Synthetic Diamond Market Size, Share, Trends, and Forecast by Type, Manufacturing Process, Application, and Region, 2025-2033

Synthetic Diamond Market Size and Share:

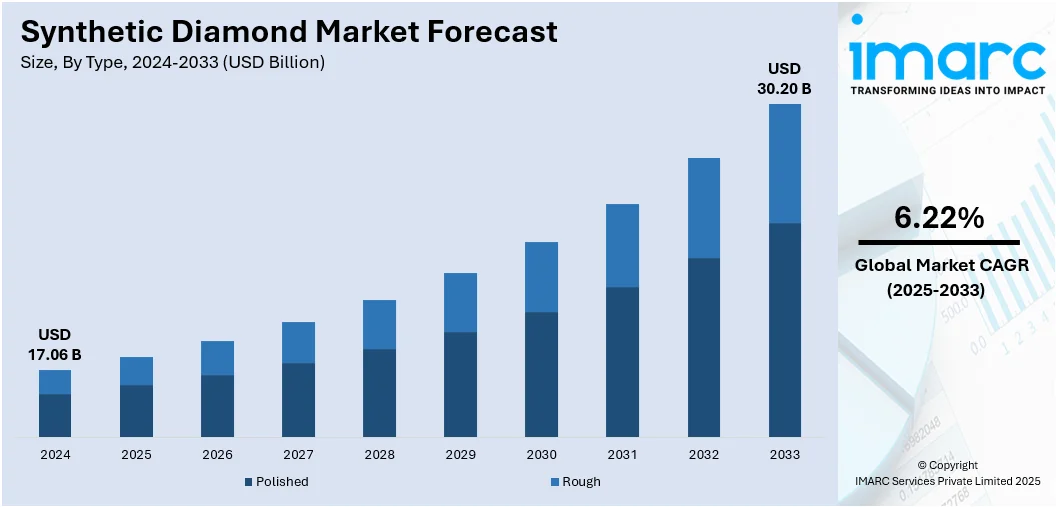

The global synthetic diamond market size was valued at USD 17.06 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 30.20 Billion by 2033, exhibiting a CAGR of 6.22% during 2025-2033. Asia Pacific dominated the market, holding a significant market share of 40.2% in 2024. The growing demand for industrial applications, the significant expansion of the jewelry industry, and the widespread adoption of synthetic diamonds in semiconductor industries for their applications in electronics and cutting tools, are some of the factors contributing to the synthetic diamond market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 17.06 Billion |

|

Market Forecast in 2033

|

USD 30.20 Billion |

| Market Growth Rate 2025-2033 | 6.22% |

The market is fueled by increasing demand in electronics, optics, and jewelry, along with expanding use in industrial applications such as cutting, grinding, and drilling. Technological advancements in chemical vapor deposition (CVD) and high-pressure high-temperature (HPHT) methods have improved quality and reduced production costs, making synthetic diamonds more accessible. Their superior hardness, thermal conductivity, and precision make them valuable in semiconductors, medical devices, and high-performance tools. Growing consumer interest in sustainable and ethically sourced products is also pushing jewelry brands to adopt lab-grown diamonds over mined ones. In addition, industries prefer synthetic diamonds for their consistency, reliability, and ability to be customized for specific purposes, supporting their adoption across sectors from aerospace to renewable energy. These factors collectively strengthen market growth prospects.

To get more information on this market, Request Sample

In the United States, luxury jewelry launches spotlight traceable, ethically sourced diamonds with blockchain authentication. Through immersive storytelling and sustainable sourcing, these offerings aim to rekindle consumer desire for natural stones, linking transparency with emotional appeal. This approach blends cutting-edge verification with heritage narratives to strengthen buyer trust and deepen the emotional value of each piece. For instance, in June 2025, De Beers launched the Ombré Desert Diamonds beacon and ORIGIN – De Beers Group polished diamonds at JCK Las Vegas. These initiatives aim to boost natural diamond demand, enhance traceability via blockchain, and deepen consumer connection through storytelling, sustainability, and ethical sourcing supported by the Tracr platform.

Synthetic Diamond Market Trends:

Rising Demand for Industrial Applications

The synthetic diamond industry is expanding owing to increased demand in various industrial sectors. In addition, synthetic diamonds are widely used in sectors such as construction, automotive, and aerospace for crucial activities including cutting, grinding, and drilling due to their excellent hardness and heat conductivity. As these industries grow, the need for synthetic diamonds is influencing market growth. As reported by IBEF, automobile exports from India surged by 19% to over 5.3 Million Units in the FY25, driven by strong demand for passenger vehicles. Besides, in construction, synthetic diamonds are used to cut and drill through difficult materials such as concrete and stone. Similarly, in the automobile sector, they are used to manufacture and polish components with great accuracy and durability. Thus, the synthetic diamond market growth is closely related to technical breakthroughs and industrial growth, assuring an upward trajectory in the coming years.

Increasing Demand in Semiconductor Industry

According to the Semiconductor Equipment and Materials International (SEMI), the global semiconductor materials market electronics sector is poised for significant expansion. For instance, on May 6, 2024, SEMI, a global industry organization for electronics manufacturing and design, reported in its Materials Market Data Subscription (MMDS) that the global semiconductor materials market revenue was 8.2% in 2023, totaling USD 66.7 Billion. This influences the synthetic diamond market growth since they are utilized in semiconductor fabrication, cutting tools, and heat sinks. Moreover, synthetic diamond demand is rising due to its intrinsic properties, including enhanced heat conductivity and extreme hardness, which are required for high-performance semiconductor components. Consequently, the synthetic diamond market is experiencing a surge in demand from the electronics sector, reflecting its pivotal role in enabling the next generation of electronic innovations.

Significant Expansion in the Jewelry Industry

Synthetic diamonds are gaining considerable attention in the jewelry market. The fascination with synthetic diamonds stems partly from their low cost and ethical creation, making them especially appealing to millennials and Generation Z buyers who value sustainability. This shift in customer tastes is propelling the global jewelry industry, which is expected to grow at a CAGR of 5.27% between 2024 and 2032, according to the IMARC Group. Technological improvements have also played an important role, as they enable the production of synthetic diamonds that rival genuine diamonds in quality and look. The capacity to make flawless, high-quality synthetic diamonds at a fraction of the cost while avoiding the ethical difficulties involved with mining has made them a popular alternative. Hence, this trend is driving development in the synthetic diamond industry, as these jewels provide an enticing combination of ethical sources, low-cost, and high-quality products.

Synthetic Diamond Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global synthetic diamond market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, manufacturing process, and application.

Analysis by Type:

- Polished

- Rough

Polished synthetic diamonds are lab-grown diamonds that have undergone extensive cutting and polishing to achieve the desired shape, clarity, and brilliance. These diamonds are primarily used in the jewelry industry, where their affordability and ethical production methods make them a popular choice among consumers. The polished segment includes various cuts such as round, princess, oval, and more, each catering to different market preferences. As a result, polished synthetic diamonds have gained significant traction due to their visual appeal, competitive pricing compared to natural diamonds, and the assurance of a conflict-free origin. This segment is anticipated to see continuous growth, driven by increasing consumer awareness and acceptance of lab-grown diamonds in fine jewelry.

Rough synthetic diamonds refer to lab-created diamonds that have not been cut or polished and are typically used for industrial applications. These diamonds are valued for their hardness and thermal conductivity, making them ideal for cutting, grinding, drilling, and other high-precision tasks. The rough synthetic diamond market caters to various industries including electronics, construction, and manufacturing. Due to the high demand for industrial diamonds and the consistent quality and supply of lab-grown varieties, this segment is crucial to the overall synthetic diamond market. As technological advancements continue to expand the applications of synthetic diamonds, the rough diamond segment is expected to maintain a strong growth trajectory.

Analysis by Manufacturing Process:

- High Pressure High Temperature

- Chemical Vapor Deposition

As per the synthetic diamond market forecast, chemical vapor deposition (CVD) emerged as the largest segment in 2024. CVD involves the deposition of carbon-containing gases onto a substrate, which allows for the growth of diamond crystals under controlled conditions of temperature and pressure. This method is gaining popularity due to its ability to produce high-quality diamonds with fewer defects and impurities compared to traditional high-pressure high temperature (HPHT) techniques. The versatility of CVD enables the production of diamonds in various shapes and sizes, making it suitable for a wide range of industrial applications, including cutting, grinding, and drilling. Additionally, CVD diamonds are increasingly used in electronics and optics due to their superior thermal conductivity and optical properties. The scalability and cost-effectiveness of the CVD process further contribute to its dominance in the synthetic diamond market. For instance, on 23 October 2023, Element Six (E6), a leading CVD diamond manufacturer under the De Beers Group, was chosen for DARPA's LADDIS program. This initiative aims to develop device-quality diamond substrates for radiofrequency and power electronics in military applications. Already, E6 has demonstrated the synthesis of polycrystalline diamond (>100 mm), utilized in passive thermal management for high-power density Si and GaN semiconductor devices, such as those in satellite communications and defense systems. Also, with over 2,000 patents and a major facility in Oregon, E6 continues to innovate, while the partnership with Raytheon and Professor Martin Kuball in the LADDIS program enhances E6's efforts in overcoming challenges through advanced thermal characterization techniques.

Analysis by Application:

- Gem

- Heat Sinks and Exchangers

- High-End Electronics

- Laser and X-Ray

- Machining and Cutting Tools

- Surgical Machinery

- Water Treatment

- Medical

- Optical

- Others

High-end electronics emerged as the largest segment in 2024. It is attributed to synthetic diamonds' exceptional properties, such as high thermal conductivity, electrical insulation, and resistance to wear and corrosion, making them highly suitable for use in electronic devices. In high-end electronics, synthetic diamonds are extensively utilized in semiconductors, laser diodes, and high-performance transistors, where they enhance device performance and longevity. Moreover, the increasing demand for advanced electronics, due to emerging technological advancements and the growing need for efficient and durable materials, fuels the significant market share held by the high-end electronics segment. For instance, on 5 June 2024, as per Huanghe Whirlwind Co. Ltd, synthetic diamond powder is distinguished by its unmatched hardness, achieved through high-pressure, high-temperature processes mimicking natural diamond formation. This hardness surpasses traditional abrasives like silicon carbide or aluminum oxide, making diamond powder ideal for cutting, grinding, and polishing in the automotive, aerospace, tool manufacturing, and construction industries.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, as per the synthetic diamond market outlook, Asia Pacific dominated the market, holding the largest market share of 40.2%. It is attributed to its booming industrial sectors, significant investments in manufacturing technologies, and the presence of key market players. Countries like China, Japan, and India are major contributors to the growth of this market due to their extensive use of synthetic diamonds in electronics, cutting tools, and jewelry industries. According to data from the United States Geological Survey in 2023, China topped the list as the largest producer of synthetic industrial diamonds, with the United States and Russia following in second and third place, respectively, ranked by production quantity. Moreover, the rapidly growing population and increasing urbanization also drive demand for synthetic diamonds in various applications, including construction and automotive industries, which is encouraging synthetic diamond manufacturers across the region. Furthermore, favorable government policies and substantial research and development initiatives further bolster the market's expansion in Asia Pacific.

Key Regional Takeaways:

United States Synthetic Diamond Market Analysis

In 2024, the United States accounted for 86.90% of the market share in North America. The market is primarily driven by the growing demand for high-performance thermal management solutions in semiconductor devices. In accordance with this, the expanding deployment of quantum technologies, particularly in sensing and computing, is increasing the need for nitrogen-vacancy center diamonds, propelling market growth. According to an industry report, quantum computing investment surpassed USD 1.25 Billion in Q1 2025, more than double that of 2024. Quantum companies captured 70% of this funding, demonstrating robust investor confidence in the technology’s commercial scalability and deployment. The rapid integration of synthetic diamonds in aerospace and defense components, due to their superior hardness and stability, is further stimulating industry expansion. Similarly, the rise in nanotechnology applications, especially in precision imaging and diagnostics, is fostering market development. The heightened emphasis on sustainable manufacturing practices, accelerating the shift from mined to lab-grown industrial diamonds, is enhancing market accessibility. Additionally, continual advances in chemical vapor deposition (CVD) and high-pressure high-temperature (HPHT) techniques are reducing production costs and impelling the market. Apart from this, increased reshoring initiatives supporting domestic production capabilities are impacting the synthetic diamond market trends.

Europe Synthetic Diamond Market Analysis

The European market is experiencing growth due to increasing demand for precision cutting tools in the automotive and aerospace industries. In line with this, continual advancements in chemical vapor deposition (CVD) technology are enhancing synthetic diamond quality, fostering wider industrial adoption. Similarly, stringent environmental regulations favor sustainable and ethical synthetic diamonds over mined alternatives, driving market preference. The expanding healthcare sector’s need for biocompatible diamond coatings in medical devices is further propelling growth. Additionally, increased investments in photonics and quantum computing research across Europe are augmenting demand for synthetic diamonds with specialized optical properties. The rising integration of synthetic diamonds in high-performance electronics for efficient heat dissipation is enhancing device reliability and stimulating market appeal. As such, the Europe consumer electronics market generated a revenue of USD 204 Billion in 2024. Furthermore, numerous collaborations between academia and industry are accelerating innovation and commercialization, bolstering development in the market. Besides this, several government incentives supporting advanced manufacturing technologies are broadening the market scope.

Asia Pacific Synthetic Diamond Market Analysis

The Asia Pacific synthetic diamond market is predominantly propelled by the region’s expanding industrial manufacturing sector. In addition to this, rising demand from the automotive and electronics industries for precision components is fueling market growth. The strong government initiatives promoting advanced materials research and innovation are supporting the market demand. Similarly, growing investments in renewable energy projects, particularly in semiconductor and solar panel manufacturing, are underscoring the importance of synthetic diamonds in cutting-edge applications. Accordingly, in July 2025, Indian clean energy company SAEL Industries planned to invest USD 954 Million to build a 5GW-per-year integrated solar cell and module manufacturing plant in Greater Noida, Uttar Pradesh, increasing its total module capacity to 8.5GW. Similarly, the expansion of healthcare infrastructure, increasing the use of synthetic diamonds in medical devices and diagnostic equipment, is stimulating market appeal. Moreover, various collaborations between regional research institutions and private enterprises are accelerating the commercialization of synthetic diamond technologies, thereby reinforcing market expansion.

Latin America Synthetic Diamond Market Analysis

In Latin America, the synthetic diamond market is expanding due to increased investments in advanced manufacturing and precision tooling industries. Similarly, the growing electronics and semiconductor sectors are driving demand for synthetic diamonds used in thermal management and device fabrication. The favorable government initiatives promoting sustainable and eco-friendly industrial practices are encouraging the adoption of synthetic diamonds as a greener alternative to natural diamonds. Furthermore, rising infrastructure development, especially in mining and construction, is fueling the need for synthetic diamond-based cutting and grinding tools, thereby supporting market growth. As such, in July 2025, Brazil Potash signed an MoU with Fictor Energia, which will fund USD 200 Million to build a 102-mile power line for the Autazes potash mining project and invest USD 20 Million in equity, supporting sustainable mining infrastructure and reducing Brazil’s reliance on potash imports.

Middle East and Africa Synthetic Diamond Market Analysis

The market in the Middle East and Africa is notably driven by increased investment in advanced drilling technologies, particularly within the oil and gas sector. Accordingly, in February 2025, ADNOC Drilling planned over USD 1 Billion in 2025 investments, targeting Gulf expansion into Kuwait and Oman. The firm expects strong growth across onshore, offshore, and oilfield services, while deepening regional partnerships and global technology investments. Furthermore, the region is experiencing a rise in domestic manufacturing of high-precision components, which is amplifying demand for industrial-grade synthetic diamonds. Similarly, the rapid digitalization of economies, especially across the GCC, is stimulating the development of data centers that require synthetic diamonds for efficient thermal management solutions. Moreover, expanding biomedical research in South Africa and the UAE is driving nanodiamond adoption in drug delivery and imaging, providing an impetus to the market.

Competitive Landscape:

In the synthetic diamond market, companies are actively working on new product variants, often with enhanced properties for electronics, optics, and jewelry. Partnerships and collaborations between manufacturers, research institutes, and tech firms are common, aiming to improve production efficiency or develop specialized applications. Agreements for technology sharing and joint ventures are frequent in regions with strong manufacturing bases. Research and development is a constant focus, especially to refine HPHT and CVD methods for better quality and lower costs. Government initiatives mainly support industrial use and export potential in certain countries. Among these activities, ongoing R&D and collaborative product development stand out as the most common practices across the industry.

The report provides a comprehensive analysis of the competitive landscape in the synthetic diamond market with detailed profiles of all major companies, including:

- Adamas One Corp.

- Applied Diamond Inc

- D.NEA Diamonds

- De Beers Group

- Element Six UK Ltd.

- Finegrown Diamonds

- Henan Huanghe Whirlwind CO., Ltd.

- Henan LiLiang Diamond Co., Ltd.

- Heyaru Group

- Iljin Diamond Co. Ltd

- Industrial Abrasives Ltd

- Sumitomo Electric Industries, Ltd.

Latest News and Developments:

- June 2025: The Antwerp World Diamond Centre (AWDC) launched a “We Protect a Legacy” campaign featuring lab-grown diamonds in a gumball machine to highlight their declining value and promote natural diamonds. The initiative aims to educate consumers on price, rarity, and the socio-economic impact of natural stones.

- May 2025: ACS Material launched Quantum Diamonds; synthetic diamonds embedded with nitrogen-vacancy (NV) centers for advanced quantum applications. These materials support magnetometry, quantum computing, and nanoscale imaging. Available in five types, including thin films and custom solutions, they enable breakthroughs in precision sensing, metrology, and quantum device fabrication.

- April 2025: Bosch and Element Six formed a joint venture, Bosch Quantum Sensing, to commercialize compact quantum sensors using synthetic diamonds. Targeting medical and mobility sectors, the partnership aims to deliver scalable, ultra-precise sensors with high industrial potential, enhancing applications from GPS alternatives to cardiac diagnostics and resource exploration.

- February 2025: LongRange Capital announced its agreement to acquire US Synthetic from ChampionX. US Synthetic, a Utah-based leader in polycrystalline diamond (PCD) technologies, will operate as a standalone business. The deal supports LongRange’s focus on innovation and industrial growth, pending the ChampionX-Schlumberger transaction closure.

- January 2025: Element Six unveiled a copper diamond composite at Photonics West, offering high thermal conductivity (~800 W/mK) for AI, HPC, and GaN RF devices. This cost-effective material addresses critical heat management challenges in semiconductors, enhancing reliability and performance while enabling integration into complex advanced packaging configurations.

Synthetic Diamond Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polished, Rough |

| Manufacturing Processes Covered | High Pressure High Temperature, Chemical Vapor Deposition |

| Applications Covered | Gem, Heat Sinks and Exchangers, High-End Electronics, Laser and X-ray, Machining and Cutting Tools, Surgical Machinery, Water Treatment, Medical, Optical, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adamas One Corp., Applied Diamond Inc, D.NEA Diamonds, De Beers Group, Element Six UK Ltd., Finegrown Diamonds, Henan Huanghe Whirlwind CO., Ltd., Henan LiLiang Diamond Co., Ltd., Heyaru Group, Iljin Diamond Co. Ltd, Industrial Abrasives Ltd, Sumitomo Electric Industries, Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the synthetic diamond market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global synthetic diamond market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the synthetic diamond industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The synthetic diamond market was valued at USD 17.06 Billion in 2024.

The synthetic diamond market is projected to exhibit a CAGR of 6.22% during 2025-2033, reaching a value of USD 30.20 Billion by 2033.

The synthetic diamond market is driven by demand from electronics, optics, and jewelry, growth in industrial applications like cutting and drilling, advances in chemical vapor deposition and HPHT technologies, cost benefits over natural diamonds, and rising preference for sustainable, ethically produced alternatives in multiple end-use sectors.

Asia Pacific dominated the synthetic diamond market in 2024, accounting for a share of 40.2% due to its strong industrial base, growing electronics and automotive sectors, rapid manufacturing growth, and increasing demand for cutting and polishing applications.

Some of the major players in the synthetic diamond market include Adamas One Corp., Applied Diamond Inc, D.NEA Diamonds, De Beers Group, Element Six UK Ltd., Finegrown Diamonds, Henan Huanghe Whirlwind CO., Ltd., Henan LiLiang Diamond Co., Ltd., Heyaru Group, Iljin Diamond Co. Ltd, Industrial Abrasives Ltd, Sumitomo Electric Industries, Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)