Global Tactical UAV Market Expected to Reach USD 10.9 Billion by 2033 - IMARC Group

Global Tactical UAV Market Statistics, Outlook and Regional Analysis 2025-2033

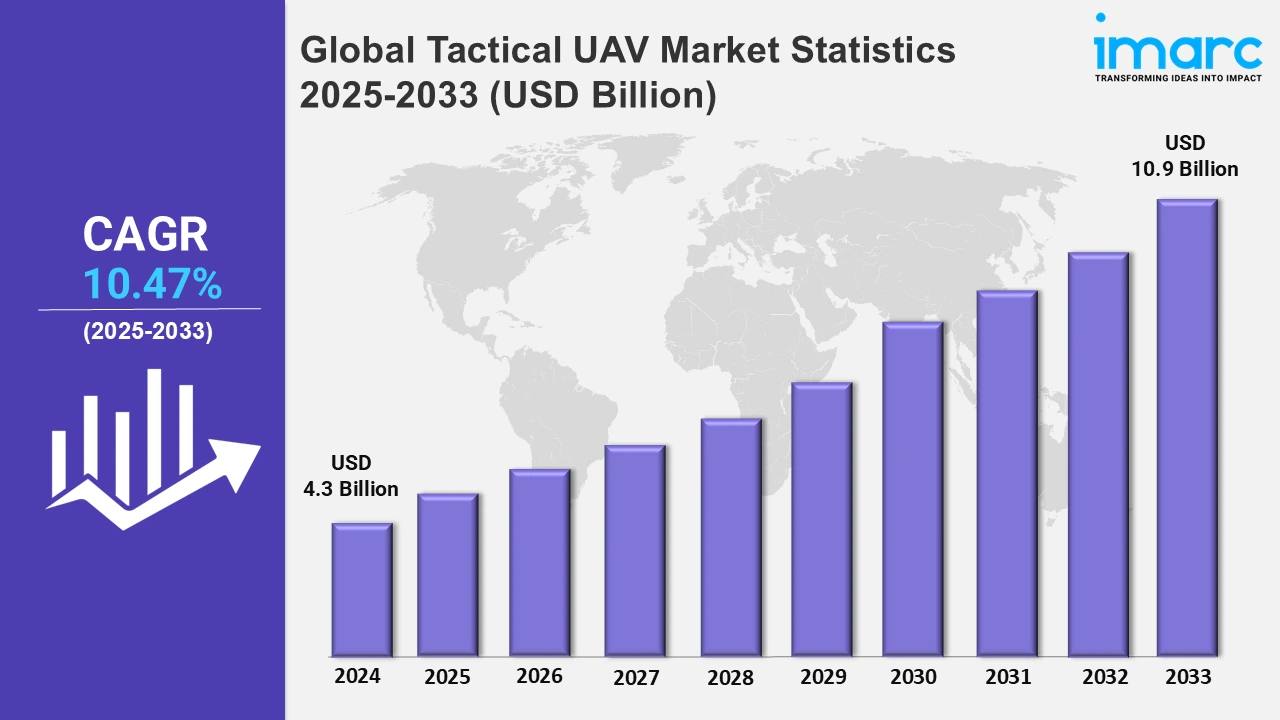

The global tactical UAV market size was valued at USD 4.3 Billion in 2024, and it is expected to reach USD 10.9 Billion by 2033, exhibiting a growth rate (CAGR) of 10.47% from 2025 to 2033.

To get more information on this market, Request Sample

The demand for tactical UAVs in military applications continues to surge, with global military spending reaching approximately $2.4 trillion in 2023, according to the Stockholm International Peace Research Institute (SIPRI). Within this broader defense budget, there has been an increasing allocation toward unmanned systems, with tactical UAVs playing a critical role in modern military operations. For instance, the budgetary allocation for unmanned systems by the United States Department of Defense increased to $6.6 billion in 2023, indicating that these systems are increasingly relied upon for surveillance, intelligence, and reconnaissance activities. Furthermore, the United States drone market is expected to grow at an estimated rate of 11.01% from 2024 to 2032, which emphasizes the growing deployment of UAVs for ISR activities.

The increasing use of tactical UAVs in non-military sectors is a major factor in the growth of the market. In 2023, the commercial drone market was estimated to be around $32.0 billion by 2024, and it is expected to grow at a rate of 19.45% from 2025 to 2033. One of the most important examples is the application of UAVs in agriculture, where they are used for crop monitoring, precision farming, and pest control. The global market for agricultural drones alone had a valuation of $2.7 billion in 2024, fueled by the increasing demand for more efficient and environmentally responsible farming techniques. In infrastructure inspection, UAV adoption is also expected to rise as industries increase the utilization of UAVs in inspecting bridges, power lines, and pipelines at a cheaper and more efficient cost.

Global Tactical UAV Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of its large defense budget, advanced technological capabilities, and extensive adoption of UAVs for military operations.

North America Tactical UAV Market Trends:

North America occupies the largest market share in tactical UAVs, given its high military spending, advancement of technology, and improvement of defense modernization programs. In 2023, military expenditure in this region was approximately $850 billion, a good portion of which is allocated to unmanned systems. The dual-purpose programs of the U.S. Department of Defense (DOD), therefore, have stimulated the demand for these unmanned systems heavily through investments into UAV technologies for ISR missions. Tactical UAVs which currently form the backbone of the U.S. military combat capability are the MQ-9 Reaper and RQ-4 Global Hawk. These systems are continuously upgraded with the mission system, software, and payloads. For the North American market, the forecasts showcase a positive outlook with growth driven as much by military need as ever-growing civilian applications for UAV technology in agriculture, logistics, and infrastructure inspection. The region also benefits from a robust regulatory framework, such as the FAA's policies on drone integration, making it even more amenable to further the expansion of the UAV industry. The combination of such factors makes North America a strong leader in the global tactical UAV market, including large budgets concerning defense and supportive legislation on the latest technological innovations.

Asia-Pacific Tactical UAV Market Trends:

The market for tactical UAVs is expanding quickly in the Asia Pacific area because of the region's growing defense spending and the growing risk of regional wars. To improve their military capabilities, nations including China, India, Japan, and South Korea are making significant investments in UAV technology. China is the world's second-largest defense investor, with over $290 billion spent in 2023, much of it directed towards unmanned aerial systems. For military and surveillance purposes, China has created and implemented sophisticated unmanned aerial vehicles (UAVs), such as the Wing Loong series. In a similar effort, India is using UAVs in increasing numbers for disaster relief, border monitoring, and counterinsurgency.

Europe Tactical UAV Market Trends:

With nations like the United Kingdom, France, Germany, and Russia giving top priority to the development and deployment of unmanned systems, Europe is another important market for tactical UAVs. Additionally, the European Union has aided in the development of UAVs through programs such as the European Defence Fund (EDF), which finances research using autonomous drones. France has included UAVs in its military operations in Africa, while nations like the UK have used them for ISR missions in war areas. In response to growing security concerns, Eastern European nations are also spending money on tactical UAVs to strengthen their defensive capabilities.

Latin America Tactical UAV Market Trends:

Despite being smaller, in terms of area, than North America and Asia Pacific, the market for tactical UAVs is expanding in Latin America. Countries like Brazil, Argentina, and Mexico are investing more in unmanned aerial systems to improve national security, monitor vast and difficult-to-patrol borders, and improve disaster management capabilities. For example, Brazil has developed its own line of unmanned aerial vehicles (UAVs), such as the Carcará drone, which is used for border surveillance and agricultural monitoring. The increasing need for border security and precision farming in agriculture is expected to drive growth in the tactical UAV market.

Middle East and Africa Tactical UAV Market Trends:

The MEA region has enormous potential for the expansion of the tactical UAV market because of armed conflict, uncertain geopolitical situations, and a significant need for border protection. Notably, three nations that are heavily investing in UAV technology are Saudi Arabia, the United Arab Emirates, and Israel. Israel is leading the globe in UAV development because companies in this area are creating extremely advanced UAVs for use in military operations and surveillance. Both Saudi Arabia and the UAE are also adapting UAV concepts for ISR and combat.

Top Companies Leading in the Tactical UAV Industry

Some of the leading tactical UAV market companies include AeroVironment, Inc, Baykar Tech, BlueBird Aero Systems Ltd., Elbit Systems Ltd., General Atomics, IAI, Leonardo S.p.A., Lockheed Martin Corporation, Northrop Grumman, Safran S.A., Textron Systems, The Boeing Company, among many others.

In November 2024, Croatia agreed to buy six Bayraktar TB2 tactical armed unmanned combat aerial vehicles (UCAVs) for EUR 67 million from Baykar Makina. The Bayraktar TB2 is a medium-altitude, long-endurance UAV that can conduct information gathering, surveillance, reconnaissance, and armed strike missions. It may also be used in civil activities such as disaster relief, search and rescue, irregular migration monitoring, and forest fire suppression.

Global Tactical UAV Market Segmentation Coverage

- On the basis of the type, the market has been categorized into close-range, short-range, medium-range, medium-range endurance, low-altitude deep penetration, and low-altitude long-endurance. Usually employed for tactical reconnaissance or surveillance over small regions, close-range unmanned aerial vehicles (UAVs) are made for activities within a restricted distance. Tactical operations, quick-response surveillance, and border patrol are common uses for short-range UAVs, which may fly up to 100 kilometers. Operational theaters frequently employ medium-range unmanned aerial vehicles (UAVs), which can fly up to 300 kilometers, for observation and information collection. Medium-range endurance UAVs are ideal for tasks that need continuous observation over wider regions because they combine a longer operational period with an expanded range. Low-altitude deep penetration UAVs are made to operate at low altitudes in order to conduct tactical attacks or gather intelligence within hostile airspace. The capacity of low-altitude long-endurance UAVs to remain in the air for prolonged periods of time makes them perfect for ongoing monitoring and reconnaissance missions.

- Based on the application, the market is classified into military, law enforcement, and others, amongst which the military segment dominates the market. The military sector continues to be the largest application for tactical UAVs since they play a critical role in ISR and precision strike missions. Increasing defense budgets and the emphasis on modernizing military capabilities are major reasons that push armed forces worldwide to continue investing in UAV technologies in order to improve their operational effectiveness and reduce the risks of personnel accidents.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 4.3 Billion |

| Market Forecast in 2033 | USD 10.9 Billion |

| Market Growth Rate 2025-2033 | 10.47% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Close-Range, Short-Range, Medium-Range, Medium-Range Endurance, Low-Altitude Deep Penetration, Low-Altitude Long-Endurance |

| Applications Covered | Military, Law Enforcement, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AeroVironment, Inc, Baykar Tech, BlueBird Aero Systems Ltd., Elbit Systems Ltd., General Atomics, IAI, Leonardo S.p.A., Lockheed Martin Corporation, Northrop Grumman, Safran S.A., Textron Systems, The Boeing Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)