerships creates streamlined customer journeys that enhance conversion rates and market participation.

Market Restraints:

What Challenges the Switzerland Used Car Market is Facing?

Uncertain Electric Vehicle Transition Impact

The transition toward electric vehicles creates uncertainty for Switzerland's used car market as buyers navigate evolving technology and residual value concerns. Rapid battery technology advancements potentially reduce desirability of current electric models, while limited used EV inventory constrains supply. Traditional combustion vehicle resale values face pressure from tightening emission regulations and shifting government incentive structures. Dealers must balance inventory composition amid unclear consumer preference trajectories, complicating procurement and pricing strategies.

Currency Fluctuations Affecting Import Prices

Swiss Franc valuation volatility against major currencies impacts the pricing dynamics of imported used vehicles entering Switzerland's secondary market. Currency appreciation increases costs for cross-border vehicle procurement, affecting dealer margins and consumer pricing. Import dependency for diverse vehicle inventory creates exposure to exchange rate movements that complicate business planning. Price sensitivity among budget-conscious buyers limits ability to fully pass through currency-related cost increases, potentially compressing market participation.

Stringent Environmental Regulations

Evolving emission standards and environmental regulations present challenges for Switzerland's used car market by potentially restricting older vehicle usage. Stricter CO2 targets and cantonal emission requirements may limit resale opportunities for less efficient models. The Swiss government's consideration of additional taxes on heavy and powerful vehicles could reshape demand patterns within the used segment. Dealers face inventory management complexities as regulatory changes influence consumer preferences and vehicle valuations.

Competitive Landscape:

The Switzerland used car market exhibits a moderately fragmented competitive structure with established players consolidating market position through strategic investments and acquisitions. Organized dealerships are gaining ground through economies of scale, standardized processes, and financing partnerships that enhance customer accessibility. Digital marketplaces intensify price transparency and competition, pressuring traditional dealer margins while expanding market reach. Innovation drives differentiation, with leading players investing in AI-based valuation tools, virtual inspection capabilities, and subscription-based mobility solutions. Strategic partnerships between established dealer networks and emerging mobility providers are reshaping competitive dynamics. The market rewards trust-building through certified pre-owned programs, comprehensive warranties, and professional after-sales support that smaller independent operators struggle to match consistently.

Switzerland Used Car Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Vehicle Types Covered | Hatchbacks, Sedan, Sports Utility Vehicle, Others |

| Vendor Types Covered | Organized, Unorganized |

| Fuel Types Covered | Gasoline, Diesel, Others |

| Sales Channels Covered | Online, Offline |

| Regions Covered | Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, Ticino |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Switzerland used car market size was valued at USD 2.26 Billion in 2025.

The Switzerland used car market is expected to grow at a compound annual growth rate of 7.20% from 2026-2034 to reach USD 4.22 Billion by 2034.

Sports utility vehicle dominated the market with a share of 36%, driven by consumer preference for spacious interiors, advanced safety features, and versatile performance across Switzerland's diverse terrains including mountainous regions.

Key factors driving the Switzerland used car market include rising new vehicle prices, digital platform expansion enhancing transparency, favorable bank financing conditions, and growing consumer preference for certified pre-owned vehicles.

Major challenges include uncertain electric vehicle transition impacts on residual values, Swiss Franc currency fluctuations affecting import costs, stringent environmental regulations, and evolving emission standards that may restrict older vehicle resale opportunities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)