Tactical UAV Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Tactical UAV Market Size and Share:

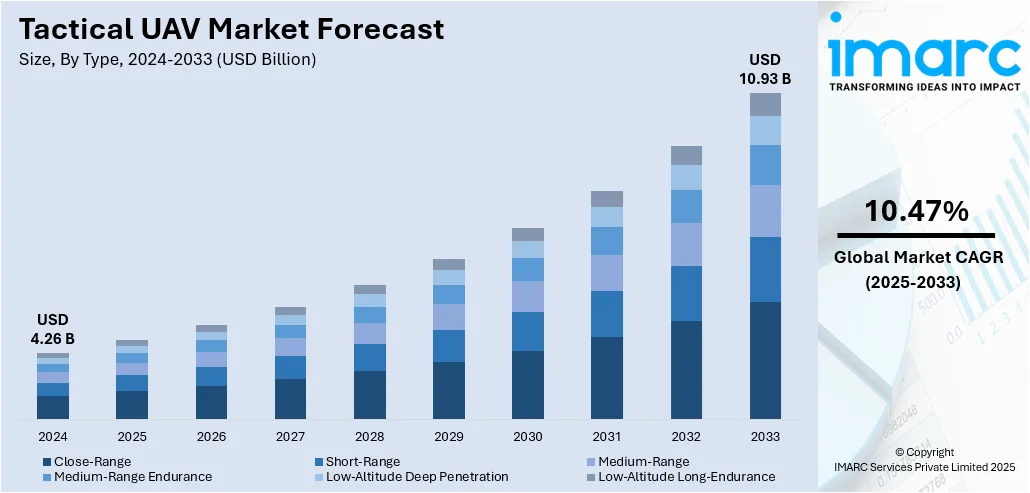

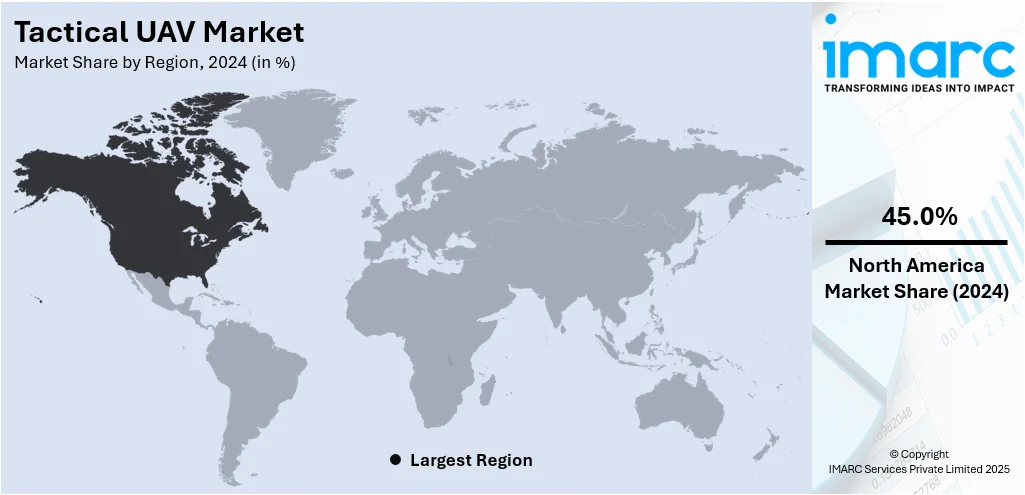

The global tactical UAV market size was valued at USD 4.26 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.93 Billion by 2033, exhibiting a CAGR of 10.47% during 2025-2033. North America currently dominates the market, holding a significant market share of over 45.0% in 2024, driven by strong defense investments and advanced military technology. This positions the region as the dominant contributor to overall tactical UAV market share, reflecting its strategic focus on unmanned aerial systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.26 Billion |

|

Market Forecast in 2033

|

USD 10.93 Billion |

| Market Growth Rate (2025-2033) | 10.47% |

The market is witnessing accelerated growth due to the increasing demand for rapid deployment platforms capable of operating in complex and asymmetric warfare environments. For instance, in May 2025, a Chennai-based company, Zuppa Geo Navigation Technologies, received field-level validation from the Indian Army for its Ajeet Mini drone, a micro-category tactical UAV designed for high-altitude reconnaissance. This marks a key step toward India’s goal of defense tech self-reliance. Tested by a Mountain Brigade, the drone met critical performance benchmarks. Built with Zuppa’s patented autopilot and fully indigenous systems, the drone also supports swarm missions. The growing emphasis on integrated multi-domain operations, particularly in contested airspaces, has led to a surge in UAVs equipped with modular payloads and enhanced electronic warfare capabilities. Moreover, the expansion of multinational peacekeeping missions and border surveillance requirements is encouraging wider adoption of compact, long-endurance UAV systems. Rising investments in swarm intelligence, secure communication protocols, and AI-based threat detection further support the operational versatility of tactical UAVs, making them indispensable assets in both conventional and unconventional military scenarios worldwide.

To get more information on this market, Request Sample

The United States tactical UAV market growth is primarily driven by sustained investments in defense innovation programs aimed at maintaining technological superiority over peer adversaries. The Department of Defense’s strategic pivot towards unmanned and autonomous warfare systems, particularly within the Army and Marine Corps, underscores growing reliance on tactical UAVs for ISR (Intelligence, Surveillance, and Reconnaissance), electronic countermeasures, and precision targeting. Additionally, the need for agile, man-portable UAV platforms to support expeditionary and special operations has spurred demand for lightweight, ruggedized systems. The U.S. focus on joint all-domain command and control (JADC2) further accelerates tactical UAV integration into network-centric warfare, enhancing real-time situational awareness and interoperability across military branches.

Tactical UAV Market Trends:

Increasing demand for personalization and customization

The growing interest in products and services that are tailored to their needs and preferences is majorly driving the tactical UAV demand. This is supported by the rising availability of information and progressive analytics, allowing companies to assess customer behavior and develop customized approaches. For instance, 81% of consumers say they prefer companies that offer personalized experiences, and this trend is reflected in the products they demand as well. As a result, emerging technologies such as AI and machine learning are used to develop personalized marketing strategies and offerings. Additionally, personalization is associated with greater customer satisfaction and retention, while also enabling organizations to address diverging consumer needs. Therefore, demand for personalization is reshuffling such industries, as retail and fashion, technology, and even healthcare, instigating companies to adjust their strategies to capture the opportunities of the rapidly changing markets.

Technological advancements in production and manufacturing

According to the tactical UAV market research report, modern consumers require much more individualized products and services suitable for their personal needs and preferences. his trend is enabled by the rise in information about consumers and its improved analysis, which allows companies to embrace detailed definitions of consumer behavior and develop products and services adjusted to differ between them. This is increasingly achievable through the adoption of AI and machine learning, which help to develop detailed consumer profiles and allow for individualized marketing, products, or services. Such a trend increases consumer satisfaction as it allows companies to target relatively narrow and diverse consumer segments accurately without harming general products. At present, personalization is an expanding trend in different fields, such as retail, fashion, technology, and healthcare, and businesses must adjust their strategies and operations to cater to the needs of modern consumers.

Global economic shifts and emerging markets

The worldwide economy is in a period of complete change, which is creating new business prospects and sparking competition. For instance, in low-income countries (LICs), growth is projected to rise to 5.3 percent in 2025 and average 6.1 percent in 2026-27. The economies in Asia, Africa, and Latin America that are rapidly increasing, have strong consumer buying power, and are quickly urbanizing. Over the last three decades, Southeast Asia has experienced significant urban growth, with approximately 245 million residents now living in urban areas across the region. Therefore, this is significantly supporting the market. For instance, intra Defence Technologies, a Saudi Arabia-based company, announced its novel medium-altitude, long-endurance UAV. The design “will be optimized for intelligence, surveillance, and reconnaissance missions”. The displayed half-scale model was located on a stand of the company at the first World Defense Show held in Riyadh. Samoom is 11m long with a wingspan of 24m. In addition, companies are rapidly scaling their business and distribution models in these new frontiers, taking advantage of the fast-growing middle-class expansion and higher spending capacity. Moreover, local improvements in infrastructure development and policy frameworks are making these regions ripe for international investment, creating a positive tactical UAV market outlook.

Tactical UAV Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global tactical UAV market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Close-Range

- Short-Range

- Medium-Range

- Medium-Range Endurance

- Low-Altitude Deep Penetration

- Low-Altitude Long-Endurance

Close-range tactical UAVs play a critical role in enhancing situational awareness and decision-making on the frontlines. Their compact size and portability make them ideal for infantry units requiring immediate intelligence in urban or contested environments. These UAVs are typically deployed for reconnaissance, perimeter monitoring, and force protection missions with flight durations ranging from minutes to a few hours. Due to their low altitude and limited operational radius, they are cost-effective and less susceptible to radar detection. As asymmetric threats grow and the need for localized surveillance intensifies, close-range UAVs are increasingly seen as indispensable tools in modern military operations.

Short-range tactical UAVs offer a balanced solution between mobility and endurance, making them highly valuable for battalion-level surveillance, reconnaissance, and target acquisition missions. Operating within ranges of 10–50 kilometers, these UAVs are capable of carrying more sophisticated payloads compared to close-range systems, including EO/IR sensors and light communication relays. Their ability to transmit real-time intelligence over broader operational zones enhances command situational awareness and mission effectiveness. They are widely adopted for battlefield support, border patrol, and coastal monitoring. With increasing geopolitical tensions and the shift toward network-centric warfare, short-range UAVs continue to gain strategic prominence across armed forces worldwide.

Medium-range tactical UAVs represent a vital segment in the tactical UAV market due to their extended endurance, higher altitude operations, and versatile mission capabilities. With ranges typically between 50 and 200 kilometers, these UAVs are suited for persistent ISR, electronic warfare, and limited strike missions in high-risk or denied-access areas. Their enhanced payload capacity allows integration of advanced radar systems, SIGINT/COMINT equipment, and long-range communications. As militaries emphasize multi-domain integration and cross-theater intelligence sharing, medium-range UAVs are increasingly favored for their ability to operate independently or as part of larger UAV networks. Their growing role underscores evolving defense doctrines prioritizing autonomy, range, and survivability.

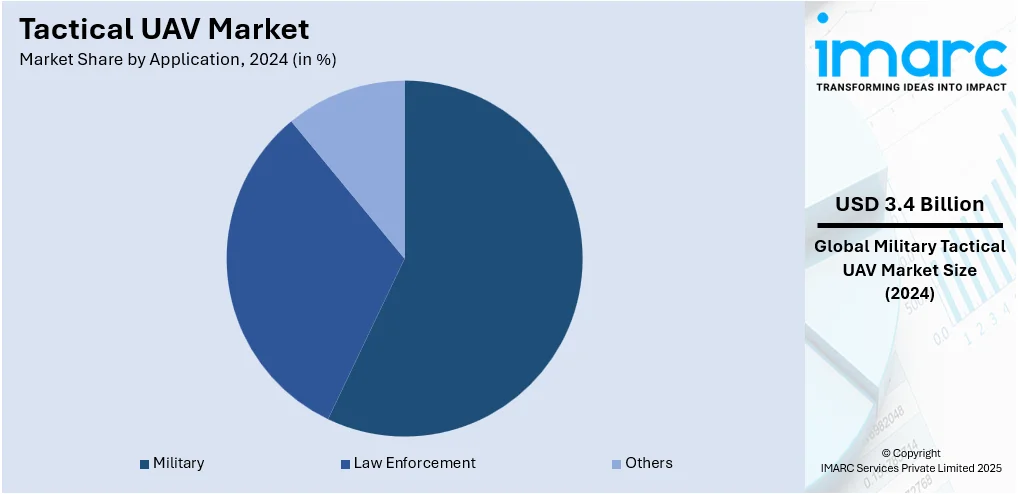

Analysis by Application:

- Military

- Law Enforcement

- Others

Military leads the market with around 80.6% of market share in 2024. The military sector is the largest application and is based on the urgent need for advanced solutions and tools to ensure national security and keep operational superiority over potential adversaries. Along with this, the rise of multiple global security threats and active geopolitical tensions is influencing the growth of defense budgets for many countries. Such additional funding is used for purchasing advanced technologies, such as unmanned systems, surveillance devices, and communication solutions. They considerably enhance the capacity of intelligence, reconnaissance, and operations, becoming an essential part of modern warfare. Moreover, the sphere remains one of the most demanding in terms of equipment reliability and efficiency, which stimulates continuous development, innovation, and production. According to the tactical UAV market analysis, the need to implement AI and cybersecurity regulations also drives this direction, as such components become vital for maintaining operational advantage in the increasingly complicated security environment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 45.0%. North America leads the tactical UAV market due to its substantial defense budget, advanced technological infrastructure, and consistent investment in unmanned aerial systems. The United States Department of Defense actively integrates UAVs for intelligence, surveillance, reconnaissance (ISR), and combat missions, driving continuous innovation and deployment. Leading defense contractors and drone manufacturers in the region contribute to rapid development and procurement cycles. Additionally, strong government support for modernizing military capabilities, including initiatives to develop AI-driven and autonomous drone technologies, enhances market dominance. The region’s geopolitical commitments, overseas military presence, and emphasis on rapid response capabilities further reinforce North America's commanding position in the global tactical UAV market. For instance, in August 2025, the U.S. Army’s Hawkeye Platoon of the 173rd Airborne Brigade innovatively filled the capability gap left by the retirement of the RQ-7B Shadow by developing and deploying cost-effective, 3D-printed FPV drones and C100 VTOL unmanned aerial systems. Built in the field using commercial parts, these drones support ISR, resupply, and rapid strike missions with up to 10 km range and 74 minutes endurance. With brigade-level funding and mobile fabrication labs, soldiers are now building, repairing, and deploying drones themselves, driving battlefield innovation and autonomous unit-level combat capacity.

Key Regional Takeaways:

United States Tactical UAV Market Analysis

In 2024, the United States held a market share of around 92.40% in North America. United States witnessed increasing tactical UAV adoption driven by growing investment in defense, which has enabled the development of highly capable unmanned platforms for modern combat scenarios. For instance, in 2025, the United States is projected to allocate around USD 886 billion to its defense budget, representing nearly 37% of global military expenditures. Enhanced funding has supported extensive research and deployment of tactical UAVs across varied terrains for real-time data transmission, situational awareness, and precision targeting. Defense-focused programs are encouraging collaborations to improve tactical UAV endurance, range, and sensor integration. With evolving threats and need for rapid tactical response, defense investments are increasingly directed toward autonomous capabilities. Advanced manufacturing and training infrastructure further support this trend. Strategic defense priorities emphasize persistent surveillance and low-risk reconnaissance, making tactical UAVs central to mission success.

Asia Pacific Tactical UAV Market Analysis

Asia-Pacific is experiencing rising tactical UAV deployment fuelled by growing investment in aerospace, promoting the integration of innovative designs and lightweight composite materials. For instance, India plans USD 230 Million drone incentive after Pakistan conflict. The region’s expanding aerospace sector supports the customization of tactical UAVs for surveillance, logistics, and battlefield coordination. Increased aerospace investment is enhancing UAV propulsion technologies, miniaturization of electronics, and mission adaptability. Collaboration among aerospace manufacturers and research institutes is fostering innovation tailored to diverse geographical environments. Tactical UAVs are becoming vital assets in airborne monitoring and rapid communication relay. Growing investment in aerospace is also enabling scalable UAV production and broader deployment across tactical operations.

Europe Tactical UAV Market Analysis

Europe has observed a surge in tactical UAV utilization driven by growing border security concerns, with increased focus on monitoring remote terrains and unauthorized crossings. For instance, a twenty-nation Drone Coalition co-chaired by Latvia and the UK has pledged USD 2.99 Billion to supply an additional one Million drones in 2025. Governments and defense entities are emphasizing persistent surveillance using compact and maneuverable UAVs. Enhanced situational awareness and real-time intelligence gathering through tactical UAVs are addressing transnational threats and aiding rapid response operations. Border surveillance is increasingly relying on UAVs for cost-effective, long-duration missions without risking personnel. Technological improvements in imaging, communication, and autonomous flight are being applied to meet these security demands. Growing border security concerns are accelerating UAV procurement and deployment across defense agencies.

Latin America Tactical UAV Market Analysis

Latin America is expanding tactical UAV deployment in response to growing expansion and modernization of military forces, with increasing focus on operational flexibility and tactical efficiency. For instance, the Brazilian defence industrial base has secured a total of USD1.31 Billion in exports in the first half of 2025, largely driven by aerospace firm Embraer Defense & Security, the Secretariat of Defence Products of the Brazilian Ministry of Defence (MoD). Rising military modernization efforts are supporting the integration of UAVs for surveillance and tactical coordination. Tactical UAVs offer low-cost, high-endurance platforms ideal for regional defense strategies.

Middle East and Africa Tactical UAV Market Analysis

Middle East and Africa are witnessing heightened adoption of tactical UAVs due to growing Intelligence, Surveillance, and Reconnaissance (ISR) needs across conflict-prone and remote regions. For instance, the Ministry of Intelligence’s official budget has been increased by 67%, reaching 54 Trillion tomans in Iran. This sharp increase signals further investment in state surveillance and repression. ISR capabilities enabled by UAVs are enhancing target tracking and threat detection. Tactical UAVs provide extended range and endurance, essential for ISR missions under diverse operational conditions.

Competitive Landscape:

The competitive landscape of the tactical UAV market is marked by rapid innovation, strategic collaborations, and increased defense spending across various regions. Companies are focusing on enhancing UAV capabilities through advanced sensor integration, longer endurance, and autonomous navigation technologies. The market is also witnessing rising interest from non-military sectors, such as border surveillance and disaster management, which is broadening the scope for growth. Governments and defense agencies are increasingly investing in next-generation tactical UAVs to improve situational awareness and mission efficiency. For instance, in June 2025, ideaForge secured a ₹137 crore emergency contract from the Indian Army to supply hybrid Mini UAVs for critical ISR missions. The domestically developed drones, equipped with VTOL capabilities, passed stringent security and sourcing evaluations. Certified for military use and proven effective during Operation Sindoor, these UAVs enhance surveillance operations in rugged terrains. Additionally, players are expanding globally to tap into emerging markets with growing defense budgets. The tactical UAV market forecast projects sustained growth over the coming years, driven by evolving security threats and the global shift towards unmanned defense systems.

The report provides a comprehensive analysis of the competitive landscape in the tactical UAV market with detailed profiles of all major companies, including:

- AeroVironment, Inc

- Baykar Tech

- BlueBird Aero Systems Ltd.

- Elbit Systems Ltd.

- General Atomics

- IAI

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman

- Safran S.A.

- Textron Systems

- The Boeing Company

Latest News and Developments:

- August 2025: Blitz Technology integrated its lightweight Mini Spectrum EO/IR gimbals into the MADDOS VTOL 350e UAV, enhancing the platform’s capabilities for multi-mission operations. Designed for tactical ISR, infrastructure surveillance, and public safety, the gimbals feature real-time 4K and thermal imaging, modular payloads, and SWaP-optimized construction. This collaboration enables long-endurance aerial missions with real-time situational awareness, especially in rugged or remote environments. Together, Blitz and MADDOS deliver a robust UAV solution ideal for defense, disaster response, and critical inspections, emphasizing modularity, rapid deployment, and high-performance imaging.

- July 2025: Turkish drone maker Solid Aero showcased its new tactical UAVs, Karagun and Toydu, featuring stealth and maritime capabilities at IDEF 2025 in Istanbul. Karagun offered modular design and AI-driven recon functions, while Toydu, a sea-based mini tactical UAV, provided encrypted surveillance and autonomous operations with low radar visibility.

- June 2025: India showcased the FWD-LM01 tactical UAV in 2025, which flew 100 km, autonomously identified targets, and executed precision strikes, marking a leap in indigenous drone warfare capabilities. The tactical UAV was developed to enhance battlefield autonomy and reduce human intervention.

- May 2025: Frontex launched a tactical UAV pilot project with the Bulgarian Border Police in May 2025 to enhance European border security using long-endurance drones equipped with advanced surveillance systems, aiming to evaluate their operational efficiency, cost-effectiveness, and ability to detect cross-border crime in real time.

- April 2025: Optiemus Unmanned Systems unveiled four advanced tactical UAVs at Milipol India 2025 in New Delhi, showcasing cutting-edge capabilities in surveillance, loitering munitions, and electronic warfare, with features like AI analytics, EO/IR sensors, and jam-resistant navigation—strengthening India's indigenous defense drone ecosystem.

- February 2025: ideaForge launched the NETRA 5 tactical UAV, marking a significant advancement in mission-critical drone technology with AI-driven workflows and modular payload capabilities. Designed for resilience and versatility, the NETRA 5 tactical UAV enabled real-time detection of threats and supported advanced payloads like LiDAR and SAR for expanded defense applications.

Tactical UAV Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Close-Range, Short-Range, Medium-Range, Medium-Range Endurance, Low-Altitude Deep Penetration, Low-Altitude Long-Endurance |

| Applications Covered | Military, Law Enforcement, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AeroVironment, Inc, Baykar Tech, BlueBird Aero Systems Ltd., Elbit Systems Ltd., General Atomics, IAI, Leonardo S.p.A., Lockheed Martin Corporation, Northrop Grumman, Safran S.A., Textron Systems, The Boeing Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the tactical UAV market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global tactical UAV market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the tactical UAV industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tactical UAV market was valued at USD 4.26 Billion in 2024.

The tactical UAV market is projected to exhibit a CAGR of 10.47% during 2025-2033, reaching a value of USD 10.93 Billion by 2033.

Key factors driving the tactical UAV market include growing demand for real-time surveillance, reconnaissance, and target acquisition; increasing military modernization programs; and advancements in UAV payload systems. Rising geopolitical tensions, expanding applications in border monitoring and disaster response, and the integration of AI and autonomous navigation technologies further accelerate market growth.

As of 2024, North America dominates the global tactical UAV market, holding a significant market share of over 45.0%, driven by high defense spending, robust R&D initiatives, and the presence of leading UAV manufacturers and military operators in the region.

Some of the major players in the global tactical UAV market include AeroVironment, Inc, Baykar Tech, BlueBird Aero Systems Ltd., Elbit Systems Ltd., General Atomics, IAI, Leonardo S.p.A., Lockheed Martin Corporation, Northrop Grumman, Safran S.A., Textron Systems, The Boeing Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)